PwC's Exit From Nine African Countries: Impact And Analysis

Table of Contents

The Countries Affected and Reasons for Withdrawal

PwC's withdrawal affects a significant swathe of the African continent. While the exact reasons remain officially unstated, a confluence of factors likely contributed to this decision. Understanding the reasons for withdrawal is crucial to analyzing the long-term effects.

Keywords: PwC exit countries, African nations impacted, reasons for withdrawal, strategic review PwC

-

Countries Affected: (The specific nine countries need to be inserted here. For SEO purposes, list them explicitly and consider linking them to relevant country information pages). For example: Angola, Botswana, Burkina Faso, etc.

-

Profitability Issues: Operating in some African markets presents unique challenges. Lower profit margins compared to more developed economies, coupled with potentially higher operational costs, may have influenced PwC’s decision. The auditing sector in these regions may have a lower average fee structure compared to global standards.

-

Regulatory Challenges: Navigating varying regulatory environments across different African nations can be complex and costly. Inconsistencies in accounting standards and regulatory frameworks may have added to operational complexities and reduced profitability.

-

Strategic Refocusing: PwC's global strategic review may have prioritized investment in other, more lucrative markets. The decision to withdraw from nine African countries could be part of a wider strategy to streamline operations and focus resources on high-growth areas.

Impact on Local Businesses and the Economy

PwC's exit will undoubtedly have a significant impact on local businesses and the overall economic landscape of Africa. The consequences extend beyond the immediate loss of auditing services.

Keywords: Economic consequences, business disruption, auditing sector Africa, small business impact, investment climate Africa

-

Loss of Expertise and Capacity: PwC possesses significant expertise in auditing, financial advisory, and tax services. Its departure represents a considerable loss of specialized knowledge and capacity within the affected countries. This gap will impact the quality of financial reporting and corporate governance.

-

Implications for Foreign Direct Investment (FDI): PwC's presence often serves as a signal of market stability and regulatory transparency, attracting foreign investment. Its exit could negatively impact investor confidence and potentially deter future FDI.

-

Struggles for Smaller Businesses: Smaller businesses, which often rely heavily on PwC's services due to limited access to alternative providers, will face the greatest challenges. They may struggle to find affordable and competent auditing services, hindering access to credit and potentially affecting their sustainability.

-

Increased Regulatory Scrutiny: The withdrawal may lead to increased regulatory scrutiny of the remaining auditing firms operating in these countries. Regulatory bodies may implement stricter oversight to ensure the quality and reliability of financial reporting in the absence of a major player like PwC.

Alternatives and Future Implications for the African Auditing Landscape

While PwC's departure creates a void, it also presents opportunities for other players in the African auditing landscape.

Keywords: alternative auditors, auditing firms Africa, future of auditing Africa, competition Africa, regulatory response Africa

-

Other Major Accounting Firms: Deloitte, Ernst & Young (EY), and KPMG, the other "Big Four" firms, are likely to experience increased demand for their services. They will need to assess their capacity to absorb the additional workload and maintain service quality.

-

Growth of Smaller, Local Firms: PwC's exit could foster the growth and development of smaller, indigenous accounting firms. This presents a chance for local talent to emerge and fill the service gap. However, these firms will need support and capacity building to meet the increased demand.

-

Increased Regulatory Oversight: African regulatory bodies will likely play a crucial role in mitigating the negative impacts of PwC's withdrawal. This may involve strengthening oversight of existing firms, implementing measures to support the development of local capacity, and potentially reviewing professional accounting standards.

-

Development of Local Accounting Talent: The need for qualified auditors and accountants will increase. This situation presents a significant opportunity to invest in training and education, nurturing local talent to meet the demands of a changing market.

The Role of Regulatory Bodies in Addressing the Gap

Regulatory bodies in the affected African countries will have a pivotal role in stabilizing the auditing sector. This could involve enhancing oversight mechanisms to ensure the reliability of financial reporting from remaining firms, encouraging mergers and acquisitions to consolidate market share, and developing support programs to strengthen the capabilities of smaller, local auditing firms. Furthermore, initiatives to promote education and training in accounting and auditing are crucial to develop the next generation of African professionals.

