Amundi Dow Jones Industrial Average UCITS ETF Dist: Understanding Net Asset Value (NAV)

Table of Contents

What is the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF Dist?

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF Dist represents the total value of all the assets held within the ETF, divided by the number of outstanding shares. Since this ETF tracks the Dow Jones Industrial Average (DJIA), its underlying assets are the 30 constituent companies of the index.

The NAV calculation involves determining the market value of each of these 30 stocks, summing these values, adding any accrued dividend income, and subtracting the ETF's expenses. This total is then divided by the total number of ETF shares outstanding to arrive at the NAV per share.

Dividend Impact: Dividend distributions from the underlying companies affect the NAV. When a company pays a dividend, the ETF receives its proportionate share, which increases the total assets and therefore the NAV. However, the NAV will usually decrease slightly on the ex-dividend date as the dividend is distributed to shareholders.

Daily NAV Fluctuations: The NAV of the Amundi DJIA UCITS ETF Dist changes daily due to fluctuations in the market prices of the underlying 30 Dow Jones Industrial Average companies. Other factors contributing to daily changes include:

- Market prices of the underlying stocks: Price increases or decreases in the 30 DJIA companies directly impact the ETF's NAV.

- Dividend income received: Dividend payments received from the underlying companies increase the NAV.

- Expenses incurred by the ETF: Management fees and other operational expenses reduce the NAV.

- Currency exchange rates (if applicable): If the ETF holds assets denominated in currencies other than the base currency, exchange rate fluctuations can affect the NAV.

How to Find the Amundi Dow Jones Industrial Average UCITS ETF Dist NAV?

Finding the current NAV for the Amundi Dow Jones Industrial Average UCITS ETF Dist is straightforward. Several reliable sources provide this information:

- Amundi's official website: The asset manager, Amundi, usually publishes the daily NAV on its website's dedicated ETF pages.

- Financial news websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance often display real-time or end-of-day NAV data for ETFs.

- Your brokerage account platform: Most brokerage platforms provide detailed information, including the NAV, for all the ETFs held in your account.

NAV vs. Market Price: It's important to understand the difference between the NAV and the market price of the ETF. The market price is the price at which the ETF is currently trading on the exchange. While ideally close, the NAV and market price may differ slightly due to supply and demand in the market. This difference can be temporary and usually evens out over time.

Why is Understanding the NAV of the Amundi Dow Jones Industrial Average UCITS ETF Dist Important?

Understanding the NAV of the Amundi DJIA UCITS ETF Dist is crucial for several reasons:

- Investment decisions: Monitoring NAV changes helps you track the ETF's performance and make informed buy/sell decisions. Consistent upward NAV trends might suggest strong performance.

- Evaluating investment returns: Calculating your return on investment (ROI) requires comparing the initial NAV with the current NAV, considering any dividend distributions received.

- Comparing different ETFs: By comparing the NAV performance of the Amundi DJIA UCITS ETF Dist with other similar ETFs tracking the DJIA or other indices, you can make better choices for your portfolio. This allows you to assess which ETF is offering better value for your investment.

The Amundi Dow Jones Industrial Average UCITS ETF Dist: NAV and Your Investment Strategy

Incorporating NAV into your investment strategy involves using it as one factor among many when assessing risk and making decisions. While NAV provides a snapshot of the underlying assets' value, it doesn't fully reflect the short-term market fluctuations and other market forces.

- Risk assessment: While the NAV gives a good picture of the ETF's intrinsic value, market volatility can significantly impact its market price, representing a risk for short-term investors.

- Long-term vs. short-term: For long-term investors, consistent monitoring of NAV trends is key; whereas, short-term traders might be more interested in market price fluctuations.

- Portfolio diversification: The Amundi DJIA UCITS ETF Dist should ideally be one component of a diversified investment portfolio. Don't put all your eggs in one basket!

