Analysis Of Petrol Prices: The Roles Of Dangote And NNPC

Table of Contents

Dangote Refinery's Potential Impact on Petrol Prices

The commissioning of the Dangote Refinery, one of the largest single-train refineries globally, represents a potential game-changer for Nigeria's petrol market.

Increased Domestic Refining Capacity

The refinery's massive capacity, capable of processing 650,000 barrels of crude oil per day, promises a significant increase in domestic petrol production. This increased local production is expected to:

- Reduce reliance on imports: Currently, Nigeria imports a substantial portion of its refined petroleum products, making it vulnerable to global price volatility and supply chain disruptions. Dangote's refinery aims to significantly reduce this reliance.

- Lower import costs: By decreasing the volume of imported petrol, the nation will save considerable foreign exchange and reduce the vulnerability to international price shocks.

- Increase competition: The introduction of a major new player will foster competition among suppliers, potentially leading to more competitive pricing.

However, achieving full capacity presents challenges. The refinery's operational efficiency, access to sufficient crude oil feedstock, and the effectiveness of its distribution network will all be crucial factors determining its actual impact.

Competition and Market Dynamics

Dangote's entry into the Nigerian petroleum market is expected to significantly alter the existing market dynamics.

- Potential price wars: The increased competition could lead to price wars, benefiting consumers through lower petrol prices.

- Increased consumer choice: Consumers may gain access to a wider range of fuel options and potentially better service.

- Price stabilization: Increased domestic production could help stabilize petrol prices, mitigating the impact of global price fluctuations.

The long-term effect will depend on the interplay between Dangote and existing players, including the NNPC.

Economic Implications of Local Refining

The impact of the Dangote Refinery extends beyond petrol prices. Local refining offers significant broader economic benefits:

- Job creation: The refinery's operations and associated industries will create numerous jobs, boosting employment across various sectors.

- Foreign exchange savings: Reduced reliance on imports will save the nation valuable foreign exchange reserves.

- Improved energy security: Greater self-sufficiency in petrol production will enhance Nigeria's energy security and reduce vulnerability to external factors.

NNPC's Role in Petrol Price Determination

The Nigerian National Petroleum Company (NNPC) continues to play a dominant role in the Nigerian petroleum sector, significantly influencing petrol prices.

Subsidy Regime and its Influence

Nigeria's long-standing petrol subsidy regime has had a profound impact on fuel pricing.

- Impact on prices: Subsidies artificially lower petrol prices at the pump, making fuel more affordable to consumers but placing a significant burden on the government's budget.

- Long-term sustainability: The sustainability of the subsidy regime is questionable given its substantial financial implications for the government.

- Budgetary implications: The cost of subsidies diverts resources that could be allocated to other crucial sectors of the economy. These costs are frequently cited as a major contributor to government debt.

NNPC's Pricing Mechanisms and Transparency

The transparency and efficiency of NNPC's pricing mechanisms have been a subject of debate.

- Factors considered: NNPC considers factors like importation costs, refining margins, and transportation expenses when setting petrol prices. However, the precise calculations and their transparency are often questioned.

- Concerns about inefficiencies: Concerns persist about potential inefficiencies and lack of transparency in NNPC's operations and pricing decisions.

- Need for greater accountability: There is a growing call for greater accountability and transparency in NNPC's pricing mechanisms to ensure fair pricing for consumers.

NNPC's Importation Practices and their Effect on Prices

NNPC's role as a major importer of refined petroleum products significantly influences petrol prices.

- Vulnerability to global price fluctuations: This reliance makes Nigeria vulnerable to global oil price fluctuations and exchange rate volatility.

- Impact of exchange rate volatility: Fluctuations in the Naira’s value against the US dollar directly impact import costs and, consequently, petrol prices.

Interplay between Dangote Refinery and NNPC

The relationship between the Dangote Refinery and NNPC will be crucial in determining the future of petrol prices in Nigeria.

- Cooperation vs. competition: The two entities could either cooperate to ensure a stable and efficient fuel market or compete for market share.

- Potential for a more efficient market: A competitive market, fostered by both players, could lead to more efficient pricing and distribution. However, potential collusion needs to be prevented to ensure consumer protection.

Conclusion: The Future of Petrol Prices in Nigeria

The Dangote Refinery's potential to increase domestic refining capacity and foster competition, alongside NNPC's ongoing role, will significantly shape Nigeria's petrol pricing landscape. While the refinery promises price stabilization and increased competition, the effectiveness of the subsidy regime and the transparency of NNPC's pricing mechanisms remain critical factors. Effective government policies and regulatory frameworks are essential to ensure a fair and efficient market that benefits both consumers and the national economy. Further analysis of petrol prices, focusing on the interplay between Dangote and NNPC, is crucial for achieving a truly sustainable and predictable fuel market. We encourage you to share your insights and perspectives on this complex issue, furthering the discussion on the Analysis of Petrol Prices: The Roles of Dangote and NNPC.