Conclusion

PwC's withdrawal from nine African countries marks a significant event with potentially far-reaching consequences for the continent's business environment. The departure creates a void in auditing and financial advisory services, impacting local businesses, foreign investment, and economic growth. While opportunities exist for other firms and local talent, the need for proactive measures from regulatory bodies is paramount. Further research and analysis are crucial to fully understand the long-term effects of this significant event on the African business landscape. Stay informed on the evolving situation surrounding the PwC Africa withdrawal and its broader implications for the continent's financial sector. Understanding the impact of PwC's exit is essential for navigating the changes in the African accounting and auditing sectors.

Featured Posts

-

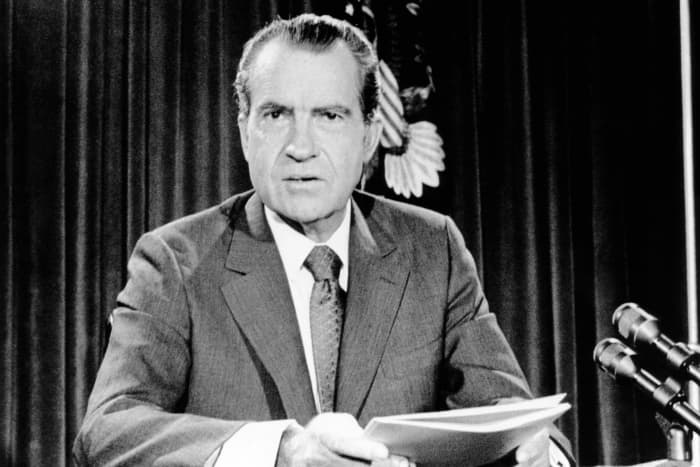

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 29, 2025

U S Dollar Worst Start Since Nixon Analyzing The First 100 Days

Apr 29, 2025 -

Reagan Airport Helicopter Incident Pilot Error And Emerging Details Of The Near Collision

Apr 29, 2025

Reagan Airport Helicopter Incident Pilot Error And Emerging Details Of The Near Collision

