Operation Sindoor: Pakistan Stock Market Plunges, KSE 100 Halted

Table of Contents

The Causes Behind the KSE 100 Halting

The abrupt halting of the KSE 100 index was a culmination of several intertwined factors, creating a perfect storm that eroded investor confidence and triggered widespread panic selling.

Political Instability and its Impact on Investor Confidence

Political instability in Pakistan has historically been a major factor influencing market volatility. The current climate, characterized by [insert specific recent political events, e.g., heightened political tensions, uncertainty surrounding key policy decisions], fueled uncertainty and significantly impacted investor sentiment.

- Specific political events: [List specific events and their dates, linking to reputable news sources]

- Expert opinions: [Quote relevant experts on the impact of political risk on the PSX]

- Impact on foreign investment: [Discuss the withdrawal or hesitation of foreign investors due to political instability]

Economic Factors Contributing to the Market Crash

Beyond political turmoil, several critical economic factors contributed to the KSE 100 crash. High inflation, a rapidly depreciating currency, and dwindling foreign exchange reserves created a climate of economic uncertainty.

- Current inflation rates: [State the current inflation rate and its impact on purchasing power]

- Recent currency fluctuations: [Detail recent fluctuations in the Pakistani Rupee and their effect on the market]

- Status of foreign exchange reserves: [Discuss the current level of foreign exchange reserves and their sustainability]

- Impact of global economic slowdown: [Analyze the influence of the global economic slowdown on Pakistan's economy and the PSX]

The Role of "Operation Sindoor" in Exacerbating the Crisis

"Operation Sindoor," [Clearly define "Operation Sindoor" and its context. Explain its significance and connection to the stock market crash. If the term is not publicly known, provide a clear and concise explanation, perhaps citing sources.] played a significant role in exacerbating the already precarious situation.

- Specific actions taken: [Detail specific actions taken as part of "Operation Sindoor" and their direct impact on the market]

- Market reaction to these actions: [Analyze the immediate market reaction to these actions – panic selling, sharp drops]

- Analysis of the chain of events: [Explain the sequence of events leading from "Operation Sindoor" to the KSE 100 halt]

Impact of the KSE 100 Halt on the Pakistani Economy

The KSE 100 halt had immediate and far-reaching consequences for the Pakistani economy, impacting investors, businesses, and the nation's overall economic standing.

Immediate Effects on Investors and Businesses

The immediate impact on investors was catastrophic. Widespread panic selling led to significant losses. Businesses also faced severe consequences, hindering their ability to secure funding and investment.

- Estimated losses incurred by investors: [Provide estimations of investor losses, citing reliable sources if available]

- Impact on Small and Medium Enterprises (SMEs): [Discuss the disproportionate impact on SMEs, highlighting their vulnerability]

- Difficulty in securing loans and investment: [Explain the challenges faced by businesses in securing loans and investments]

Long-Term Implications for Economic Growth

The long-term implications of the KSE 100 crash are potentially severe, threatening Pakistan's economic stability and growth trajectory.

- Potential impact on GDP growth: [Estimate the potential negative impact on GDP growth]

- Foreign investment outlook: [Discuss the potential for reduced foreign investment in the aftermath of the crash]

- Government response and recovery strategies: [Analyze the government's response and its effectiveness in mitigating the crisis]

International Response and Global Market Reactions

The KSE 100 crash attracted international attention, with global markets reacting to the news and international organizations issuing statements.

- Statements from international organizations: [Summarize the responses from international financial institutions like the IMF or World Bank]

- Impact on Pakistan's credit rating: [Discuss the potential impact on Pakistan's credit rating and borrowing costs]

- Foreign investor sentiment: [Assess the shift in foreign investor sentiment towards Pakistan]

Analyzing the Future of the Pakistan Stock Market

The future of the Pakistan Stock Market hinges on effective recovery strategies and lessons learned from the "Operation Sindoor" crisis.

Potential Recovery Strategies

Government intervention and market-led recovery strategies will be crucial in restoring investor confidence and stabilizing the market.

