Palantir Stock: Your Pre-May 5th Investment Decision Guide

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's recent financial health is critical for any potential investor. Examining revenue growth and profitability, as well as debt and cash flow, paints a clearer picture of the company's overall financial strength.

Revenue Growth and Profitability

Palantir's recent quarterly and annual reports reveal important trends in its revenue streams and profitability.

- Government vs. Commercial Revenue: While government contracts have historically been a significant portion of Palantir's revenue, the company is actively expanding its commercial business. Monitoring the growth rate of both sectors is vital for understanding overall performance and diversification.

- Key Metrics: Investors should focus on year-over-year revenue growth, operating income, and net income. Significant increases or decreases in these metrics can indicate positive or negative trends in the company's financial health.

- Gross Margin and Operating Expenses: Analyzing gross margin provides insight into Palantir's pricing power and operational efficiency. Monitoring operating expenses helps understand cost management and profitability. Recent partnerships and contract wins should also be factored in.

Debt and Cash Flow

A strong financial position involves managing debt effectively and generating healthy cash flow.

- Free Cash Flow (FCF): Analyzing Palantir's FCF is crucial. Positive and growing FCF indicates the company's ability to generate cash from its operations and reinvest in growth initiatives.

- Debt Levels: Understanding Palantir's debt levels and its ability to service that debt is crucial. High debt levels can increase financial risk.

- Future Growth Funding: Palantir's cash flow generation directly impacts its ability to fund research and development, acquisitions, and other growth strategies.

Growth Potential and Future Outlook

Palantir operates in the rapidly expanding AI and data analytics markets, offering significant growth potential. However, understanding the market opportunity, product innovation, and the balance between government and commercial contracts is crucial for assessing the PLTR stock future.

Market Opportunity in AI and Data Analytics

Palantir is well-positioned within the booming AI and big data markets.

- Competitive Advantages: Palantir's proprietary technology and platform offer unique advantages over competitors. Analyzing these advantages and how they translate to market share is vital.

- Addressable Market Size: Understanding the overall size of the market and Palantir's potential market share is critical for projecting future growth.

- Market Share Growth: Tracking Palantir's progress in gaining market share will provide insights into its competitive positioning and success in the market.

Product Innovation and Pipeline

Continuous innovation is key for sustained growth in the technology sector.

- New Product Releases: New product releases and updates demonstrate Palantir's commitment to innovation and its ability to adapt to evolving market needs.

- AI Capabilities: Advancements in AI and machine learning capabilities are critical for maintaining a competitive edge.

- Strategic Alliances and Acquisitions: Strategic partnerships and acquisitions can accelerate growth by expanding product offerings and market reach.

Government Contracts and Commercial Expansion

Palantir's revenue model involves a mix of government and commercial contracts.

- Government Contract Stability: Government contracts are often long-term and stable, but they may be subject to budget constraints and political shifts.

- Commercial Market Growth: Expanding into the commercial sector is crucial for diversification and reducing reliance on government contracts.

- Diversification Strategies: Assessing the company's diversification strategy is crucial for understanding its long-term sustainability and resilience.

Risks and Challenges Facing Palantir

Despite the growth potential, Palantir faces several risks and challenges that need consideration.

Competition and Market Saturation

The data analytics and AI markets are becoming increasingly competitive.

- Key Competitors: Identifying and analyzing key competitors, such as Databricks, Snowflake, and other players, is crucial.

- Competitive Strengths and Weaknesses: A thorough competitive analysis helps assess Palantir's strengths and weaknesses relative to its competitors.

- Market Saturation Risk: The risk of market saturation and the potential for increased competition and price wars should be carefully considered.

Dependence on Key Clients

Palantir's reliance on a few large clients presents a significant risk.

- Client Concentration Risk: Loss of major contracts could significantly impact Palantir's revenue and financial performance.

- Client Diversification: Analyzing Palantir's strategies to diversify its client base and reduce reliance on key clients is vital.

- Contract Renewal Risks: The risk of contract non-renewal or delays needs to be evaluated.

Valuation and Stock Price Volatility

Palantir's stock price has experienced significant volatility.

- Valuation Comparison: Comparing Palantir's valuation to its competitors helps determine whether it is overvalued or undervalued.

- Stock Price Volatility Factors: Understanding the factors that contribute to stock price volatility is important for managing investment risk.

