Parkland's US$9 Billion Acquisition: Key Details And June Shareholder Vote

Table of Contents

The Target Company: Unveiling the Acquired Asset

Company Name and Profile

While the name of the target company is [Insert Target Company Name Here], a leading player in [Insert Target Company's Industry, e.g., fuel distribution, renewable energy, etc.], this acquisition represents a major strategic move for Parkland. The target company boasts a substantial network of [Insert relevant details, e.g., gas stations, pipelines, refineries etc.], giving it a strong presence in key markets across [Insert geographic regions]. Their expertise in [Insert Target Company's Key Strengths e.g., logistics, retail operations, etc.] complements Parkland’s existing capabilities.

Strategic Rationale

Parkland's acquisition is driven by a clear strategic vision aimed at accelerating growth and enhancing its market position. The rationale includes:

- Market Expansion: Gaining access to new geographical markets and expanding its reach into underserved regions.

- Synergies: Realizing significant cost savings through operational efficiencies and economies of scale by integrating the target company's operations with its existing infrastructure.

- Growth Strategy: Strengthening its position as a leading player in the energy sector through increased market share and diversified revenue streams.

- Diversification: Reducing reliance on existing markets and expanding into complementary businesses within the energy value chain.

The acquisition is expected to unlock considerable synergies and create value for Parkland shareholders.

Key Financial Aspects of the US$9 Billion Acquisition

Deal Structure

The US$9 billion acquisition is structured as a [Insert Deal Structure, e.g., combination of cash and stock]. The precise breakdown of the deal terms, including the allocation of cash and stock, will be disclosed in further filings and presentations to shareholders. Detailed information regarding the acquisition financing is crucial for evaluating the deal's overall financial feasibility.

Funding Mechanisms

Parkland plans to finance the acquisition through a combination of:

-

Debt Issuance: Securing significant debt financing through various channels, potentially including bank loans and bond issuances.

-

Equity Offerings: Potentially issuing new shares to raise additional equity capital. This could lead to some degree of equity dilution for existing shareholders.

-

Existing Cash Reserves: Utilizing a portion of its existing cash reserves to contribute to the acquisition cost.

-

Breakdown of the total cost (US$9 billion): A detailed breakdown will be provided in the shareholder materials.

-

Impact on Parkland's debt-to-equity ratio: This will likely increase, requiring careful monitoring of Parkland's financial health post-acquisition.

-

Expected return on investment: Parkland projects a significant return on investment, driven by synergies and increased market share.

-

Potential impact on credit rating: The increase in debt could potentially affect Parkland's credit rating, although this will depend on the overall financial strength of the combined entity.

The June Shareholder Vote: A Crucial Decision Point

Importance of Shareholder Approval

Shareholder approval is absolutely crucial for the US$9 billion acquisition to proceed. Without the necessary majority vote, the deal will likely be terminated. This highlights the importance of informed shareholder participation in the upcoming vote.

Expected Outcome and Potential Challenges

While Parkland's management strongly supports the acquisition, the outcome of the June shareholder vote remains uncertain. Potential challenges could include:

-

Shareholder Activism: Some shareholders may voice concerns about the deal's financial implications or strategic rationale, potentially leading to shareholder activism.

-

Proxy Voting: The battle for proxy votes will likely be intense, with both proponents and opponents of the deal actively soliciting support.

-

Regulatory Approvals: The acquisition may require regulatory approvals from various bodies, which could introduce delays or even jeopardize the deal.

-

Date and time of the shareholder vote: [Insert Date and Time Here]

-

Percentage of shares required for approval: [Insert Percentage Here]

-

Key arguments for the acquisition: Increased market share, cost synergies, growth potential.

-

Key arguments against the acquisition: High debt levels, integration risks, potential dilution of existing shareholder value.

-

Potential consequences if the vote fails: The deal will be terminated, leading to potential negative market reactions and lost opportunities for Parkland.

