Kering Shares Plunge 6% Following Disappointing Q1 Earnings

Table of Contents

Reasons Behind Kering's Disappointing Q1 Earnings

Kering's Q1 2024 financial performance fell significantly short of expectations, triggering the sharp "Kering shares plunge." Several interconnected factors contributed to this revenue decline and impacted profit margins.

-

Underperforming Key Brands: Sales figures for some of Kering's flagship brands, notably Gucci and Yves Saint Laurent, significantly lagged behind analysts' projections. While precise figures are still emerging, preliminary reports suggest a double-digit percentage decrease in sales growth compared to the same period last year. This underperformance is a major driver of the overall negative Q1 results.

-

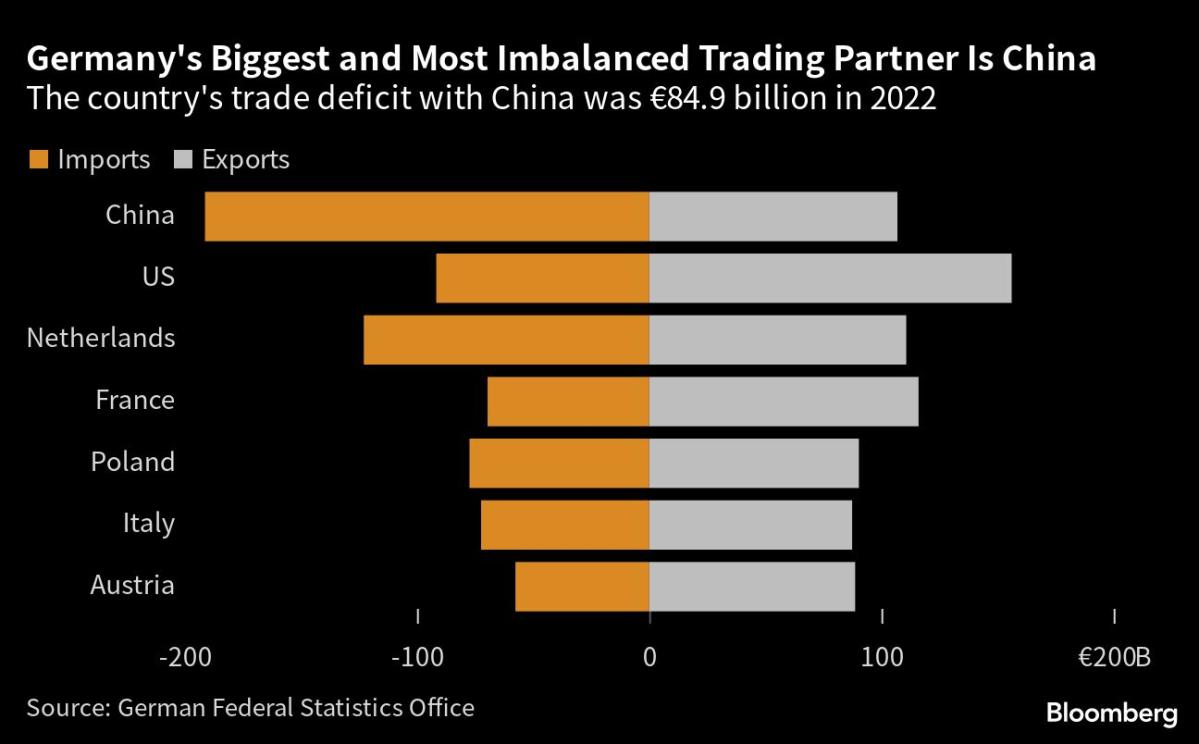

Macroeconomic Headwinds: The global economic slowdown, persistent inflation, and ongoing supply chain disruptions created a challenging operating environment. These macroeconomic factors significantly impacted consumer spending, particularly in luxury goods, a sector highly sensitive to economic fluctuations.

-

Evolving Consumer Spending Habits: Changes in consumer behavior across key markets, including China, Europe, and the US, played a role. A shift towards more cautious spending, coupled with a potential preference for experiences over luxury goods, contributed to the lower-than-expected sales. The impact of this shift is clearly reflected in the Q1 results.

-

Increased Competition: The luxury goods sector is increasingly competitive. New entrants and established players are vying for market share, putting pressure on pricing and margins, further impacting Kering's financial performance and contributing to the "Kering shares plunge."

