Evaluating Palantir Technologies Stock: Is It Right For Your Portfolio?

Table of Contents

Understanding Palantir's Business Model and Revenue Streams

Palantir Technologies operates primarily through two platforms: Gotham and Foundry. Palantir Gotham caters to government agencies, providing powerful data analytics tools for national security and intelligence operations. Palantir Foundry, on the other hand, serves commercial clients across various industries, offering similar data integration and analysis capabilities.

Palantir's revenue model is a blend of software licenses, services, and ongoing support. This subscription-based revenue model aims to foster long-term relationships and generate recurring revenue streams. However, it's important to consider the following:

- High government contracts dependence: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and procurement policies.

- Growing commercial sector adoption: While government contracts remain crucial, Palantir is actively expanding its commercial client base, diversifying its revenue streams and reducing reliance on a single sector.

- Subscription-based revenue model: The shift towards subscription-based revenue offers the potential for predictable, recurring income, enhancing financial stability over time.

- Potential for long-term contracts and recurring revenue: Securing long-term contracts is key to Palantir's success and provides stability in its financial projections. The recurring revenue component is a strong indicator of future financial health. Understanding the "Palantir revenue" streams is crucial for evaluating PLTR stock performance and future "PLTR revenue model" potential.

Analyzing Palantir's Financial Performance and Growth Prospects

Analyzing Palantir's financial performance requires examining several key metrics:

- Year-over-year revenue growth: Consistent year-over-year revenue growth indicates strong market demand and successful business expansion. Investors should closely monitor this trend to gauge the company's trajectory.

- Profitability margins and path to profitability: While Palantir has historically operated at a loss, investors need to examine the company's progress toward profitability and the projected timeline for achieving sustainable margins.

- Cash flow generation: Positive cash flow generation signals strong financial health and the ability to reinvest in growth initiatives or return capital to shareholders.

- Market capitalization and valuation: Palantir's market capitalization and valuation relative to its peers and growth prospects are crucial factors in assessing its investment potential. Evaluating "PLTR financial performance" is essential for understanding "Palantir growth prospects" and making informed decisions about "Palantir stock valuation." Analyzing "PLTR profitability" is a key aspect of this assessment.

Assessing Palantir's Competitive Landscape and Risks

Palantir operates in a competitive big data analytics market, facing established players and emerging startups. Key competitors include companies like AWS, Microsoft Azure, and Google Cloud Platform. However, Palantir's distinct focus on complex data integration and analysis, particularly within the government sector, provides a degree of differentiation. However, several risks must be considered:

- Key competitors and their market share: Understanding the market share held by Palantir's competitors is vital in assessing its competitive position and future growth potential within the "PLTR competitive landscape."

- Risk of contract loss or delays: The nature of government contracts entails inherent risks of delays or cancellations, which could significantly impact Palantir's revenue.

- Data security and privacy concerns: As a company handling sensitive data, Palantir faces stringent regulatory scrutiny and potential reputational damage from security breaches or privacy violations.

- Geopolitical risks affecting government contracts: Government contracts are particularly susceptible to shifts in geopolitical landscape, impacting revenue streams and project timelines. These are significant aspects of "Palantir risks" and deserve careful consideration before any "Palantir investment."

Evaluating Palantir Stock's Valuation and Investment Suitability

Evaluating Palantir stock's valuation involves employing various methods, such as the Price-to-Sales (P/S) ratio. Comparing Palantir's P/S ratio to industry peers helps assess whether it's overvalued or undervalued. Additionally, consider the following:

- Current stock price and historical performance: Reviewing "Palantir stock price" trends and historical performance provides valuable insights into its volatility and long-term trajectory.

- Comparison with industry peers: Comparing Palantir's financial metrics and valuation to those of its competitors provides context for assessing its relative attractiveness.

- Suitable investor profile (aggressive vs. conservative): Palantir stock is generally considered a high-growth, high-risk investment, more suitable for aggressive investors with a higher risk tolerance.

- Potential for capital appreciation and dividends: While capital appreciation is the primary driver of returns for Palantir stock, the potential for future dividend payouts should also be considered. The "PLTR valuation" needs to be carefully assessed to determine the suitability of "Palantir investment strategy" for your risk profile. This includes a thorough "Palantir stock analysis."

Conclusion: Is Palantir Technologies Stock Right for Your Portfolio?

Palantir Technologies presents a compelling investment opportunity with its innovative platforms and strong growth potential. However, the high dependence on government contracts, competitive landscape, and inherent risks in the data analytics sector cannot be ignored. Our analysis indicates that Palantir stock could be suitable for investors with a high-risk tolerance and long-term investment horizon, seeking exposure to the growth of the big data market. However, this is only a preliminary assessment.

