Decline On Frankfurt Stock Exchange: DAX Under 24,000

Table of Contents

Macroeconomic Factors Contributing to the DAX Decline

Several significant macroeconomic factors have converged to contribute to the recent decline of the DAX below 24,000. These interconnected issues have created a challenging environment for German businesses and investors.

Global Inflation and Interest Rate Hikes

Global inflation has surged to levels unseen in decades, forcing central banks worldwide, including the European Central Bank (ECB), to aggressively raise interest rates. This aims to curb inflation but has significant consequences for the markets.

- Impact on Investor Sentiment: Rising interest rates increase borrowing costs for businesses, impacting investment and potentially slowing economic growth. This leads to increased risk aversion among investors, causing them to sell off assets, including stocks.

- Effect on Risk Appetite: The uncertainty surrounding inflation and the aggressive interest rate hikes have dampened investor confidence, leading to a flight to safety and a reduction in risk appetite.

- Examples: The ECB's multiple interest rate increases throughout 2022 and 2023 directly impacted borrowing costs for German companies, contributing to the DAX decline. The Federal Reserve's actions in the US also have ripple effects on global markets, impacting the DAX indirectly.

Geopolitical Uncertainty and the War in Ukraine

The ongoing war in Ukraine has introduced considerable geopolitical uncertainty, significantly impacting global markets, including the Frankfurt Stock Exchange.

- Energy Price Volatility: The war disrupted energy supplies, leading to soaring energy prices in Europe and placing immense pressure on energy-intensive German industries.

- Supply Chain Disruptions: The conflict disrupted global supply chains, affecting manufacturing and production across various sectors, especially the automotive industry.

- Investor Confidence: The geopolitical instability and uncertainty surrounding the war have eroded investor confidence, leading to risk aversion and capital flight. Sanctions imposed on Russia further complicated the economic landscape.

Energy Crisis and its Ripple Effect

The energy crisis gripping Europe, exacerbated by the war in Ukraine, has hit Germany particularly hard. Its significant reliance on Russian energy has left it vulnerable to energy price shocks.

- Impact on German Businesses: High energy costs have squeezed profit margins for many German businesses, particularly those in energy-intensive industries like manufacturing and chemicals.

- Vulnerability of German Industries: The German industrial sector is highly reliant on energy, making it particularly susceptible to the volatility of energy prices. This reliance makes the country vulnerable to energy supply disruptions.

- Long-Term Effects on Economic Growth: The energy crisis threatens to impede Germany's economic growth and negatively impact the DAX's long-term performance. The transition to renewable energy sources presents both opportunities and challenges.

Sector-Specific Performance and DAX Components

The DAX decline below 24,000 is not uniform across all sectors. Some sectors have been more heavily impacted than others.

Underperforming Sectors within the DAX

Several sectors within the DAX have experienced particularly sharp declines:

- Automotive: The automotive sector has been significantly affected by supply chain disruptions, rising energy costs, and the global chip shortage. Companies like Volkswagen and BMW have seen substantial share price drops.

- Energy: Energy companies, heavily impacted by volatile energy prices and geopolitical uncertainty, have also suffered significant losses.

- Technology: The technology sector, sensitive to interest rate hikes and shifts in investor sentiment, has also experienced a downturn.

Stronger Performing Sectors within the DAX

While many sectors have underperformed, some have shown relative resilience. Examples might include certain consumer staples companies or those benefiting from the current economic climate (though this may vary depending on the specific time period). Analyzing these sectors can provide valuable insights into the evolving economic landscape.

Potential Future Outlook and Investor Sentiment

Predicting the future performance of the DAX is challenging, but analyzing analyst predictions and considering investor sentiment provides clues.

Analyst Predictions and Market Forecasts

Financial analysts offer a range of predictions for the DAX's future performance, with opinions varying widely based on different macroeconomic scenarios. Some anticipate a continued decline, while others foresee a potential recovery, depending on factors such as inflation, interest rate policies, and the resolution of the geopolitical situation. Consulting reputable financial news sources is crucial for the most up-to-date information.

Strategies for Investors During Market Volatility

Navigating the current market volatility requires careful planning and risk management:

- Diversification: Spreading investments across different asset classes helps mitigate risk.

- Risk Management: Understanding your risk tolerance and adjusting your portfolio accordingly is crucial.

- Long-Term Perspective: Maintaining a long-term investment strategy can help weather short-term market fluctuations.

Conclusion: Navigating the DAX Under 24,000 – What's Next?

