Global Commodity Markets: 5 Key Charts To Track This Week

Table of Contents

Crude Oil Price Chart: Geopolitical Impacts and OPEC+ Decisions

Analyzing the impact of OPEC+ production cuts on global supply.

The price of crude oil is a significant driver of global inflation and economic activity. OPEC+ (the Organization of the Petroleum Exporting Countries and its allies) plays a crucial role in setting global oil supply. Their production decisions significantly impact crude oil prices.

- Geopolitical Instability: The ongoing conflict in Ukraine, for instance, has created significant geopolitical risk, impacting oil supply chains and driving prices higher. Sanctions on Russian oil have further tightened the global supply.

- Key Players: Saudi Arabia, as the largest producer in OPEC+, holds considerable influence over production cuts and price stability. Understanding their strategic decisions is key to interpreting the crude oil price chart.

- Supply and Demand: The chart visually represents the interplay of supply and demand. Decreased supply due to OPEC+ cuts or geopolitical events generally pushes prices upward, while increased production can lead to lower prices. Analyzing the slope of the curve provides insights into the prevailing market dynamics.

Tracking the relationship between oil prices and inflation.

Rising oil prices are directly linked to inflation. Crude oil is a crucial input for many industries, and price increases translate into higher production costs, ultimately affecting consumer prices.

- Inflationary Pressure: When oil prices rise, the cost of transportation, manufacturing, and energy increases, feeding directly into the Consumer Price Index (CPI).

- Consumer Spending: Higher energy costs reduce consumer purchasing power, impacting overall economic growth. This relationship is clearly visible when comparing the oil price chart with inflation rate data.

- CPI Correlation: Monitoring the correlation between the crude oil price and the CPI is crucial for understanding the inflationary impact of oil price fluctuations. A strong positive correlation suggests that rising oil prices are a significant contributor to inflation.

Natural Gas Price Chart: Energy Security and Seasonal Demand

Understanding seasonal fluctuations in natural gas prices.

Natural gas prices exhibit significant seasonal fluctuations, primarily driven by heating demand during winter months.

- Winter Demand: As temperatures drop, demand for natural gas for heating surges, leading to price increases. This seasonal effect is clearly observable in historical natural gas price charts.

- Storage Levels: Natural gas storage levels play a vital role in determining future prices. High storage levels going into winter can mitigate price spikes, while low levels can exacerbate them.

- Alternative Energy: The growing adoption of renewable energy sources, such as solar and wind power, can influence natural gas demand and, consequently, its price.

Evaluating the impact of weather patterns on supply and price.

Extreme weather events can significantly disrupt natural gas production and transportation, leading to price volatility.

- Weather Disruptions: Hurricanes, severe cold snaps, or floods can damage infrastructure, impacting supply and pushing prices upward.

- Weather Forecasting: Analyzing weather forecasts and their potential impact on production and supply chains is crucial for anticipating price fluctuations. Sophisticated weather models are increasingly used by traders to predict price movements.

Agricultural Commodity Price Chart: Climate Change and Global Food Security

Examining the influence of climate change on crop yields and prices.

Climate change poses a significant threat to global food security by impacting crop yields and agricultural commodity prices.

- Extreme Weather: Droughts, floods, and extreme temperatures can severely damage crops, leading to production shortfalls and higher prices.

- Fertilizer Prices: The cost of fertilizers, a crucial input in agriculture, also plays a significant role in determining agricultural commodity prices. Fluctuations in fertilizer prices can amplify the impact of adverse weather conditions.

- Global Food Security: Understanding these factors is essential for assessing the implications for global food security and potential food price inflation.

Analyzing the effects of supply chain disruptions on food prices.

Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can significantly impact global food prices.

- Transportation Costs: Rising fuel costs and logistical bottlenecks can increase transportation costs, contributing to higher food prices.

- Geopolitical Factors: Conflicts, trade wars, and sanctions can disrupt global food supply chains, creating shortages and price spikes.

Metals Price Chart: Industrial Activity and Technological Advancements

Assessing the impact of industrial activity on metal demand.

Metal prices are closely tied to industrial activity. Strong manufacturing output generally translates to higher demand for metals like copper, steel, and aluminum.

- Manufacturing Output: Growth in sectors like construction, infrastructure development, and manufacturing directly drives demand for various metals.

- Construction and Infrastructure: Large-scale infrastructure projects, for example, significantly increase demand for steel and other metals.

Exploring the role of technological advancements in shaping metal markets.

Technological advancements are reshaping metal markets, particularly with the growing demand for rare earth metals in green technologies.

- Electric Vehicles and Renewables: The shift towards electric vehicles and renewable energy sources is driving demand for rare earth metals crucial for battery production and wind turbines.

- Mining Technology: Technological advancements in mining can also impact metal supply, potentially influencing prices.

Soft Commodity Price Chart: Consumer Demand and Sustainability

Understanding the impact of consumer preferences on soft commodity markets.

Consumer preferences, particularly for sustainability and ethically sourced products, are increasingly influencing soft commodity markets.

- Sustainable and Ethical Sourcing: Growing consumer demand for sustainably produced coffee, cocoa, and sugar is impacting supply chains and prices.

- Health Trends: Changes in consumer dietary habits and health trends also affect demand and price dynamics for various soft commodities.

Analyzing the influence of global trade policies on soft commodity prices.

Global trade policies significantly impact soft commodity prices through tariffs, trade agreements, and government regulations.

