Analyzing The Net Asset Value Of The Amundi DJIA UCITS ETF (Distributing)

Table of Contents

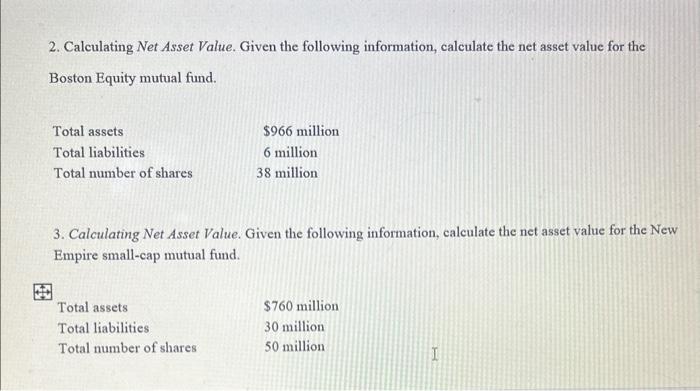

Factors Affecting the Amundi DJIA UCITS ETF (Distributing) NAV

The Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing), like any ETF, is directly tied to the performance of its underlying assets. This ETF tracks the Dow Jones Industrial Average (DJIA), meaning its NAV is heavily influenced by the performance of the 30 constituent companies within the index.

-

Underlying Asset Performance: The primary driver of the ETF's NAV is the collective performance of the DJIA components. If the DJIA rises, so too will the ETF's NAV, and vice versa. Strong individual company performance within the index contributes positively to the overall NAV, while poor performance has the opposite effect.

-

Currency Fluctuations: As a UCITS ETF, the Amundi DJIA ETF may hold assets denominated in various currencies. Fluctuations in exchange rates can impact the NAV, especially if the underlying assets are primarily in a currency different from the ETF's base currency. A strengthening US dollar (USD), for instance, could negatively affect the NAV if a significant portion of the underlying assets are in Euros or other currencies.

-

Dividends and Distribution Payments: The Amundi DJIA UCITS ETF is a distributing ETF, meaning it distributes dividends received from the underlying companies to its shareholders.

- Dividend payouts reduce the ETF's NAV on the ex-dividend date. This is because the distributed funds are no longer part of the ETF's total assets.

- However, the benefit of a distributing ETF is that investors receive regular income streams, which can be reinvested or used for other purposes. This is a key factor to consider when comparing this ETF to accumulating ETFs.

-

Expense Ratios: The ETF's expense ratio, which covers management fees and operational costs, indirectly impacts the NAV. While not a direct deduction, these fees are factored into the overall performance, subtly affecting the growth of the NAV over time.

-

Market Sentiment and Investor Behavior: Broader market sentiment and investor behavior significantly influence the DJIA, and consequently, the ETF's NAV. Periods of high investor confidence lead to rising prices, while fear and uncertainty can drive prices down, impacting the NAV accordingly.

How to Track the Amundi DJIA UCITS ETF (Distributing) NAV

Tracking the daily NAV of the Amundi DJIA UCITS ETF is crucial for informed investment decisions. You can find this information from several reliable sources:

- Amundi's Website: The official website of Amundi is a primary source for the most up-to-date NAV figures.

- Financial News Sources: Many financial news websites and portals provide real-time or delayed quotes for ETFs, including the NAV.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will typically display the current NAV alongside other relevant data.

Regular monitoring of the NAV is vital for:

- Performance Evaluation: Tracking NAV changes helps assess the ETF's performance over time, enabling comparisons against benchmarks and other investments.

- Investment Strategy Adjustments: Consistent NAV monitoring allows investors to adapt their investment strategies based on market conditions and the ETF's performance.

It's important to understand the difference between the NAV and the market price:

- NAV vs. Market Price: The market price (bid/ask spread) of the ETF can deviate slightly from the NAV due to supply and demand factors in the secondary market. This difference is usually small but can exist.

Analyzing NAV Trends and Investment Implications

Analyzing historical NAV data provides valuable insights into the long-term performance of the Amundi DJIA UCITS ETF (Distributing). By studying past trends, investors can:

- Identify Patterns: Observe patterns in NAV fluctuations to predict potential future movements (though past performance is not indicative of future results).

- Inform Investment Decisions: The "buy low, sell high" strategy can be employed based on perceived NAV trends, though this requires careful analysis and consideration of other factors.

However, relying solely on NAV analysis is insufficient for sound investment decisions. Consider these other crucial factors:

- Risk Tolerance: Your personal risk tolerance should guide your investment decisions.

- Investment Goals: Align your investment strategy with your long-term financial objectives.

- Diversification: The Amundi DJIA UCITS ETF represents a specific segment of the market. Broader diversification is crucial for mitigating risk.

- Time Horizon: Your investment timeline (short-term or long-term) influences how you interpret NAV fluctuations.

Conclusion: Making Informed Decisions with Amundi DJIA UCITS ETF (Distributing) NAV Analysis

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF (Distributing) is paramount for successful investment management. This article highlighted key factors influencing its NAV, including the performance of the underlying DJIA components, currency fluctuations, dividend distributions, expense ratios, and broader market sentiment. Regularly tracking and analyzing the Amundi DJIA UCITS ETF NAV and considering other investment factors allows for informed decisions. Remember to conduct thorough research and consult with a financial advisor before making any investment choices. Regularly monitor your Amundi DJIA UCITS ETF NAV tracking and develop a sound Amundi DJIA ETF investment strategy based on your understanding of ETF NAV and your personal risk tolerance. For more information, consider exploring resources such as [link to Amundi's website] and other reputable financial sources. Remember that understanding ETF NAV is key to successful ETF investing.

Featured Posts

-

Maryland Softball Defeats Delaware 11 1 Behind Aubrey Wursts Strong Game

May 24, 2025

Maryland Softball Defeats Delaware 11 1 Behind Aubrey Wursts Strong Game

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025

Rekomendasi Dayamitra Telekomunikasi Mtel And Merdeka Battery Mbma Pasca Masuk Msci Small Cap Index

May 24, 2025 -

Walker Peters To Leeds Latest Transfer News And Speculation

May 24, 2025

Walker Peters To Leeds Latest Transfer News And Speculation

May 24, 2025 -

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025

Latest Posts

-

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025 -

Beurzen Herstellen Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Beurzen Herstellen Na Trump Uitstel Aex Fondsen Boeken Winsten

May 24, 2025 -

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025 -

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025

Shareholders Unanimously Approve All Resolutions At Imcd N V Agm

May 24, 2025 -

Amsterdam Stock Market Trade War Anxiety Causes 7 Opening Plunge

May 24, 2025

Amsterdam Stock Market Trade War Anxiety Causes 7 Opening Plunge

May 24, 2025