Apple Stock (AAPL) Price Targets: Identifying Crucial Support And Resistance

Table of Contents

Understanding Support and Resistance Levels in Apple Stock (AAPL)

Support and resistance levels are crucial concepts in technical analysis. Support represents a price floor where buying pressure is strong enough to prevent further price declines. Conversely, resistance signifies a price ceiling where selling pressure overwhelms buying pressure, hindering upward momentum. These levels are dynamic and can shift based on various market factors.

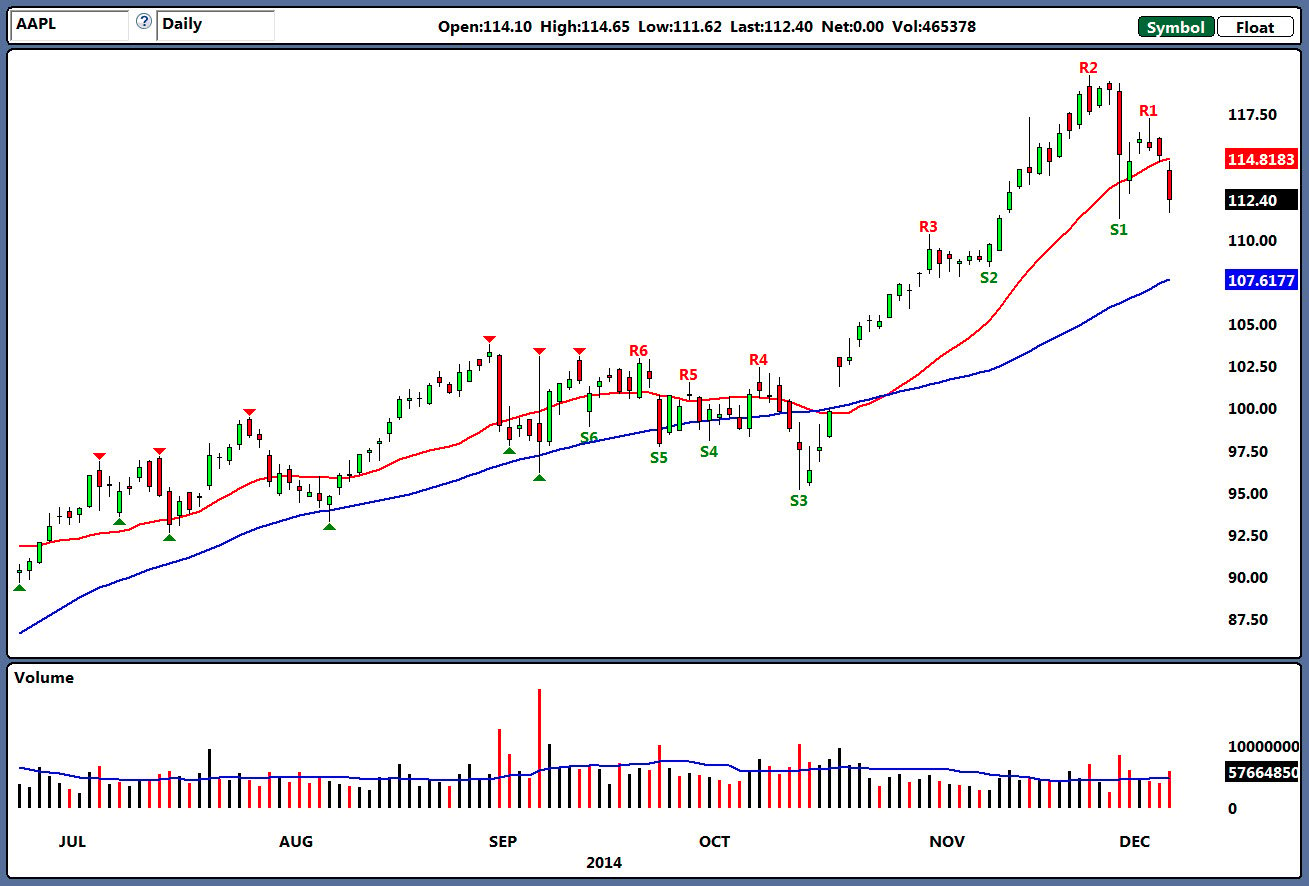

[Insert Chart 1: Historical AAPL chart showing clear support and resistance levels]

- Support level: A price point where the stock price has historically found buyers willing to step in and prevent further drops. For AAPL, past support levels might be observed by analyzing historical charts.

