Pre-Q2 Earnings: Apple Stock's Current Market Position

Table of Contents

Apple stock is a bellwether for the tech industry, and as we approach Q2 earnings, understanding its current market position is crucial for investors. This analysis delves into the key factors impacting Apple's stock price before the release of its financial results, examining its strengths, weaknesses, and potential future trajectory. The pre-Q2 landscape presents a complex picture, requiring careful consideration of various economic and company-specific factors before making investment decisions.

Apple's Recent Performance & Market Share

Analyzing Apple's recent performance requires examining its key product lines. While the iPhone remains the undisputed revenue king, understanding the performance of Macs, wearables, and services is vital for a comprehensive assessment of Apple's market share.

- Market share comparisons with competitors: Apple maintains a strong lead in the smartphone market, particularly in the premium segment, competing fiercely with Samsung. However, competition in other areas, such as wearables, is intensifying. Analyzing market share data from reputable sources like IDC and Counterpoint Research offers valuable insights.

- Impact of supply chain issues on production and sales: Past supply chain disruptions have impacted Apple's production and sales. While the situation has improved, potential future disruptions remain a risk factor influencing Apple market share and overall performance. Monitoring global supply chain trends is therefore crucial.

- Growth in services revenue and its contribution to overall profitability: Apple's services revenue, encompassing subscriptions like Apple Music, iCloud, and Apple TV+, continues to grow at a rapid pace, significantly contributing to overall profitability and mitigating reliance on hardware sales. This diversification is a key strength, increasing the resilience of Apple's business model. Analyzing the growth trajectory of this segment is crucial for understanding Apple's long-term prospects. Keywords: Apple market share, iPhone sales, Apple services revenue, Apple supply chain.

