Meta Faces FTC Defense In Monopoly Case

Table of Contents

The FTC's Case Against Meta's Monopoly

The FTC's case rests on two primary pillars: accusations of anti-competitive acquisitions and claims of stifling competition through strategic practices.

Accusations of Anti-Competitive Acquisitions

The FTC alleges that Meta's acquisitions of Instagram and WhatsApp were not merely strategic business moves, but deliberate attempts to eliminate potential rivals and solidify its dominance in the social networking market.

-

Instagram Acquisition (2012): The FTC argues that acquiring Instagram, a then-emerging photo-sharing platform with significant potential, prevented it from becoming a serious competitor to Facebook. They point to internal Meta communications suggesting a preemptive strike against a growing threat.

-

WhatsApp Acquisition (2014): Similarly, the acquisition of WhatsApp, a popular messaging app, is alleged to have removed a significant competitor in the messaging and communication space. The FTC argues this acquisition stifled innovation and reduced consumer choice.

-

Evidence: The FTC's case relies heavily on internal Meta documents, market analysis reports, and expert testimony detailing the competitive landscape at the time of the acquisitions and the potential for Instagram and WhatsApp to grow into independent market leaders.

Claims of Stifling Competition Through Strategic Practices

Beyond acquisitions, the FTC contends that Meta employs various anti-competitive tactics to maintain its dominance.

-

Data Collection and Algorithmic Manipulation: The FTC alleges that Meta leverages its vast data collection capabilities and sophisticated algorithms to suppress competition. This includes allegedly using data to understand and react to the success of emerging competitors, potentially influencing user experience and algorithm rankings against them.

-

Developer Restrictions and Platform Control: The FTC points to Meta's control over its platform and the restrictions placed on developers as a barrier to entry for competing applications. This limits the ability of smaller companies to integrate with and compete within the Meta ecosystem.

-

Impact on Consumers: The FTC argues that these anti-competitive actions limit consumer choice, restrict innovation, and ultimately harm consumers by reducing the quality and diversity of social networking services.

Meta's Defense Strategy

Meta's defense strategy centers on challenging the FTC's definition of the relevant market and justifying its acquisitions.

Arguments Against Monopoly Claims

Meta contests the FTC's characterization of its market dominance.

-

Competitive Landscape: Meta argues that the social media market is highly dynamic and competitive, pointing to the rise of platforms like TikTok, Twitter, and Snapchat as evidence of a vibrant and contested space. They argue that the FTC's definition of the relevant market is too narrow and fails to account for the broader competitive landscape.

-

Innovation and User Experience: Meta emphasizes its continuous investment in innovation and improvements to user experience across its platforms. They highlight features and improvements as evidence of a commitment to serving users and competing effectively.

Justification of Acquisitions

Meta defends its acquisitions by emphasizing the benefits for users and the overall market.

-

Strategic Rationale: Meta argues that the acquisitions of Instagram and WhatsApp were strategically sound decisions aimed at expanding its services and improving its offerings for users. They claim that integrating these platforms led to innovation and enhanced user experiences.

-

Pro-Competitive Benefits: Meta contends that the acquisitions created a more integrated and user-friendly experience, leading to increased competition and benefiting consumers. They claim the integration brought increased functionalities and cross-platform capabilities that consumers enjoy.

-

Successes and Innovations Post-Acquisition: Meta showcases the continued growth, innovation, and features added to both Instagram and WhatsApp since their acquisitions as proof of their positive impact.

Potential Outcomes and Implications

The outcome of this case will have significant repercussions for Meta, the tech industry, and consumers.

Potential Penalties for Meta

Depending on the court's ruling, Meta could face substantial penalties.

-

Fines: Significant financial penalties are a possibility.

-

Structural Remedies: This could involve the divestment of assets, forcing Meta to sell off Instagram or WhatsApp.

-

Behavioral Remedies: The court might impose restrictions on Meta's future business practices, such as limiting its data collection practices or changing its approach to acquisitions.

-

Legal Precedent: This case will set a crucial precedent for future antitrust cases involving large technology companies, influencing how regulators approach similar situations.

Impact on the Tech Industry and Consumers

The case's outcome will reshape the tech landscape.