- Tariffs and Trade Agreements: Tariffs and trade agreements can affect import/export prices, influencing the overall cost and availability of soft commodities.

- Government Regulations: Government regulations on production methods and trade practices can also influence prices.

Conclusion

Tracking these five key commodity price charts offers a valuable insight into the complex and interconnected nature of the global commodity markets. Understanding the influence of geopolitical factors, weather patterns, consumer demand, and technological advancements on commodity prices is crucial for informed decision-making. The impact of these fluctuations on inflation, global food security, and energy independence is undeniable. Stay informed about crucial shifts in the global commodity markets by regularly checking these key charts. Understanding these indicators will help you make better decisions in the volatile world of commodity trading and investment. Continue to monitor the global commodity markets for up-to-date information.

Featured Posts

-

Mindy Kalings Love Life Past Relationships And Current Status

May 06, 2025

Mindy Kalings Love Life Past Relationships And Current Status

May 06, 2025 -

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025

Warren Buffetts Greatest Investing Wins And Losses Key Lessons Learned

May 06, 2025 -

2025 Met Gala Le Bron James Withdraws As Honorary Chair Due To Knee Problem

May 06, 2025

2025 Met Gala Le Bron James Withdraws As Honorary Chair Due To Knee Problem

May 06, 2025 -

Celtics Vs Heat Live February 10th Game Details Time Tv Stream

May 06, 2025

Celtics Vs Heat Live February 10th Game Details Time Tv Stream

May 06, 2025 -

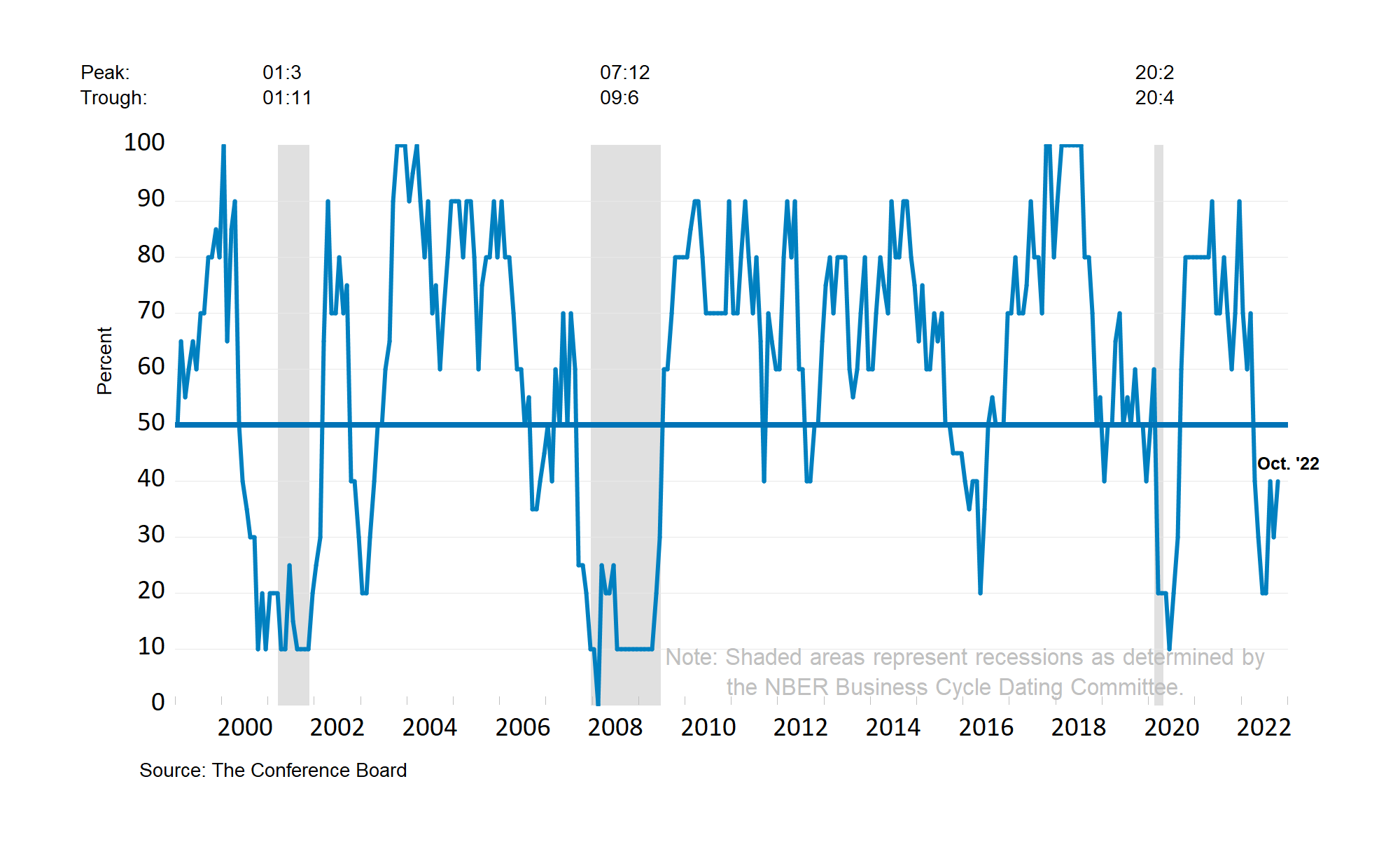

Social Media Sentiment And Economic Forecasting The Case Of Recession Indicators

May 06, 2025

Social Media Sentiment And Economic Forecasting The Case Of Recession Indicators

May 06, 2025