Amundi DJIA UCITS ETF: A Detailed Look At Its Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. For ETFs tracking an index like the Dow Jones Industrial Average (DJIA), the NAV reflects the collective value of the underlying securities held within the fund. This value is calculated daily, providing a snapshot of the ETF's intrinsic worth.

- Definition of NAV: NAV is calculated by taking the total market value of all assets held by the ETF, subtracting any liabilities (like management fees and expenses), and then dividing by the total number of outstanding shares.

- How NAV is calculated for ETFs: (Total Assets - Total Liabilities) / Number of Outstanding Shares.

- Factors affecting NAV: Several factors can impact an ETF's NAV, including:

- Market fluctuations of underlying assets: The primary driver of NAV changes is the performance of the underlying assets (in this case, the 30 companies in the DJIA). A rising DJIA generally leads to a higher NAV, while a falling DJIA results in a lower NAV.

- Dividend payments: Dividends received from the underlying DJIA companies are added to the ETF's assets, increasing its NAV.

- Expense ratios: The ETF's expense ratio, which covers management and operational costs, reduces the NAV slightly over time.

- Difference between NAV and market price: While ideally the NAV and market price of an ETF should be very close, discrepancies can occur due to trading volume, supply and demand, and market sentiment. The market price reflects the price at which the ETF is currently being traded, which can fluctuate throughout the day.

Understanding Amundi DJIA UCITS ETF's NAV Calculation

The Amundi DJIA UCITS ETF's NAV is directly influenced by the performance of the Dow Jones Industrial Average. Understanding the specific factors affecting its NAV is critical for effective investment management.

- Impact of DJIA component price changes on NAV: The prices of the 30 companies comprising the DJIA have a direct and significant impact on the ETF's NAV. A rise in the DJIA generally translates to a rise in the ETF's NAV, and vice-versa.

- Effect of dividends from DJIA companies on NAV: Dividends paid by the DJIA companies are reinvested by the ETF, contributing positively to the NAV.

- Role of the ETF's expense ratio in affecting NAV: The expense ratio, expressed as a percentage of assets under management, gradually reduces the ETF's NAV over time. This is a recurring cost of holding the ETF.

- Currency fluctuations (if applicable): Since the DJIA is a US dollar-denominated index, currency fluctuations can impact the NAV for investors holding the ETF in currencies other than the USD. A strengthening US dollar would generally decrease the NAV for non-USD investors.

Where to Find the Amundi DJIA UCITS ETF NAV

Accessing real-time or historical NAV data for the Amundi DJIA UCITS ETF is straightforward. Several reliable sources provide this crucial information:

- Official Amundi website: Amundi, the fund manager, typically publishes daily NAV information on their official website.

- Major financial data providers: Bloomberg Terminal, Refinitiv Eikon, and other professional financial data platforms offer real-time and historical NAV data.

- Brokerage platforms: Most brokerage platforms that offer the Amundi DJIA UCITS ETF will display the current NAV on the ETF's information page.

- Dedicated ETF data websites: Several websites specialize in providing comprehensive ETF data, including NAV information.

Interpreting NAV Changes

Understanding how to interpret changes in the Amundi DJIA UCITS ETF NAV is essential for making informed investment decisions.

- Positive NAV changes: An increase in the NAV generally indicates positive performance of the underlying DJIA, reflecting positive market sentiment and growth among the constituent companies.

- Negative NAV changes: A decrease in the NAV usually signifies negative market performance of the DJIA, suggesting potential economic slowdown or negative investor sentiment.

- Correlation between DJIA performance and Amundi DJIA UCITS ETF NAV: The Amundi DJIA UCITS ETF NAV should closely track the performance of the DJIA. Significant deviations might warrant further investigation.

- Importance of considering NAV alongside other performance metrics: While NAV is a crucial metric, investors should also consider other performance indicators, such as the ETF's total return, expense ratio, and trading volume, for a comprehensive assessment.

Conclusion

Understanding the Amundi DJIA UCITS ETF NAV is paramount for investors seeking to manage their portfolio effectively. By regularly monitoring your Amundi DJIA UCITS ETF NAV, analyzing its fluctuations in relation to DJIA performance, and considering other performance metrics, you can make informed decisions, manage investment risk, and evaluate the overall performance of your investment. Learn more about Amundi DJIA UCITS ETF NAV management by visiting the Amundi website or consulting with a qualified financial advisor. Monitor your Amundi DJIA UCITS ETF NAV today to stay informed about your investment's performance.