-

Innovation and Competition: The ruling could significantly impact innovation and competition in the digital market, potentially encouraging or discouraging mergers and acquisitions in the tech sector.

-

Consumer Choice: The outcome will affect consumer choice and the availability of diverse social media platforms.

-

Tech Regulation: The case highlights the ongoing debate surrounding the regulation of large technology companies and the need for clearer guidelines concerning anti-competitive practices.

Conclusion

The Meta Faces FTC Defense in Monopoly Case represents a pivotal moment in the ongoing discussion about tech regulation and the dominance of large technology companies. The FTC's allegations of anti-competitive behavior and Meta's counterarguments highlight the complexities of antitrust law in the digital age. The outcome will significantly shape the future of the tech industry, impacting competition, innovation, and consumer choice. Staying informed on the developments in this critical case is crucial for understanding the future of the digital market. Further research into the Meta Faces FTC Defense in Monopoly Case and related antitrust litigation is highly recommended.

Featured Posts

-

Cote D Ivoire Controle Inopine De La Bcr Dans Les Marches Abidjanais

May 20, 2025

Cote D Ivoire Controle Inopine De La Bcr Dans Les Marches Abidjanais

May 20, 2025 -

D Wave Quantum Qbts Stock Crash Understanding Mondays Sharp Decline

May 20, 2025

D Wave Quantum Qbts Stock Crash Understanding Mondays Sharp Decline

May 20, 2025 -

New Wave Of Hmrc Letters Dont Ignore This Important Notice

May 20, 2025

New Wave Of Hmrc Letters Dont Ignore This Important Notice

May 20, 2025 -

High Ranking Admirals Fall From Grace Corruption Conviction Explained

May 20, 2025

High Ranking Admirals Fall From Grace Corruption Conviction Explained

May 20, 2025 -

Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 20, 2025

Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 20, 2025

Latest Posts

-

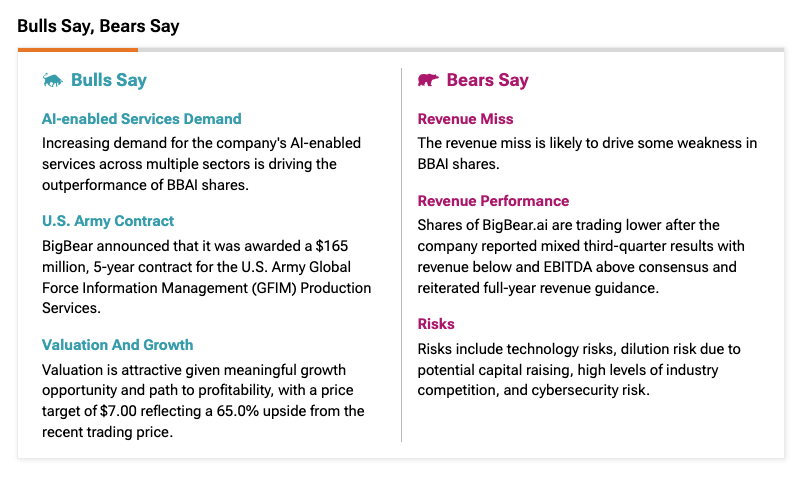

Big Bear Ai Bbai Investors Contact Gross Law Firm Before June 10 2025

May 20, 2025

Big Bear Ai Bbai Investors Contact Gross Law Firm Before June 10 2025

May 20, 2025 -

Understanding The Thursday Decline In D Wave Quantum Qbts Stock Price

May 20, 2025

Understanding The Thursday Decline In D Wave Quantum Qbts Stock Price

May 20, 2025 -

One Compelling Reason To Invest In Ai Quantum Computing Stocks

May 20, 2025

One Compelling Reason To Invest In Ai Quantum Computing Stocks

May 20, 2025 -

Investors In Big Bear Ai Holdings Inc Should Contact Gross Law Firm Before June 10 2025

May 20, 2025

Investors In Big Bear Ai Holdings Inc Should Contact Gross Law Firm Before June 10 2025

May 20, 2025 -

Winter Storm And School Closures What You Need To Know

May 20, 2025

Winter Storm And School Closures What You Need To Know

May 20, 2025