Frankfurt Stock Market: DAX Remains Steady Following Record Growth

Table of Contents

DAX Performance and Analysis

The DAX index recently experienced a period of record-breaking growth, culminating in a peak closing value of [Insert most recent peak value and date]. This impressive surge represents a [Insert Percentage]% increase compared to [Insert comparison date and value]. Several factors contributed to this positive trend. Strong corporate earnings from German blue-chip companies, fueled by robust domestic consumption and increased global demand, played a significant role. Furthermore, positive economic indicators, such as [mention specific indicators e.g., rising industrial production and consumer confidence], boosted investor sentiment. Global market trends, particularly in the tech sector, also contributed positively to the DAX's performance.

Currently, the market appears to be in a consolidation phase, exhibiting a relatively steady state after its recent surge. While volatility remains a factor, predictions for the near future vary among analysts. Some anticipate continued growth, citing strong underlying economic fundamentals, while others predict a period of moderate correction before further upward movement.

- DAX Closing Values: [Insert data points for at least 3-5 recent closing values with dates]

- Key Economic Indicators: [List and briefly explain 2-3 key economic indicators influencing DAX performance]

- Significant Company Performance: [Mention 1-2 companies and how their performance influenced the DAX]

Factors Influencing DAX Stability

The stability of the DAX is influenced by a complex interplay of macroeconomic factors, geopolitical risks, and investor sentiment. Macroeconomic conditions, such as inflation rates and interest rate decisions by the European Central Bank (ECB), exert significant influence. High inflation, for instance, can dampen consumer spending and corporate profitability, potentially impacting stock prices. Conversely, interest rate adjustments can influence borrowing costs for businesses and affect investment decisions.

Geopolitical risks, particularly the ongoing war in Ukraine and global trade tensions, also cast a shadow over market stability. These uncertainties can lead to increased volatility and negatively affect investor confidence. The sentiment among investors, influenced by news, economic forecasts, and political developments, is another crucial determinant. A pessimistic outlook can lead to sell-offs, while optimism can drive prices higher.

- Macroeconomic Factors: Inflation directly affects corporate profitability and consumer spending, impacting stock valuations. Interest rate adjustments by the ECB influence borrowing costs and investment decisions.

- Geopolitical Risks: The war in Ukraine and global trade tensions create uncertainty and can lead to increased market volatility.

- Influence of Interest Rate Changes: Higher interest rates can increase borrowing costs for companies, potentially slowing growth and decreasing stock prices. Lower rates can stimulate investment and boost stock markets.

Investment Opportunities in the Frankfurt Stock Market

Despite the current steady state, the recent record growth of the DAX presents compelling investment opportunities in the Frankfurt Stock Market. Investors can explore a range of strategies for capitalizing on the market's potential. Stock picking, focusing on companies with strong fundamentals and growth prospects within sectors like [mention specific high-growth sectors e.g., renewable energy, technology, or pharmaceuticals], remains a viable approach. Diversification across different sectors and asset classes is crucial for mitigating risk.

Effective risk management involves carefully assessing individual risk tolerance and constructing a portfolio that aligns with those parameters. Various trading strategies, such as value investing or growth investing, can be employed depending on the investor's objectives and the prevailing market conditions.

- Promising Growth Sectors: [Mention 2-3 sectors with specific examples of companies]

- Identifying Undervalued Stocks: Thorough fundamental analysis, looking at factors like price-to-earnings ratio (P/E) and other key financial metrics, is crucial.

- Importance of Diversification and Risk Management: Diversifying your investment portfolio across different asset classes reduces your overall risk.

Understanding the Risks

Investing in the Frankfurt Stock Market, like any other market, involves inherent risks. Market volatility is a significant factor; prices can fluctuate significantly in response to various economic and geopolitical events. Economic downturns can negatively impact corporate profits and subsequently stock prices. Geopolitical uncertainty, as discussed earlier, also contributes to market instability. Thorough research and a well-diversified portfolio are essential to mitigate these risks. Understanding your own risk tolerance is key to making sound investment choices.

Conclusion

The Frankfurt Stock Market, reflected in the performance of the DAX, has recently demonstrated significant growth, followed by a period of consolidation. This presents both opportunities and challenges for investors. Understanding the key factors influencing the DAX's performance, including macroeconomic conditions, geopolitical risks, and investor sentiment, is vital for making informed investment decisions. By carefully considering the potential risks and employing appropriate strategies, investors can navigate this dynamic market and potentially benefit from its long-term growth prospects. Stay informed on the Frankfurt Stock Market and DAX performance to make informed investment decisions. Learn more about investing in the DAX and the Frankfurt Stock Market today!