Featured Posts

-

The Ultimate Guide To An Escape To The Country

May 24, 2025

The Ultimate Guide To An Escape To The Country

May 24, 2025 -

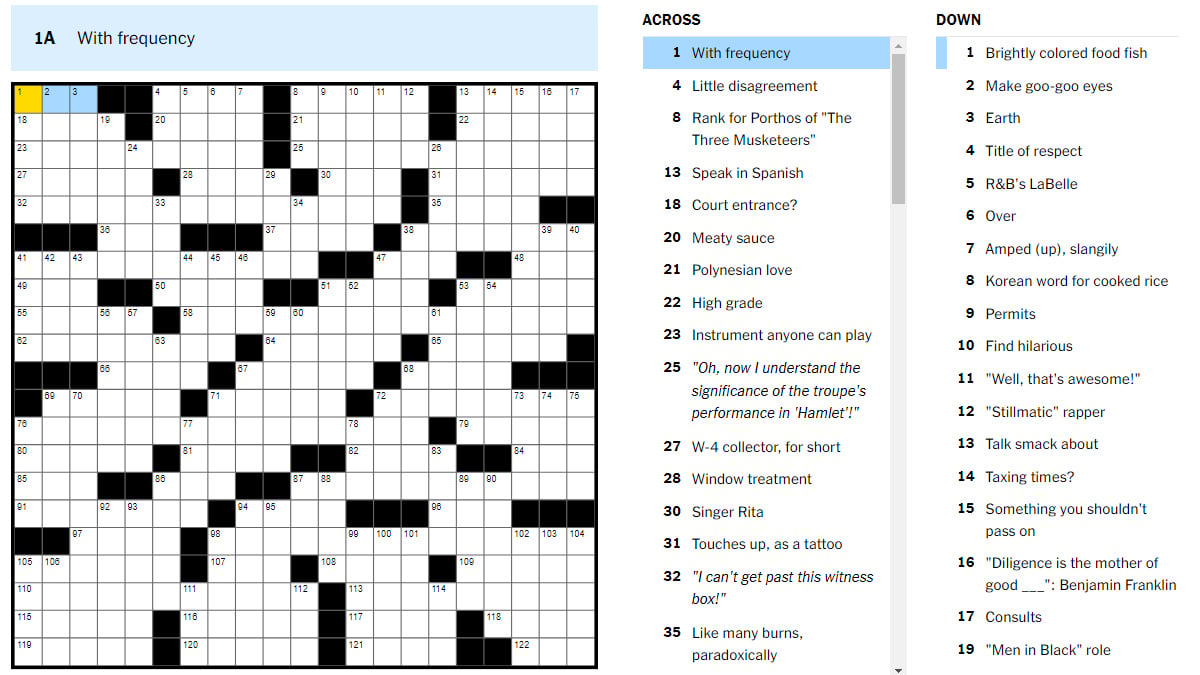

Complete Guide Nyt Mini Crossword Answers March 13 2025

May 24, 2025

Complete Guide Nyt Mini Crossword Answers March 13 2025

May 24, 2025 -

The Unrealized M62 Relief Road Exploring Burys Bypassed Future

May 24, 2025

The Unrealized M62 Relief Road Exploring Burys Bypassed Future

May 24, 2025 -

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculations

May 24, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculations

May 24, 2025

Latest Posts

-

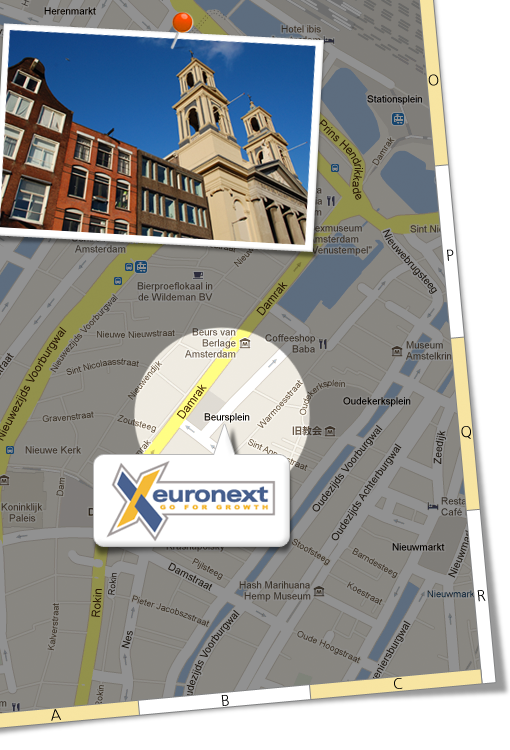

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025 -

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025 -

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025 -

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025