Net Asset Value (NAV) Explained: Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets after deducting its liabilities. In simpler terms, it's the value of everything the ETF owns, minus what it owes, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, understanding its NAV is critical to gauging its performance and the value of your investment.

The calculation is straightforward:

(Assets - Liabilities) / Number of Outstanding Shares = NAV per share

Let's break down the components:

- Assets: This encompasses the ETF's holdings, primarily comprising a diversified portfolio of global equities mirroring the MSCI World Index. Other assets might include cash reserves, accounts receivable, and any other investments.

- Liabilities: These represent the ETF's obligations, such as management fees, expenses payable, accrued interest, and other operational costs.

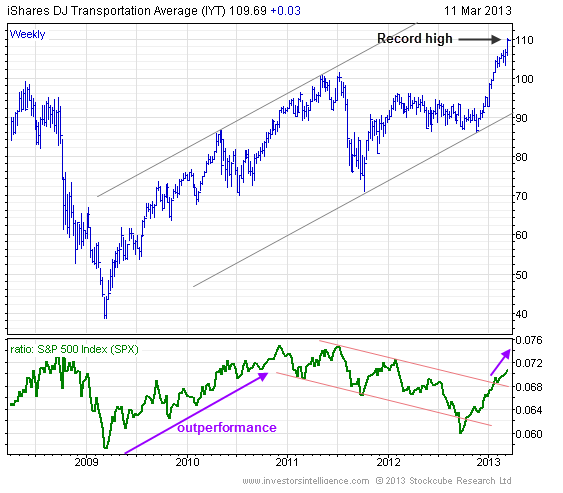

Daily market fluctuations significantly impact the NAV. The value of the underlying assets within the ETF's portfolio changes constantly, causing the NAV to fluctuate accordingly.

Several key factors influence the daily NAV changes:

- Market price movements of underlying assets: Changes in the prices of the stocks and other securities held by the ETF directly impact its NAV. A rising market generally leads to an increase in NAV, and vice versa.

- Dividend income received: Dividends paid by the underlying companies are added to the ETF's assets, increasing its NAV. The Amundi MSCI World II UCITS ETF Dist is a distributing ETF, meaning dividends are paid out to investors.

- Management fees and expenses: These operational costs reduce the ETF's assets, thus lowering the NAV.

- Currency exchange rate fluctuations: As the Amundi MSCI World II UCITS ETF Dist invests globally, fluctuations in currency exchange rates can impact the NAV, especially if a significant portion of the portfolio is denominated in a currency other than the ETF's base currency.

NAV's Importance for Amundi MSCI World II UCITS ETF Dist Investors

Monitoring the NAV of the Amundi MSCI World II UCITS ETF Dist is crucial for several reasons:

- Relationship between NAV and ETF share price: While the ETF share price might deviate slightly from the NAV due to supply and demand in the market (bid-ask spread), the NAV serves as the underlying value of the ETF. Significant discrepancies should warrant further investigation.

- Performance evaluation: By tracking the NAV over time, investors can accurately assess the ETF's performance, comparing it to its benchmark index (MSCI World Index) and other similar ETFs.

- Informed buy/sell decisions: Understanding the NAV allows investors to make more informed decisions about buying or selling shares. A consistently rising NAV, coupled with positive market trends, generally signals a healthy investment.

The benefits of monitoring the Amundi MSCI World II UCITS ETF Dist's NAV are substantial:

- Performance tracking: Provides a clear picture of the ETF's performance, allowing for effective investment strategy adjustments.

- Transparency of holdings: The NAV calculation indirectly reflects the value of the underlying assets, providing transparency into the portfolio’s composition.

- Valuation accuracy: Offers a reliable valuation of your investment compared to relying solely on the market price.

- Comparison with other ETFs: Enables a comparative analysis of the Amundi MSCI World II UCITS ETF Dist's performance against its competitors.

Where to Find the Daily NAV of the Amundi MSCI World II UCITS ETF Dist

The daily NAV of the Amundi MSCI World II UCITS ETF Dist is typically updated daily and can be found in several places:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

- Financial News Sources: Major financial news websites and data providers often list the NAVs of popular ETFs, including the Amundi MSCI World II UCITS ETF Dist.

- Brokerage Platforms: Most brokerage platforms that offer the ETF will display its current NAV alongside the market price.

It’s important to note that minor discrepancies might exist between the NAV and the market price. These discrepancies are usually attributed to the bid-ask spread (the difference between the buying and selling prices) and the trading volume of the ETF.

Tools and resources for tracking NAV include:

- Your brokerage account.

- Financial data websites (e.g., Bloomberg, Yahoo Finance).

- Amundi's investor relations portal.

Mastering Net Asset Value for Amundi MSCI World II UCITS ETF Dist Success

Understanding Net Asset Value is fundamental to successful investing in ETFs like the Amundi MSCI World II UCITS ETF Dist. Regularly monitoring the NAV provides valuable insights into your investment's performance, enabling informed decisions. Remember, while the market price fluctuates based on supply and demand, the NAV reflects the intrinsic value of your holdings in the ETF. By understanding the interplay between Amundi MSCI World II ETF NAV, UCITS ETF NAV calculation, and its impact on your portfolio, you gain a significant advantage as an investor.

Understand your investment better by regularly monitoring the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist holdings. Learn more about Net Asset Value calculations and their impact on your portfolio today!

Featured Posts

-

Get Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park

May 24, 2025

Get Tickets For Bbc Radio 1s Big Weekend 2025 At Sefton Park

May 24, 2025 -

Nimi Muistiin Ferrarin 13 Vuotias Kuljettaja

May 24, 2025

Nimi Muistiin Ferrarin 13 Vuotias Kuljettaja

May 24, 2025 -

Annie Kilner Runs Errands After Kyle Walkers Night Out With Two Women

May 24, 2025

Annie Kilner Runs Errands After Kyle Walkers Night Out With Two Women

May 24, 2025 -

Memorial Day Flights 2025 Choosing The Least Crowded Travel Dates

May 24, 2025

Memorial Day Flights 2025 Choosing The Least Crowded Travel Dates

May 24, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berkolaborasi

May 24, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berkolaborasi

May 24, 2025

Latest Posts

-

Massachusetts Authorities Seize Over 100 Firearms Charge 18 Brazilian Nationals

May 24, 2025

Massachusetts Authorities Seize Over 100 Firearms Charge 18 Brazilian Nationals

May 24, 2025 -

18 Brazilian Nationals Face Charges In Large Scale Massachusetts Gun Trafficking Ring

May 24, 2025

18 Brazilian Nationals Face Charges In Large Scale Massachusetts Gun Trafficking Ring

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Crackdown On Gun Trafficking Nets 100 Firearms 18 Brazilian Arrests In Mass

May 24, 2025

Crackdown On Gun Trafficking Nets 100 Firearms 18 Brazilian Arrests In Mass

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025