Analyzing The $67 Million Ethereum Liquidation: Market Trends And Forecasts

Table of Contents

H2: Understanding the $67 Million Ethereum Liquidation Event

H3: Causes of the Liquidation: The $67 million Ethereum liquidation wasn't a singular event but rather a confluence of factors. Understanding these contributing elements is crucial for preventing similar occurrences in the future.

- Leveraged Trading: Many traders employed high leverage, magnifying their potential profits but also their potential losses exponentially. A relatively small price movement against their positions triggered margin calls, leading to cascading liquidations.

- Algorithmic Trading Failures: Automated trading bots, designed to execute trades based on pre-programmed algorithms, may have malfunctioned or exacerbated the sell-off during the price downturn, contributing to the overall liquidation volume.

- Market Volatility: The inherent volatility of the cryptocurrency market played a significant role. A sudden, sharp drop in Ethereum's price acted as the catalyst for the margin calls, triggering the chain reaction of liquidations.

- Whale Activity (Potential): While difficult to definitively prove, the possibility of large holders ("whales") strategically manipulating the market to capitalize on leveraged positions cannot be ruled out. Further investigation is needed to clarify this aspect.

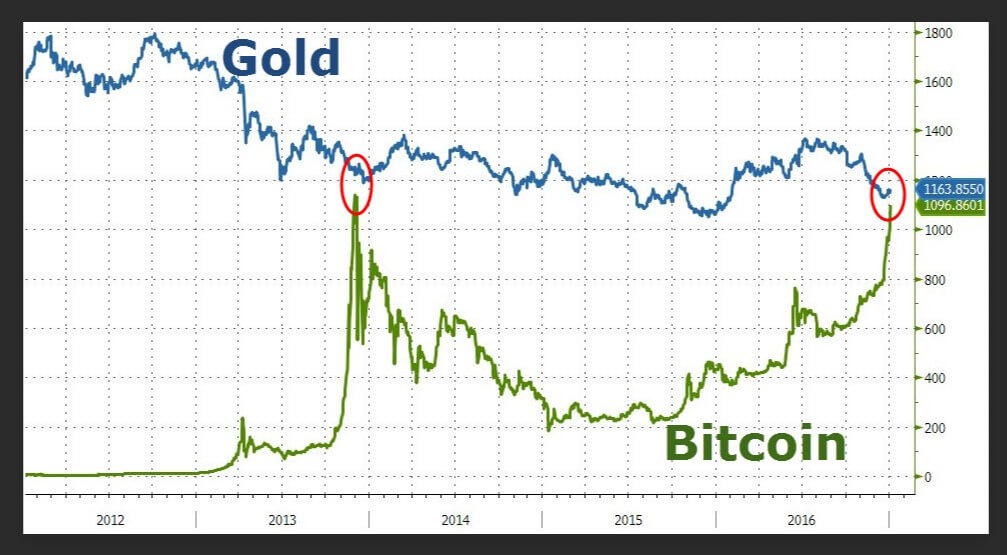

H3: Impact on Ethereum Price: The $67 million liquidation had an immediate and noticeable impact on Ethereum's price. [Insert chart showing price fluctuation around the time of the liquidation]. The price experienced a sharp decline, reflecting the selling pressure generated by the forced liquidations. The magnitude of the drop significantly impacted market sentiment, leading to further uncertainty and volatility.

H3: Affected Parties: The liquidation affected a range of players within the Ethereum ecosystem. While precise details regarding individual losses remain largely private, it is likely that:

- Retail Traders: Numerous retail traders employing leverage were significantly impacted, suffering substantial financial losses.

- Lending Platforms: Platforms offering leveraged trading likely experienced increased stress and potential losses due to the defaults triggered by the liquidations.

- DeFi Protocols: Certain decentralized finance protocols that rely on liquidity pools could have experienced temporary disruptions or increased risk exposure.

H2: Market Trends Following the Liquidation

H3: Volatility and Market Sentiment: Following the $67 million liquidation, market volatility spiked considerably. [Insert chart or graph illustrating volatility metrics]. The fear and greed index likely plummeted, reflecting the negative sentiment among investors. Trading volume increased temporarily as market participants reacted to the event. The overall market reaction leaned bearish in the immediate aftermath.

H3: Impact on DeFi: The liquidation had a ripple effect on the DeFi ecosystem, particularly Ethereum-based protocols. Liquidity pools experienced temporary imbalances, and some lending and borrowing protocols faced increased stress. The event highlighted the systemic risks associated with interconnected DeFi applications and the importance of risk management within the ecosystem.

H3: Whale Activity and Market Manipulation: The possibility of large-scale market manipulation by whales warrants further investigation. While direct evidence is lacking, the timing and scale of the liquidation raise questions about the potential involvement of sophisticated traders attempting to exploit market inefficiencies.

H2: Forecasting Future Trends Based on the Liquidation

H3: Short-Term Predictions: In the short term, Ethereum's price is likely to remain volatile, influenced by broader market sentiment and ongoing macroeconomic factors. [Insert cautiously optimistic or pessimistic short-term prediction with a clear explanation of reasoning and caveats].

H3: Long-Term Implications for Ethereum: The long-term implications of this liquidation event are less clear-cut. However, it highlights the need for robust risk management practices within the Ethereum ecosystem. This could spur further development of risk mitigation tools and protocols, potentially leading to a more mature and resilient DeFi landscape. Regulatory scrutiny might also intensify.

H3: Risk Assessment for Investors: Investors considering Ethereum investments should carefully assess their risk tolerance and understand the inherent volatility of the cryptocurrency market. Diversification, limiting leverage, and thoroughly researching projects are crucial for mitigating potential losses.

