Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the intrinsic value of a single share of the ETF. This is different from the market price, which fluctuates throughout the trading day based on supply and demand. The market price can sometimes deviate from the NAV, particularly in less liquid ETFs. The Amundi DJIA UCITS ETF NAV, however, is calculated daily at the close of the market, providing a snapshot of the ETF's underlying value.

- NAV reflects the underlying asset value: The NAV calculation directly incorporates the value of the holdings within the ETF, mirroring the performance of the DJIA.

- Market price can fluctuate due to supply and demand: Market forces can cause temporary price discrepancies between the market price and the NAV.

- NAV is a more accurate representation of the ETF's intrinsic value: While the market price shows what buyers and sellers are willing to trade at any given moment, the NAV reflects the true value of the assets held within the ETF.

Calculating the Amundi DJIA UCITS ETF NAV

The calculation of the Amundi DJIA UCITS ETF NAV is a straightforward process. It primarily depends on the performance of the 30 constituent stocks of the Dow Jones Industrial Average. Each stock's market value is weighted according to its representation in the DJIA index.

- Total value of underlying assets: This is the sum of the market values of all the stocks held by the ETF, reflecting their closing prices.

- Less any ETF expenses: Operational costs, management fees, and other expenses are deducted from the total asset value.

- Divided by the number of outstanding shares: The resulting net asset value is then divided by the total number of outstanding Amundi DJIA UCITS ETF shares to arrive at the NAV per share.

Currency exchange rates can influence the NAV if the ETF holds assets denominated in currencies other than the base currency of the ETF. However, since the Amundi DJIA UCITS ETF focuses on US-based companies, the impact of currency fluctuations is typically minimal.

Importance of Monitoring Amundi DJIA UCITS ETF NAV

Monitoring the Amundi DJIA UCITS ETF NAV is crucial for several reasons. It provides a clear and reliable metric for assessing the ETF's performance over time.

- Track long-term growth: By regularly tracking the NAV, investors can observe the long-term growth and assess the success of their investment in line with the DJIA's performance.

- Identify periods of underperformance or overperformance: Comparing the NAV to the previous day's NAV or to the DJIA itself can help highlight periods where the ETF has underperformed or outperformed its benchmark.

- Compare against similar ETFs: Tracking the NAV allows for comparisons against similar ETFs tracking the DJIA or other market indices to assess relative performance and costs.

- Inform investment decisions: Understanding NAV trends can inform crucial investment decisions, such as buying low or selling high, based on perceived undervaluation or overvaluation compared to market price.

Where to Find the Amundi DJIA UCITS ETF NAV

Finding the daily Amundi DJIA UCITS ETF NAV is straightforward. Reliable sources for this information include:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Major financial data providers (Bloomberg, Refinitiv, etc.): These professional platforms offer comprehensive financial data, including real-time and historical NAV information for various ETFs, including the Amundi DJIA UCITS ETF.

- Your brokerage account: Most brokerage platforms display the current NAV, along with other relevant data, for all ETFs held within an investor's portfolio.

The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

Conclusion

This guide has explored the significance of understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF. By grasping how NAV is calculated and its role in assessing performance against the Dow Jones Industrial Average, investors can make more informed decisions regarding their investment in this ETF. Regularly monitoring the Amundi DJIA UCITS ETF NAV, alongside other key performance indicators like the market price and expense ratio, is vital for successful investment strategies. Learn more about the Amundi DJIA UCITS ETF NAV and enhance your investment knowledge today!

