Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV Calculation And Analysis

Table of Contents

What is NAV and Why is it Important for Amundi MSCI World II UCITS ETF USD Hedged Dist?

Net Asset Value (NAV) represents the net worth of an ETF's holdings. Simply put, it's the total value of all the assets the ETF owns, minus its liabilities (like expenses and management fees), divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, the NAV reflects the underlying value of its investment in a broad range of global equities, as represented by the MSCI World Index.

The NAV is vital because it directly reflects the intrinsic value of the ETF. Fluctuations in the ETF's market price are often influenced by supply and demand, which can temporarily deviate from the NAV. Understanding this relationship is crucial. The NAV changes throughout the trading day, typically calculated at the market close, providing a daily snapshot of the ETF's value.

- NAV reflects the intrinsic value of the ETF.

- Daily NAV calculation provides transparency to investors.

- Comparing NAV with the market price helps identify potential arbitrage opportunities.

- Tracking NAV changes helps understand ETF performance over time.

Analyzing NAV trends can provide valuable insights for investment decisions. A rising NAV generally indicates positive performance, potentially signaling a good time to hold or even buy more shares. Conversely, a falling NAV may warrant a closer examination of the underlying assets and market conditions.

Understanding the Calculation of Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Calculating the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist involves several key components:

- Total Assets: This is the market value of all the underlying securities held within the ETF, reflecting the current prices of the stocks and other assets that mirror the MSCI World Index.

- Liabilities: This includes expenses such as management fees, administrative costs, and any other outstanding obligations.

- Currency Hedging Impact: The "USD Hedged" designation means the ETF employs strategies to mitigate the risk associated with fluctuations in exchange rates between the underlying assets' currencies and the US dollar. This hedging impacts the NAV calculation, aiming to provide more stable returns in USD terms. The hedging strategy's effectiveness will affect the NAV, potentially dampening its volatility compared to an unhedged version.

- Data Sources: The NAV calculation relies on accurate and up-to-date market data from reputable sources, primarily MSCI data for the index composition and current exchange rates for the currency hedging.

The NAV is typically calculated daily, at the close of the market, using the prevailing market prices of the underlying assets. The complexities of replicating the MSCI World Index—which involves holding a diverse portfolio of international stocks—are accounted for in this calculation, ensuring an accurate reflection of the ETF's holdings.