- Future Price Movements: Identifying potential factors that could influence future stock price movements is crucial for informed decision-making.

Conclusion

Investing in Palantir stock before the May 5th earnings report necessitates a thorough evaluation of its financial health, growth potential, and inherent risks. We've explored Palantir's recent performance, its future prospects in AI and data analytics, and the challenges it faces. This pre-May 5th analysis provides a balanced perspective to aid your investment decision.

Call to Action: Make an informed decision about Palantir stock (PLTR) based on this in-depth pre-May 5th analysis. Remember to conduct your own thorough due diligence and consider your personal risk tolerance before investing in Palantir or any other technology stock. Take control of your Palantir investment strategy today!

Featured Posts

-

Exploring The Candidacy Of A Canadian Billionaire As Warren Buffetts Heir

May 09, 2025

Exploring The Candidacy Of A Canadian Billionaire As Warren Buffetts Heir

May 09, 2025 -

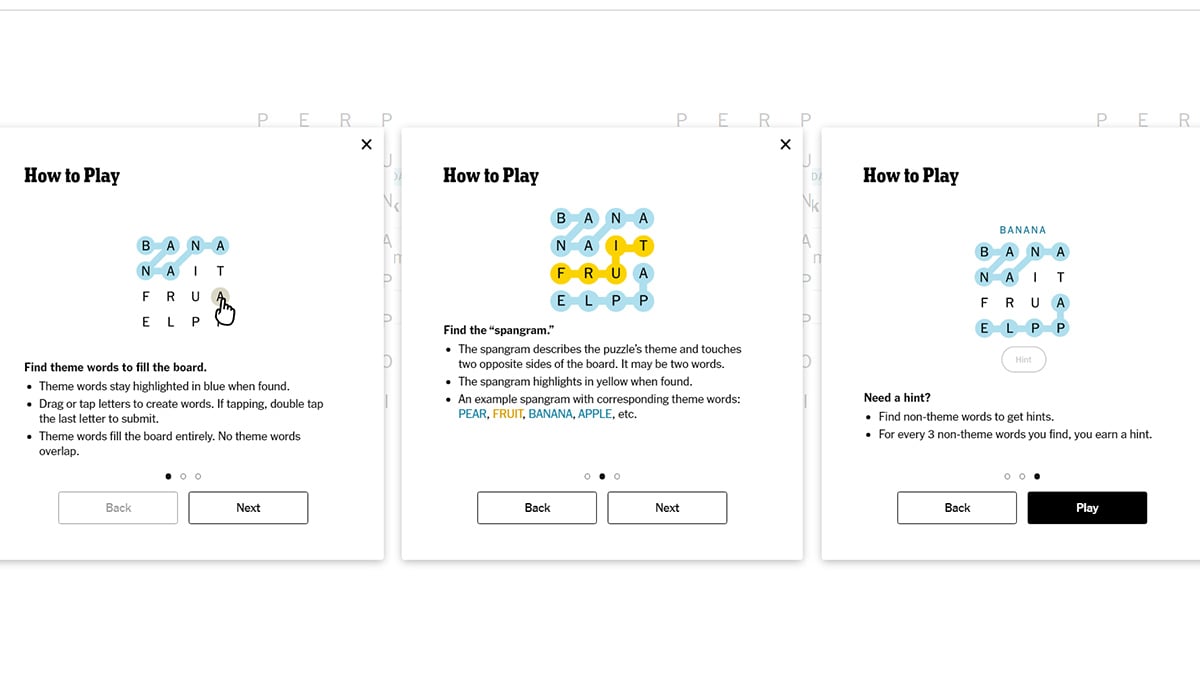

Complete Guide To Nyt Strands Game 357 Sunday February 23

May 09, 2025

Complete Guide To Nyt Strands Game 357 Sunday February 23

May 09, 2025 -

Billions Added To Elon Musks Net Worth Teslas Rise And Dogecoins Fall

May 09, 2025

Billions Added To Elon Musks Net Worth Teslas Rise And Dogecoins Fall

May 09, 2025 -

Materialists Premiere Dakota Johnsons Elegant White Dress

May 09, 2025

Materialists Premiere Dakota Johnsons Elegant White Dress

May 09, 2025 -

Les Mis Cast Considers Protest Over Trumps Kennedy Center Performance

May 09, 2025

Les Mis Cast Considers Protest Over Trumps Kennedy Center Performance

May 09, 2025