Featured Posts

-

Celebrity Stylist Elizabeth Stewarts Spring Collaboration With Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewarts Spring Collaboration With Lilysilk

May 10, 2025 -

Bof As Analysis Why Current Stock Market Valuations Are Justified

May 10, 2025

Bof As Analysis Why Current Stock Market Valuations Are Justified

May 10, 2025 -

Sensex And Nifty 50 Record Gains Understanding The 1400 23800 Point Surge

May 10, 2025

Sensex And Nifty 50 Record Gains Understanding The 1400 23800 Point Surge

May 10, 2025 -

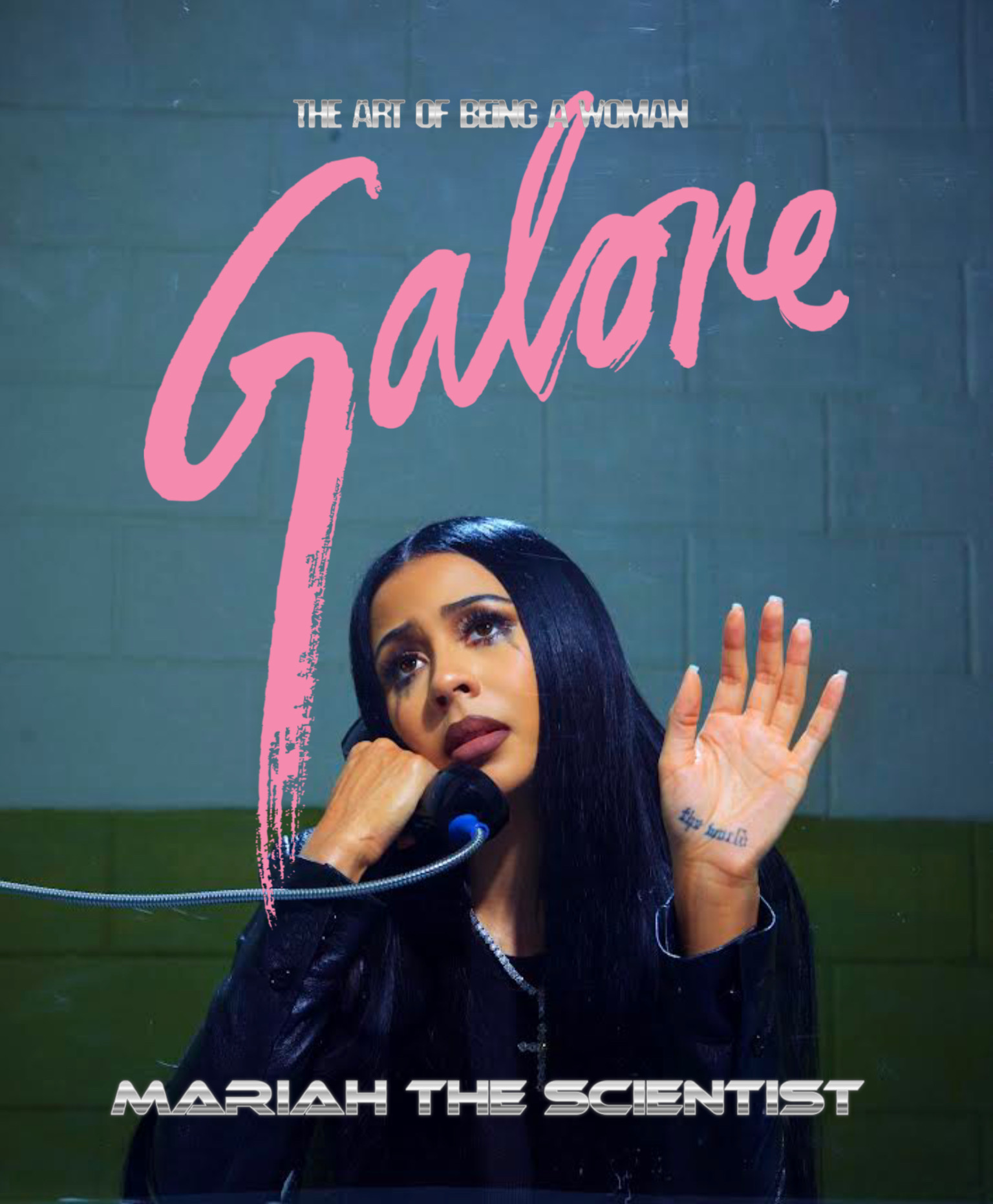

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Revealed

May 10, 2025

Young Thugs Loyalty Vow To Mariah The Scientist New Snippet Revealed

May 10, 2025 -

New Bot Governor Needed As Thailand Faces Tariff Headwinds

May 10, 2025

New Bot Governor Needed As Thailand Faces Tariff Headwinds

May 10, 2025