Further research on Palantir Technologies stock is recommended before making any investment decisions. Consider your own risk tolerance before investing in PLTR stock. Evaluate Palantir Technologies stock for your portfolio needs and seek professional financial advice if necessary. Remember that this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Understanding The Candidates In Your Nl Federal Riding

May 10, 2025

Understanding The Candidates In Your Nl Federal Riding

May 10, 2025 -

Evaluating Palantir Stock Investment Opportunities Before May 5th

May 10, 2025

Evaluating Palantir Stock Investment Opportunities Before May 5th

May 10, 2025 -

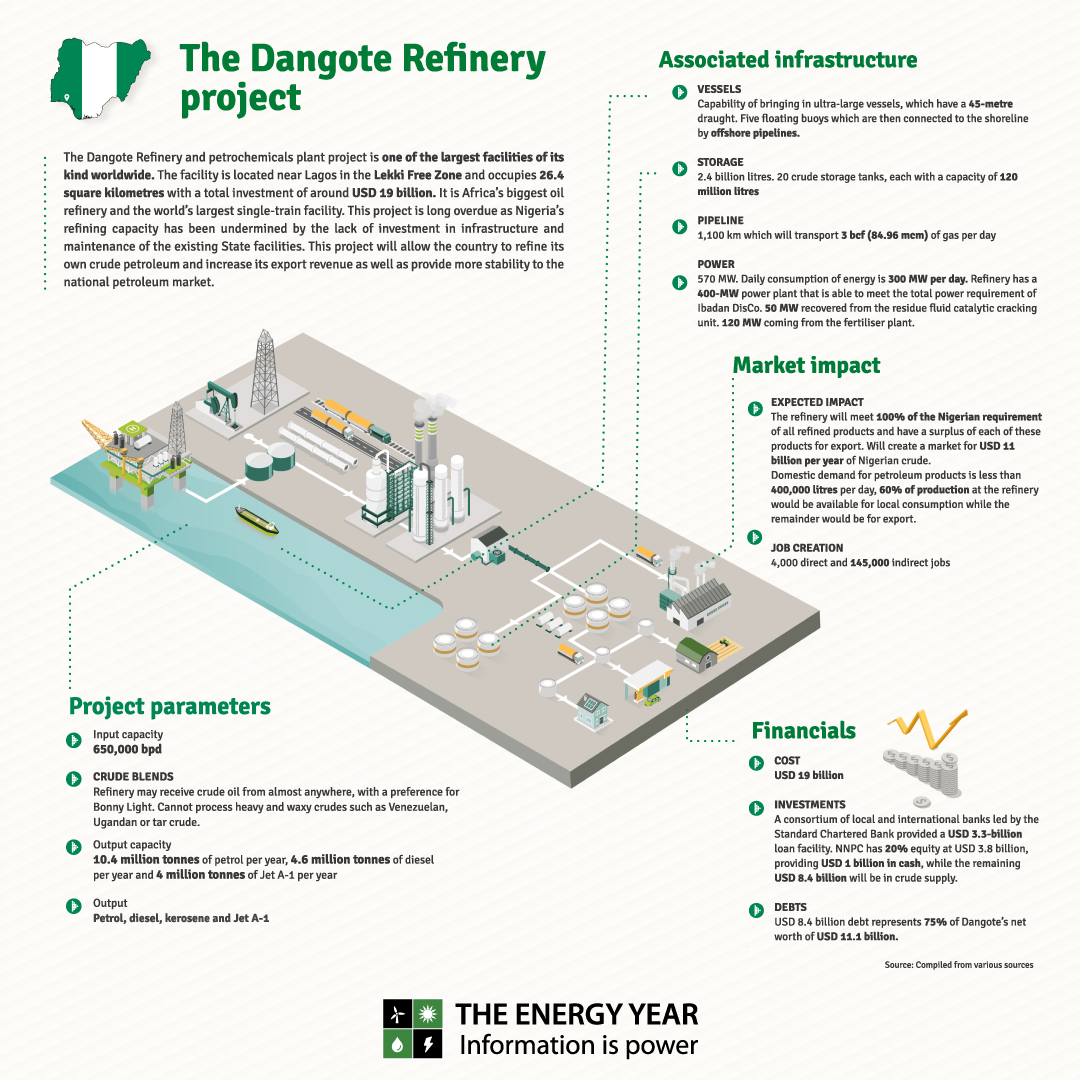

Understanding The Dynamics Between Nnpc Dangote Refinery And Petrol Prices

May 10, 2025

Understanding The Dynamics Between Nnpc Dangote Refinery And Petrol Prices

May 10, 2025 -

Evaluating Palantir Technologies Stock Is It Right For Your Portfolio

May 10, 2025

Evaluating Palantir Technologies Stock Is It Right For Your Portfolio

May 10, 2025 -

Nyt Strands April 6 2025 Pangram And Solution Strategies

May 10, 2025

Nyt Strands April 6 2025 Pangram And Solution Strategies

May 10, 2025