The DAX decline below 24,000 reflects a confluence of macroeconomic factors, including global inflation, interest rate hikes, geopolitical uncertainty stemming from the war in Ukraine, and an energy crisis heavily impacting the German economy. The uneven impact across different DAX sectors highlights the complex and interconnected nature of these challenges. The future trajectory of the DAX remains uncertain, emphasizing the importance of staying informed and adapting investment strategies to the evolving situation. Stay informed about the evolving situation of the DAX under 24,000 by following reputable financial news sources and conducting thorough research before making any investment decisions. Understanding the intricacies of the "DAX under 24,000" situation is crucial for navigating the current market volatility.

Featured Posts

-

Breaking News Vehicle Strikes Pedestrian On Princess Road Live Updates

May 25, 2025

Breaking News Vehicle Strikes Pedestrian On Princess Road Live Updates

May 25, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025 -

Heinekens Strong Revenue Performance Reaffirming Outlook Amidst Tariff Uncertainty

May 25, 2025

Heinekens Strong Revenue Performance Reaffirming Outlook Amidst Tariff Uncertainty

May 25, 2025 -

West Hams Transfer Strategy Focus On Kyle Walker Peters

May 25, 2025

West Hams Transfer Strategy Focus On Kyle Walker Peters

May 25, 2025 -

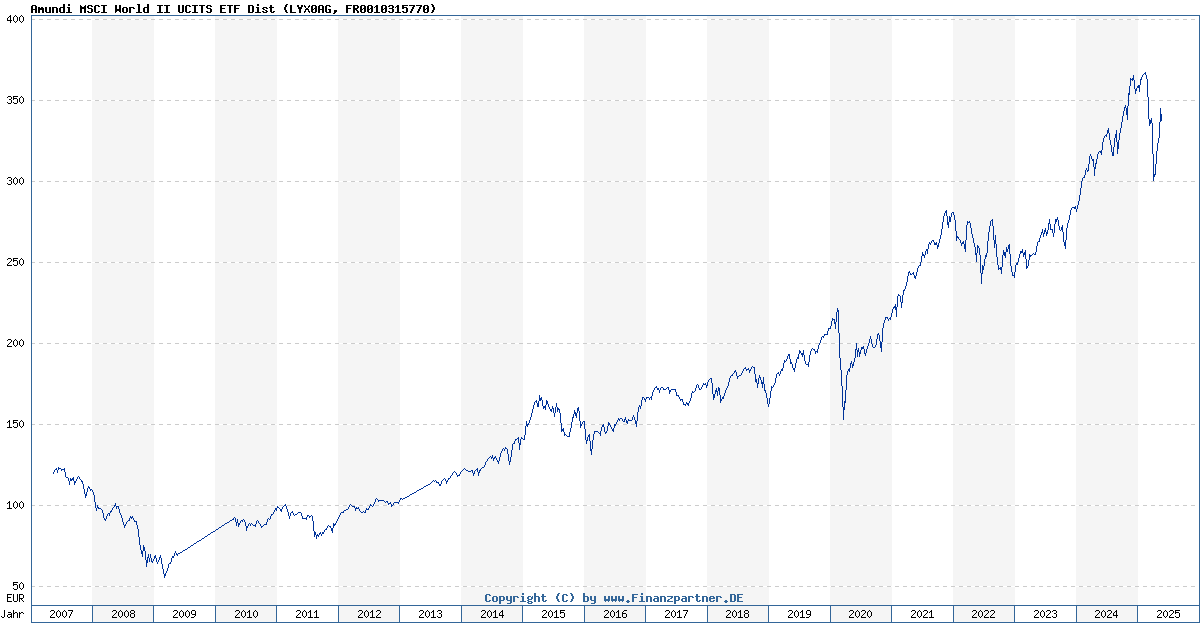

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025

Amundi Msci World Ex Us Ucits Etf Acc Net Asset Value Explained

May 25, 2025

Latest Posts

-

Berkshire Hathaways Apple Holdings Changes Expected After Ceo Transition

May 25, 2025

Berkshire Hathaways Apple Holdings Changes Expected After Ceo Transition

May 25, 2025 -

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 25, 2025

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025 -

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 25, 2025

Ces Unveiled Europe Les Technologies De Demain A Amsterdam

May 25, 2025 -

Decouvrez Les Innovations Au Ces Unveiled Europe A Amsterdam

May 25, 2025

Decouvrez Les Innovations Au Ces Unveiled Europe A Amsterdam

May 25, 2025