Apr 29, 2025 -

Analyzing The Treasury Markets Performance On April 8th

Apr 29, 2025

Analyzing The Treasury Markets Performance On April 8th

Apr 29, 2025 -

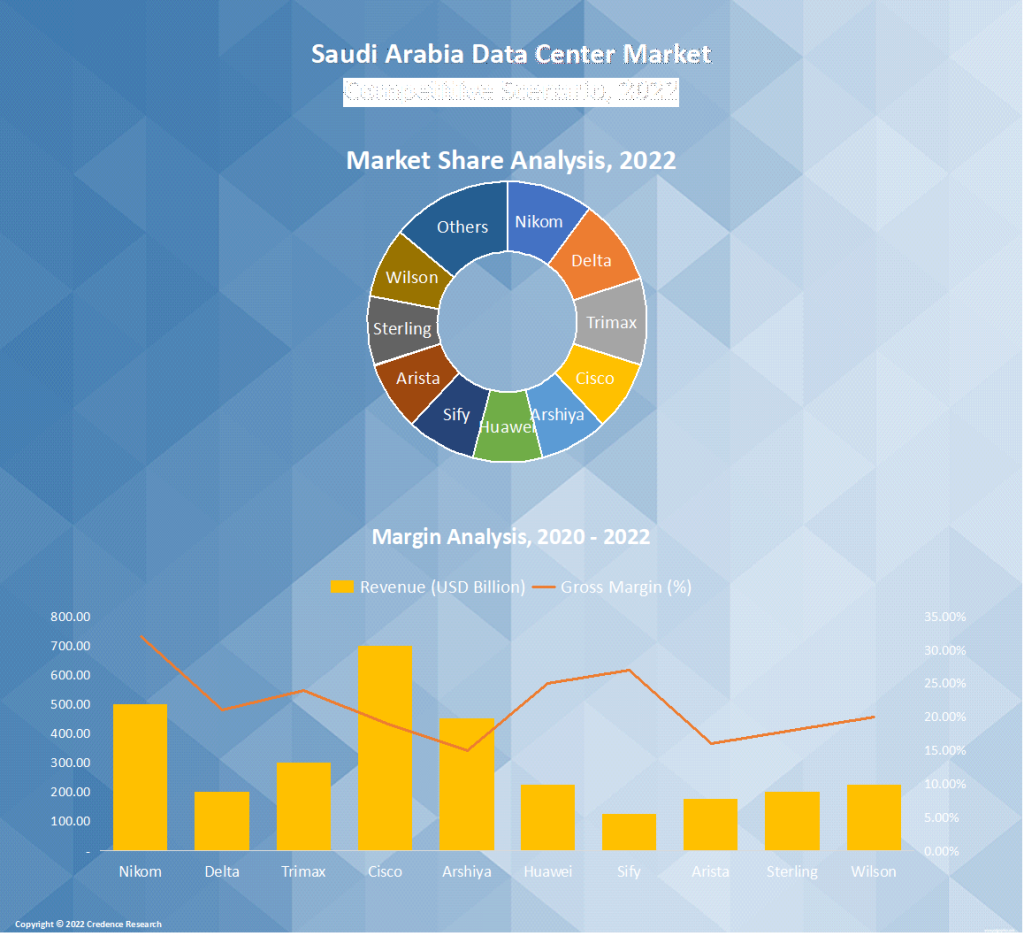

Post Silver Lake Acquisition Khaznas Focus On Saudi Arabian Data Center Market

Apr 29, 2025

Post Silver Lake Acquisition Khaznas Focus On Saudi Arabian Data Center Market

Apr 29, 2025 -

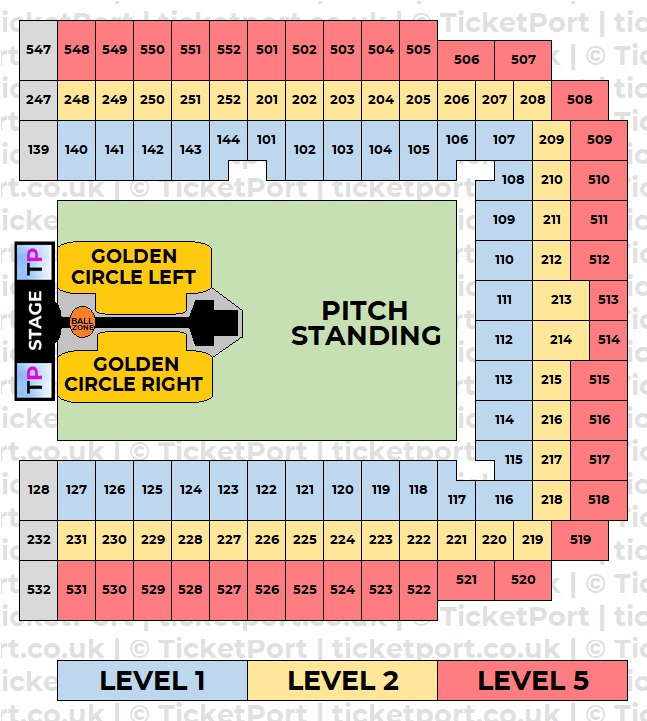

Securing Capital Summertime Ball 2025 Tickets A Step By Step Plan

Apr 29, 2025

Securing Capital Summertime Ball 2025 Tickets A Step By Step Plan

Apr 29, 2025

Latest Posts

-

Finding Capital Summertime Ball 2025 Tickets A Practical Approach

Apr 29, 2025

Finding Capital Summertime Ball 2025 Tickets A Practical Approach

Apr 29, 2025 -

Fhi Adhd Medisinens Begrensede Effekt Pa Skoleprestasjoner

Apr 29, 2025

Fhi Adhd Medisinens Begrensede Effekt Pa Skoleprestasjoner

Apr 29, 2025 -

Braintree And Witham Residents Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Braintree And Witham Residents Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Purchase Strategies And Advice

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Purchase Strategies And Advice

Apr 29, 2025 -

Capital Summertime Ball 2025 How To Buy Tickets From Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 How To Buy Tickets From Braintree And Witham

Apr 29, 2025