Investing In Quantum Computing Stocks: Rigetti & IonQ In 2025

Table of Contents

Rigetti Computing: A Deep Dive

Rigetti's Technology and Approach

Rigetti Computing focuses on superconducting qubit technology, a leading approach in the quantum computing race. Their architecture emphasizes a modular design, allowing for scalability by connecting multiple quantum processing units (QPUs). This approach aims to build larger, more powerful quantum computers by combining smaller modules. They have established several key partnerships, collaborating with various research institutions and companies to further develop their technology and expand its applications.

- Advantages of Rigetti's approach:

- Scalability through modular design.

- Established partnerships accelerating development.

- Potential for high qubit counts in the near future.

- Disadvantages of Rigetti's approach:

- Complexity of superconducting qubit fabrication.

- Challenges associated with maintaining coherence in large-scale systems.

- Competition from other superconducting qubit companies.

Rigetti's Business Model and Financial Performance

Rigetti generates revenue through several streams, including cloud access to their QPUs, providing quantum computing services to researchers and businesses. They also sell quantum computing hardware directly to select clients. Their financial performance is subject to the typical volatility of a young, rapidly-growing technology company. Recent funding rounds have provided them with capital to continue their research and development efforts.

- Key Financial Metrics (Illustrative, subject to change):

- Revenue growth projections: Significant year-on-year growth anticipated.

- Operating expenses: High due to R&D investment.

- Funding secured: Several rounds of substantial investment.

These metrics need to be reviewed regularly via their official financial reports.

Investment Risks and Potential Returns for Rigetti

Investing in Rigetti carries significant risk. The quantum computing industry is still in its early stages, and there's no guarantee that Rigetti will achieve its ambitious goals. The technology is complex, and unforeseen challenges could delay progress. However, the potential for high returns is also substantial, given the potential transformative impact of quantum computing across various industries.

- Key Risk Factors:

- Technological hurdles in scaling up QPU capabilities.

- Intense competition from other quantum computing companies.

- Uncertain regulatory landscape for the quantum computing industry.

- Potential Rewards:

- First-mover advantage in certain quantum computing applications.

- High market valuation if successful in commercializing their technology.

- Significant returns if quantum computing becomes a mainstream technology.

IonQ: A Contender in the Quantum Race

IonQ's Technology and Approach

IonQ employs trapped ion technology, a different approach to quantum computing compared to Rigetti's superconducting qubits. They use lasers to control and manipulate individual ions trapped in an electromagnetic field, forming qubits. Their approach boasts high qubit fidelity and potentially greater scalability. The unique advantage lies in the inherent stability and long coherence times of trapped ions.

- Comparison with Rigetti:

- IonQ: Higher qubit fidelity, potentially longer coherence times, but potentially slower scaling.

- Rigetti: Potentially faster scaling, but challenges in maintaining qubit coherence at higher qubit counts.

IonQ's Business Model and Financial Performance

IonQ's revenue model is similar to Rigetti's, relying on cloud access to their quantum computers and partnerships with businesses and research organizations. They are also actively pursuing strategic partnerships to expand their market reach and develop specific applications. Like Rigetti, their financial performance reflects the early-stage nature of the quantum computing sector.

- Key Financial Metrics (Illustrative, subject to change):

- Revenue growth: Similar to Rigetti, significant year-on-year growth is projected.

- Partnerships and collaborations: Driving revenue growth and market expansion.

- Market capitalization: Reflecting investor confidence and market potential.

Investment Risks and Potential Returns for IonQ

Investment in IonQ also presents substantial risks similar to Rigetti, including technological uncertainties and intense competition. However, their unique trapped-ion technology offers a potentially significant advantage. The potential returns are high, driven by the potential market disruption and the increasing adoption of quantum computing solutions.

- Key Risk Factors:

- Challenges in scaling up the trapped ion technology.

- Competition from other quantum computing companies using different technologies.

- Market uncertainty and potential delays in widespread adoption of quantum computing.

- Potential Rewards:

- Technological leadership in trapped ion quantum computing.

- Significant market share if their technology proves superior.

- High returns driven by the growth of the quantum computing market.

Comparing Rigetti and IonQ: Which is the Better Investment?

Choosing between Rigetti and IonQ depends on your risk tolerance and investment strategy. Both companies present significant risks and potential rewards. Rigetti's modular approach might offer faster scalability, while IonQ's trapped ion technology might offer higher qubit fidelity. A thorough comparison requires analyzing their latest financial reports, technological advancements, and market positioning.

| Feature | Rigetti Computing | IonQ |

|---|---|---|

| Technology | Superconducting qubits | Trapped ions |

| Scalability | Potentially faster | Potentially slower |

| Qubit Fidelity | Moderate | High |

| Business Model | Cloud access, hardware sales | Cloud access, partnerships |

The Future of Quantum Computing and Investment Strategies

The overall market potential for quantum computing is immense, with projected exponential growth over the next decade. However, challenges remain, including technological limitations, high costs, and the need for skilled personnel. A diversified investment approach, combining exposure to both Rigetti and IonQ, or other companies in the quantum computing ecosystem, is a prudent strategy.

Conclusion:

Investing in quantum computing stocks like Rigetti and IonQ presents a high-risk, high-reward opportunity. Both companies are leading players in the field but face considerable challenges. Thorough research, understanding the technological differences, and careful assessment of financial performance are crucial before investing. Start your journey into the exciting world of quantum computing stocks today by researching further and developing a well-informed investment strategy. Consider the potential of both Rigetti and IonQ within your diversified portfolio, but remember to proceed with caution and thorough analysis. Learn more about investing in quantum computing by exploring additional resources and consulting with financial professionals.