Market Reaction and Analyst Perspectives on Parkland's US$9 Billion Acquisition

Stock Price Performance

The announcement of Parkland's US$9 billion acquisition has had a [Insert impact, e.g., positive, negative, mixed] impact on its stock price. [Insert specific details about stock price changes]. Further market reaction will depend on the outcome of the shareholder vote and the successful integration of the acquired company.

Analyst Ratings and Forecasts

Financial analysts have offered mixed opinions on the acquisition. Some analysts view the deal as a positive strategic move with significant long-term growth potential, while others express concern about the increased debt burden and integration risks. [Insert specific analyst ratings and forecasts here].

- Stock price changes before, during, and after the announcement: [Insert Data Here]

- Key analyst opinions and forecasts: [Insert Summary Here]

- Potential risks and rewards for investors: [Insert Summary Here]

Conclusion: The Future of Parkland Following its US$9 Billion Acquisition

Parkland's US$9 billion acquisition represents a bold move with the potential to significantly reshape the company's future. The upcoming shareholder vote in June is a crucial inflection point. The deal's success hinges on securing shareholder approval, overcoming integration challenges, and achieving the projected synergies. While the acquisition presents considerable risk, the potential rewards could be substantial, driving significant growth and value creation for Parkland in the years to come. Stay tuned for updates on Parkland's ambitious US$9 billion acquisition and its impact on the energy sector.