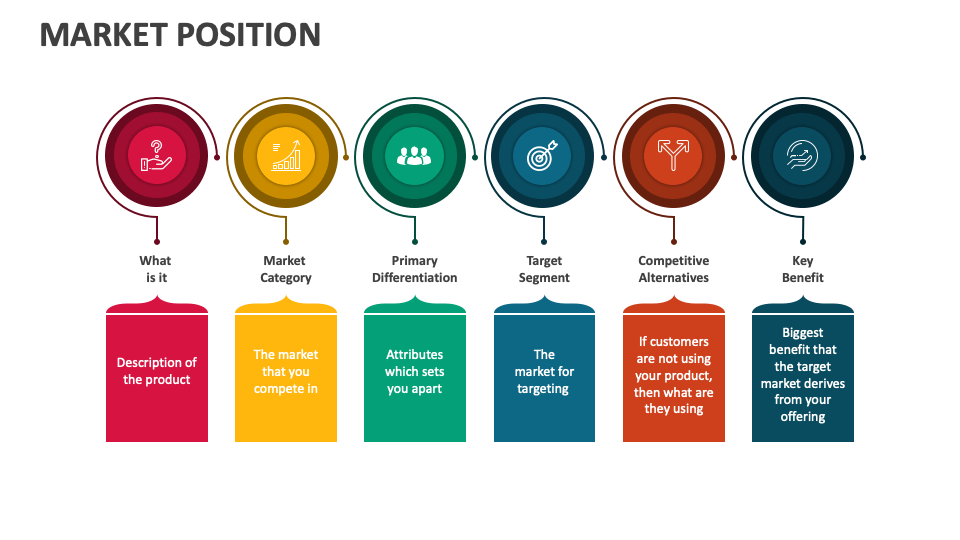

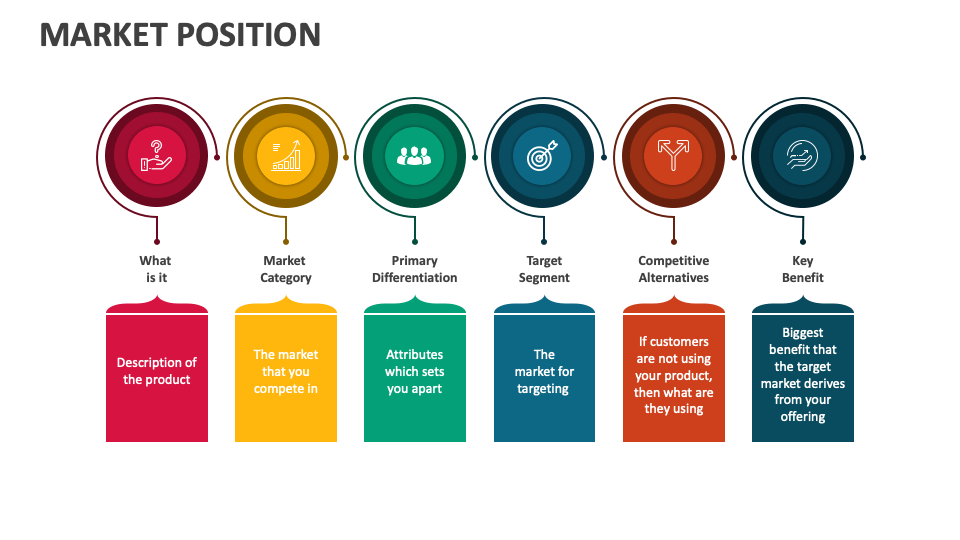

Factors Influencing Apple Stock Price Before Q2 Earnings

Several factors beyond Apple's direct control influence its stock price. Understanding these macroeconomic and geopolitical influences is critical for accurate Apple stock price prediction.

- Impact of macroeconomic factors (inflation, interest rates): Rising inflation and interest rates impact consumer spending, potentially affecting demand for Apple products, particularly higher-priced items. Investors should carefully analyze these macroeconomic trends and their potential ripple effects on Apple's financial performance.

- Impact of geopolitical instability on global demand: Geopolitical uncertainty, such as the ongoing conflict in Ukraine and trade tensions, can disrupt supply chains and reduce consumer confidence, affecting global demand for Apple products and consequently influencing Apple stock price forecasts.

- Competitor actions and their potential impact on Apple's market position: The competitive landscape is dynamic. Actions by rivals, such as the release of new products or aggressive marketing campaigns, can affect Apple's market share and, subsequently, its stock price. Monitoring competitor activities is therefore vital for making informed investment decisions. Keywords: Apple stock price prediction, Apple stock forecast, macroeconomic factors, consumer spending.

Analysis of Key Performance Indicators (KPIs)

Monitoring key performance indicators provides insights into Apple's financial health and future potential.

- Revenue growth: Analyzing revenue growth across different product categories reveals trends and areas of strength or weakness. Comparing this growth to previous quarters and industry benchmarks provides context.

- Profit margins: Profit margins reflect Apple's pricing strategy, cost efficiency, and overall profitability. Tracking changes in profit margins helps investors gauge the company's ability to navigate economic headwinds and maintain profitability.

- User engagement: Measuring user engagement metrics, such as app usage, active users, and customer retention, provides crucial insights into customer loyalty and the overall health of Apple's ecosystem. Keywords: Apple KPIs, Apple revenue growth, Apple profit margin, user engagement.

Investment Strategies & Outlook for Apple Stock

Investing in Apple stock requires a careful assessment of risks and opportunities.

- Buy, hold, or sell recommendations: Investment decisions should be based on a thorough analysis of the factors discussed above, including Apple's recent performance, market share, macroeconomic conditions, and key performance indicators. Risk tolerance and individual investment goals are also crucial factors.

- Discussion of potential risks and opportunities: Potential risks include economic downturns, increased competition, and supply chain disruptions. Opportunities include growth in the services sector, expansion into new markets, and continued innovation in product development.

- Long-term outlook for Apple and its stock price: Apple's strong brand loyalty, diversified revenue streams, and innovative capacity suggest a positive long-term outlook, although short-term fluctuations are to be expected. Keywords: Apple stock investment, Apple stock buy or sell, Apple stock outlook.

Conclusion

This pre-Q2 analysis of Apple's market position reveals a complex picture influenced by various factors, ranging from macroeconomic conditions to its own performance indicators. While challenges exist, Apple's strong brand loyalty and diversified revenue streams provide a degree of resilience. The upcoming Q2 earnings report will provide critical data to further refine this analysis.

Call to Action: Stay informed on Apple's Q2 earnings and continue monitoring its market position to make informed decisions about your Apple stock investments. Understanding the nuances of Apple stock's current market position is critical for successful investment strategies.