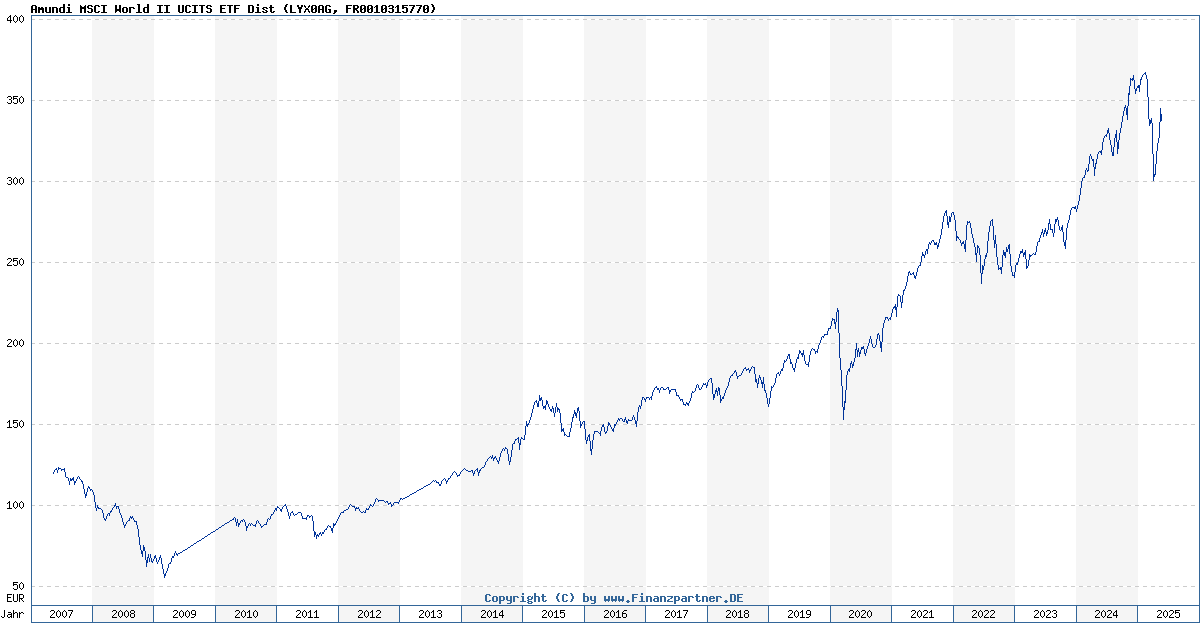

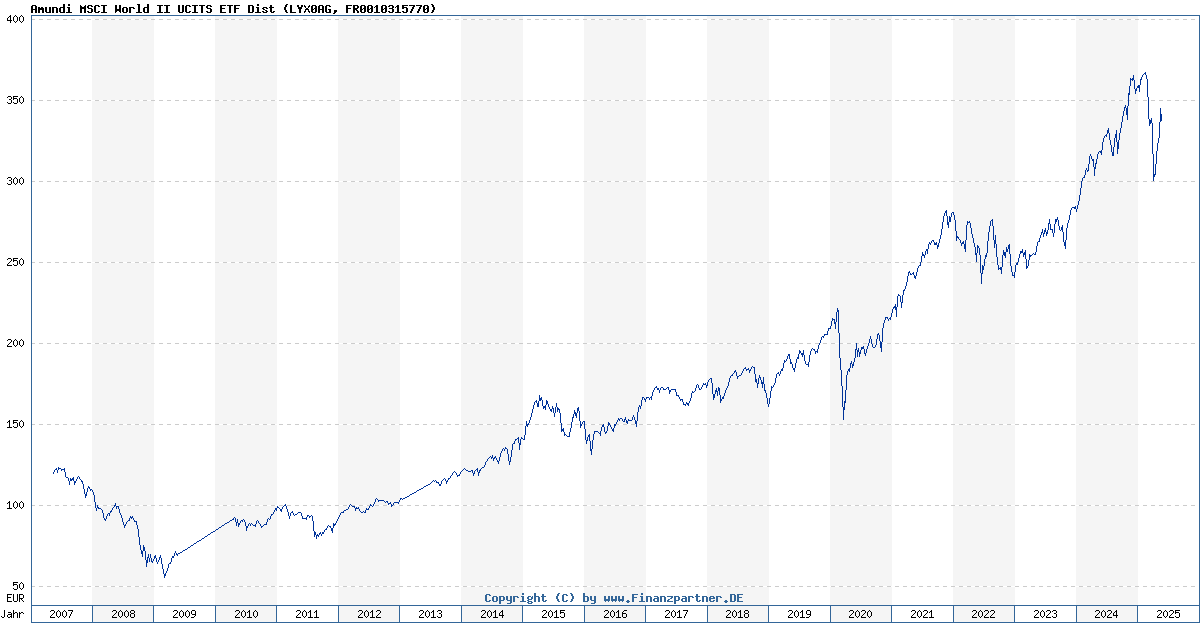

Analyzing Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Trends

Analyzing NAV trends over time provides crucial insights into the ETF's performance. An upward trend generally suggests positive performance, while a downward trend signals potential concerns.

- Long-term NAV trends reflect the overall market performance and the effectiveness of the ETF's investment strategy.

- Short-term fluctuations are influenced by daily market volatility and news events affecting the underlying assets.

- Comparing the NAV against the MSCI World Index provides a benchmark for performance evaluation. A significant divergence could indicate either outperformance (positive) or underperformance (negative) compared to the benchmark index.

- Analyzing NAV alongside expense ratios is crucial for a holistic performance assessment. High expense ratios can negatively impact overall returns.

To identify potential risks, look for persistent downward trends or unusual volatility that deviates significantly from the benchmark index's movements. Historical NAV data can be obtained from various sources, including Amundi's official website and major financial data providers.

Tools and Resources for NAV Analysis of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several resources can help you access and analyze the NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Amundi's official website: This is the primary source for official NAV data and ETF information.

- Major financial data providers (Bloomberg, Refinitiv): These platforms offer comprehensive data, including historical NAV, allowing for detailed analysis.

- Brokerage account platforms: If you hold this ETF through a brokerage account, the platform typically provides access to real-time and historical NAV information.

- Spreadsheet software (like Excel): You can import NAV data into spreadsheets to create charts and graphs visualizing trends and performance over time.

- Specialized financial software: For more advanced analysis, dedicated financial software packages can provide sophisticated tools for portfolio management and performance tracking.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Analysis

Understanding the NAV calculation and analysis for the Amundi MSCI World II UCITS ETF USD Hedged Dist is vital for making informed investment decisions. By consistently monitoring NAV trends, comparing it to benchmarks, and considering relevant factors like expense ratios and currency hedging, you can gain valuable insights into the ETF's performance and manage your portfolio effectively. Start analyzing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today and make confident investment choices. Understand the nuances of NAV calculation and unlock the potential of this diversified ETF.

