As Markets Swooned, Pros Sold—and Individuals Pounced: A Market Analysis

Table of Contents

The Professional Sell-Off: Why Pros Dumped Assets During the Market Swoon

Professional investors, with their sophisticated tools and vast resources, often react differently to market volatility than individual investors. Their actions during a market swoon are driven by several key factors.

Risk Aversion and Hedging Strategies

Professional investors prioritize risk management above all else. During periods of heightened market volatility, like a significant market swoon, they employ various hedging strategies to mitigate potential losses. These strategies aim to protect their portfolios from further declines.

- Increased use of derivatives: Options and futures contracts are employed to offset potential losses in other asset classes.

- Portfolio rebalancing: Shifting assets from riskier equities to safer havens like government bonds is a common practice.

- Profit-taking: Locking in profits from previous gains allows professionals to reduce exposure to further market declines.

Sophisticated risk models, incorporating various economic indicators and historical data, play a crucial role in influencing these decisions. These models help professionals assess the probability and potential impact of a market swoon, guiding their hedging strategies and asset allocation.

Forecasting and Economic Indicators

Professional investors rely heavily on economic indicators and forecasting models to predict future market trends. A market swoon often triggers a careful reassessment of these forecasts.

- Analyzing inflation data: High inflation rates can signal future interest rate hikes, impacting market valuations.

- Interest rate hikes: Increased interest rates generally lead to higher borrowing costs and can dampen economic growth, further influencing market performance during a market swoon.

- Geopolitical instability: Global events and political uncertainty significantly impact market sentiment and can exacerbate a market swoon.

By analyzing these indicators, professional investors try to anticipate further market declines and adjust their portfolios accordingly. Negative forecasts often lead to selling pressure, contributing to the overall market swoon.

Institutional Constraints and Regulatory Requirements

Institutional investors face unique constraints due to regulations and fiduciary responsibilities. These constraints can significantly influence their actions during a market swoon.

- Mandatory disclosures: Strict reporting requirements necessitate transparency, potentially influencing selling decisions to meet disclosure deadlines.

- Limitations on certain investment types: Regulations may restrict investment in specific asset classes, forcing portfolio adjustments during a market swoon.

- Performance benchmarks: The pressure to meet predetermined performance benchmarks can lead to selling assets to avoid falling short of targets, even during a market swoon.

These factors can force institutional investors to sell assets, even if they believe the market is undervalued, contributing significantly to the downward pressure observed during a market swoon.

The Individual Investor Surge: Why Retail Traders Pounced During the Market Dip

While professionals were selling, many individual investors saw the market swoon as a buying opportunity. This contrarian behavior is driven by several factors.

Contrarian Investing and "Buy the Dip" Mentality

Contrarian investing, the practice of going against the prevailing market sentiment, is appealing to many individual investors. A market swoon, for them, often signifies a "buy the dip" opportunity.

- Belief in long-term growth: Many individual investors focus on long-term growth, viewing temporary market downturns as buying opportunities.

- Discounted prices: A market swoon presents the chance to acquire assets at reduced prices, potentially leading to higher returns in the long run.

- Taking advantage of market volatility: Some individual investors actively seek out volatility, seeing it as a chance to profit from short-term price swings.

This "buy the dip" mentality is a significant driver behind the increased participation of individual investors during a market swoon.

Increased Access to Information and Trading Platforms

The accessibility of market information and user-friendly trading platforms has empowered individual investors to participate more actively in the market.

- Real-time data: Access to real-time market data allows investors to react quickly to changes.

- Educational resources: Numerous online resources provide education and insights into market trends, enabling informed decision-making.

- Low-cost brokerage services: Reduced brokerage fees and commission-free trading have lowered the barriers to entry for individual investors.

These factors have democratized investing, allowing more people to participate, including during periods of market swoon.

Behavioral Finance and Emotional Responses

Behavioral finance explores the psychological factors that influence investor decisions. During a market swoon, these factors can significantly impact individual investor behavior.

- Fear of missing out (FOMO): The fear of missing potential gains can lead to impulsive buying decisions.

- Herd behavior: Following the actions of other investors, without independent analysis, can exacerbate market swings.

