Bitcoin's Rebound: Understanding The Factors Driving The Surge

Table of Contents

Institutional Investment and Adoption

The growing acceptance of Bitcoin as a legitimate asset class by institutional investors is a major driver of Bitcoin's rebound. Hedge funds, corporations, and even some sovereign wealth funds are increasingly allocating a portion of their portfolios to Bitcoin, significantly impacting its price. This institutional adoption reflects a shift in perception, moving away from viewing Bitcoin solely as a speculative asset to recognizing its potential as a store of value and a diversification tool.

- Increased regulatory clarity in some jurisdictions: More defined regulatory frameworks in certain countries are reducing uncertainty and encouraging institutional participation.

- Growing acceptance of Bitcoin as a legitimate asset class: Major financial institutions are now offering Bitcoin-related services, further legitimizing its place in the financial world.

- Examples of major institutional investors adopting Bitcoin: Companies like MicroStrategy and Tesla have made significant Bitcoin purchases, demonstrating a growing confidence in the cryptocurrency.

- Grayscale Bitcoin Trust and other significant investment vehicles: The success of Grayscale's Bitcoin Trust highlights the increasing demand for regulated exposure to Bitcoin from institutional investors.

Macroeconomic Factors and Inflation

The current macroeconomic environment, characterized by high inflation and economic uncertainty in many parts of the world, is another significant factor contributing to Bitcoin's price surge. Investors are increasingly seeking alternative assets that can act as a hedge against inflation, and Bitcoin's deflationary nature makes it an attractive option.

- Bitcoin's deflationary nature: Unlike fiat currencies, Bitcoin has a limited supply of 21 million coins, making it inherently deflationary. This contrasts with inflationary fiat currencies, potentially preserving purchasing power during times of economic instability.

- Bitcoin's performance against traditional assets during inflationary periods: Historical data suggests a positive correlation between Bitcoin's price and periods of high inflation, solidifying its position as a potential inflation hedge.

- Analysis of current macroeconomic trends and their effect on Bitcoin's value: The ongoing global economic uncertainty is driving investors towards assets perceived as safe havens, benefiting Bitcoin's price.

- Bitcoin as a safe haven asset: Some investors view Bitcoin as a safe haven, a store of value that can protect their investments during times of market volatility and economic turmoil.

Technological Advancements and Network Upgrades

Technological improvements within the Bitcoin ecosystem are enhancing its scalability, efficiency, and user experience, leading to increased adoption and driving the Bitcoin price increase. Upgrades like the Lightning Network and Taproot are crucial in this regard.

- Lightning Network and its benefits: The Lightning Network is a second-layer scaling solution that enables faster and cheaper Bitcoin transactions, addressing scalability concerns.

- Taproot upgrade and its impact on transaction fees and privacy: The Taproot upgrade enhances Bitcoin's privacy and reduces transaction fees, improving overall usability.

- Other upcoming technological advancements in the Bitcoin ecosystem: Continued development and innovation within the Bitcoin ecosystem ensure its long-term viability and attractiveness to users.

- Enhanced usability and appeal: These upgrades contribute to a more user-friendly and efficient experience, attracting a wider range of users and investors.

Growing Retail Investor Interest and Sentiment

Renewed retail investor interest and positive market sentiment have also played a significant role in Bitcoin's rebound. Social media trends, news coverage, and overall market psychology all contribute to this phenomenon.

- Social media trends and their influence on Bitcoin's price: Social media platforms are powerful drivers of market sentiment, influencing retail investor behavior and impacting Bitcoin's price volatility.

- Retail investor behavior and its impact on market volatility: The actions of retail investors can contribute significantly to market fluctuations, particularly in volatile assets like Bitcoin.

- The role of news coverage and media attention in driving investor sentiment: Positive media coverage can amplify investor confidence and drive up the price, while negative news can have the opposite effect.

- Impact of crypto exchange listings and user growth: Increased accessibility through new exchange listings and a growing user base can fuel demand and further boost the Bitcoin price.

