Rising GPU Prices: What's Behind The Increase And What To Expect

Table of Contents

H2: Global Chip Shortage and Supply Chain Disruptions

The foundation of the rising GPU price problem lies in a global crisis: the semiconductor shortage. This shortage directly impacts GPU production, as GPUs are complex chips requiring specialized manufacturing processes.

H3: Impact of Semiconductor Manufacturing

The global semiconductor industry relies heavily on a limited number of foundries capable of producing advanced chips. Geopolitical factors, such as trade tensions and unexpected factory closures (like the TSMC factory fire in 2021), severely disrupt the delicate balance of supply and demand. This ripple effect is felt across various industries, impacting GPU availability and ultimately driving up prices.

- Examples of specific semiconductor shortages: Shortages of specific transistors and memory chips crucial for GPU performance.

- Impact of factory closures/slowdowns: Reduced production capacity leads to longer wait times and increased costs.

- Increased transportation costs: Global shipping delays and increased fuel prices add significantly to the overall cost of GPUs.

H3: Increased Demand for GPUs

The semiconductor shortage is exacerbated by a dramatic surge in demand for GPUs. This increased demand stems from several factors:

- Growth of cryptocurrency mining: Cryptocurrency mining, particularly during periods of high Bitcoin prices, consumes vast quantities of GPUs. The high profitability of mining incentivizes large-scale purchases, further straining supply.

- Rise in popularity of demanding games: The release of graphically intensive games like Cyberpunk 2077 and the increasing popularity of high-resolution gaming (4K, 8K) drive the need for more powerful, and therefore expensive, GPUs.

- Increased demand from data centers and AI research: The rapid advancement of artificial intelligence and machine learning necessitates powerful GPUs for training complex algorithms, further fueling demand.

H2: Increased Raw Material Costs and Manufacturing Expenses

Beyond the chip shortage, the rising costs of raw materials and manufacturing contribute significantly to the escalating GPU prices.

H3: Inflation and Rising Energy Prices

Global inflation and soaring energy prices directly impact the cost of producing GPUs. These factors increase the price of everything from raw materials like silicon wafers and precious metals to labor costs and energy consumption during the manufacturing process.

- Examples of specific raw materials used in GPU manufacturing: Silicon, copper, gold, and various rare earth elements.

- Impact of inflation on labor costs: Higher wages for engineers and factory workers add to the overall production cost.

- Rising energy costs: The energy-intensive nature of semiconductor manufacturing makes it highly vulnerable to fluctuations in energy prices.

H3: Tariffs and Trade Wars

International trade disputes and tariffs imposed on imported components add another layer of complexity to the cost equation. These tariffs increase the price of essential parts, making GPUs more expensive to manufacture and ultimately impacting the final retail price.

- Examples of specific tariffs affecting GPU components: Tariffs on imported memory chips or other specialized components.

- Geopolitical factors impacting supply chains: Trade wars and geopolitical instability can disrupt established supply routes, increasing transportation costs and scarcity.

H2: Speculation and Market Manipulation

The combination of high demand and limited supply creates a fertile ground for speculation and market manipulation, further exacerbating the rising GPU prices.

H3: Scalpers and Resellers

Scalpers and resellers capitalize on the shortage, purchasing large quantities of GPUs at MSRP (Manufacturer's Suggested Retail Price) and then reselling them at significantly inflated prices on secondary markets.

- Explain how scalping impacts availability: Scalping removes GPUs from the legitimate market, making them harder to find for consumers at reasonable prices.

- Explain how it inflates prices for consumers: The artificially high prices set by scalpers influence the overall market price, making it more expensive for everyone.

H3: Cryptocurrency Mining's Influence

The demand generated by cryptocurrency mining continues to play a significant role in driving up GPU prices. The correlation between cryptocurrency prices and GPU demand is undeniable; a rise in cryptocurrency value often translates to increased demand for GPUs, pushing prices higher.

H2: What to Expect in the Future of GPU Prices

Predicting the future of GPU prices is challenging, but several factors could influence stabilization or further price increases.

H3: Potential for Stabilization

Several factors could contribute to a potential stabilization of GPU prices:

- Predictions from industry analysts: Some analysts predict increased production capacity and a gradual easing of the chip shortage.

- Potential advancements in manufacturing: Innovations in semiconductor manufacturing could improve efficiency and increase production.

- Easing of supply chain issues: Improvements in global logistics and reduced geopolitical tensions could alleviate some supply chain bottlenecks.

H3: Long-Term Trends

Despite potential stabilization, several long-term trends point toward continued high demand for GPUs:

- Growth in AI and machine learning: The continued growth of AI and machine learning will likely drive sustained demand for high-performance GPUs.

- Advancements in gaming technology: The constant evolution of gaming technology will continue to push the need for more powerful, and therefore expensive, GPUs.

- Increased demand from other industries: Industries beyond gaming and AI, such as medical imaging and scientific research, are increasingly reliant on GPU technology.