- Possible government policies: [Suggest potential government policies to address the crisis, such as fiscal stimulus or regulatory reforms]

- Measures to boost investor confidence: [Outline strategies to rebuild investor confidence, such as transparency initiatives or policy clarity]

- Predictions for market recovery timeline: [Offer cautious predictions regarding the timeline for market recovery]

Lessons Learned and Future Risk Mitigation

The "Operation Sindoor" crisis underscores the need for stronger regulatory frameworks, improved transparency, and economic diversification to prevent future market collapses.

- Strengthening regulatory frameworks: [Discuss the need for strengthened regulatory frameworks to protect investors and maintain market stability]

- Improving transparency and accountability: [Highlight the importance of increased transparency and accountability within the PSX]

- Diversifying the economy: [Emphasize the need for economic diversification to reduce reliance on specific sectors]

Conclusion: Understanding the Significance of the "Operation Sindoor" Market Plunge

The "Operation Sindoor" crisis represents a significant setback for the Pakistani economy, highlighting the vulnerabilities of the PSX to political instability and economic headwinds. The severity of the KSE 100 crash and its widespread impact cannot be understated. A comprehensive understanding of the events surrounding "Operation Sindoor" is critical to preventing similar crises in the future. Follow the latest on the Pakistan Stock Market, stay updated on the KSE 100's recovery, and understand the implications of Operation Sindoor by following reputable news sources for ongoing updates.

Featured Posts

-

Canadian Housing Crisis High Down Payments Price Out Buyers

May 09, 2025

Canadian Housing Crisis High Down Payments Price Out Buyers

May 09, 2025 -

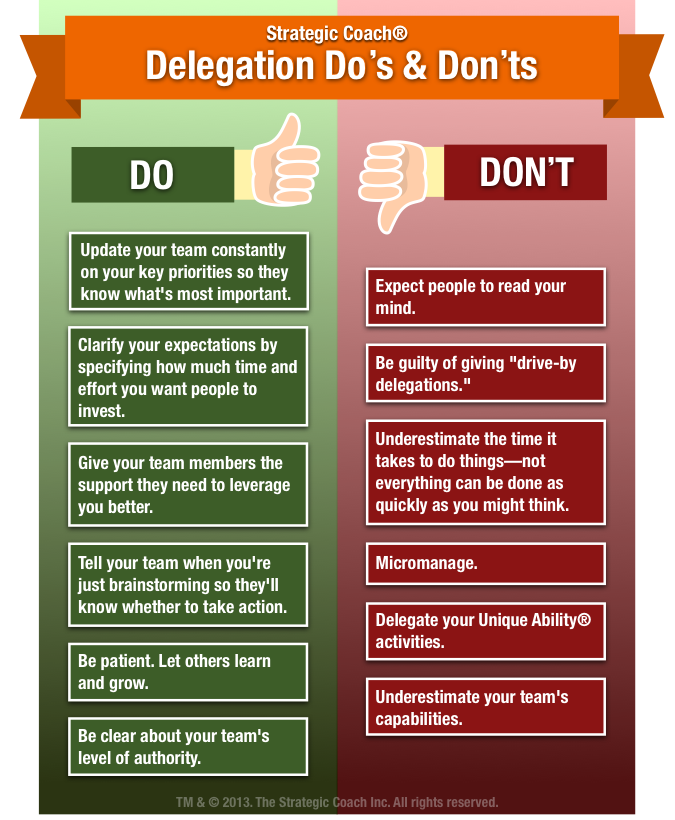

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

May 09, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

May 09, 2025 -

Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 09, 2025

Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 09, 2025 -

Planned Elizabeth Line Strikes Route And Service Updates For February And March 2024

May 09, 2025

Planned Elizabeth Line Strikes Route And Service Updates For February And March 2024

May 09, 2025 -

Doohans F1 Future Montoya Leaks Pre Emptive Decision

May 09, 2025

Doohans F1 Future Montoya Leaks Pre Emptive Decision

May 09, 2025