3. Conclusion:

The $67 million Ethereum liquidation served as a stark reminder of the risks associated with leveraged trading and the volatility inherent in the cryptocurrency market. Analyzing this event reveals vulnerabilities within the DeFi ecosystem and underscores the importance of robust risk management practices. While short-term predictions remain uncertain, the long-term impact might involve increased regulatory scrutiny and further technological advancements to improve market stability. By continuing to analyze Ethereum liquidations and other significant market events, investors can make more informed decisions and navigate the complex landscape of cryptocurrency investments more effectively. Stay informed, analyze market data, and continue analyzing Ethereum liquidations to protect your investments.

Featured Posts

-

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025 -

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025

Micro Strategy Vs Bitcoin In 2025 Which Is The Better Investment

May 08, 2025 -

Nba Game Thunder Vs Trail Blazers How To Watch On March 7th

May 08, 2025

Nba Game Thunder Vs Trail Blazers How To Watch On March 7th

May 08, 2025 -

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Reactions

May 08, 2025

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Reactions

May 08, 2025 -

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Ethereum Price Forecast 1 11 Million Eth Accumulated Bullish Momentum Builds

May 08, 2025

Latest Posts

-

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025

Lahore Schools Adjust Timings For Psl Matches

May 08, 2025 -

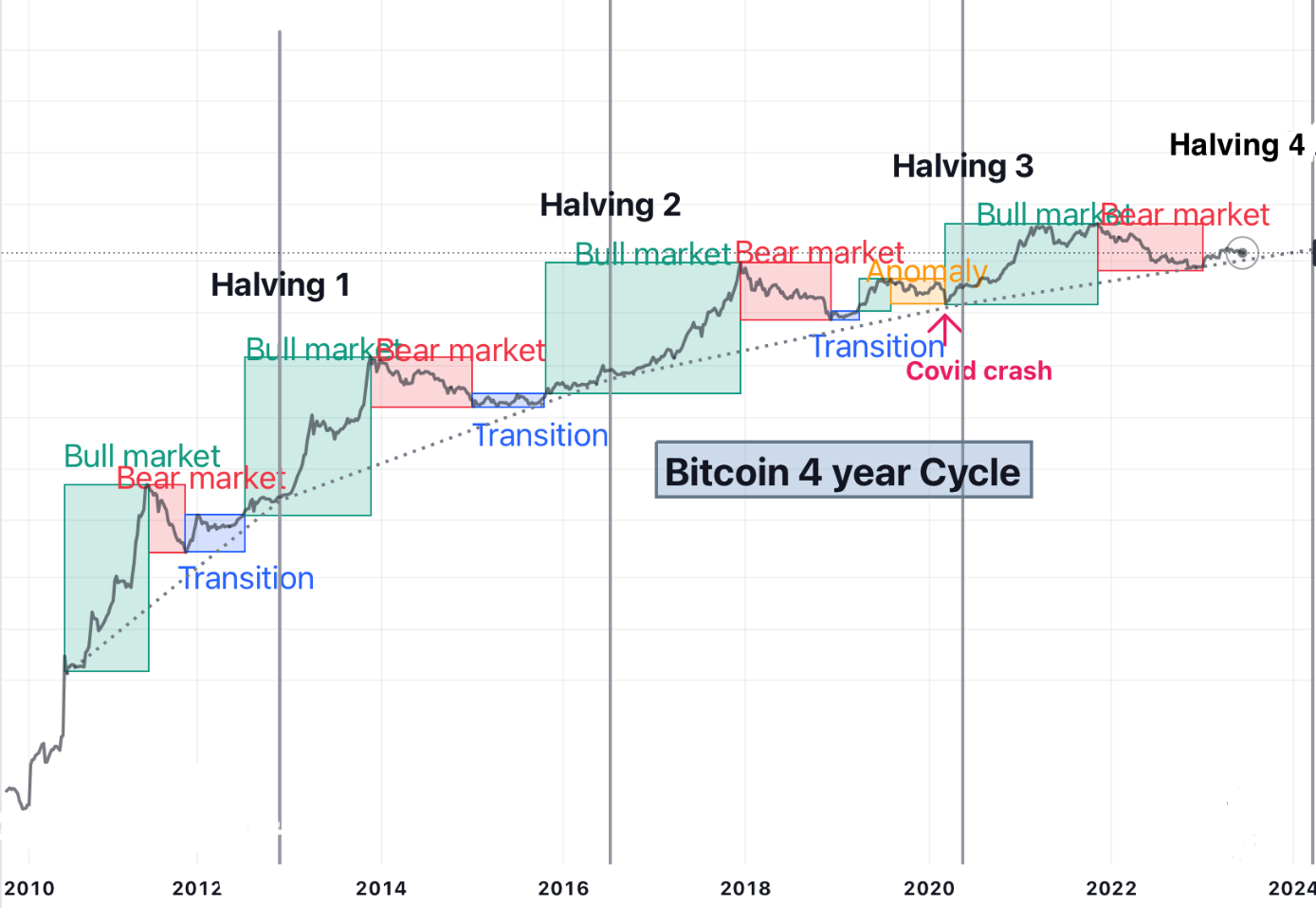

Bitcoins Recent Rebound Signs Of Recovery Or Short Lived Surge

May 08, 2025

Bitcoins Recent Rebound Signs Of Recovery Or Short Lived Surge

May 08, 2025 -

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025 -

Marriyum Aurangzeb Addresses Lahore Zoo Ticket Price Increase

May 08, 2025

Marriyum Aurangzeb Addresses Lahore Zoo Ticket Price Increase

May 08, 2025 -

Bitcoin Rebound A New Bull Market Or Temporary Rally

May 08, 2025

Bitcoin Rebound A New Bull Market Or Temporary Rally

May 08, 2025