BofA's Analysis: Why Current Stock Market Valuations Are Justified

Table of Contents

BofA's Macroeconomic Outlook: A Foundation for Justified Valuations

BofA's assessment of current stock market valuations rests heavily on its macroeconomic forecast. Their analysis considers several key macroeconomic factors that significantly impact stock prices and market valuation. These factors form the foundation of their argument for justified valuations.

-

Sustained Economic Growth: BofA generally predicts sustained, albeit moderate, economic growth. This forecast is based on several factors including continued consumer spending, improving business investment, and ongoing government spending. This sustained growth directly impacts corporate earnings, a key driver of stock prices.

-

Inflation and Interest Rates: BofA's perspective on inflation is crucial. While acknowledging inflationary pressures, their analysis suggests these pressures are likely to moderate over time. This, in turn, influences their predictions regarding interest rates. They anticipate a gradual increase in interest rates, but not a sharp, disruptive hike that would severely curtail economic growth and negatively impact corporate profitability.

-

Influence on Corporate Earnings: BofA connects their macroeconomic predictions directly to corporate earnings. Sustained growth, coupled with manageable inflation and interest rates, translates into projections of healthy, though potentially not explosive, corporate earnings growth. This positive outlook on earnings is central to justifying current stock valuations. (Note: Ideally, we would include a relevant chart or graph here depicting BofA's earnings growth projections, if publicly available).

Earnings Growth and its Role in Supporting Current Stock Prices

BofA's analysis emphasizes the crucial role of earnings growth in supporting current stock prices. They examine corporate earnings growth projections across various sectors, identifying key drivers of future growth.

-

Corporate Earnings Projections: BofA's research provides projections of corporate earnings growth, which are considered realistic given their macroeconomic outlook. These projections serve as a cornerstone of their justification for current valuations.

-

Key Growth Sectors: BofA likely identifies specific sectors poised for strong earnings growth. These could include technology, healthcare, or consumer staples, depending on their current assessment. Pinpointing these sectors helps illustrate the foundation of their positive outlook.

-

P/E Ratio Justification: BofA connects earnings growth projections to current Price-to-Earnings (P/E) ratios. Their analysis likely argues that current P/E ratios, while potentially high compared to historical averages, are justified given the anticipated future earnings growth. (Note: Specific data from BofA's research on P/E ratios and projected earnings growth would strengthen this section considerably.)

Addressing the Risk Factors: Why BofA Sees Limited Downside

While acknowledging inherent market risks, BofA's analysis suggests that these risks are largely priced into the current market valuations.

-

Recessionary Fears and Geopolitical Instability: BofA assesses potential risks such as recessionary fears or geopolitical instability. These are valid concerns that could impact the market negatively.

-

Risks Already Priced In: BofA's crucial argument is that these risks are largely accounted for in current stock prices. The market, in their view, has already discounted these potential negative scenarios to some degree.

-

Mitigating Factors: BofA may identify mitigating factors that could offset some of these risks. This could include strong consumer balance sheets, resilient corporate balance sheets, or government interventions.

-

Downside Scenarios: BofA likely provides its perspective on potential downside scenarios and their probability. This demonstrates a cautious but not overly pessimistic approach.