Impact on Investors and Market Reaction

The news of Kering's disappointing Q1 results sent immediate ripples through the stock market. Investor sentiment turned sharply negative, resulting in significant share price volatility.

-

Sharp Share Price Drop: The initial 6% drop in Kering's share price was a dramatic response to the negative Q1 earnings report. This substantial decline underscores the market's concern regarding the company's future prospects.

-

Negative Analyst Reactions: Analysts reacted swiftly, revising their forecasts downwards and expressing concern over Kering's ability to meet its full-year targets. Several investment banks downgraded their ratings on Kering stock, further fueling the negative market sentiment.

-

Market Capitalization Impact: The "Kering shares plunge" resulted in a considerable reduction in the company's market capitalization, reflecting investors' loss of confidence. This loss in valuation highlights the severity of the Q1 performance shortfall.

-

Long-Term Strategic Implications: The disappointing Q1 results may necessitate a reevaluation of Kering's long-term strategic plans. The company may need to adjust its growth strategy and consider alternative approaches to navigate the current challenging market conditions.

Kering's Response and Future Outlook

Kering has issued an official statement acknowledging the disappointing Q1 results and outlining its plans to address the challenges. The company's response will be crucial in determining the trajectory of its "Kering stock" price and restoring investor confidence.

-

Strategic Initiatives: Kering is likely to implement several strategic initiatives to reinvigorate its brands and improve financial performance. This may involve new product launches, innovative marketing campaigns, and a renewed focus on key customer segments.

-

Operational Efficiency: Cost-cutting measures and restructuring plans may be employed to improve operational efficiency and enhance profitability. These measures could involve streamlining operations, reducing overhead costs, and optimizing supply chains.

-

Market Expansion and Diversification: Expanding into new markets and diversifying its product offerings could help mitigate the impact of regional economic downturns and changing consumer preferences.

-

Digital Transformation and Sustainability: Investing further in digital transformation and sustainability initiatives is essential to maintain competitiveness and appeal to environmentally conscious consumers. These long-term investments are likely to be key components of Kering's turnaround plan.

Analyzing the Kering Shares Plunge and What's Next

The 6% drop in Kering shares following its disappointing Q1 earnings highlights the vulnerability of luxury goods companies to macroeconomic headwinds and shifting consumer preferences. The underperformance of key brands, combined with the global economic slowdown, played a significant role in this "Kering shares plunge." While the immediate outlook appears challenging, Kering's response and the company's ability to implement effective strategic initiatives will be crucial in determining its future prospects and the recovery of its "Kering stock." To stay informed about future developments concerning the Kering shares plunge and the company's performance, subscribe to reliable financial news sources and follow Kering's investor relations page for official updates.

Featured Posts

-

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025 -

Philips Future Health Index 2025 Urgent Call To Action For Healthcare Leaders

May 24, 2025

Philips Future Health Index 2025 Urgent Call To Action For Healthcare Leaders

May 24, 2025 -

Analysis National Rallys Sunday Demonstration For Le Pen

May 24, 2025

Analysis National Rallys Sunday Demonstration For Le Pen

May 24, 2025 -

Apple Stock Prediction 254 Analysts Outlook And Buy Recommendation At 200

May 24, 2025

Apple Stock Prediction 254 Analysts Outlook And Buy Recommendation At 200

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Latest Posts

-

Impact Of G 7 De Minimis Tariff Talks On Chinese Exports

May 24, 2025

Impact Of G 7 De Minimis Tariff Talks On Chinese Exports

May 24, 2025 -

Cybersecurity Failure Costs Marks And Spencer 300 Million

May 24, 2025

Cybersecurity Failure Costs Marks And Spencer 300 Million

May 24, 2025 -

Actors Join Writers Strike Full Hollywood Shutdown Looms

May 24, 2025

Actors Join Writers Strike Full Hollywood Shutdown Looms

May 24, 2025 -

Microsoft Activision Deal Ftcs Appeal Challenges Regulatory Approval

May 24, 2025

Microsoft Activision Deal Ftcs Appeal Challenges Regulatory Approval

May 24, 2025 -

Accenture Announces 50 000 Promotions Following Six Month Hold

May 24, 2025

Accenture Announces 50 000 Promotions Following Six Month Hold

May 24, 2025