Amundi Dow Jones Industrial Average UCITS ETF: NAV Explained

Table of Contents

Understanding Net Asset Value (NAV)

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For ETFs, this calculation reflects the underlying value of the securities held within the fund. Essentially, the NAV tells you the theoretical value of one share of the ETF. It's a crucial indicator of the ETF's intrinsic worth.

- NAV Calculation (Simplified): (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

- NAV vs. Market Price: While the NAV reflects the intrinsic value, the market price is the actual price at which the ETF is traded on the exchange. These prices can differ slightly due to supply and demand.

- Factors Influencing Daily NAV Fluctuations: The NAV changes daily based on fluctuations in the value of the underlying assets within the ETF. Market movements, dividend payments, and other factors can all influence the daily NAV.

Amundi Dow Jones Industrial Average UCITS ETF: A Closer Look

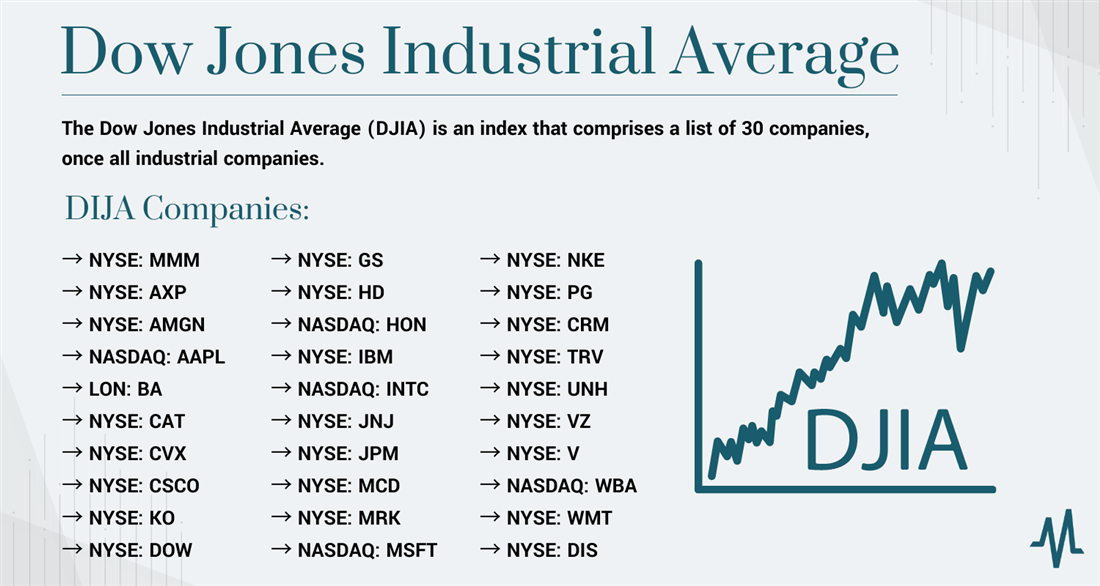

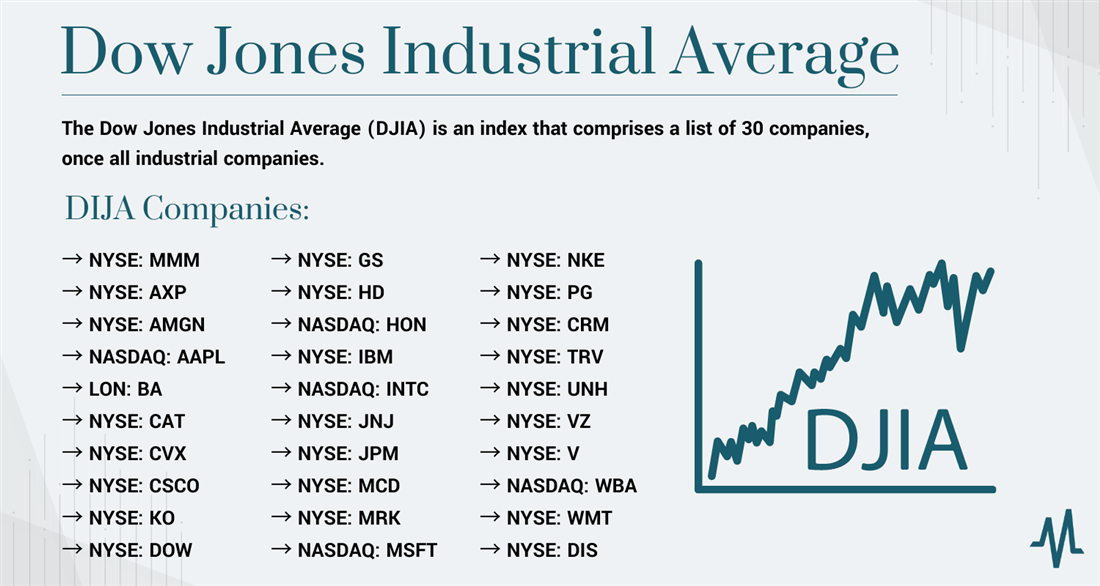

The Amundi Dow Jones Industrial Average UCITS ETF aims to track the performance of the Dow Jones Industrial Average (DJIA), a leading index of 30 large, publicly-owned companies in the United States. This ETF provides investors with exposure to a diversified basket of blue-chip American companies.

- Investment Strategy: The ETF utilizes a full replication strategy, aiming to hold all 30 components of the DJIA in the same weighting as the index.

- Top Holdings: The top holdings will naturally mirror the components of the DJIA, with companies like Apple, Microsoft, and Johnson & Johnson typically representing a significant portion of the portfolio.

- Historical NAV Performance: (Insert chart or graph showing historical NAV performance here. Source should be clearly cited.) Analyzing past NAV performance provides valuable insights into the ETF's historical behavior, though past performance is not indicative of future results.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Several reliable sources provide this information:

- Reliable Sources: Amundi's official website is the most accurate source. Many financial news websites and brokerage platforms also display real-time and historical NAV data.

- Potential Discrepancies: Minor discrepancies might exist between different data providers due to slight timing differences in updates.

- Interpreting NAV Data: NAV data is usually presented per share. Understanding this unit of measurement is essential for accurate interpretation.

NAV and Investment Decisions

