Net Asset Value (NAV) Explained: Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. Think of it as the true net worth of each share in the ETF. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), the NAV reflects the collective value of its holdings, which mirror the composition of the Dow Jones Industrial Average. Knowing your ETF's NAV provides a transparent view of its intrinsic worth.

Calculating the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

The NAV calculation for the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is a relatively straightforward process, though the complexity increases when considering the hundreds of components involved. The ETF's NAV is calculated daily, reflecting the closing prices of the underlying assets.

- Assets Included: The calculation includes the market value of each of the 30 stocks comprising the Dow Jones Industrial Average, weighted according to their representation in the index.

- Valuation Process: Each stock's closing market price is multiplied by the number of shares held by the ETF. This is done for each of the 30 components.

- Adjustments: The total value of these holdings is then adjusted for any accrued expenses (like management fees) and any accrued income (before distribution). This adjusted value is then divided by the total number of outstanding ETF units. These adjustments directly impact the final NAV calculation for the ETF.

The NAV is typically calculated and published at the close of each trading day. The exact timing might vary slightly based on the ETF provider's processes. Regularly checking the published NAV helps to track the performance of your investment in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing).

Factors Affecting the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Several factors can influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing). Understanding these factors allows for more nuanced investment strategies.

-

Market Fluctuations: The primary driver of NAV changes is the performance of the underlying Dow Jones Industrial Average stocks. A rise in the index generally leads to a higher NAV, while a decline results in a lower NAV.

-

Dividends and Distributions: Because this is a "distributing" ETF, dividend payments from the underlying stocks are distributed to shareholders. This reduces the NAV, as the cash is no longer held within the ETF. The NAV will reflect the reduction in asset value.

-

Expense Ratio: The ETF's expense ratio, which covers management and administrative fees, gradually reduces the NAV over time. While the impact might be small on a daily basis, it accumulates over longer investment periods.

-

Relationship between market performance and NAV: A positive market trend for the Dow Jones usually translates to a higher ETF NAV, and vice-versa.

-

Impact of dividend reinvestment or distribution: If dividends are reinvested, the impact on the NAV is neutralized as the additional shares increase the overall asset value. However, distributions directly reduce the NAV.

-

Effect of the expense ratio on NAV: The expense ratio acts as a drag on NAV growth over time; a higher expense ratio will result in comparatively lower NAV growth.

Using NAV to Make Informed Investment Decisions about the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Understanding the NAV empowers you to make more informed investment decisions.

-

NAV and Share Price: The ETF's market price often closely tracks its NAV, though temporary discrepancies can occur. A premium exists if the market price exceeds the NAV, and a discount if the market price is below the NAV.

-

Comparing NAV to other ETFs: By comparing the NAV of the Amundi ETF to similar Dow Jones Industrial Average tracking ETFs, investors can assess the relative value and potential cost-effectiveness of their chosen investment.

-

Timing Investments based on NAV: While tempting, using NAV fluctuations alone to time investments is risky. Market timing based solely on short-term NAV changes can be unreliable and often counter-productive. It’s crucial to factor in broader market conditions and your own investment objectives.

-

Premium/Discount to NAV: This difference can indicate market sentiment or temporary trading inefficiencies. A persistent premium or discount warrants further investigation.

-

Using NAV in comparative analysis: Compare the NAV growth and expense ratios of similar ETFs to find the best value proposition for your portfolio.

-

Caution against using NAV alone for timing decisions: NAV is a valuable tool, but only one piece of the puzzle when making investment decisions.

Conclusion: Understanding Net Asset Value (NAV) for Smart Investing in the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is essential for any investor. We've explored how it's calculated, the factors affecting it, and how it can be used (in conjunction with other market indicators) to inform investment decisions. Remember to regularly track the NAV to monitor your investment's performance. Understanding your ETF's NAV is a cornerstone of responsible investing. To learn more about the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) and how to monitor your ETF's NAV, visit the Amundi website. Learn to track the NAV, understand your ETF's NAV, and make smarter investment choices.

Featured Posts

-

Dazi Trump L Impatto Del 20 Sull Unione Europea E Il Settore Moda

May 24, 2025

Dazi Trump L Impatto Del 20 Sull Unione Europea E Il Settore Moda

May 24, 2025 -

Escape To The Country Top Destinations And Considerations

May 24, 2025

Escape To The Country Top Destinations And Considerations

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Booking Info

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets Full Lineup And Booking Info

May 24, 2025 -

Nyt Mini Crossword Sunday April 19th Complete Clue Solutions

May 24, 2025

Nyt Mini Crossword Sunday April 19th Complete Clue Solutions

May 24, 2025

Latest Posts

-

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

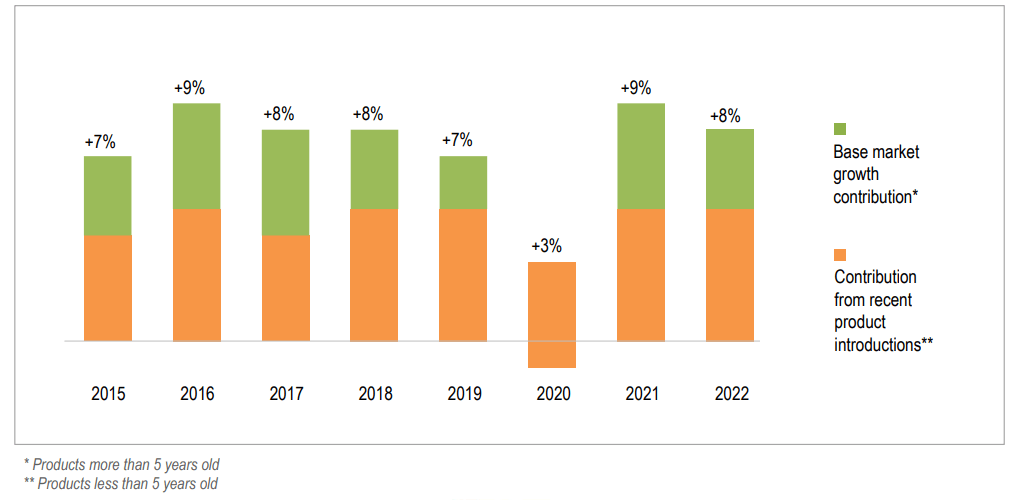

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025 -

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025

Royal Philips 2025 Annual General Meeting Of Shareholders Update

May 24, 2025 -

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025

Trumps Tariff Halt Sends Euronext Amsterdam Stocks Up 8

May 24, 2025 -

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 24, 2025

Sterke Resultaten Relx Ai Als Motor Voor Groei Tot 2025

May 24, 2025