Featured Posts

-

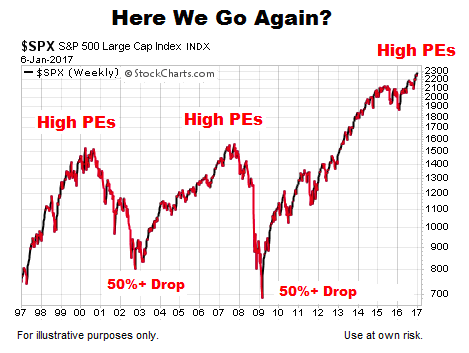

Understanding Elevated Stock Market Valuations A Bof A Viewpoint

May 07, 2025

Understanding Elevated Stock Market Valuations A Bof A Viewpoint

May 07, 2025 -

Indian Bourse Bse Share Price Surge On Earnings

May 07, 2025

Indian Bourse Bse Share Price Surge On Earnings

May 07, 2025 -

Xrp Price Recovery Derivatives Market Slowdown

May 07, 2025

Xrp Price Recovery Derivatives Market Slowdown

May 07, 2025 -

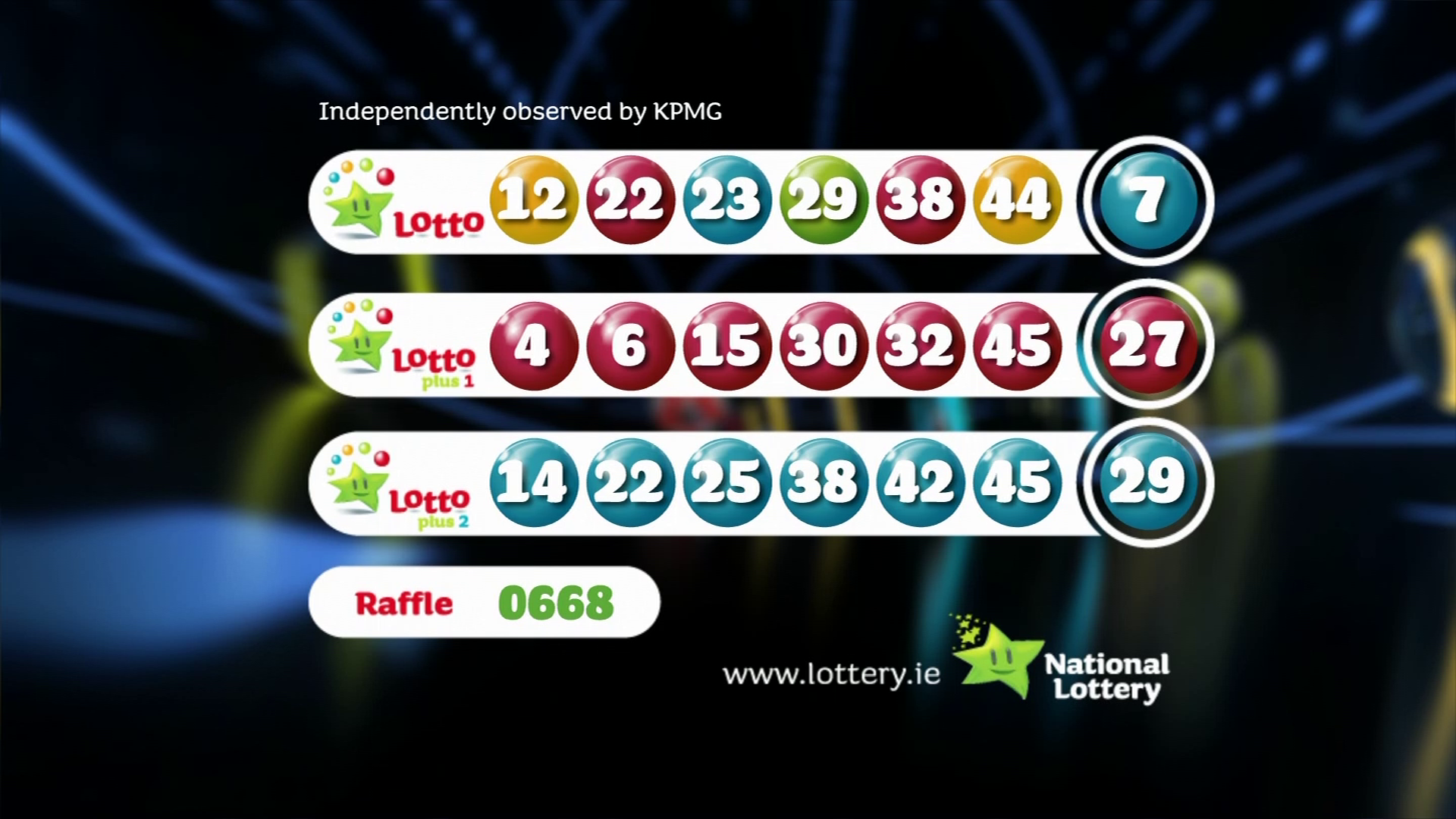

Winning Lotto Numbers Saturday April 12th Draw Results

May 07, 2025

Winning Lotto Numbers Saturday April 12th Draw Results

May 07, 2025 -

Il Nuovo Conclave Analisi Dei Cardinali Scelti Da Papa Francesco

May 07, 2025

Il Nuovo Conclave Analisi Dei Cardinali Scelti Da Papa Francesco

May 07, 2025

Latest Posts

-

New Trailer For The Long Walk A Glimpse Into Kings Brutal Story

May 08, 2025

New Trailer For The Long Walk A Glimpse Into Kings Brutal Story

May 08, 2025 -

Stephen King In 2025 Will The Monkey Adaptation Impact The Years Overall Success

May 08, 2025

Stephen King In 2025 Will The Monkey Adaptation Impact The Years Overall Success

May 08, 2025 -

First Trailer For The Long Walk Simplicity Hides Terror

May 08, 2025

First Trailer For The Long Walk Simplicity Hides Terror

May 08, 2025 -

Stephen Kings The Long Walk First Look At The Bleak Film Adaptation

May 08, 2025

Stephen Kings The Long Walk First Look At The Bleak Film Adaptation

May 08, 2025 -

Is 2025 Shaping Up To Be A Banner Year For Stephen King Film And Tv Adaptations Even If The Monkey Disappoints

May 08, 2025

Is 2025 Shaping Up To Be A Banner Year For Stephen King Film And Tv Adaptations Even If The Monkey Disappoints

May 08, 2025