House Approves Amended Trump Tax Legislation

Table of Contents

Key Amendments to the Trump Tax Legislation

The amended Trump Tax Legislation includes several notable changes affecting both corporate and individual taxpayers, as well as estate and gift tax provisions.

Corporate Tax Rate Adjustments

One of the most significant alterations concerns the corporate tax rate. The original legislation established a rate of [Insert Original Rate Here]%. The amended bill adjusts this rate to [Insert Amended Rate Here]%.

- Specific Changes: A reduction of [Difference in Percentage Points]% in the corporate tax rate.

- Impact on Businesses: Smaller businesses will likely experience a more substantial benefit due to lower overall tax burdens, potentially leading to increased investment and job creation. Larger corporations may also see benefits, although the magnitude of impact may vary based on their specific tax situations.

- Job Creation/Loss Implications: While the lower rate is expected to stimulate investment, the actual impact on job creation remains to be seen and will depend on several economic factors. Some analyses suggest a potential for modest job growth, while others predict minimal change.

Individual Tax Bracket Modifications

The amended bill also modifies individual income tax brackets. While the specific changes are complex, several key alterations stand out:

- Specific Examples: The standard deduction may be adjusted, impacting taxpayers across various income levels. Tax rates for specific income brackets may be altered, potentially resulting in higher or lower tax liabilities for certain individuals.

- Impact on Household Budgets: Depending on the specific changes to brackets and deductions, some households may experience a net tax increase while others see a decrease. Families with higher incomes may be disproportionately affected by changes to deductions or credits.

- Changes to Deductions and Credits: Certain deductions and credits may be modified or eliminated, significantly affecting the tax burden for those who previously relied on them.

Changes to Estate and Gift Taxes

The amended Trump Tax Legislation also includes revisions to estate and gift tax laws.

- Impacts on High-Net-Worth Individuals: These changes may significantly impact wealth transfer strategies for high-net-worth individuals and families. The increased or decreased exemption amounts will influence inheritance planning and tax liability upon death.

- Potential Effects on Wealth Transfer: The revisions could accelerate or decelerate wealth transfer depending on the specific changes implemented.

Political Ramifications of the Amended Trump Tax Legislation

The House's approval of the amended legislation has significant political implications.

Party Line Votes and Congressional Debate

The voting patterns largely followed party lines, indicating a lack of bipartisan consensus. [Mention specific political figures and their stances, e.g., "Representative X strongly supported the bill, citing its benefits for small businesses, while Senator Y voiced concerns about its impact on the national debt."] The bill now faces further scrutiny in the Senate, where additional debates and amendments are likely.

Public Opinion and Reaction

Public reaction to the amended legislation has been mixed. [Include relevant polling data or news coverage summarizing public sentiment. For example: "Recent polls indicate that 45% of Americans approve of the changes, while 30% disapprove."] This division reflects differing viewpoints on the bill's potential economic consequences and its impact on different segments of the population.

Economic Impact of the Amended Trump Tax Legislation

The economic consequences of the amended Trump Tax Legislation are complex and subject to ongoing debate among economists.

Short-Term and Long-Term Effects

The short-term effects might include a temporary boost in consumer spending due to tax cuts. However, long-term effects are less clear and will depend on numerous factors. Some economists predict increased inflation, while others forecast limited impact on job growth and the national debt. [Cite relevant economic analyses or forecasts from reputable sources.]

Impact on Different Sectors of the Economy

The impact will likely vary across different sectors. The manufacturing sector may benefit from specific provisions, while the technology sector’s reaction might depend on changes to research and development tax credits. The healthcare sector could see altered tax implications for hospitals and pharmaceutical companies.

Conclusion

The House's approval of the amended Trump Tax Legislation signifies a major shift in US tax policy. This article has highlighted the key amendments, their political ramifications, and the projected economic impacts. Understanding the intricacies of this revised legislation is crucial for businesses, individuals, and policymakers. For in-depth analysis and professional guidance on the implications of this amended Trump tax legislation, consult financial and legal professionals. Stay informed on future developments regarding this crucial tax legislation and its effect on your financial well-being.