Featured Posts

-

Test Znanie Roley Olega Basilashvili

May 25, 2025

Test Znanie Roley Olega Basilashvili

May 25, 2025 -

Successfully Buying Bbc Radio 1 Big Weekend 2025 Tickets

May 25, 2025

Successfully Buying Bbc Radio 1 Big Weekend 2025 Tickets

May 25, 2025 -

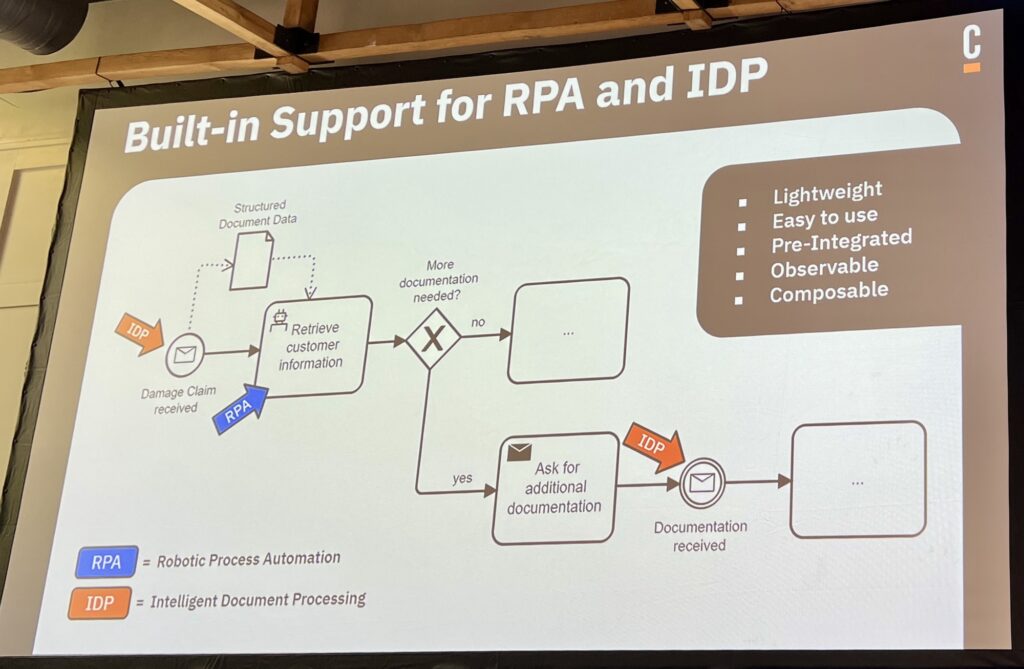

Amsterdam 2025 How Orchestration At Camunda Con Will Boost Your Ai Automation Roi

May 25, 2025

Amsterdam 2025 How Orchestration At Camunda Con Will Boost Your Ai Automation Roi

May 25, 2025 -

Protecting Your Ferrari Essential Gear And Maintenance Tools

May 25, 2025

Protecting Your Ferrari Essential Gear And Maintenance Tools

May 25, 2025 -

Wall Streets Comeback A Threat To Germanys Dax Rally

May 25, 2025

Wall Streets Comeback A Threat To Germanys Dax Rally

May 25, 2025

Latest Posts

-

New Ae Xplore Campaign Encourages Local And Global Travel From England Airpark And Alexandria International Airport

May 25, 2025

New Ae Xplore Campaign Encourages Local And Global Travel From England Airpark And Alexandria International Airport

May 25, 2025 -

Alexandria International Airport And England Airpark Launch Ae Xplore Global Campaign

May 25, 2025

Alexandria International Airport And England Airpark Launch Ae Xplore Global Campaign

May 25, 2025 -

Berkshire Hathaways Apple Holdings Changes Expected After Ceo Transition

May 25, 2025

Berkshire Hathaways Apple Holdings Changes Expected After Ceo Transition

May 25, 2025 -

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 25, 2025

The Future Of Berkshire Hathaways Apple Stock A Post Buffett Analysis

May 25, 2025 -

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025

Will Berkshire Hathaway Sell Apple Stock After Buffetts Departure

May 25, 2025