Las Vegas Resorts World Faces $10.5 Million Penalty For Money Laundering

Table of Contents

Details of the Nevada Gaming Control Board's Investigation

The NGCB's investigation into Resorts World's anti-money laundering (AML) practices began in [Insert Start Date of Investigation]. The investigation involved a thorough review of the resort's financial transactions, internal controls, and compliance procedures. The NGCB’s findings revealed several critical violations that led to the hefty penalty. These violations included:

- Insufficient Anti-Money Laundering Procedures: The investigation uncovered significant deficiencies in Resorts World's AML program, including inadequate training for employees responsible for identifying and reporting suspicious activity. This lack of proper training and protocols hindered the effective detection and prevention of money laundering schemes.

- Failure to Report Suspicious Activity: The NGCB found evidence that Resorts World failed to report numerous suspicious transactions, a clear violation of Nevada gaming regulations. This failure to report potentially illegal activities allowed suspicious funds to flow through the casino undetected.

- Inadequate Due Diligence: The resort's procedures for conducting customer due diligence were also deemed insufficient, allowing potentially high-risk individuals to engage in large-scale financial transactions without proper scrutiny.

The NGCB's report, released on [Insert Report Release Date], detailed the evidence gathered throughout the investigation, including witness testimonies, financial records, and internal documents. While the report does not name specific individuals implicated in the violations, it clearly outlines systemic failures within Resorts World's compliance framework. The evidence presented strongly suggests a pattern of negligence and a lack of commitment to AML compliance.

The $10.5 Million Penalty: Breakdown and Impact

The $10.5 million penalty represents a significant financial blow to Resorts World. This substantial fine is likely to impact the resort's revenue, potentially affecting its profitability and future expansion plans. The penalty’s impact extends beyond immediate financial losses; it's expected to negatively influence the resort's stock price, investor confidence, and overall reputation. The penalty could also lead to further legal actions, including potential civil lawsuits from affected parties. The long-term consequences for Resorts World’s standing in the competitive Las Vegas market remain to be seen. The incident serves as a cautionary tale for other casinos operating in Nevada and beyond.

Implications for the Las Vegas Casino Industry and Anti-Money Laundering Regulations

The Resorts World case has far-reaching implications for the entire Las Vegas casino industry. The penalty sends a strong message about the NGCB’s commitment to enforcing AML regulations and the severe consequences for non-compliance. This incident is likely to lead to:

- Enhanced Regulatory Scrutiny: Expect increased oversight of casino operations, with more frequent and thorough audits of AML programs and compliance procedures across all Las Vegas casinos.

- Strengthened Anti-Money Laundering Regulations: The case may prompt the NGCB and Nevada legislature to consider amendments to existing AML regulations, potentially making them more stringent and comprehensive.

- Industry-Wide Changes in Practices: Other casinos are likely to review and strengthen their AML programs to avoid similar penalties. This may involve investing in new technology, improving employee training, and enhancing internal controls.

Enhanced Scrutiny of Casino Operations Post-Penalty

The Resorts World penalty is expected to trigger a wave of increased oversight within the Las Vegas casino industry. We can anticipate:

- More Frequent Audits: Casinos can expect more rigorous and frequent audits from the NGCB and other regulatory bodies to ensure compliance with AML regulations.

- Improved Compliance Programs: Casinos will likely invest in upgrading their AML compliance programs, including enhanced employee training, improved technology, and more robust internal controls.

- Regulatory Changes: The incident could lead to significant changes in Nevada's gaming regulations, potentially increasing penalties for AML violations and introducing stricter compliance requirements.

Conclusion

The $10.5 million penalty imposed on Las Vegas Resorts World serves as a stark warning regarding the severe consequences of neglecting stringent anti-money laundering regulations within the Nevada casino industry. The investigation's findings emphasize the critical need for robust compliance programs and constant vigilance in detecting and preventing financial crimes. This case will undoubtedly have a lasting impact on the industry, prompting enhanced scrutiny, a renewed focus on regulatory compliance, and potentially significant changes in AML practices.

Call to Action: Stay informed about the ongoing developments in the Las Vegas Resorts World money laundering case and the evolving landscape of anti-money laundering regulations within the casino industry. Understanding these crucial issues is vital for industry professionals and consumers alike. Learn more about [link to relevant resource on AML regulations or the Resorts World case].

Featured Posts

-

Gridlock On Gop Tax Bill Medicaid And Clean Energy Changes Spark Conservative Backlash

May 18, 2025

Gridlock On Gop Tax Bill Medicaid And Clean Energy Changes Spark Conservative Backlash