Featured Posts

-

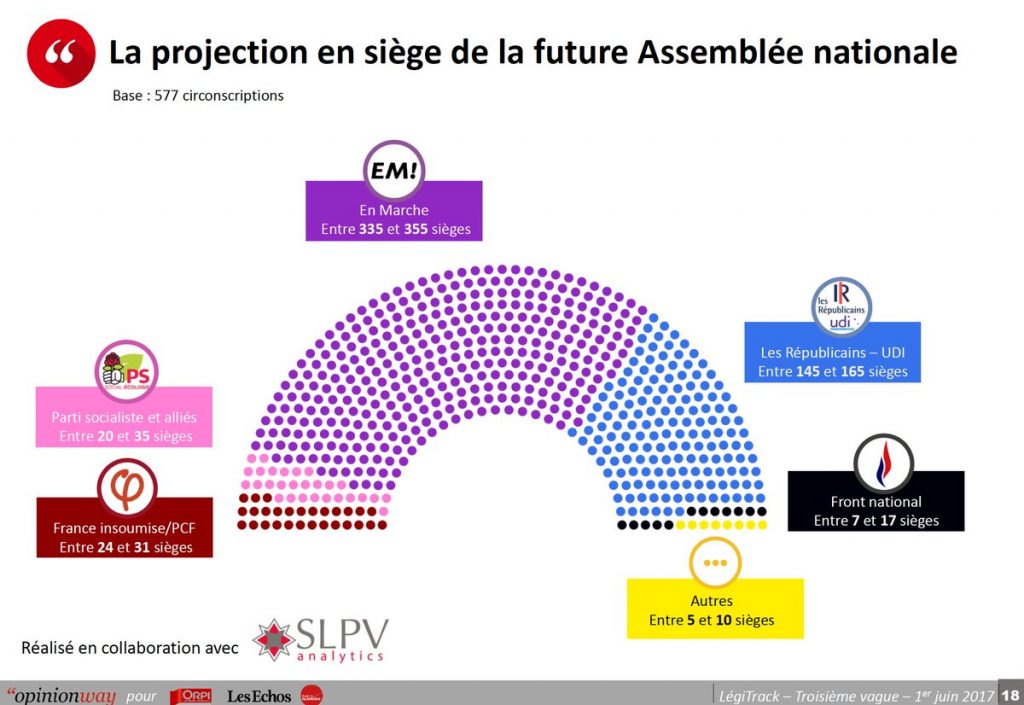

French Elections 2027 Bardellas Path To Power

May 24, 2025

French Elections 2027 Bardellas Path To Power

May 24, 2025 -

Dazi Trump Sul 20 Conseguenze Per Nike Lululemon E Il Mercato Della Moda Europeo

May 24, 2025

Dazi Trump Sul 20 Conseguenze Per Nike Lululemon E Il Mercato Della Moda Europeo

May 24, 2025 -

Refleksiya Nad Trillerom Fedor Lavrov O Pavle I I Tyage K Opasnosti

May 24, 2025

Refleksiya Nad Trillerom Fedor Lavrov O Pavle I I Tyage K Opasnosti

May 24, 2025 -

Zimmermann Showcases Amira Al Zuhair At Paris Fashion Week

May 24, 2025

Zimmermann Showcases Amira Al Zuhair At Paris Fashion Week

May 24, 2025 -

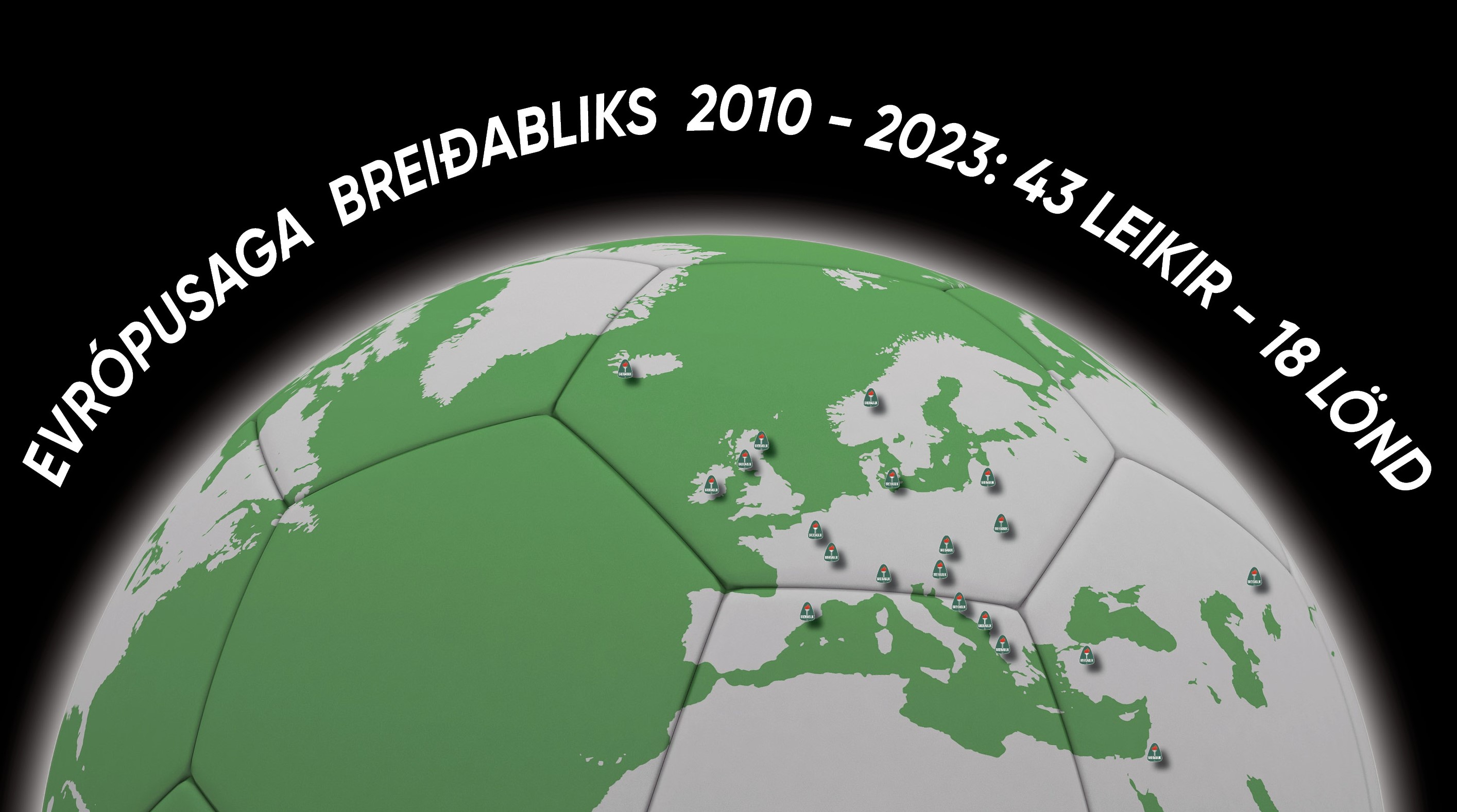

Fyrsta Rafmagnsutgafa Porsche Macan Yfirlit Og Eiginleikar