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for making sound investment decisions. By comparing the NAV to the market price, you can potentially identify arbitrage opportunities (though these are rare and require swift action).

- Using NAV to Assess ETF Value: The NAV provides a benchmark for the ETF's intrinsic value.

- Comparing NAV to Market Price: A significant divergence between the NAV and market price might suggest an opportunity or a potential risk.

- NAV in a Diversified Portfolio: Consider the NAV alongside other factors when integrating this ETF into your overall investment strategy.

Conclusion

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is paramount for any investor considering this fund. By closely monitoring the NAV and comparing it to the market price, you can make more informed decisions about buying, selling, or holding this ETF. Remember that the NAV provides a valuable insight into the underlying asset value, but it's just one piece of the puzzle in a comprehensive investment strategy. Learn more about the Amundi DJIA ETF NAV and actively monitor its performance to make well-informed investment choices. Visit the Amundi website for detailed information and updates on the Amundi Dow Jones Industrial Average UCITS ETF NAV and other investment products.

Featured Posts

-

Dax Falls Below 24 000 Frankfurt Stock Market Closing Report

May 24, 2025

Dax Falls Below 24 000 Frankfurt Stock Market Closing Report

May 24, 2025 -

When To Fly For Memorial Day Weekend 2025 Avoid The Crowds

May 24, 2025

When To Fly For Memorial Day Weekend 2025 Avoid The Crowds

May 24, 2025 -

Sejarah Porsche 356 Eksplorasi Pabrik Zuffenhausen Jerman

May 24, 2025

Sejarah Porsche 356 Eksplorasi Pabrik Zuffenhausen Jerman

May 24, 2025 -

Lvmh First Quarter Sales Below Forecast Shares Down 8 2

May 24, 2025

Lvmh First Quarter Sales Below Forecast Shares Down 8 2

May 24, 2025 -

Frankfurt Stock Exchange Opens Dax Remains Stable Post Record

May 24, 2025

Frankfurt Stock Exchange Opens Dax Remains Stable Post Record

May 24, 2025

Latest Posts

-

Berkshire Hathaways Apple Stock Post Buffett Ceo Transition Analysis

May 24, 2025

Berkshire Hathaways Apple Stock Post Buffett Ceo Transition Analysis

May 24, 2025 -

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Holdings

May 24, 2025

The Impact Of Buffetts Retirement On Berkshire Hathaways Apple Holdings

May 24, 2025 -

Buffetts Succession The Future Of Berkshire Hathaways Apple Investment

May 24, 2025

Buffetts Succession The Future Of Berkshire Hathaways Apple Investment

May 24, 2025 -

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 24, 2025 -

Ai I Phone

May 24, 2025

Ai I Phone

May 24, 2025