Will Berkshire Hathaway Sell Apple Stock After Buffett's Departure?

Table of Contents

Buffett's Legacy and Apple's Importance to Berkshire Hathaway

Warren Buffett's investment philosophy, centered on value investing and long-term growth, has been perfectly aligned with Apple's remarkable success. Berkshire Hathaway's investment in Apple is not just significant; it's monumental. This stake represents a considerable portion of Berkshire Hathaway's overall portfolio, significantly impacting its overall performance and financial health.

- Percentage of Berkshire Hathaway's portfolio held in Apple stock: As of [Insert most recent data], Apple stock constituted approximately [Insert Percentage]% of Berkshire Hathaway's total portfolio, making it the company's largest holding by a significant margin.

- Historical performance of Apple stock within Berkshire Hathaway's portfolio: Apple's stock has consistently outperformed many other investments within Berkshire Hathaway’s portfolio since its initial acquisition, contributing substantially to the company's overall returns.

- Buffett's public statements regarding Apple's long-term potential: Buffett has repeatedly expressed his admiration for Apple's business model, strong brand, and loyal customer base, indicating confidence in its long-term growth prospects.

The Succession Plan and its Potential Impact on Investment Strategy

Berkshire Hathaway's succession plan rests primarily on the shoulders of Greg Abel and Ajit Jain, two long-serving executives with diverse skill sets. While both have proven their capabilities within the Berkshire Hathaway ecosystem, their investment styles might differ from Buffett's. This divergence could influence how Berkshire Hathaway manages its substantial Apple stock holdings.

- Known investment philosophies of Abel and Jain: While neither Abel nor Jain has publicly revealed a detailed investment philosophy, their past actions within Berkshire Hathaway suggest a focus on different sectors and strategies than Buffett's historical approach. Abel is said to favor operational efficiency, while Jain is known for his expertise in insurance.

- Potential for a shift in investment strategy after Buffett's departure: A shift towards a more diversified portfolio, potentially reducing reliance on any single stock, is a plausible scenario. This doesn't necessarily mean selling Apple, but it could indicate a different approach to future investment decisions.

- Discussion on whether they might maintain or divest from Apple stock: The decision to maintain, partially divest, or completely sell Apple stock will hinge on various factors including market conditions, Apple's future performance, and the overall investment strategy adopted by Abel and Jain.

Analyzing Potential Scenarios

Several scenarios regarding Berkshire Hathaway's future Apple stock ownership are plausible:

- Scenario 1: Complete sale of Apple stock – implications and rationale: A complete divestment could be driven by a desire to diversify the portfolio, reduce risk, or raise significant capital for other investment opportunities. However, this would significantly impact Berkshire Hathaway's financial position.

- Scenario 2: Partial sale – strategic reasons and potential impact: A partial sale would allow Berkshire Hathaway to maintain a stake in Apple while still achieving some diversification and reducing concentration risk. This would represent a gradual shift rather than a drastic change.

- Scenario 3: Maintaining current holdings – supporting arguments and risks: Continuing to hold Apple stock reflects confidence in its continued growth. However, this maintains the risk associated with having a substantial portion of the portfolio concentrated in one company.

Market Reactions and Investor Sentiment

The market's response to any decision regarding Berkshire Hathaway's Apple holdings will be significant. The sheer size of the stake means even partial divestment could create substantial market volatility.

- Potential short-term volatility in Apple's stock price: A sudden sale of even a portion of Berkshire Hathaway’s Apple stock could trigger a temporary downturn in Apple's share price due to reduced demand.

- Long-term implications for Apple's valuation: While short-term fluctuations are possible, Apple’s long-term valuation is likely to depend more on its own performance and the broader technology market rather than Berkshire Hathaway's investment decisions.

- Investor confidence in Berkshire Hathaway's future investment decisions: The way Berkshire Hathaway handles this transition will greatly influence investor confidence in the company's long-term future and its ability to generate returns under new leadership.

Conclusion

The future of Berkshire Hathaway's Apple stock holdings remains uncertain after Warren Buffett's departure. Several scenarios are possible, ranging from maintaining the current stake to a complete divestment. The decision will significantly impact both Berkshire Hathaway and Apple, influencing market sentiment and investor confidence. While predicting the future is impossible, understanding the potential scenarios surrounding Berkshire Hathaway's Apple stock is crucial for investors. Stay informed about Berkshire Hathaway's succession plan and Apple's performance to make informed decisions about your own investments. Continue to follow developments surrounding Berkshire Hathaway's Apple stock holdings for updates.

Featured Posts

-

Nemecke Firmy Rusia Pracovne Miesta Prehlad Najvaecsich Prepustani

May 25, 2025

Nemecke Firmy Rusia Pracovne Miesta Prehlad Najvaecsich Prepustani

May 25, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Purchase Guide And Faqs

May 25, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Line Up Purchase Guide And Faqs

May 25, 2025 -

The Four Women Who Married Frank Sinatra Their Stories

May 25, 2025

The Four Women Who Married Frank Sinatra Their Stories

May 25, 2025 -

Escape To The Country Financing Your Rural Dream

May 25, 2025

Escape To The Country Financing Your Rural Dream

May 25, 2025 -

The M62 Relief Road Burys Unrealized Transport Link

May 25, 2025

The M62 Relief Road Burys Unrealized Transport Link

May 25, 2025

Latest Posts

-

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025 -

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025 -

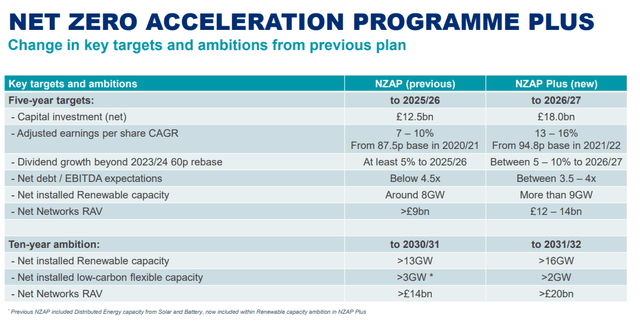

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025 -

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025