Featured Posts

-

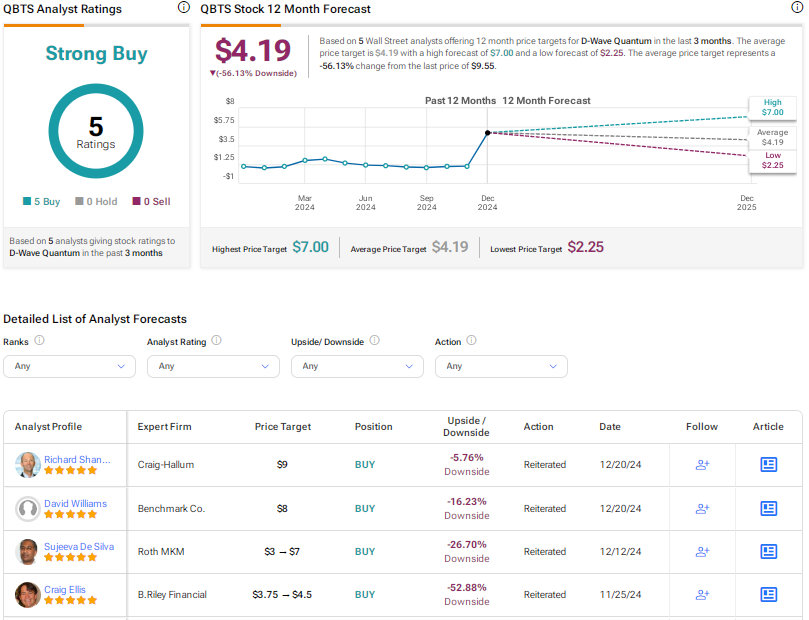

D Wave Quantum Qbts Stock Plunges Kerrisdale Capitals Valuation Concerns

May 20, 2025

D Wave Quantum Qbts Stock Plunges Kerrisdale Capitals Valuation Concerns

May 20, 2025 -

Agatha Christies Towards Zero Why No Murder In The First Episode

May 20, 2025

Agatha Christies Towards Zero Why No Murder In The First Episode

May 20, 2025 -

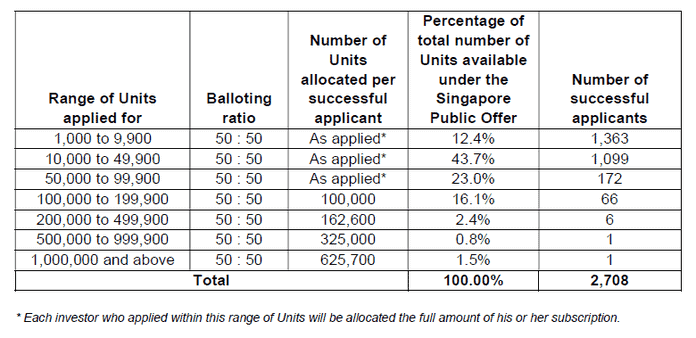

Dubai Holdings Reit Ipo A 584 Million Investment Opportunity

May 20, 2025

Dubai Holdings Reit Ipo A 584 Million Investment Opportunity

May 20, 2025 -

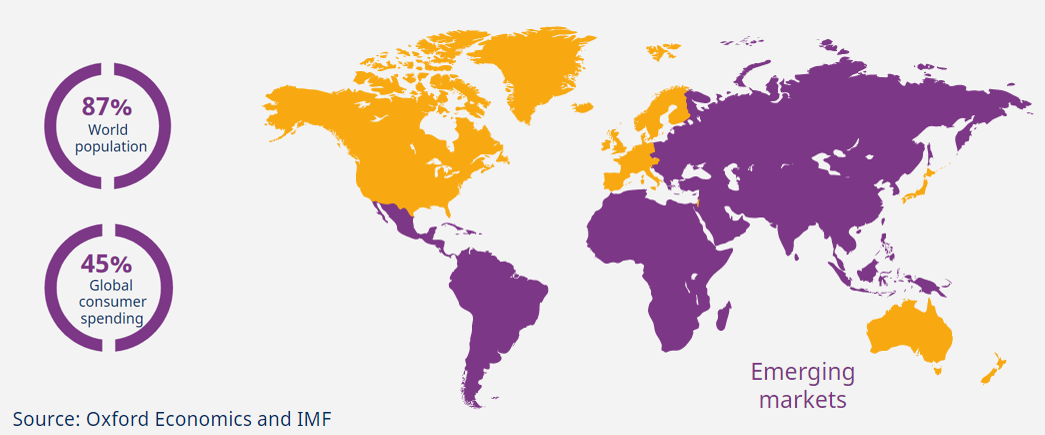

A Comprehensive Map Of The Countrys Emerging Business Hot Spots

May 20, 2025

A Comprehensive Map Of The Countrys Emerging Business Hot Spots

May 20, 2025 -

La Famille Schumacher Accueille Une Petite Fille

May 20, 2025

La Famille Schumacher Accueille Une Petite Fille

May 20, 2025

Latest Posts

-

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025 -

Mm Karsinnat 2024 Huuhkajien Valmennus Ja Tulevaisuus

May 20, 2025

Mm Karsinnat 2024 Huuhkajien Valmennus Ja Tulevaisuus

May 20, 2025 -

Wwe Raw Tyler Bate Returns Reuniting With Pete Dunne

May 20, 2025

Wwe Raw Tyler Bate Returns Reuniting With Pete Dunne

May 20, 2025 -

Huuhkajien Mm Unelma Uuden Valmennuksen Tehtaevae

May 20, 2025

Huuhkajien Mm Unelma Uuden Valmennuksen Tehtaevae

May 20, 2025 -

Tyler Bate And Pete Dunne Reunite On Wwe Raw

May 20, 2025

Tyler Bate And Pete Dunne Reunite On Wwe Raw

May 20, 2025