Featured Posts

-

Mia Farrow And Sadie Sink A Broadway Photo Opportunity

May 24, 2025

Mia Farrow And Sadie Sink A Broadway Photo Opportunity

May 24, 2025 -

Fedor Lavrov O Pavle I Trillerakh I Lyudskoy Lyubvi K Ostrym Oschuscheniyam

May 24, 2025

Fedor Lavrov O Pavle I Trillerakh I Lyudskoy Lyubvi K Ostrym Oschuscheniyam

May 24, 2025 -

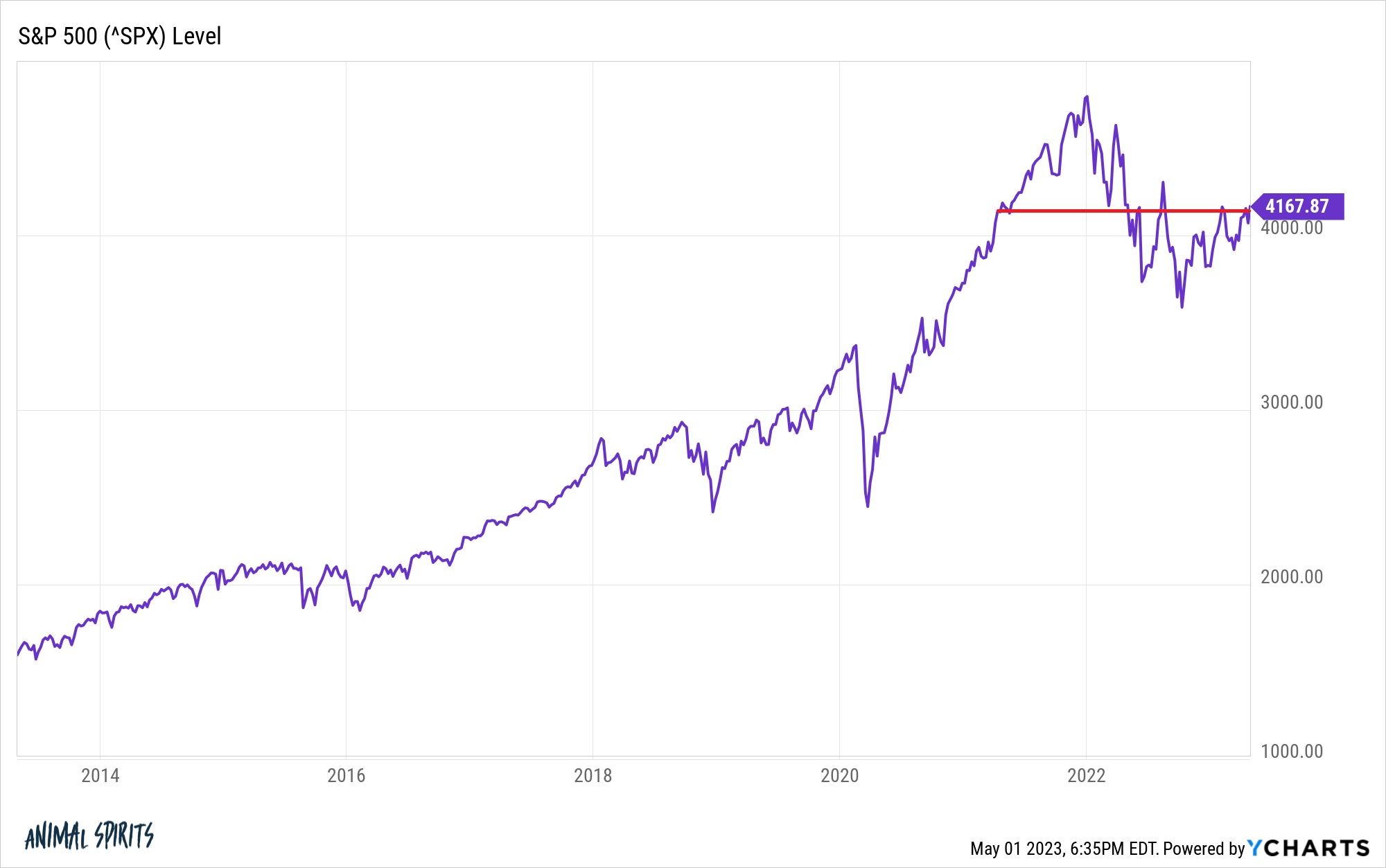

Understanding High Stock Market Valuations Why Investors Shouldnt Panic According To Bof A

