How To Monitor The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF and its NAV

The Amundi Dow Jones Industrial Average UCITS ETF is designed to replicate the performance of the Dow Jones Industrial Average, a leading index of 30 large, publicly-owned companies in the United States. The NAV, or Net Asset Value, represents the total value of the ETF's holdings (shares of the 30 companies) minus liabilities, divided by the number of outstanding shares. This figure reflects the intrinsic value of one share of the ETF.

It's important to differentiate between the NAV and the market price. The market price is the price at which the ETF is currently trading on the exchange and fluctuates throughout the trading day based on supply and demand. The NAV, however, is typically calculated at the end of the trading day and represents a more accurate reflection of the underlying asset value. Understanding this difference helps investors avoid making impulsive decisions based solely on short-term market fluctuations. While the ETF's ticker symbol will vary depending on the exchange, you can find it easily through your broker or financial news sites.

- The NAV reflects the net asset value of the ETF's holdings per share.

- Market price can fluctuate throughout the trading day, while the NAV is typically calculated at the end of the trading day.

- Understanding the difference helps investors avoid making impulsive decisions based on short-term market fluctuations.

Methods to Monitor the Amundi Dow Jones Industrial Average UCITS ETF NAV

There are several reliable methods to stay informed about the Amundi Dow Jones Industrial Average UCITS ETF NAV:

Checking with the Amundi Website

The most direct method is to check the official Amundi website. This ensures you're accessing the most accurate and up-to-date information.

- Navigate to the Amundi website and locate the ETF product page for the Amundi Dow Jones Industrial Average UCITS ETF.

- Look for a section dedicated to pricing and performance, often labeled "factsheet," "fund details," or "key figures."

- The NAV will typically be displayed alongside other key performance indicators, possibly in different currencies (e.g., EUR, USD). Note the currency to avoid misinterpretations.

- The NAV is usually updated daily, at the close of market.

Using Financial News Websites and Data Providers

Reputable financial news websites and data providers, such as Yahoo Finance, Google Finance, Bloomberg, and others, offer real-time or near real-time ETF data.

-

Search for the Amundi Dow Jones Industrial Average UCITS ETF using its ticker symbol.

-

These platforms usually display the current market price and the previous day's closing NAV.

-

Many platforms offer historical NAV data, allowing you to track performance over time via charts and graphs.

-

These websites often offer historical NAV data, allowing you to track performance over time.

-

Look for charts showing NAV trends.

-

Consider using advanced charting tools for in-depth analysis.

Employing Brokerage Platforms

If you hold the Amundi Dow Jones Industrial Average UCITS ETF within your brokerage account, accessing the NAV is usually very straightforward.

-

Your brokerage platform will typically display the NAV alongside your portfolio holdings, offering convenient access to the information.

-

The update frequency varies by brokerage, but many offer real-time or near real-time updates.

-

Easily compare the current NAV with your purchase price to gauge your investment's performance.

-

Convenient access to NAV data alongside your portfolio holdings.

-

Real-time or near real-time updates depending on your brokerage.

-

Ability to easily compare the NAV with your purchase price.

Interpreting the NAV and Making Informed Decisions

Changes in the Amundi Dow Jones Industrial Average UCITS ETF NAV reflect the performance of the underlying Dow Jones Industrial Average components.

- An increasing NAV generally indicates positive performance, meaning the value of the underlying assets has increased.

- A decreasing NAV suggests negative performance, indicating a decline in the value of the underlying assets.

- Regularly monitoring the NAV helps you make informed buy, sell, or hold decisions, complementing your broader investment strategy. However, remember to consider other market factors and your personal financial goals.

Factors influencing NAV changes include market conditions (overall market trends, investor sentiment), individual company performance within the Dow Jones Industrial Average, and dividend payouts (which can slightly reduce the NAV after distribution).

Conclusion

Regularly monitoring the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is vital for informed investment decisions. By using the methods outlined above – checking the Amundi website, utilizing financial news sources, and leveraging your brokerage platform – you can effectively track the ETF's performance and understand its underlying asset value. Remember that consistent monitoring of the Amundi Dow Jones Industrial Average UCITS ETF NAV, along with other relevant market analysis, is key to successful long-term investing. Start monitoring your Amundi Dow Jones Industrial Average UCITS ETF NAV today!