Featured Posts

-

The Impact Of A Potential Canada Post Strike On Customer Retention

May 25, 2025

The Impact Of A Potential Canada Post Strike On Customer Retention

May 25, 2025 -

Escape To The Country Nicki Chapmans Profitable Property Investment

May 25, 2025

Escape To The Country Nicki Chapmans Profitable Property Investment

May 25, 2025 -

Joy Crookes Drops New Track Carmen

May 25, 2025

Joy Crookes Drops New Track Carmen

May 25, 2025 -

Apple Stock Forecast Wedbushs Bullish Stance Despite Lower Target

May 25, 2025

Apple Stock Forecast Wedbushs Bullish Stance Despite Lower Target

May 25, 2025 -

Gear Essentials For Ferrari Owners A Complete Guide

May 25, 2025

Gear Essentials For Ferrari Owners A Complete Guide

May 25, 2025

Latest Posts

-

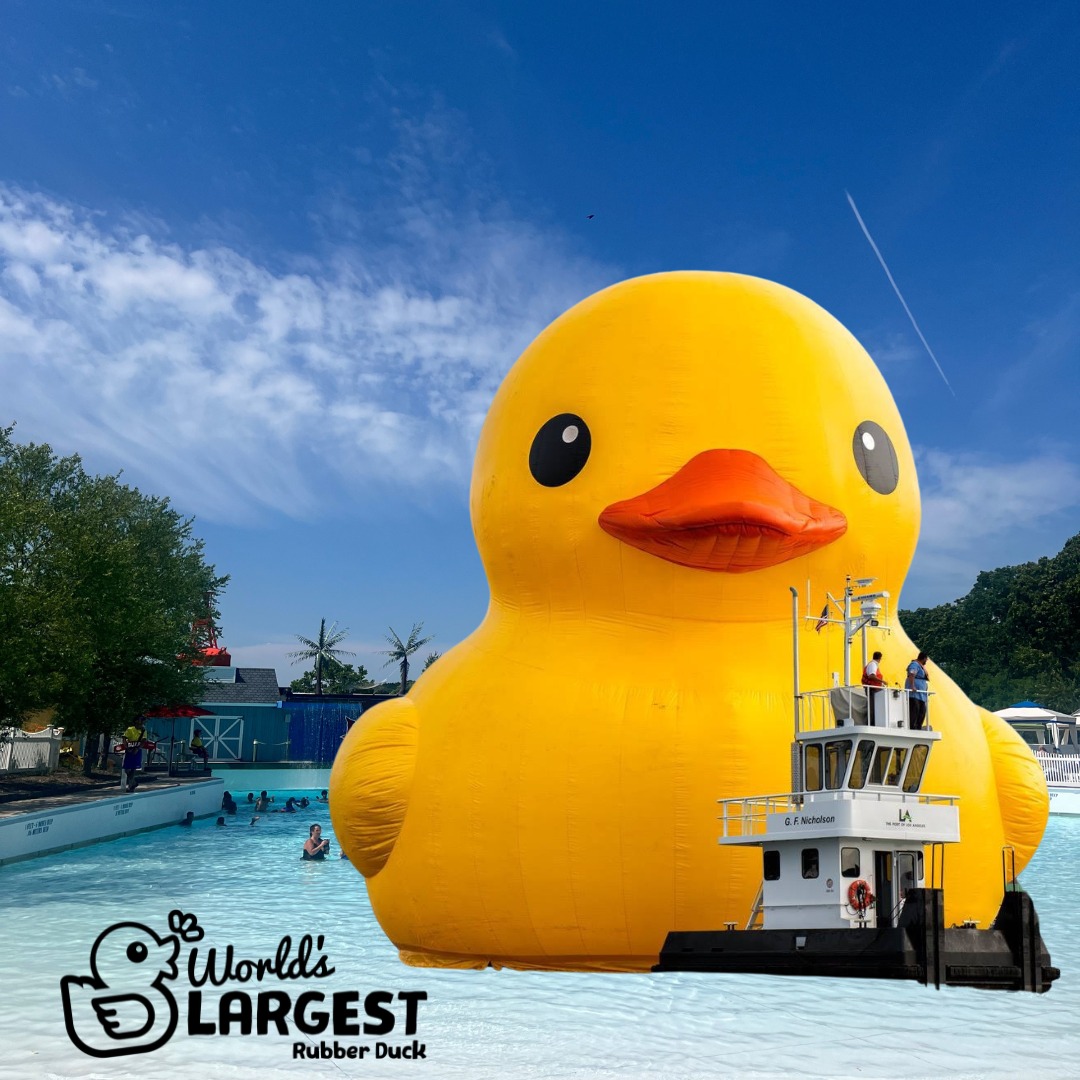

Giant Rubber Duck Brings Important Message To Myrtle Beach

May 25, 2025

Giant Rubber Duck Brings Important Message To Myrtle Beach

May 25, 2025 -

Worlds Largest Rubber Duck Arrives In Myrtle Beach With A Message

May 25, 2025

Worlds Largest Rubber Duck Arrives In Myrtle Beach With A Message

May 25, 2025 -

Flash Flood Watch Cayuga County Residents Urged To Take Precautions

May 25, 2025

Flash Flood Watch Cayuga County Residents Urged To Take Precautions

May 25, 2025 -

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025 -

North Myrtle Beachs Water Crisis Understanding The Public Safety Implications

May 25, 2025

North Myrtle Beachs Water Crisis Understanding The Public Safety Implications

May 25, 2025