3. Conclusion

Rising GPU prices are a complex issue stemming from a confluence of factors: the global chip shortage, increased demand across various sectors, rising manufacturing costs due to inflation and trade disputes, and market manipulation by scalpers. Understanding these interconnected elements is crucial to comprehending the current situation. The key takeaway is that while some stabilization is possible, sustained high demand in the long term suggests that GPU prices might remain elevated for the foreseeable future. Understanding the factors behind rising GPU prices empowers you to make informed decisions. Stay tuned for updates on the GPU market and consider your options before your next purchase.

Featured Posts

-

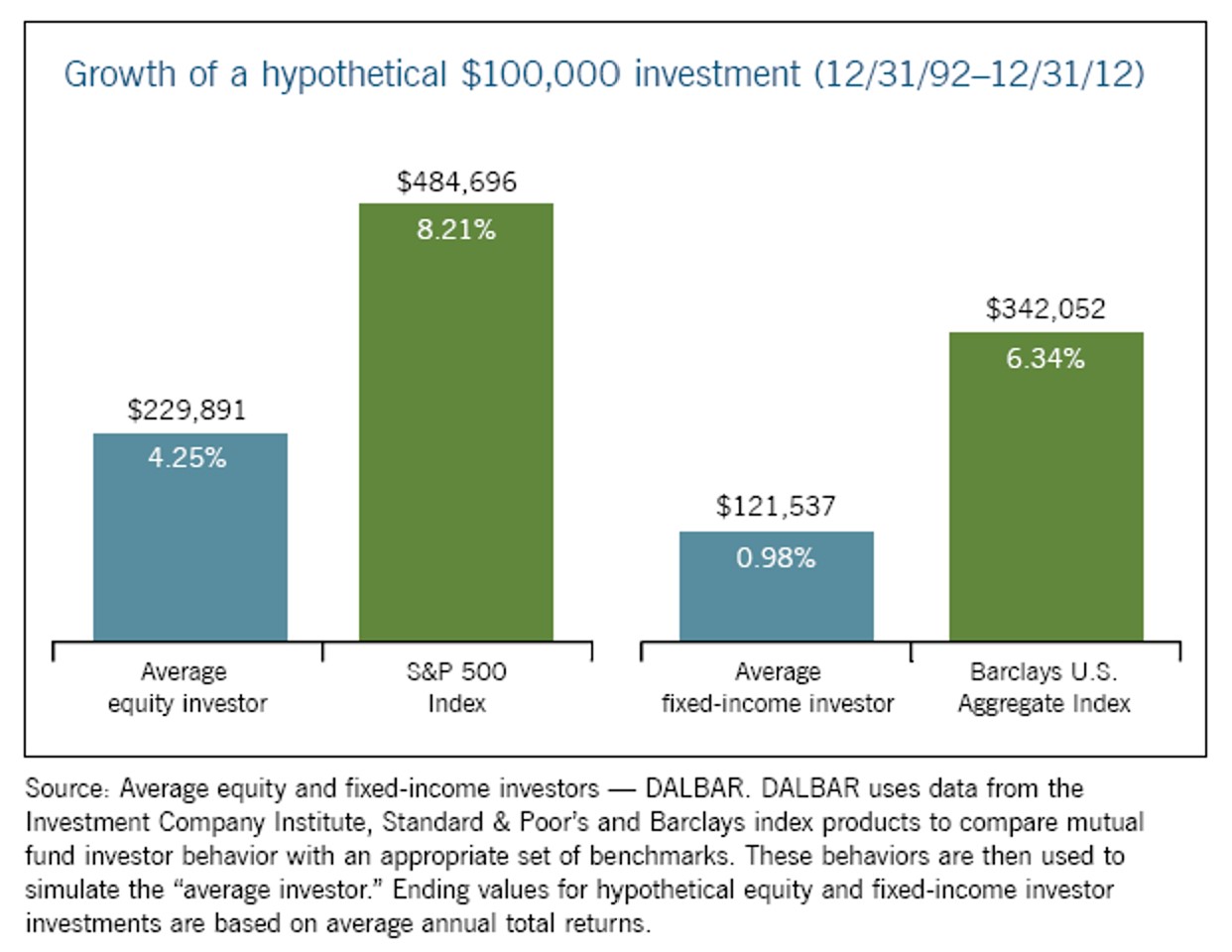

Analyzing Market Behavior Professionals Vs Individuals During Downturns

Apr 28, 2025

Analyzing Market Behavior Professionals Vs Individuals During Downturns

Apr 28, 2025 -

Individual Investors And Market Swings Opportunities And Risks

Apr 28, 2025

Individual Investors And Market Swings Opportunities And Risks

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025 -

At And T Exposes Extreme Price Increases In Broadcoms V Mware Deal

Apr 28, 2025

At And T Exposes Extreme Price Increases In Broadcoms V Mware Deal

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025

Latest Posts

-

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025