China's Rate Cuts And Easier Bank Lending: A Response To Tariffs

Table of Contents

Understanding China's Monetary Policy Response

Faced with slowing growth and weakening external demand, the People's Bank of China (PBOC) has employed a two-pronged approach: lowering interest rates and easing bank lending requirements.

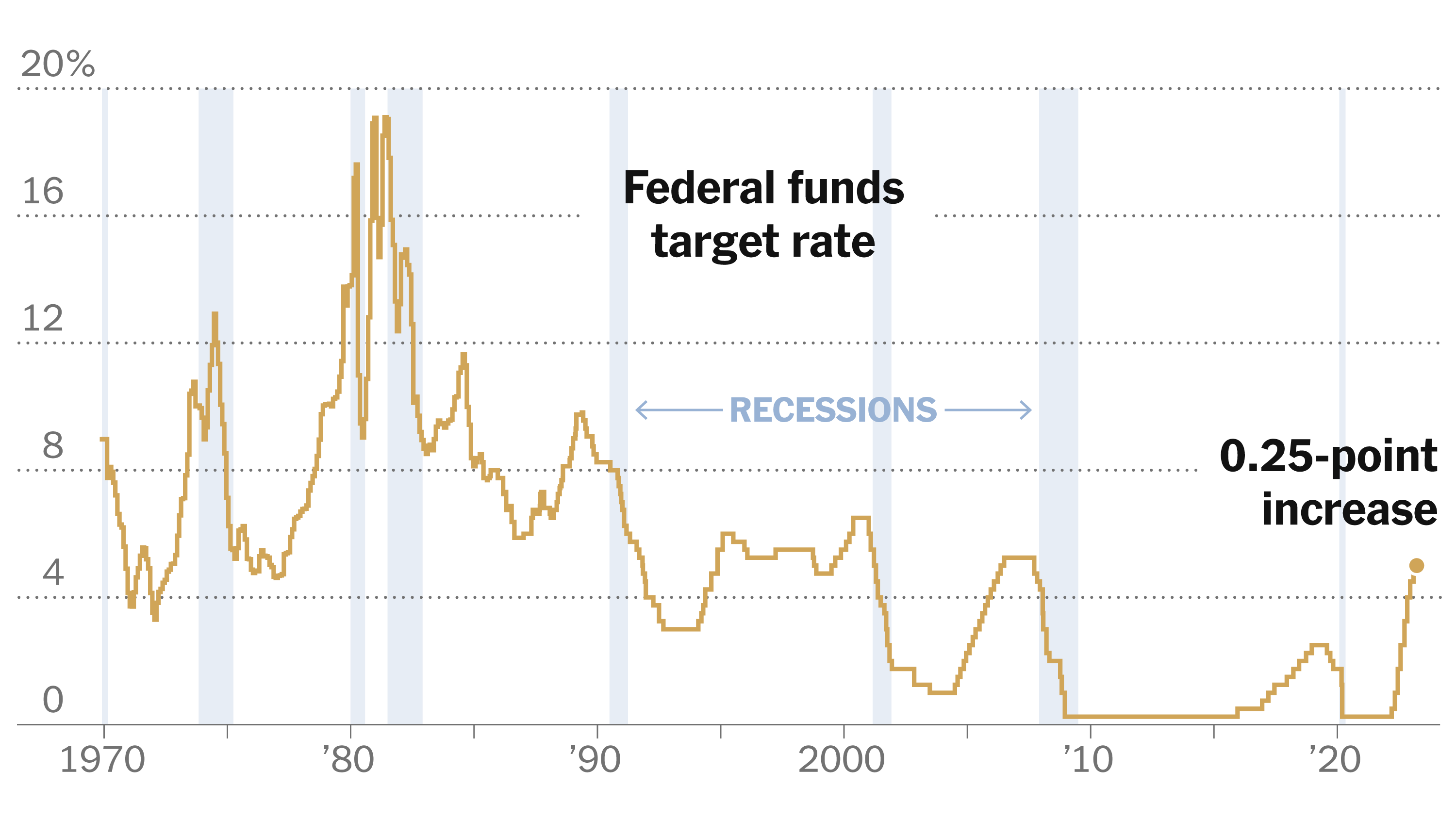

The Significance of Interest Rate Cuts

Lowering interest rates is a classic method of economic stimulus. By reducing borrowing costs, the PBOC aims to encourage increased investment and consumption, thereby boosting economic activity. Several interest rate cuts have been implemented in recent years, impacting both lending rates for businesses and consumer borrowing costs.

- Rationale: Stimulate investment and consumption by making borrowing cheaper.

- Specific Cuts: The PBOC has implemented several cuts to its benchmark lending rates, including the Loan Prime Rate (LPR). [Insert specific data on rate cuts and dates here, citing sources].

- Intended Effect: Reduced borrowing costs for businesses should lead to increased investment in expansion and new projects. Lower rates for consumers should stimulate spending on durable goods and housing.

- Historical Context: Analysis of previous rate cut cycles in China reveals [insert data on effectiveness of past rate cuts, referencing reliable sources]. The effectiveness varies depending on several factors, including the overall economic climate and the responsiveness of businesses and consumers to lower rates. The current situation, complicated by external trade pressures, presents a unique challenge. Keywords: interest rate cuts, monetary policy, PBOC, economic stimulus, lending rates.