Conclusion: Mastering the Net Asset Value of Your Amundi Dow Jones Industrial Average UCITS ETF Dist Investment

Understanding the Net Asset Value of your Amundi Dow Jones Industrial Average UCITS ETF Dist investment is vital for effective portfolio management. By regularly checking the NAV from reliable sources like Amundi's website or your brokerage account, you can monitor your investment's performance and make informed decisions. Remember to consider the NAV in conjunction with other market factors and your overall investment strategy. Start monitoring your Amundi Dow Jones Industrial Average UCITS ETF Dist's NAV today! If you need personalized investment advice, consult a qualified financial advisor.

Featured Posts

-

Pobediteli Evrovideniya 2025 Smeloe Predskazanie Konchity Vurst

May 24, 2025

Pobediteli Evrovideniya 2025 Smeloe Predskazanie Konchity Vurst

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Guide To Net Asset Value Nav

May 24, 2025 -

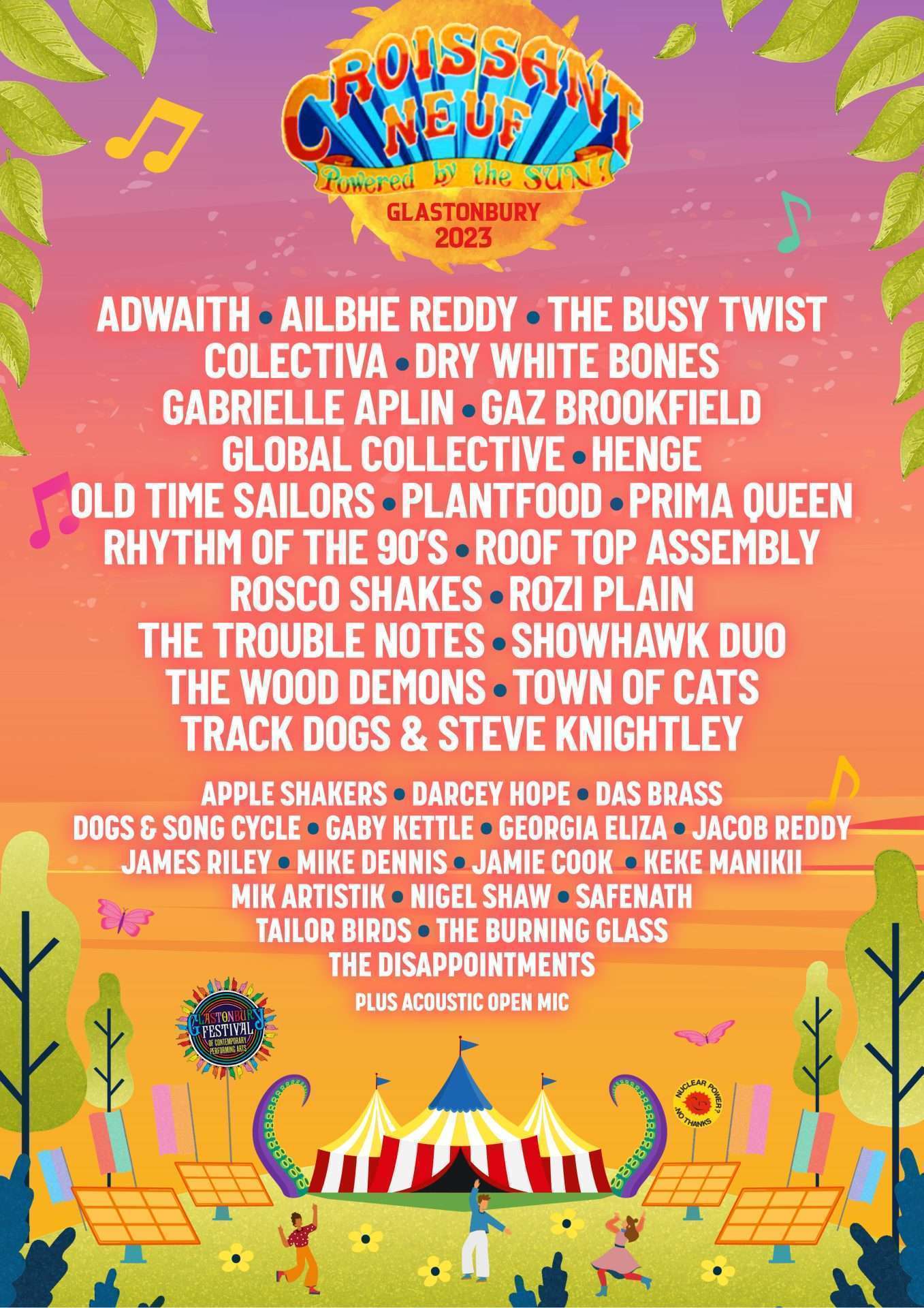

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

Living The Dream A Realistic Look At Escaping To The Country

May 24, 2025

Living The Dream A Realistic Look At Escaping To The Country

May 24, 2025 -

Skolko Let Bylo Akteram V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Skolko Let Bylo Akteram V Filme O Bednom Gusare Zamolvite Slovo

May 24, 2025

Latest Posts

-

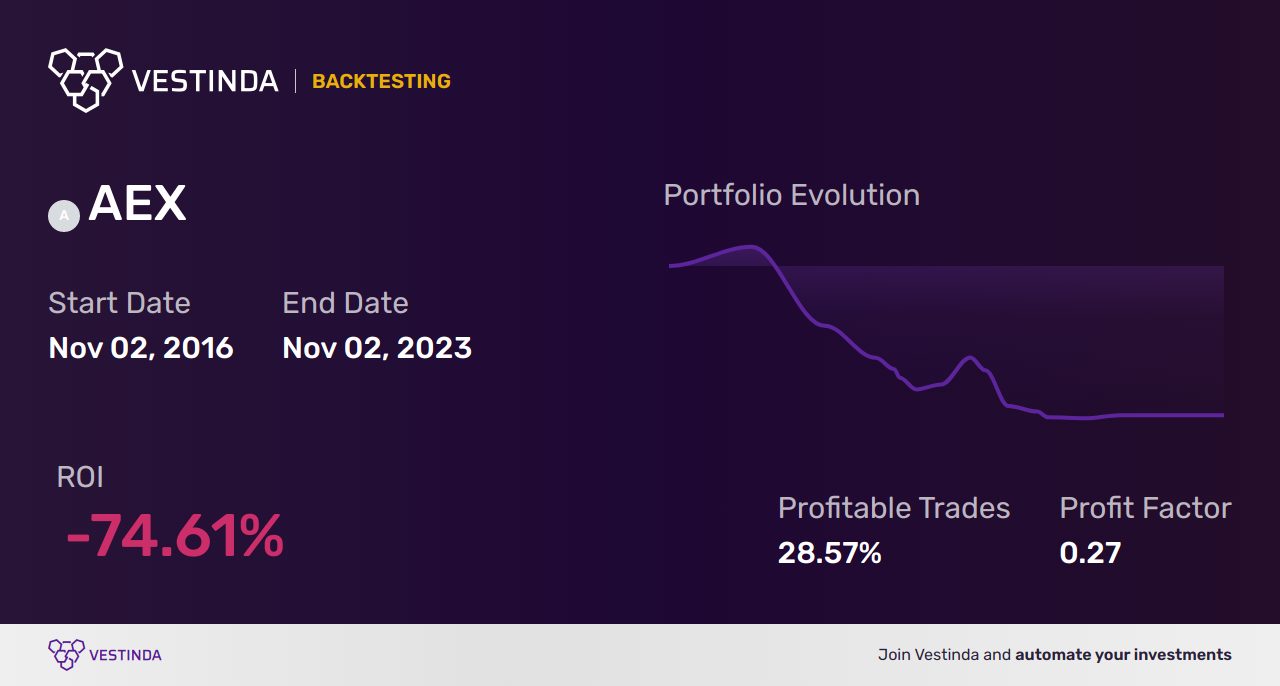

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025