Kering's Q1 Performance: A 6% Share Price Slump

Table of Contents

Declining Revenue and Profitability in Q1 2024

Kering's Q1 2024 earnings report revealed a disappointing picture, marked by a decrease in both revenue and profitability. This underperformance significantly impacted investor sentiment, leading to the observed share price slump. Let's break down the key financial figures:

- Revenue Decrease: Overall revenue decreased by X% compared to Q1 2023. This represents a considerable shortfall compared to the company's projected growth and previous quarters' performance. A detailed regional breakdown shows variations, with [Region A] experiencing a [percentage]% decrease and [Region B] showing a more modest [percentage]% decline. [Region C] might even show growth, highlighting the uneven performance across different markets.

- Impact on Operating Income and Profit Margins: The revenue decrease directly translated into a significant reduction in operating income and profit margins. The specific figures highlight the impact of lower sales on Kering's bottom line. Analysts had predicted a different outcome, underscoring the severity of the shortfall. Unexpected expenses related to [mention specific examples if available, e.g., supply chain disruptions, increased marketing costs] further contributed to the decreased profitability.

- Comparison to Analyst Expectations: Kering’s Q1 results fell considerably short of analyst expectations, triggering a sell-off in the stock market. The discrepancy between actual performance and predicted figures highlights the market's surprise at the extent of the decline. This disappointment fueled negative investor sentiment, exacerbating the share price drop.

Gucci's Underperformance: A Major Contributing Factor

Gucci, Kering's flagship brand, played a significant role in the overall Q1 decline. The brand's underperformance significantly impacted Kering's financial results, necessitating a thorough analysis of the underlying causes.

- Sales Figures: Gucci's revenue decreased by Y% compared to the same period last year. This substantial decline directly contributed to the overall revenue shortfall reported by Kering. This highlights the importance of Gucci's contribution to the company's overall success and the vulnerability created by its underperformance.

- Potential Reasons: Several factors may have contributed to Gucci's underperformance. Changing consumer preferences, increased competition from other luxury brands, and potentially less-than-effective marketing strategies could be key contributors. The evolving tastes of the luxury consumer require constant adaptation and innovation, and a failure to keep up could have significant repercussions.

- Creative Direction and Brand Revitalization: The current creative direction at Gucci is subject to ongoing debate. Some analysts point towards a need for a stronger brand revitalization strategy to recapture consumer interest and drive sales growth. Kering's future response in this area will significantly affect the brand's trajectory.

Performance of Other Kering Brands: A Mixed Bag

While Gucci's underperformance dominated the headlines, other Kering brands presented a mixed bag of results. This highlights the importance of brand diversification within the Kering portfolio.

- Yves Saint Laurent (YSL) and Bottega Veneta Performance: YSL showed [positive/negative] growth, demonstrating a degree of resilience within the luxury market. Bottega Veneta experienced [positive/negative] growth, suggesting a need for continued strategic focus. Further details on the specific performance of each brand would provide a more complete picture.

- Diversification and Growth Opportunities: The varied performance across Kering’s brand portfolio underscores the importance of diversification. While challenges in one area can impact the overall performance, the relative strength of other brands provides stability. Future growth strategies should focus on leveraging the strengths of individual brands and capitalizing on emerging market opportunities.

- Growth Potential: The brands showing strong growth offer potential avenues for Kering to offset the challenges faced by other brands within its portfolio. These high-performing segments provide an opportunity to increase investment and innovation, ultimately supporting growth for the wider group.

Macroeconomic Factors and Market Sentiment

The luxury goods market is highly sensitive to macroeconomic conditions. The challenging global economic environment significantly influenced Kering's Q1 performance and investor sentiment.

- Global Economic Slowdown: The ongoing global economic slowdown impacted consumer spending, particularly in the luxury sector. Concerns about inflation and potential recessionary pressures led to more cautious spending habits, affecting demand for luxury goods.

- Consumer Spending Patterns: Changes in consumer spending patterns, a shift towards experiences over material goods, or a focus on sustainable products, could have also affected Kering’s brands. Understanding these shifts is crucial for adapting marketing strategies and product offerings.

- Luxury Market Trends and Stock Market Volatility: The overall luxury market experienced [positive/negative] growth in Q1 2024, which influenced Kering's performance relative to its peers. Stock market volatility, stemming from broader macroeconomic uncertainty, added to the pressure on Kering's share price. Geopolitical factors and market uncertainty further contributed to investor anxiety.