- Anchoring bias: Over-reliance on past price levels can distort investment decisions.

- Overconfidence: An inflated sense of one's investment skills can lead to excessive risk-taking.

These behavioral biases can lead to both successful and unsuccessful investment choices during a market swoon, highlighting the importance of rational decision-making.

Conclusion

The recent market swoon highlighted a fascinating divergence between professional and individual investor behavior. Professionals prioritized risk mitigation and reacted to economic forecasts, while many individuals saw the downturn as a buying opportunity, fueled by contrarian strategies and increased market access. This underscores the fundamental differences in investment approaches, timelines, and risk tolerances. Understanding the dynamics of a market swoon and the differing responses of these groups is crucial for navigating future market volatility. Learn more about managing risk during a market swoon and developing your own informed investment strategy. Stay informed about market trends and make well-researched investment decisions to effectively navigate future market swoons.

Featured Posts

-

Florida Keys Highway A Drive From Railroad To Ocean

Apr 28, 2025

Florida Keys Highway A Drive From Railroad To Ocean

Apr 28, 2025 -

Rising Gpu Prices Whats Behind The Increase And What To Expect

Apr 28, 2025

Rising Gpu Prices Whats Behind The Increase And What To Expect

Apr 28, 2025 -

Federal Judge To Hear Case Of 2 Year Old U S Citizen Facing Deportation

Apr 28, 2025

Federal Judge To Hear Case Of 2 Year Old U S Citizen Facing Deportation

Apr 28, 2025 -

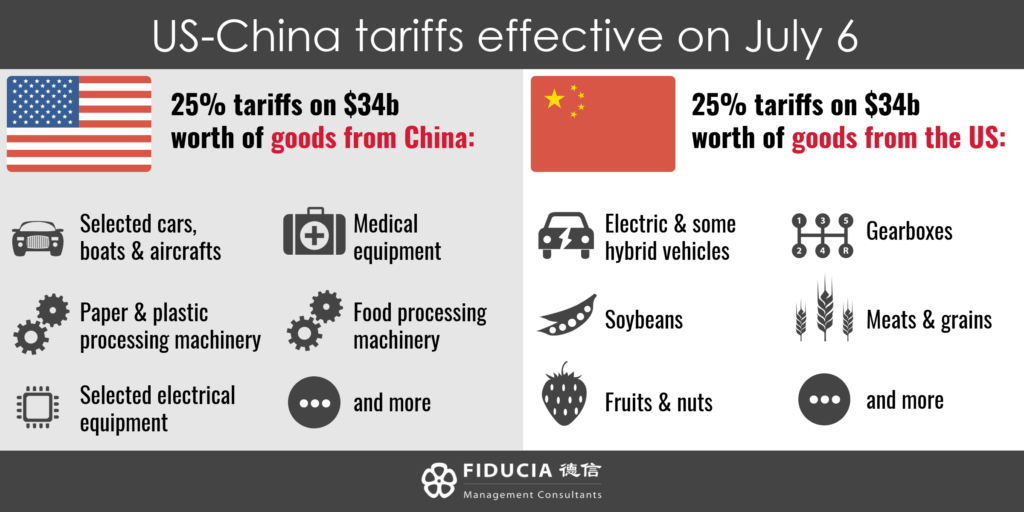

Chinas Tariff Exemptions Some Us Goods Get A Break

Apr 28, 2025

Chinas Tariff Exemptions Some Us Goods Get A Break

Apr 28, 2025 -

Fox News Faces Defamation Suit From Ray Epps Regarding January 6th Allegations

Apr 28, 2025

Fox News Faces Defamation Suit From Ray Epps Regarding January 6th Allegations

Apr 28, 2025

Latest Posts

-

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Prediction

Apr 28, 2025 -

160 Game Hit Streak Ends For Orioles Player Announcers Curse Debunked

Apr 28, 2025

160 Game Hit Streak Ends For Orioles Player Announcers Curse Debunked

Apr 28, 2025 -

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025

Red Sox Outfielder Breakout Could This Player Be The Next Jarren Duran

Apr 28, 2025