- Resistance level: A price point where the stock price has historically faced strong selling pressure, preventing further price increases. Breaching resistance levels often signals bullish sentiment for AAPL.

- Breakouts and breakdowns: A breakout occurs when the price decisively moves above a resistance level, suggesting a potential upward trend. A breakdown happens when the price decisively moves below a support level, indicating a potential downward trend. These events are significant for AAPL stock price prediction.

- Identifying support and resistance: Technical analysis indicators, such as moving averages (e.g., 50-day, 200-day MA) and trendlines, help identify potential support and resistance levels for AAPL.

Analyzing Current Apple Stock (AAPL) Price Targets from Leading Analysts

Several reputable financial analysts offer price target forecasts for AAPL. These predictions vary based on their assessment of Apple's future performance, considering factors such as product launches, economic conditions, and overall market sentiment.

| Analyst Firm | Price Target | Target Date | Rationale |

|---|---|---|---|

| Goldman Sachs | $200 | Dec 2024 | Strong iPhone sales, Services growth |

| Morgan Stanley | $185 | Dec 2024 | Concerns about macroeconomic headwinds |

| JPMorgan Chase | $195 | Dec 2024 | Positive outlook for new product categories |

| Average | $193 | Dec 2024 |

(Note: These are hypothetical examples; always consult up-to-date information from reliable financial sources.)

- High price targets: These often reflect optimistic expectations regarding future product innovations, strong market share growth, and robust financial performance.

- Low price targets: These reflect more cautious outlooks, potentially considering macroeconomic risks or concerns about specific segments of Apple's business.

- Average price target: Provides a consensus view of analyst predictions, offering a potentially more balanced perspective on AAPL's price trajectory.

- Sources for price target information: Bloomberg, Yahoo Finance, and other reputable financial news websites are valuable sources for AAPL price targets.

Impact of Macroeconomic Factors on AAPL Price Targets

Broader economic trends significantly influence Apple stock price targets. Factors such as inflation, interest rates, and recessionary fears create uncertainty and can shift support and resistance levels.

- Inflation's effect: High inflation impacts consumer spending, potentially affecting demand for Apple products and thus impacting AAPL price targets.

- Interest rate hikes: Higher interest rates increase borrowing costs for businesses, impacting growth and potentially lowering investor enthusiasm for tech stocks like AAPL.

- Recessionary concerns: During economic downturns, consumer spending often decreases, potentially impacting Apple's sales and leading to downward pressure on the AAPL stock price.

Technical Analysis of Apple Stock (AAPL): Identifying Key Levels

Technical analysis of AAPL's price chart reveals key support and resistance levels. We can identify these levels using various indicators.

[Insert Chart 2: AAPL chart with technical indicators highlighting support and resistance levels]

- Key support levels: These are price points where a significant amount of buying pressure historically emerged, suggesting potential buying opportunities.

- Key resistance levels: These are price points where selling pressure historically dominated, presenting potential obstacles to further price appreciation.

- Moving averages: 50-day and 200-day moving averages often act as dynamic support and resistance levels, providing insights into the prevailing trend.

- Candlestick patterns: Certain candlestick patterns (e.g., hammer, engulfing patterns) can signal potential reversals or confirmations of trends, aiding in AAPL stock price prediction.

Conclusion

Identifying crucial support and resistance levels for Apple Stock (AAPL) requires a combination of fundamental and technical analysis. By studying analyst price targets, macroeconomic factors, and technical indicators, investors can develop a more informed perspective on potential price movements. Remember, thorough research and effective risk management are essential when making investment decisions related to Apple Stock (AAPL) price targets. Stay informed about Apple Stock (AAPL) price targets and crucial support and resistance levels to make well-informed investment decisions. Continue your research on Apple Stock (AAPL) to refine your trading strategy.

