Half-Point Interest Rate Cut: Can The Bank Of England Stay Ahead?

Table of Contents

The Rationale Behind the Half-Point Interest Rate Cut

The Bank of England's justification for the half-point interest rate cut centers on the need to stimulate economic growth and counteract the growing threat of a recession. Weakening economic indicators, such as slowing GDP growth and plummeting consumer spending, played a significant role in this decision. The central bank aims to inject much-needed liquidity into the system, making borrowing cheaper for businesses and consumers, thereby encouraging investment and spending.

Specific economic indicators influencing this decision included:

- Falling consumer confidence: Surveys consistently showed a decline in consumer optimism about the future, leading to reduced spending.

- Weakening economic growth projections: Official forecasts indicated a significant slowdown in GDP growth, raising the spectre of a recession.

- Potential for a deeper recession: The Bank of England likely judged that a proactive interest rate cut was necessary to prevent a more severe and prolonged economic downturn. The aim is to preempt a deeper crisis rather than react to one.

Potential Impacts of the Half-Point Interest Rate Cut

The half-point interest rate cut is expected to have wide-ranging effects across various sectors of the UK economy. While intended to boost economic activity, it also carries potential risks.

Potential Benefits:

- Reduced borrowing costs: Lower interest rates make loans and mortgages cheaper, potentially encouraging businesses to invest and consumers to spend.

- Stimulated economic activity: Increased borrowing and spending could lead to higher demand, boosting production and employment.

Potential Risks:

- Higher inflation: Lower interest rates could fuel inflation if increased demand outpaces supply. This is a significant concern given the current inflationary pressures.

- Increased national debt: Lower interest rates can make it easier for the government to borrow, potentially increasing the national debt.

Further considerations include:

- Impact on mortgage rates: Homeowners with variable-rate mortgages will likely see lower monthly payments.

- Effect on business investment: Reduced borrowing costs may encourage firms to expand and create jobs.

- Changes in consumer spending patterns: Lower interest rates might lead to increased consumer spending on big-ticket items.

- Potential inflationary pressures: The risk of increased inflation needs careful monitoring and management.

Alternative Monetary Policy Options and Their Limitations

The half-point interest rate cut wasn't the only monetary policy tool available to the Bank of England. Other options included quantitative easing (QE) and forward guidance.

- Quantitative easing (QE): This involves the central bank injecting money into the economy by purchasing government bonds. While QE can increase liquidity, it carries the risk of fueling inflation and may not be as effective in stimulating lending as direct interest rate cuts.

- Forward guidance: This involves the Bank of England communicating its future intentions regarding interest rates. While this can influence market expectations, it can be less effective if economic conditions change unexpectedly.

The limitations of these alternatives include:

- Quantitative easing and its effectiveness: The effectiveness of QE can diminish over time, and its impact on the real economy can be indirect.

- Limitations of forward guidance: Forward guidance is subject to uncertainty and can lose credibility if not adhered to precisely.

- Risks associated with each policy option: Each monetary policy tool carries inherent risks that must be carefully weighed against the potential benefits.

The Bank of England's Predictive Capabilities and Future Outlook

The Bank of England's success in navigating the current economic climate hinges on its ability to accurately predict future trends. However, economic forecasting is inherently challenging.

Factors influencing the future outlook include:

- Accuracy of past economic forecasts: Evaluating the Bank's past forecasting accuracy provides insight into its current predictive capabilities.

- Uncertainties surrounding global economic conditions: Global factors, such as geopolitical instability and energy prices, significantly influence the UK economy.