Featured Posts

-

La Caduta Delle Borse Analisi Dell Impatto Dei Dazi Ue E Prospettive Future

May 24, 2025

La Caduta Delle Borse Analisi Dell Impatto Dei Dazi Ue E Prospettive Future

May 24, 2025 -

I Miliardari Piu Influenti Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025

I Miliardari Piu Influenti Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 24, 2025 -

Unofficial Glastonbury Lineup Us Band Confirms Appearance

May 24, 2025

Unofficial Glastonbury Lineup Us Band Confirms Appearance

May 24, 2025 -

Live Updates Pedestrian Struck By Vehicle On Princess Road Emergency Response Underway

May 24, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road Emergency Response Underway

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist What You Need To Know

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist What You Need To Know

May 24, 2025

Latest Posts

-

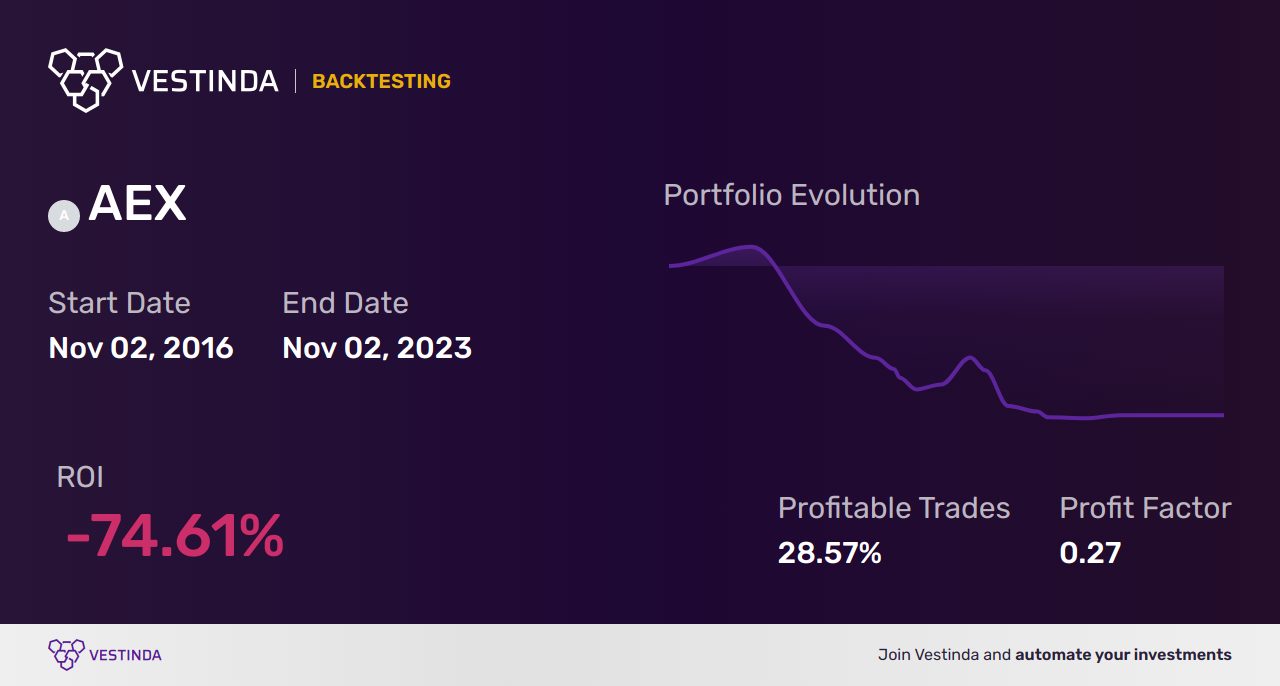

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025 -

Relx Ai Gedreven Groei Ondanks Economische Tegenwind

May 24, 2025

Relx Ai Gedreven Groei Ondanks Economische Tegenwind

May 24, 2025 -

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025