Impact Of Trump's Tariff Decision On Euronext Amsterdam Stocks: An 8% Increase

Table of Contents

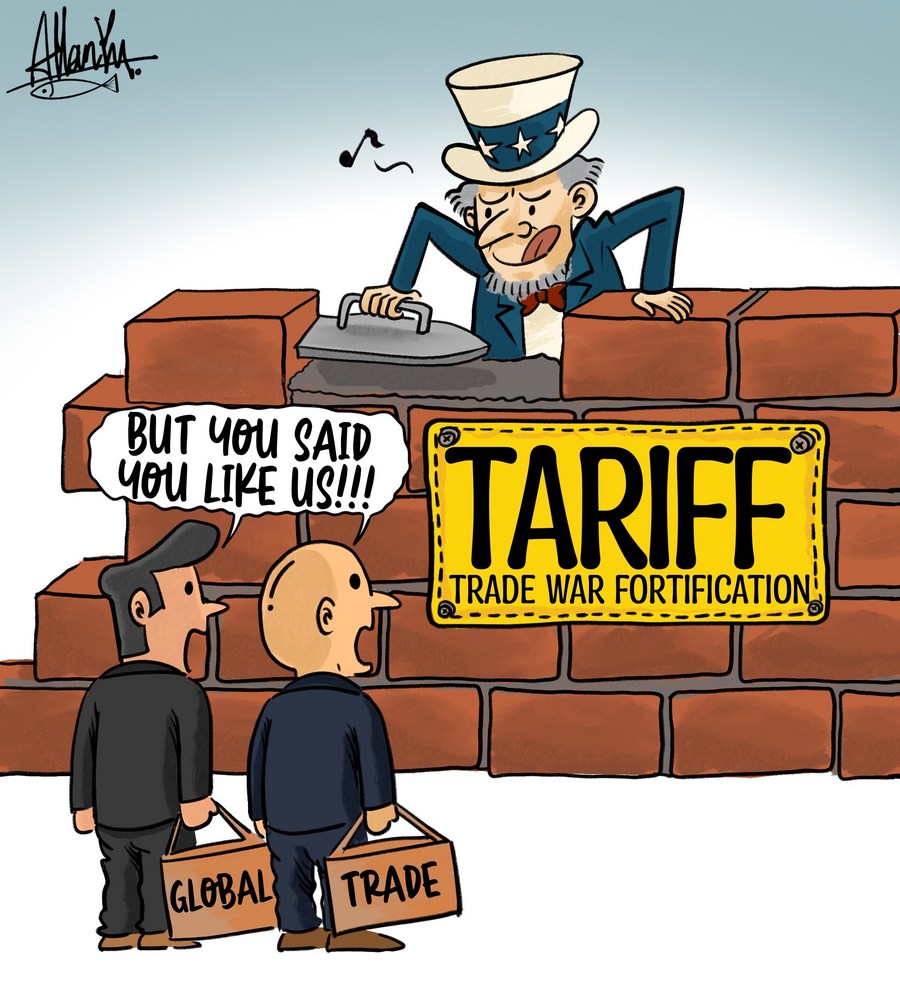

Understanding the Specific Tariff Decision

The unexpected surge in Euronext Amsterdam stock prices stemmed from a specific Trump administration tariff announcement in [Insert Date and Specific Details of Tariff Decision Here - e.g., July 2018, targeting steel and aluminum imports from the EU]. This decision, part of a broader trade war strategy, imposed significant tariffs on specific goods imported into the United States from the European Union.

- Targeted Industries: The tariffs primarily impacted [List specific industries affected, e.g., steel, aluminum, automotive parts] industries, many of which had significant European players listed on Euronext Amsterdam.

- Political and Economic Context: The decision came amid rising trade tensions between the US and EU, fueled by concerns about trade imbalances and unfair trade practices. [Add details regarding the political climate, trade negotiations, and overall economic situation at the time]. The announcement itself was unexpected, leading to market volatility.

- Keywords: "Trump trade policy," "tariff announcement," "specific tariff," "affected industries," "EU trade relations."

Analyzing the Unexpected 8% Increase

The impact of the tariff announcement on Euronext Amsterdam was dramatic. [Insert chart or graph here visually representing the 8% increase]. The rise wasn't uniform across all sectors.