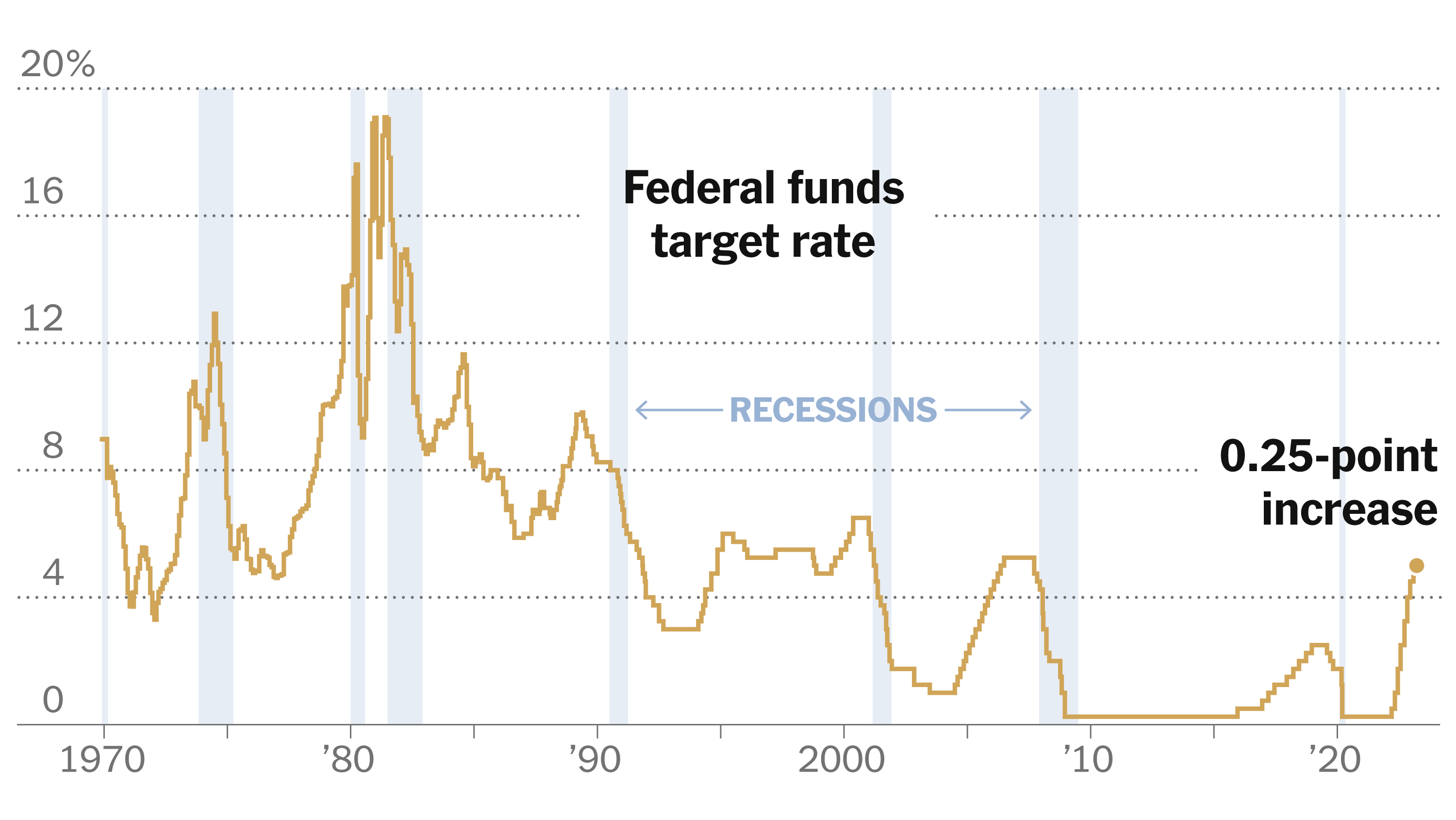

- Potential for future interest rate hikes or cuts: The need for further adjustments to interest rates will depend on the evolving economic landscape.

The Bank’s track record, though not perfect, provides some basis for evaluating its capacity to guide the economy through these uncertain times. However, unpredictable global events and the inherent complexity of economic modelling mean that absolute certainty is impossible.

Conclusion: Half-Point Interest Rate Cut – A Calculated Gamble?

The half-point interest rate cut represents a significant intervention by the Bank of England in response to growing economic anxieties. While it aims to stimulate growth and avert a deeper recession, it also carries the risk of increased inflation and a rise in national debt. Whether this bold move will successfully navigate the UK economy through the current challenges remains to be seen. The effectiveness of the policy will depend on various factors, including the response of consumers and businesses, as well as the evolution of global economic conditions. To understand the ongoing implications of this decision and future monetary policy adjustments, stay informed about further developments by subscribing to our newsletter or continuing to explore our other financial news articles. The impact of this half-point interest rate cut will undoubtedly continue to unfold, requiring close monitoring and analysis.

Featured Posts

-

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025

Nba Playoffs Triple Doubles Quiz How Many Can You Name

May 08, 2025 -

Chinas Rate Cuts And Easier Bank Lending A Response To Tariffs

May 08, 2025

Chinas Rate Cuts And Easier Bank Lending A Response To Tariffs

May 08, 2025 -

Fetterman Responds To Questions About His Health After Ny Magazine Article

May 08, 2025

Fetterman Responds To Questions About His Health After Ny Magazine Article

May 08, 2025 -

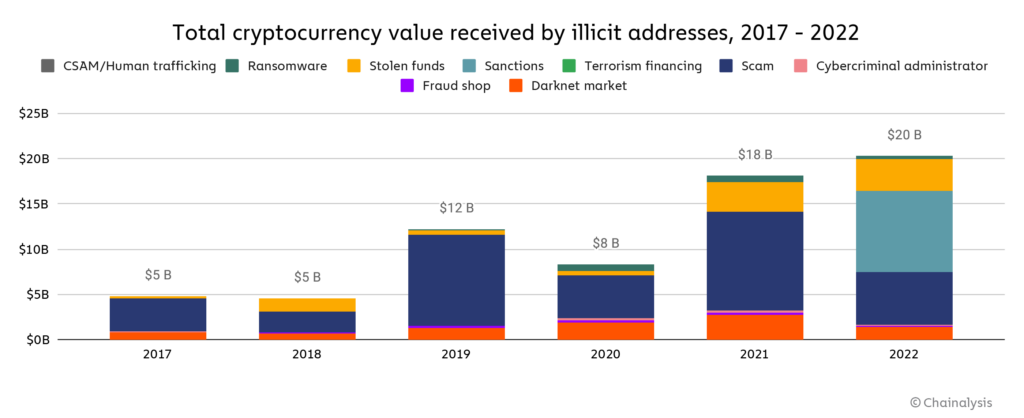

The Trade War And Crypto A Single Cryptocurrencys Potential For Growth

May 08, 2025

The Trade War And Crypto A Single Cryptocurrencys Potential For Growth

May 08, 2025 -

New Superman Movie 5 Minute Preview Showcases Krypto

May 08, 2025

New Superman Movie 5 Minute Preview Showcases Krypto

May 08, 2025

Latest Posts

-

Secure Your Psl 10 Tickets Sales Open Today

May 08, 2025

Secure Your Psl 10 Tickets Sales Open Today

May 08, 2025 -

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025

Qwmy Hyrw Aym Aym Ealm Ky 12 Wyn Brsy Aj Ky Tqrybat

May 08, 2025 -

Buy Your Psl 10 Tickets Sale Starts Today

May 08, 2025

Buy Your Psl 10 Tickets Sale Starts Today

May 08, 2025 -

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025

Psl 10 Tickets Available Today Get Yours Now

May 08, 2025 -

Ptt Postane Is Basvurulari 2025 Tarihler Ve Detaylar

May 08, 2025

Ptt Postane Is Basvurulari 2025 Tarihler Ve Detaylar

May 08, 2025