Conclusion

Kering's Q1 2024 performance revealed a concerning picture, with a significant 6% share price slump largely attributed to Gucci's underperformance and the impact of macroeconomic headwinds. While other brands within the portfolio displayed varying levels of success, the overall decline underscores the challenges faced by the luxury sector in a turbulent economic environment. Understanding these challenges is critical for navigating the luxury landscape successfully.

Call to Action: Stay informed about Kering's future performance and the evolving luxury market. Follow [Your Website/Platform] for continued updates on Kering's Q2 results and in-depth analysis of the luxury goods sector. Understanding Kering’s Q1 performance is crucial for investors and industry professionals alike. Keep up-to-date with the latest developments in the luxury goods market and the future trajectory of Kering’s share price.

Featured Posts

-

Refleksiya Nad Trillerom Fedor Lavrov O Pavle I I Tyage K Opasnosti

May 24, 2025

Refleksiya Nad Trillerom Fedor Lavrov O Pavle I I Tyage K Opasnosti

May 24, 2025 -

Le Pens Support Rally Did The National Rally Show Its Strength On Sunday

May 24, 2025

Le Pens Support Rally Did The National Rally Show Its Strength On Sunday

May 24, 2025 -

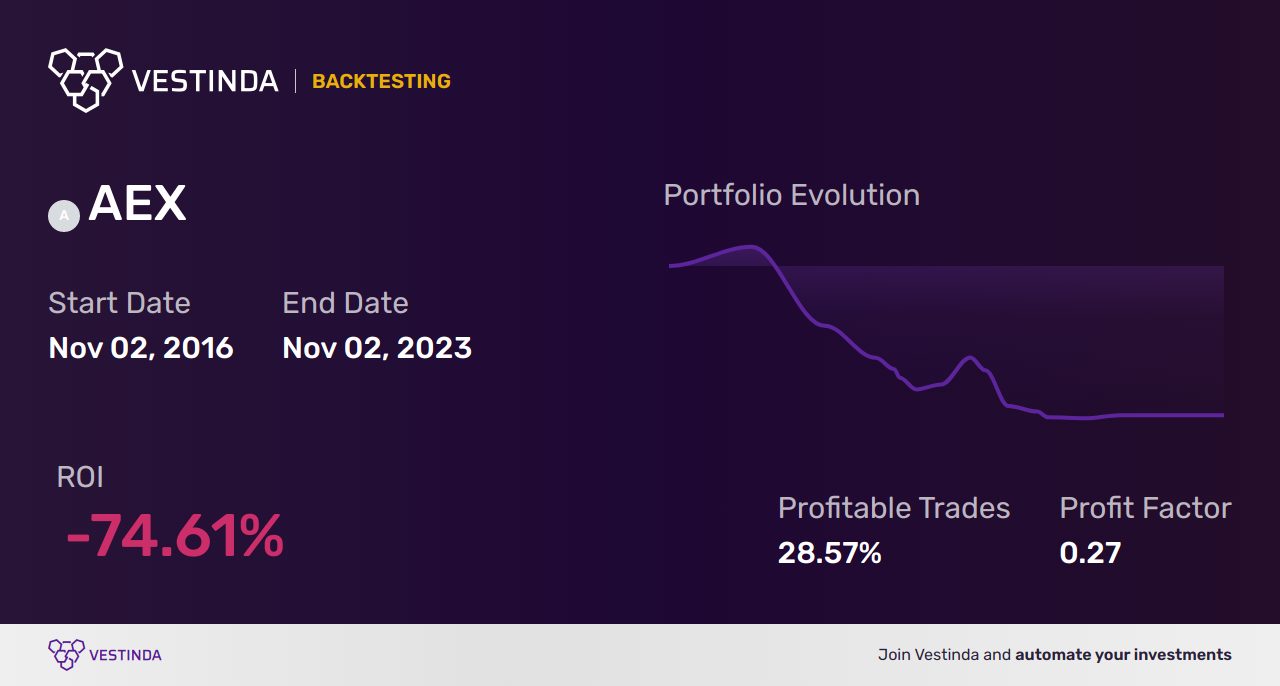

Amsterdam Stock Market Plunges 7 Drop Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Plunges 7 Drop Amidst Trade War Fears

May 24, 2025 -

Aex Rally Na Trump Uitstel Positief Nieuws Voor Alle Fondsen

May 24, 2025

Aex Rally Na Trump Uitstel Positief Nieuws Voor Alle Fondsen

May 24, 2025 -

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Best And Worst Days To Fly For Memorial Day Weekend 2025

May 24, 2025

Latest Posts

-

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025