- Significant Gains: [Identify specific sectors or companies that experienced the most substantial gains. For example, "The technology sector saw a 12% increase, while the automotive parts industry experienced a more modest 5% rise"].

- Contributing Factors: While the initial reaction may have been directly linked to the tariffs, other factors likely contributed to the magnitude of the increase.

- Market Speculation: Market speculation regarding the long-term implications of the tariffs and potential retaliatory measures from the EU likely played a significant role. Many investors anticipated that certain European companies could potentially benefit from a redirection of trade flows.

- Investor Sentiment: Overall investor sentiment toward the European market may also have influenced the increase. [Discuss any prevailing investor sentiment at the time, e.g., positive outlook, risk appetite etc.].

- Keywords: "stock market reaction," "market volatility," "investment strategy," "stock performance," "return on investment," "sector performance."

Potential Reasons for the Positive Market Response

The positive market response to a seemingly negative event (tariff imposition) warrants a closer investigation. Several factors could explain this seemingly paradoxical outcome:

Unforeseen Opportunities

The tariffs inadvertently created opportunities for certain Euronext Amsterdam-listed companies.

- Increased Competitiveness: For some companies, the tariffs reduced competition from US and other global players, boosting their market share within Europe and potentially within other markets.

- Domestic Demand: Some companies might have benefited from increased domestic demand within Europe as consumers and businesses shifted away from US-based imports.

Shift in Global Trade Flows

The tariffs forced a reshuffling of global trade relationships.

- New Trade Partners: European companies might have found new trade partners in Asia or other regions to offset the impact of the US tariffs. This diversification could have positively impacted their stock prices.

- Trade Diversion: Trade flows were diverted away from the US, benefiting some European companies that could now fill the gap in supply.

Investor Speculation and Market Sentiment

Market psychology played a considerable role.

- Short-Term Gains: Investors may have focused on the immediate, short-term opportunities presented by the tariff decision, leading to a speculative buying spree.

- Anticipation of Policy Changes: Speculation about potential future policy changes by the Trump administration, or indeed by the EU in response, might have also influenced investor sentiment.

Keywords: "global trade," "market opportunity," "competitive advantage," "investment trends," "market psychology," "trade diversion."

Long-Term Implications and Risks

While the immediate aftermath showed a positive reaction, the long-term effects of the Trump tariff decision on Euronext Amsterdam stocks are less certain.

- Sustained Impact: The sustained impact of the tariffs on Euronext Amsterdam-listed companies' profitability remains uncertain. Continued trade tensions could negatively affect long-term growth.

- Unforeseen Repercussions: The initial positive reaction might mask longer-term negative consequences, such as reduced export opportunities or damage to international trade relationships.

- Economic Uncertainty: Global economic uncertainty and the wider impacts of the trade war could create instability in the market, impacting the performance of Euronext Amsterdam stocks.

- Keywords: "long-term investment," "risk assessment," "market uncertainty," "economic outlook," "future projections," "trade uncertainty."

Conclusion: Navigating the Impact of Trump's Tariffs on Euronext Amsterdam

The 8% increase in Euronext Amsterdam stocks following a specific Trump tariff decision was unexpected but highlights the complex interplay of trade policy and market dynamics. This surge, while initially positive for some, was likely driven by a combination of unforeseen opportunities, shifts in global trade flows, and market speculation. However, the long-term implications remain uncertain, with potential risks associated with continued trade tensions and global economic instability. Stay updated on the impact of future trade decisions on your Euronext Amsterdam investments. Learn more about navigating the complexities of Trump's tariffs and understand the implications of Trump's trade policies on your portfolio to make informed investment choices. Analyze the effects of Trump's tariff decisions on Euronext Amsterdam stocks for informed investing.

Featured Posts

-

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 25, 2025

I Miliardari Del 2025 La Classifica Forbes Degli Uomini Piu Ricchi

May 25, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Menya Vela Kakaya To Sila

May 25, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Menya Vela Kakaya To Sila

May 25, 2025 -

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration With Ai And Automation In Amsterdam

May 25, 2025 -

Escape To The Country Lifestyle Changes And Considerations

May 25, 2025

Escape To The Country Lifestyle Changes And Considerations

May 25, 2025 -

Escape To The Country Top Destinations For A Tranquil Life

May 25, 2025

Escape To The Country Top Destinations For A Tranquil Life

May 25, 2025

Latest Posts

-

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025 -

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025 -

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025 -

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025