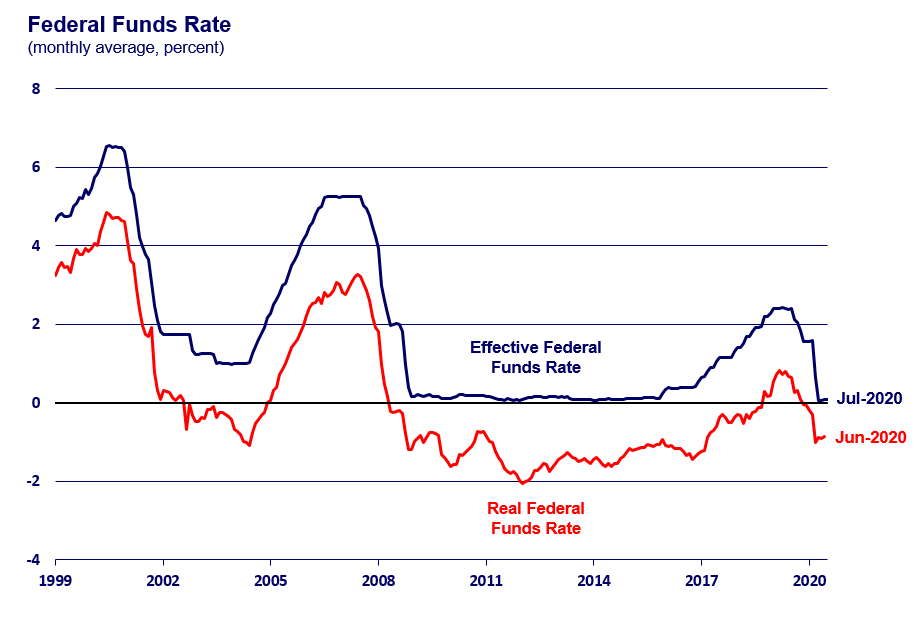

The Role of Low Interest Rates and Monetary Policy

BofA's valuation analysis considers the impact of the current low interest rate environment and the role of monetary policy.

-

Low Interest Rates and Stock Valuations: Low interest rates generally make equities more attractive relative to bonds, potentially driving up stock prices. BofA incorporates this dynamic into their analysis.

-

Influence of Monetary Policy: The actions of central banks, such as quantitative easing or interest rate adjustments, significantly influence stock valuations. BofA considers the current and anticipated future monetary policy in their assessment.

-

Future Interest Rate Changes: BofA's analysis likely considers the effect of potential future interest rate changes on stock prices. They probably assess the impact of rate hikes or potential cuts on market valuations.

Conclusion

This analysis of BofA's perspective on current stock market valuations reveals a nuanced view, suggesting that current prices are largely justified considering the bank's macroeconomic outlook, earnings growth projections, and risk assessment. While risks such as recessionary fears or geopolitical instability exist, BofA's analysis indicates these are largely priced in. Understanding BofA's analysis of stock market valuation is crucial for informed investment decisions. Further research into BofA's reports and other reputable sources is recommended before making any investment choices. Stay informed about the evolving stock market valuation landscape and continue your research into justified stock market valuations.

Featured Posts

-

From Wolves Reject To European Champion The Rise Of A Football Star

May 10, 2025

From Wolves Reject To European Champion The Rise Of A Football Star

May 10, 2025 -

Bof As Analysis Why Current Stock Market Valuations Are Justified

May 10, 2025

Bof As Analysis Why Current Stock Market Valuations Are Justified

May 10, 2025 -

Why The Federal Reserve Is Different Interest Rate Policy Explained

May 10, 2025

Why The Federal Reserve Is Different Interest Rate Policy Explained

May 10, 2025 -

The Epstein Case Attorney General Pam Bondis Role And The Missing Client List

May 10, 2025

The Epstein Case Attorney General Pam Bondis Role And The Missing Client List

May 10, 2025 -

Hidden Epstein Files Senate Democrats Investigation Into Pam Bondis Actions

May 10, 2025

Hidden Epstein Files Senate Democrats Investigation Into Pam Bondis Actions

May 10, 2025

Latest Posts

-

Is This Underrated Character The Perfect Season 2 Victim High Potential

May 10, 2025

Is This Underrated Character The Perfect Season 2 Victim High Potential

May 10, 2025 -

5 Times Morgan Showed Less Than Stellar Intelligence In High Potential Season 1

May 10, 2025

5 Times Morgan Showed Less Than Stellar Intelligence In High Potential Season 1

May 10, 2025 -

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025 -

Attorney General Uses Prop Fentanyl To Highlight Drug Crisis

May 10, 2025

Attorney General Uses Prop Fentanyl To Highlight Drug Crisis

May 10, 2025 -

Fake Fentanyl Demonstration By Attorney General Sparks Debate

May 10, 2025

Fake Fentanyl Demonstration By Attorney General Sparks Debate

May 10, 2025