May 24, 2025

Fyrsta Rafmagnsutgafa Porsche Macan Yfirlit Og Eiginleikar

May 24, 2025

Latest Posts

-

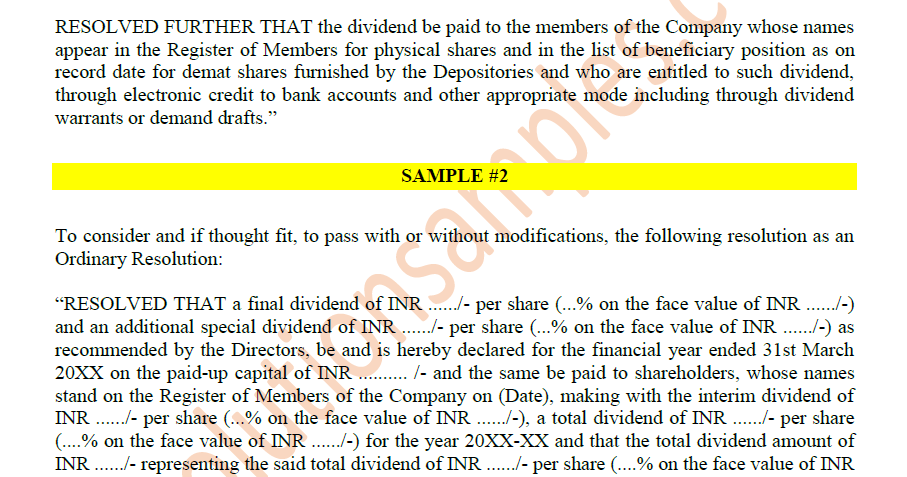

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025 -

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025 -

Amsterdam Stock Market Trade War Anxiety Causes 7 Opening Plunge

May 24, 2025

Amsterdam Stock Market Trade War Anxiety Causes 7 Opening Plunge

May 24, 2025 -

7 Drop Amsterdam Stock Market Hit Hard By Trade War Fears

May 24, 2025

7 Drop Amsterdam Stock Market Hit Hard By Trade War Fears

May 24, 2025 -

La Caduta Delle Borse Analisi Dell Impatto Dei Dazi Ue E Prospettive Future

May 24, 2025

La Caduta Delle Borse Analisi Dell Impatto Dei Dazi Ue E Prospettive Future

May 24, 2025