Conclusion

Bitcoin's recent rebound is a result of a confluence of factors, including significant institutional investment, the appeal of Bitcoin as a hedge against inflation in the current macroeconomic environment, key technological advancements improving its functionality, and renewed retail investor interest. These factors have all contributed to a surge in Bitcoin's price.

Understanding the factors behind Bitcoin's rebound is crucial for anyone interested in this volatile yet potentially lucrative market. The interplay of institutional adoption, macroeconomic conditions, technological improvements, and retail sentiment creates a dynamic and complex environment. Stay informed about Bitcoin's price fluctuations and future developments to make informed investment decisions. Continue your research on Bitcoin's rebound and its implications for the future of finance.

Featured Posts

-

Ocasio Cortez And Trump A Heated Exchange Covered By Fox News

May 09, 2025

Ocasio Cortez And Trump A Heated Exchange Covered By Fox News

May 09, 2025 -

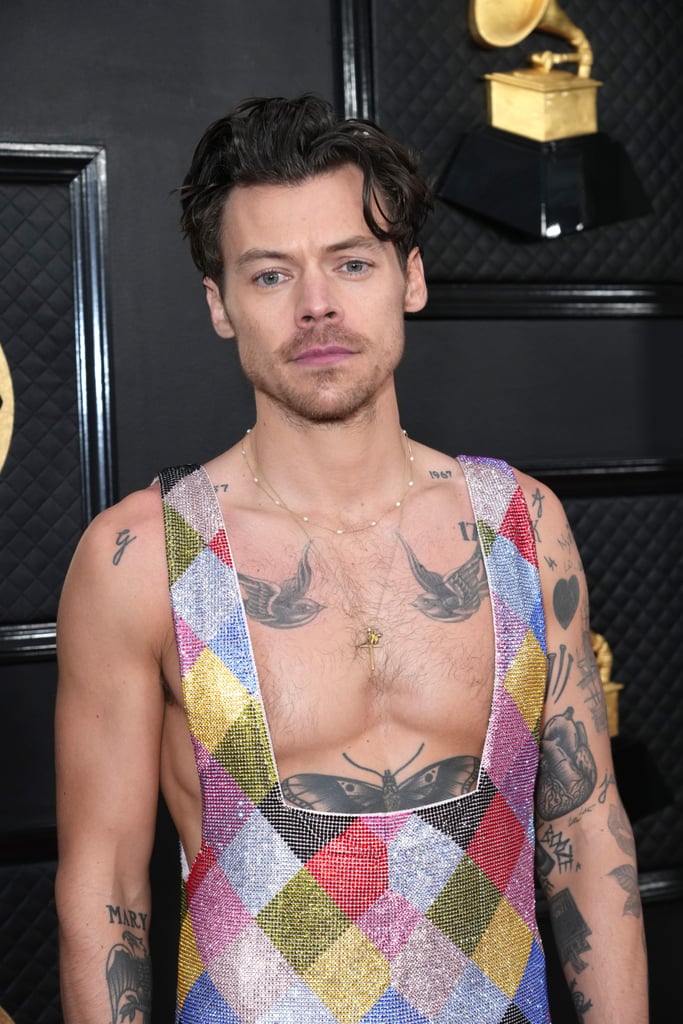

Snls Impression Of Harry Styles The Singers Disappointed Response

May 09, 2025

Snls Impression Of Harry Styles The Singers Disappointed Response

May 09, 2025 -

Infineon Ifx Stock Sales Forecast Misses Targets Amidst Tariff Concerns

May 09, 2025

Infineon Ifx Stock Sales Forecast Misses Targets Amidst Tariff Concerns

May 09, 2025 -

Tesla Stock Slump Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025

Tesla Stock Slump Impacts Elon Musks Net Worth Falling Below 300 Billion

May 09, 2025 -

Elizabeth City Law Enforcement Investigating Recent Vehicle Break Ins

May 09, 2025

Elizabeth City Law Enforcement Investigating Recent Vehicle Break Ins

May 09, 2025