Featured Posts

-

Sean Penn Defends Woody Allen Renewed Scrutiny Of Sexual Abuse Claims

May 25, 2025

Sean Penn Defends Woody Allen Renewed Scrutiny Of Sexual Abuse Claims

May 25, 2025 -

Sales Slump At Kering Demnas Gucci Designs To Launch In September

May 25, 2025

Sales Slump At Kering Demnas Gucci Designs To Launch In September

May 25, 2025 -

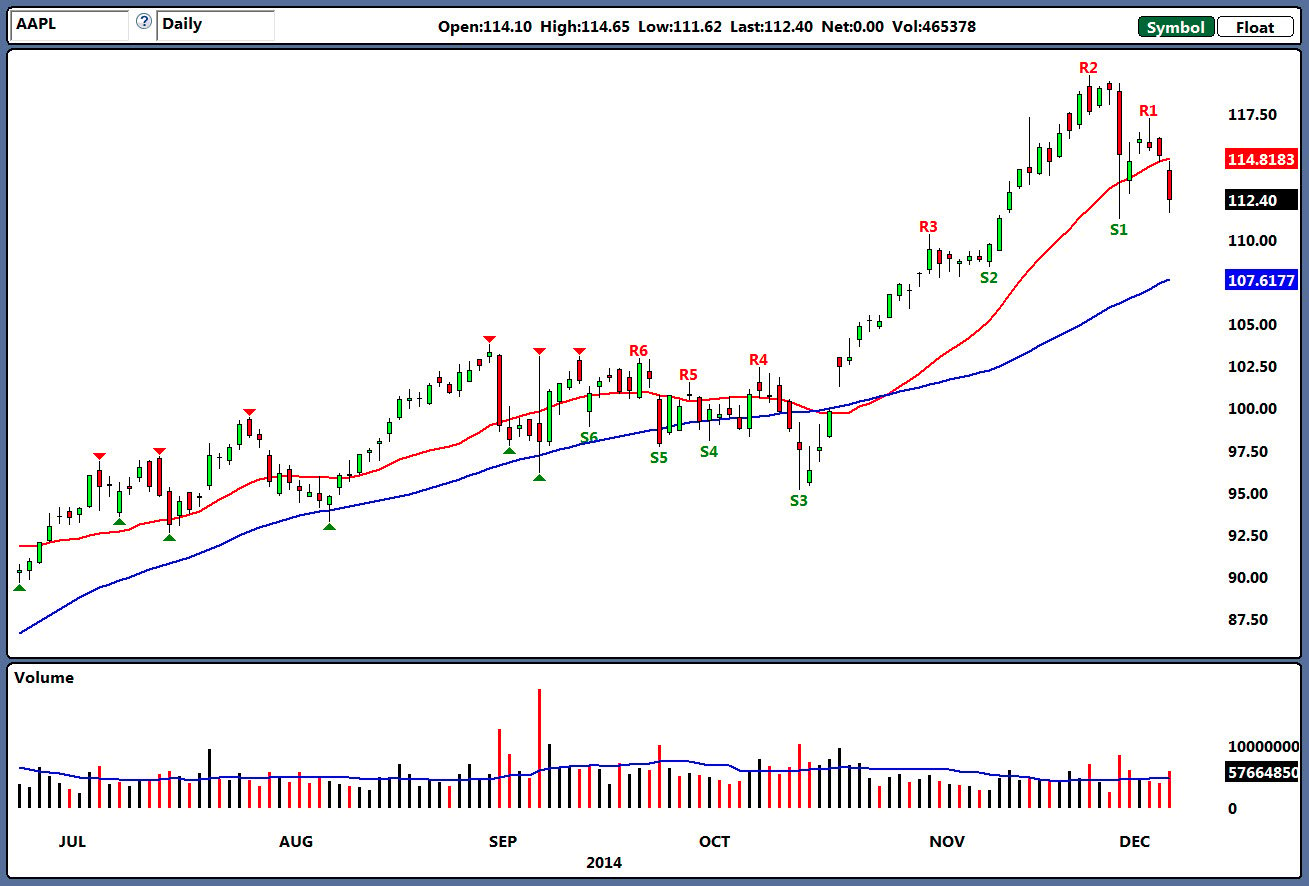

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 25, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Implications