May 24, 2025

Understanding High Stock Market Valuations Why Investors Shouldnt Panic According To Bof A

May 24, 2025 -

Revised Trump Tax Bill Approved By The House

May 24, 2025

Revised Trump Tax Bill Approved By The House

May 24, 2025 -

Terrapins Softball Edges Delaware 5 4 After Thrilling Comeback

May 24, 2025

Terrapins Softball Edges Delaware 5 4 After Thrilling Comeback

May 24, 2025

Latest Posts

-

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 24, 2025

Jonathan Groffs Just In Time A Night Of Celebration With Lea Michele And Friends

May 24, 2025 -

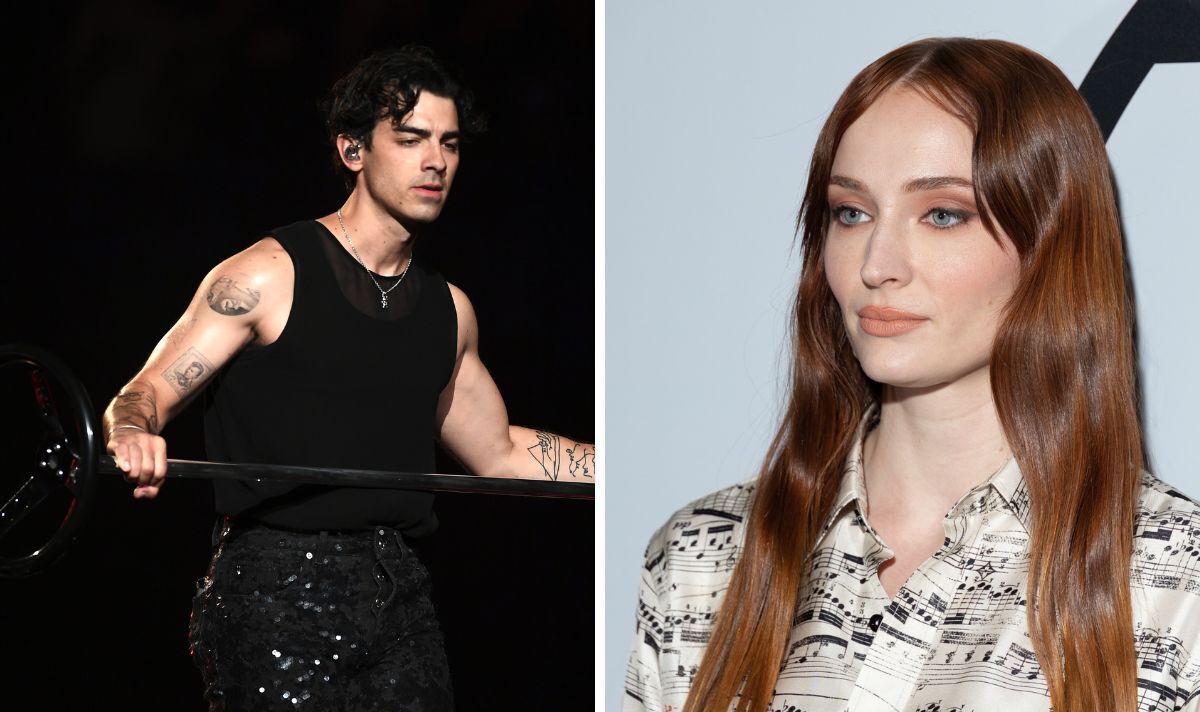

A Couples Argument Over Joe Jonas The Story And His Response

May 24, 2025

A Couples Argument Over Joe Jonas The Story And His Response

May 24, 2025 -

Jonathan Groffs Just In Time A Night Of Support From Broadways Best

May 24, 2025

Jonathan Groffs Just In Time A Night Of Support From Broadways Best

May 24, 2025 -

Joe Jonas A Classy Response To A Fans Unusual Situation

May 24, 2025

Joe Jonas A Classy Response To A Fans Unusual Situation

May 24, 2025 -

Jonathan Groffs Just In Time Photos From The Star Studded Broadway Opening

May 24, 2025

Jonathan Groffs Just In Time Photos From The Star Studded Broadway Opening

May 24, 2025