Featured Posts

-

Nicki Chapmans Garden Design Inspiration From Her Chiswick Home

May 24, 2025

Nicki Chapmans Garden Design Inspiration From Her Chiswick Home

May 24, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Prehlad O Situacii

May 24, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Prehlad O Situacii

May 24, 2025 -

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025 -

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025 -

The Allure Of A Country Escape Benefits And Considerations

May 24, 2025

The Allure Of A Country Escape Benefits And Considerations

May 24, 2025

Latest Posts

-

Over 100 Firearms Seized 18 Brazilian Nationals Charged In Massachusetts Gun Bust

May 24, 2025

Over 100 Firearms Seized 18 Brazilian Nationals Charged In Massachusetts Gun Bust

May 24, 2025 -

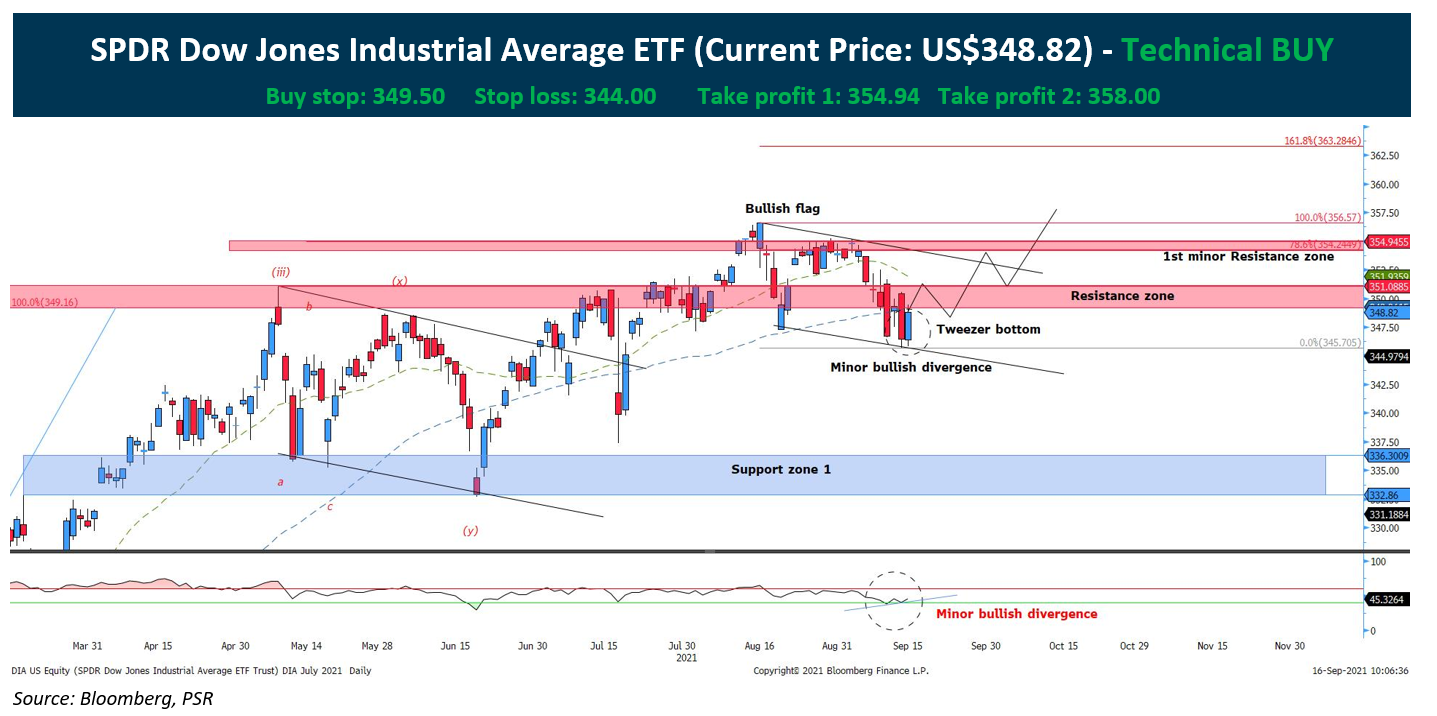

Amundi Dow Jones Industrial Average Ucits Etf How Net Asset Value Nav Impacts Your Investment

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf How Net Asset Value Nav Impacts Your Investment

May 24, 2025 -

Massachusetts Authorities Seize Over 100 Firearms Charge 18 Brazilian Nationals

May 24, 2025

Massachusetts Authorities Seize Over 100 Firearms Charge 18 Brazilian Nationals

May 24, 2025 -

18 Brazilian Nationals Face Charges In Large Scale Massachusetts Gun Trafficking Ring

May 24, 2025

18 Brazilian Nationals Face Charges In Large Scale Massachusetts Gun Trafficking Ring

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025