Palantir Technology Stock Outlook: Pre-May 5th Wall Street Analysis

Table of Contents

Recent Palantir Performance & Key Financials

Analyzing Palantir's recent financial performance is crucial for understanding its current stock valuation and future potential. Let's delve into the key metrics:

-

Review of Q4 2022 and full-year 2022 earnings: Palantir's Q4 2022 and full-year results revealed [insert actual data here, e.g., revenue growth of X%, net income of Y, etc.]. This performance needs to be contextualized against previous quarters and annual results to identify trends. Were these results better or worse than expectations? What were the contributing factors? A comparison to analyst estimates is crucial here. [Include a chart or graph visualizing key financial data for enhanced readability and SEO].

-

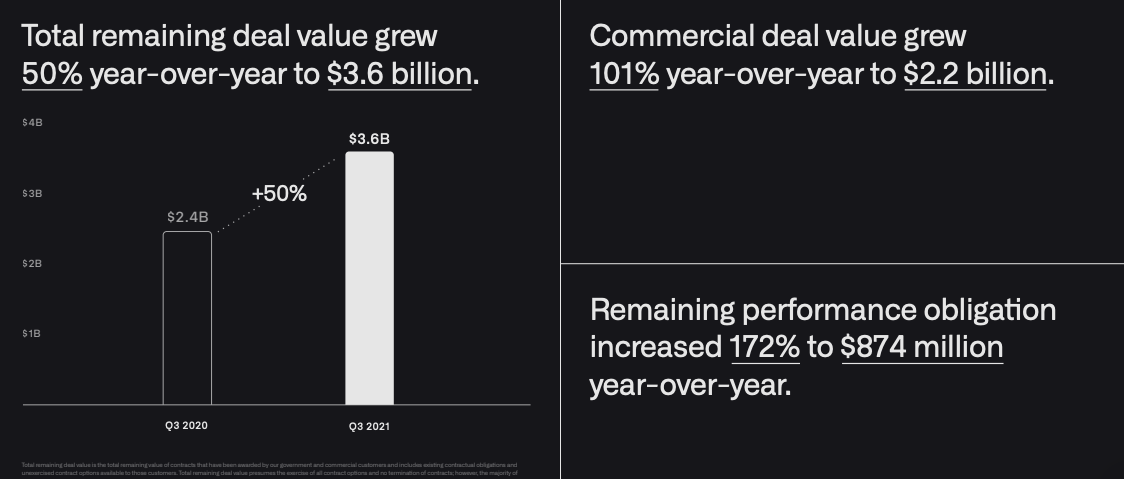

Analysis of revenue growth trends and projections: Examining the trajectory of Palantir's revenue growth is essential for assessing its long-term sustainability. Are they consistently increasing their revenue year-over-year? What are the company's projections for future revenue growth? Are these projections realistic given current market conditions and competition?

-

Discussion of profitability margins and their implications: Profitability is a key indicator of a company's financial health. Examining Palantir's profit margins (gross, operating, and net) provides insight into its operational efficiency and ability to translate revenue into profit. Are margins improving or deteriorating? What are the underlying factors driving these trends?

-

Comparison to industry benchmarks and competitors: To gain a fuller understanding of Palantir's performance, it's essential to compare it to its competitors in the big data analytics market. How does Palantir's revenue growth, profitability, and market share compare to companies like [mention key competitors]?

Factors Influencing Palantir Stock Price Before May 5th

Several factors could significantly impact Palantir's stock price in the lead-up to the May 5th earnings report.

-

Impact of current macroeconomic conditions on technology stocks: The overall health of the economy and the technology sector plays a significant role. Rising interest rates, inflation, and potential recessionary pressures can negatively affect investor sentiment towards tech stocks, including Palantir.

-

Analysis of recent news and analyst ratings: Any significant news events, such as new partnerships, product launches, or regulatory changes, can greatly influence investor sentiment and the stock price. Tracking analyst ratings and their rationale provides valuable insights.

-

Assessment of the competitive landscape and potential threats: The competitive landscape in the big data analytics market is constantly evolving. The emergence of new competitors, innovative technologies, or shifts in market demand can pose challenges to Palantir's market position.

-

Potential impact of new product launches or partnerships: The success of any new products or strategic partnerships can significantly impact Palantir's future revenue growth and stock valuation. Anticipation around these announcements can drive price volatility before the earnings release.

-

The role of government contracts in Palantir's revenue stream: Palantir's revenue is significantly tied to government contracts. Geopolitical instability or changes in government spending can impact its financial performance and investor confidence.

Wall Street Predictions & Analyst Ratings

Wall Street analysts offer a diverse range of opinions on Palantir's future performance.

-

Summary of key analyst ratings (buy, hold, sell): A consensus of analyst ratings (buy, hold, or sell) provides a general overview of market sentiment towards Palantir stock. [Include data on the percentage of analysts giving each rating].

-

Average price target predictions: The average price target from multiple analysts gives a general indication of the potential future price.

-

Range of price target predictions from different analysts: It's important to note the range of price targets, as it reflects the uncertainty surrounding Palantir's future performance. A wide range indicates significant disagreement amongst analysts.

-

Reasons behind the varying analyst opinions: Understanding the reasons behind differing analyst opinions is crucial. Analysts may disagree on the company's growth prospects, competitive position, or the impact of external factors.

Risks and Opportunities

Investing in Palantir stock, like any investment, carries both risks and opportunities.

-

Potential risks related to the company's financials, market competition, or regulatory environment: Financial risks include the company's dependence on large government contracts, potential for decreased profitability, and vulnerability to changes in macroeconomic conditions. Market competition and regulatory changes also present challenges.

-

Opportunities presented by growth in specific market segments: Palantir operates in a rapidly growing market segment, offering potential for significant returns. Growth in specific markets like [mention relevant specific market segments] could positively impact Palantir's revenue.

-

Potential for significant returns versus high risk: Palantir presents the potential for substantial returns, given the growth in its market. However, this potential is coupled with high risk due to the factors mentioned above.

Conclusion

This pre-May 5th Wall Street analysis of Palantir (PLTR) stock highlights the significant factors influencing its price movement. While Palantir shows potential for growth, particularly in government and commercial markets, investors need to carefully consider the risks associated with its financial performance and the competitive landscape. The upcoming earnings report on May 5th will be a crucial data point, and the impact of the results on the PLTR stock price remains to be seen. Before making any investment decisions regarding Palantir (PLTR) stock, carefully consider this pre-May 5th Wall Street analysis and conduct your own thorough research. Remember that past performance is not indicative of future results and all investments carry risk.

Featured Posts

-

New York Times Spelling Bee Solutions For April 4 2025

May 09, 2025

New York Times Spelling Bee Solutions For April 4 2025

May 09, 2025 -

Barbwza Yfqd Asnanh Tfasyl Merkt Marakana Almsyryt

May 09, 2025

Barbwza Yfqd Asnanh Tfasyl Merkt Marakana Almsyryt

May 09, 2025 -

The Bitcoin Rebound What Investors Need To Know

May 09, 2025

The Bitcoin Rebound What Investors Need To Know

May 09, 2025 -

Bitcoin Miner Surge Understanding This Weeks Increase

May 09, 2025

Bitcoin Miner Surge Understanding This Weeks Increase

May 09, 2025 -

Is Palantir Stock A Good Investment Right Now Pros And Cons Considered

May 09, 2025

Is Palantir Stock A Good Investment Right Now Pros And Cons Considered

May 09, 2025