May 18, 2025 -

Gonsolin Dominates In First 2023 Start Leading Dodgers To Victory

May 18, 2025

Gonsolin Dominates In First 2023 Start Leading Dodgers To Victory

May 18, 2025 -

Trump Declares Taylor Swift Not Hot Sparks Maga Celebration

May 18, 2025

Trump Declares Taylor Swift Not Hot Sparks Maga Celebration

May 18, 2025 -

Compare Online Casino Bonuses Black Lotus Vs Competitors

May 18, 2025

Compare Online Casino Bonuses Black Lotus Vs Competitors

May 18, 2025 -

Kasselakis Gia Ti Naytilia Kainotomia Kai Biosimotita Stin Elliniki T Halassa

May 18, 2025

Kasselakis Gia Ti Naytilia Kainotomia Kai Biosimotita Stin Elliniki T Halassa

May 18, 2025

Latest Posts

-

Bringing Your Pet On Uber In Mumbai Rules And Regulations

May 19, 2025

Bringing Your Pet On Uber In Mumbai Rules And Regulations

May 19, 2025 -

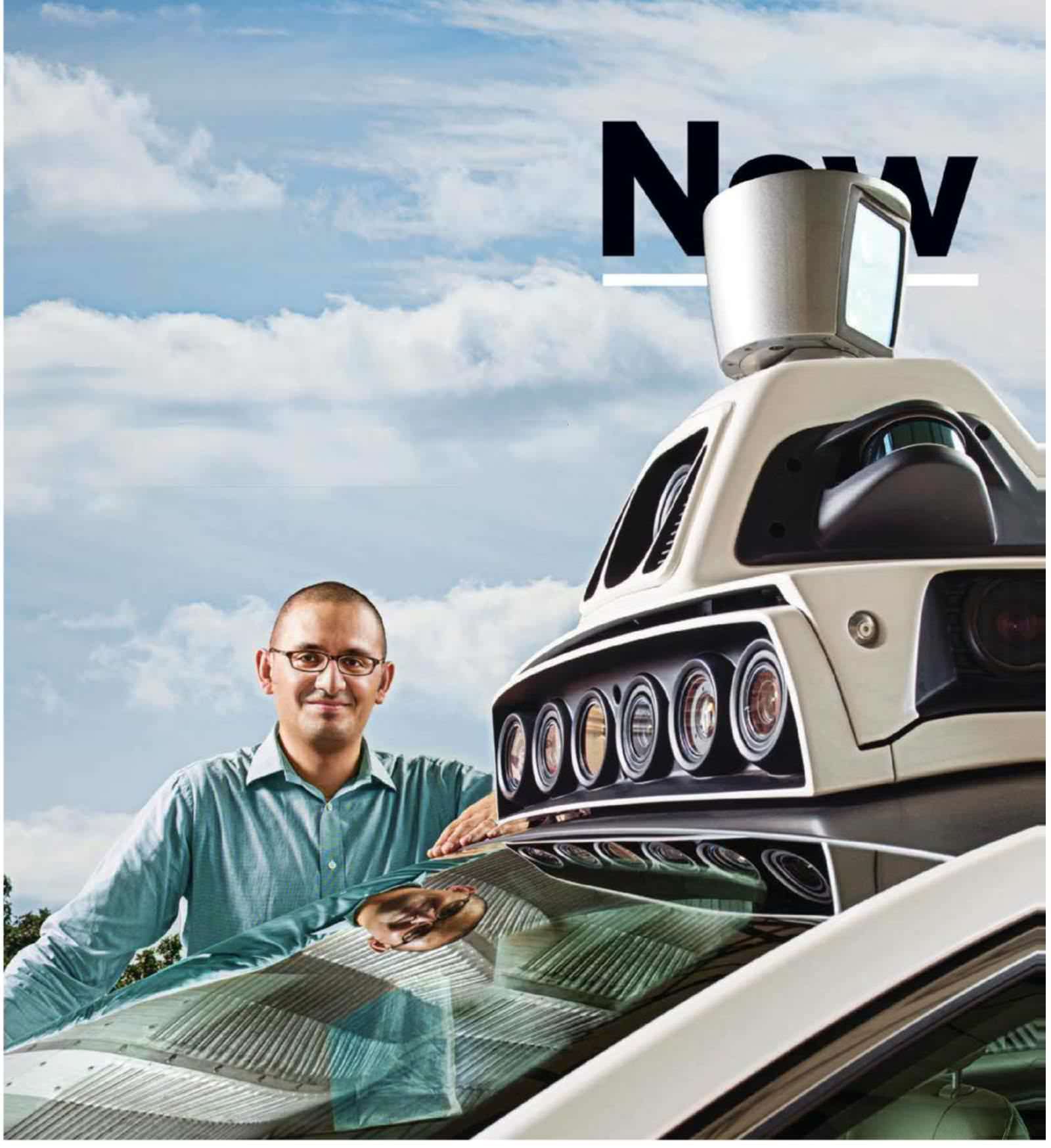

Investing In Ubers Driverless Technology An Etf Analysis

May 19, 2025

Investing In Ubers Driverless Technology An Etf Analysis

May 19, 2025 -

Mumbai Uber Taking Your Pet On A Ride A Step By Step Guide

May 19, 2025

Mumbai Uber Taking Your Pet On A Ride A Step By Step Guide

May 19, 2025 -

The Autonomous Future Etf Opportunities With Ubers Driverless Technology

May 19, 2025

The Autonomous Future Etf Opportunities With Ubers Driverless Technology

May 19, 2025 -

Will Ubers Autonomous Vehicles Drive Etf Returns

May 19, 2025

Will Ubers Autonomous Vehicles Drive Etf Returns

May 19, 2025