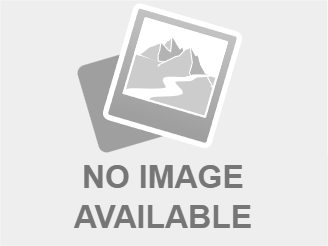

Easing Bank Lending Requirements

Simultaneously, the PBOC has worked to increase credit availability by easing bank lending requirements. This includes adjustments to the reserve requirement ratio (RRR), the percentage of deposits banks are required to hold in reserve. Lowering the RRR frees up more funds for banks to lend.

- Measures Implemented: [Specify the adjustments made to the RRR, including dates and percentages, citing reliable sources]. Other measures might include targeted lending programs for specific sectors.

- Impact on Credit Availability: Easing these requirements increases the amount of money banks can lend to businesses, particularly small and medium-sized enterprises (SMEs), which often struggle to access credit.

- Potential Risks: Relaxed lending standards carry the inherent risk of increased non-performing loans (NPLs). Careful monitoring and effective risk management are crucial to mitigate this risk. Keywords: reserve requirement ratio, bank lending, credit availability, SME financing, non-performing loans.

The Effectiveness of Rate Cuts and Easier Lending in Countering Tariffs

Evaluating the success of these monetary policies in offsetting the negative impact of tariffs requires a careful examination of key economic indicators.

Impact on Economic Growth

The effect of China's rate cuts and easier bank lending on key economic indicators such as GDP growth, investment, and consumption is a complex issue. While these policies have likely provided some support, the overall impact is difficult to isolate from other factors, including global economic uncertainty and the ongoing trade dispute.

- Economic Indicators: [Insert data on GDP growth, investment levels, and consumer spending, comparing figures before and after the implementation of the monetary policies. Cite reliable sources].

- Offsetting Tariff Impact: [Analyze the extent to which the monetary measures have mitigated the negative impact of tariffs. Present data and arguments supporting your analysis]. The extent to which these measures have successfully offset the negative impacts of tariffs is debatable, and further research is required. Keywords: GDP growth, economic indicators, investment, consumption, tariff impact.

Challenges and Limitations

While China's rate cuts and easier bank lending have offered some support, these measures are not without limitations.

- Potential Downsides: Easing monetary policy too aggressively carries risks, including potential inflation and the formation of asset bubbles.

- Limitations of Monetary Policy: Monetary policy alone cannot solve all economic problems. Structural issues, such as overcapacity in certain industries and inefficient resource allocation, require broader structural reforms.

- Role of Fiscal Policy: Fiscal policy, involving government spending and taxation, plays a vital role in supporting economic growth. Keywords: inflation, asset bubbles, fiscal policy, structural reforms, economic challenges.

Alternative Strategies and Future Outlook

Addressing the challenges posed by the trade war requires a multi-pronged approach that goes beyond monetary policy.

Exploring Fiscal Policy Options

Fiscal stimulus, in the form of increased government spending and/or tax cuts, could provide additional support to the economy.

- Potential Measures: [Discuss specific fiscal policy options that could be implemented, such as infrastructure spending, tax breaks for businesses, or direct cash transfers to consumers].

- Constraints: Political considerations and concerns about increasing government debt may limit the extent of fiscal expansion. Keywords: fiscal stimulus, government spending, tax cuts, fiscal policy.

Long-Term Economic Strategies

China's long-term economic success will depend on broader reforms and a shift towards a more sustainable growth model.

- Economic Reform Plans: [Discuss specific aspects of China's economic reform plans, such as promoting innovation, enhancing productivity, and fostering greater domestic consumption].

- Diversification and Technological Advancement: Reducing reliance on exports and investing in technological innovation are crucial for long-term resilience. Keywords: economic reform, diversification, technological innovation, long-term growth.

Conclusion: Navigating the Trade War with China's Rate Cuts and Easier Bank Lending

China's response to the trade war, utilizing China's rate cuts and easier bank lending, has provided some level of economic support, but its effectiveness in fully offsetting the negative impact of tariffs is debatable. The challenges are significant, requiring a comprehensive strategy that incorporates both monetary and fiscal policies, alongside broader structural reforms. Staying informed about further developments in China's rate cuts and easier bank lending and their impact on the global economy is crucial. Further research into the effectiveness of different policy mixes is recommended. For more in-depth analysis, explore resources from the PBOC, the IMF, and other reputable economic research organizations.

Featured Posts

-

Beat The Ps 5 Price Hike Secure Your Console Today

May 08, 2025

Beat The Ps 5 Price Hike Secure Your Console Today

May 08, 2025 -

Psg Nice Maci Canli Izle Hangi Kanalda Ve Nasil

May 08, 2025

Psg Nice Maci Canli Izle Hangi Kanalda Ve Nasil

May 08, 2025 -

Psg Nantes Suerpriz Berabere Sonuc

May 08, 2025

Psg Nantes Suerpriz Berabere Sonuc

May 08, 2025 -

The Arteta Debate Collymore Adds Fuel To The Arsenal Fire

May 08, 2025

The Arteta Debate Collymore Adds Fuel To The Arsenal Fire

May 08, 2025 -

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025

Latest Posts

-

Bitcoin Price Rebound What To Expect Next

May 08, 2025

Bitcoin Price Rebound What To Expect Next

May 08, 2025 -

110 Growth Potential Analyzing The Billionaire Backed Black Rock Etf For 2025

May 08, 2025

110 Growth Potential Analyzing The Billionaire Backed Black Rock Etf For 2025

May 08, 2025 -

Wall Street Predicts 110 Jump Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

Wall Street Predicts 110 Jump Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

Black Rock Etf Billionaire Investment Signals Potential 110 Surge In 2025

May 08, 2025

Black Rock Etf Billionaire Investment Signals Potential 110 Surge In 2025

May 08, 2025