May 25, 2025 -

Trillery I Refleksiya Pochemu Lyudi Lyubyat Schekotat Nervy

May 25, 2025

Trillery I Refleksiya Pochemu Lyudi Lyubyat Schekotat Nervy

May 25, 2025 -

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025

Porsche Cayenne Gts Coupe Czy Spelnia Oczekiwania

May 25, 2025

Latest Posts

-

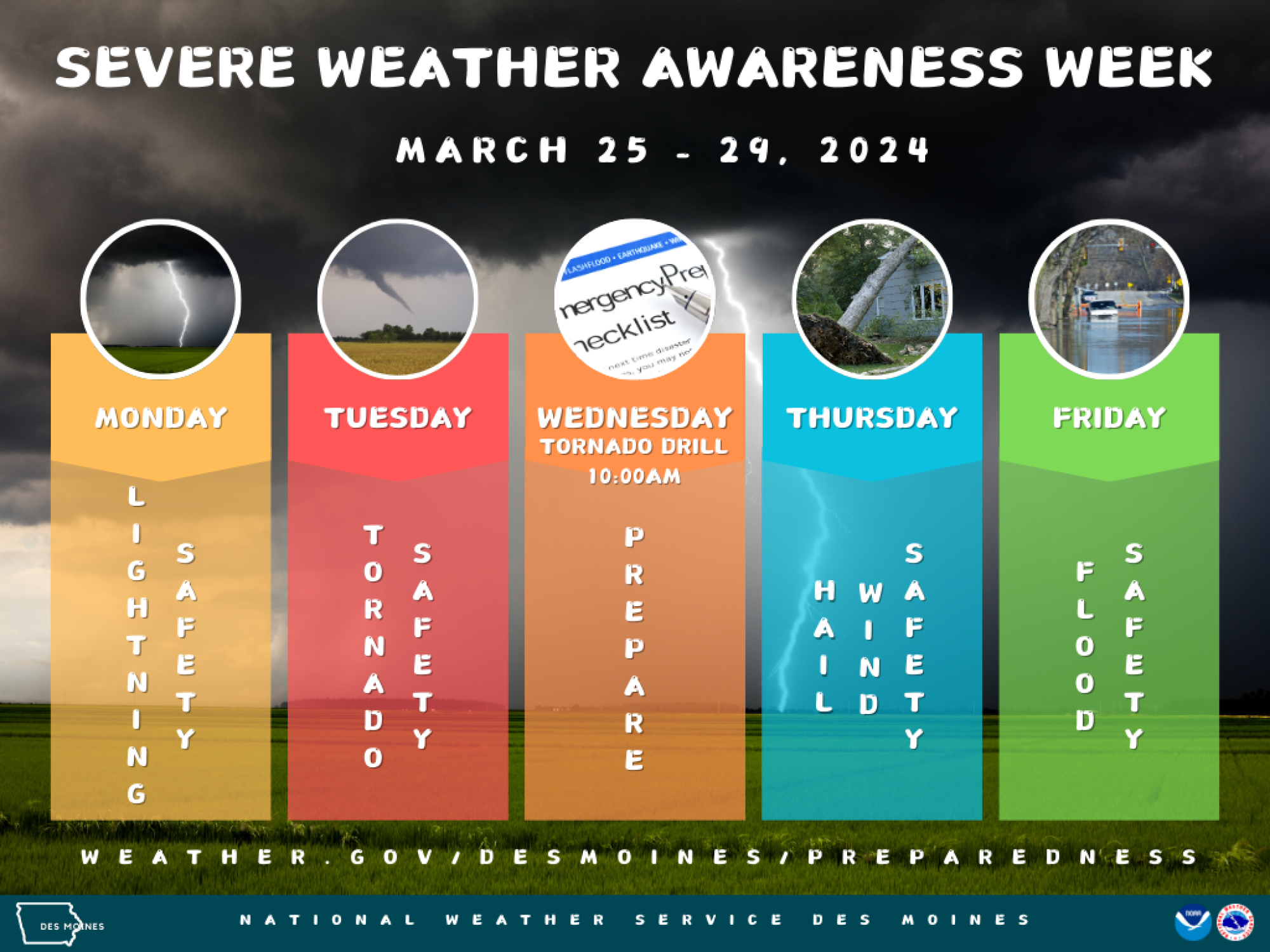

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025

Protecting Yourself And Your Family From Floods Severe Weather Awareness Week

May 25, 2025 -

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025

Severe Weather Report April 2nd Tornado Activity And Current Flash Flood Warnings April 4th 2025

May 25, 2025 -

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025

1 050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Deal

May 25, 2025 -

Broadcoms V Mware Acquisition At And T Faces A Staggering 1 050 Price Increase

May 25, 2025

Broadcoms V Mware Acquisition At And T Faces A Staggering 1 050 Price Increase

May 25, 2025 -

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025

Severe Weather Awareness Week Day 5 Flood Safety Tips And Preparedness

May 25, 2025