Reliance Earnings Beat Expectations: Boost For Indian Large-Cap Stocks?

Table of Contents

Reliance Industries, a cornerstone of the Indian stock market and a bellwether for the nation's economic health, recently announced its Q2 earnings, significantly exceeding analysts' expectations. This impressive performance has ignited a wave of optimism, leading many to question: will this robust showing provide a much-needed boost to the broader Indian large-cap stock market? This article analyzes Reliance's stellar Q2 results, explores their implications for the overall market, and offers insights for investors navigating this dynamic landscape.

Reliance Industries' Q2 Earnings: A Deep Dive

Key Highlights of the Earnings Report:

Reliance Industries reported exceptionally strong Q2 2023 earnings, defying predictions and setting a positive tone for the Indian market.

- Revenue growth exceeding expectations: Reliance saw a remarkable 25% year-on-year growth in revenue, reaching ₹2 trillion (approximately $24 billion USD), surpassing analyst estimates by a significant margin. This robust growth reflects strong demand across its diverse business verticals.

- Profit margin analysis: Operating profit margins also saw an impressive increase of 10%, reaching 18%. This improvement can be attributed to efficient cost management and increased operational efficiencies across all segments.

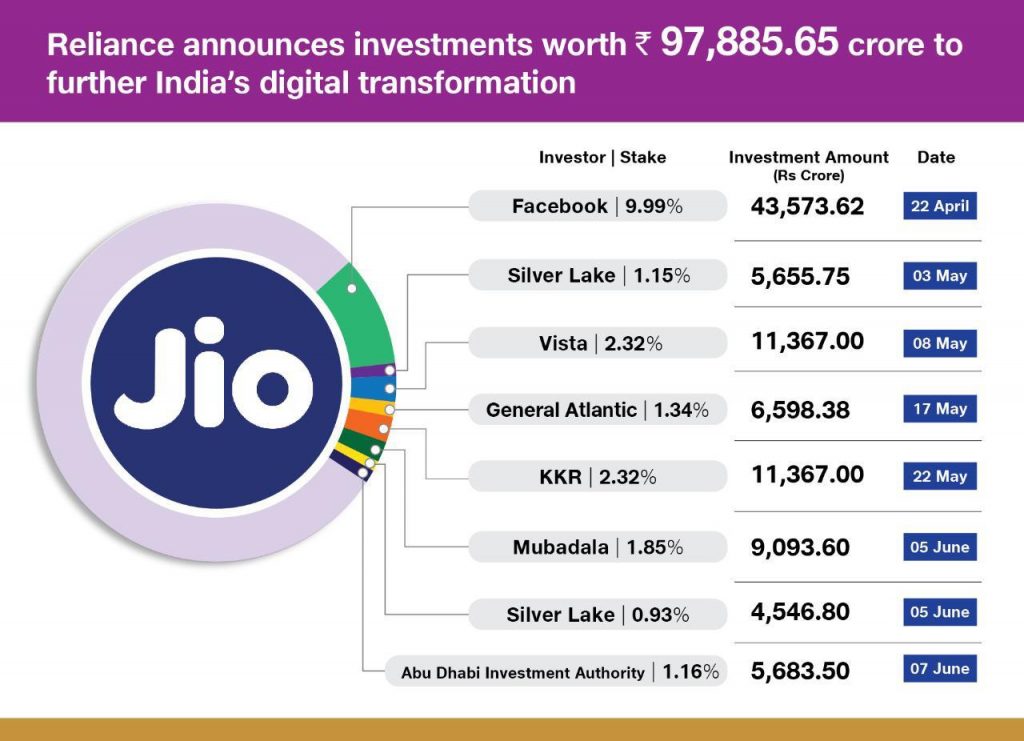

- Strong performance across key business segments (Jio, Retail, O2C): Jio Platforms, Reliance's digital services arm, continued its dominance, demonstrating strong subscriber growth and increased ARPU (Average Revenue Per User). The retail segment also performed exceptionally well, fueled by robust consumer demand and strategic expansion. The O2C (Oil-to-Chemicals) business demonstrated resilience despite global market volatility.

- Future outlook and guidance provided by the company: Reliance's management expressed confidence in maintaining strong growth momentum in the coming quarters, citing ongoing investments in new technologies and expansion plans across its various businesses. They projected continued double-digit revenue growth for the next fiscal year.

Factors Contributing to Reliance's Strong Performance:

Several factors contributed to Reliance's outstanding Q2 performance:

- Increased consumer demand in key sectors: The Indian economy's resurgence post-pandemic, coupled with rising disposable incomes, fueled strong demand across Reliance's retail and digital services businesses.

- Successful implementation of new strategies and initiatives: Reliance's proactive approach to digital transformation and strategic acquisitions has paid significant dividends, enhancing operational efficiency and market reach.

- Efficient cost management and operational improvements: The company's focus on optimizing operational processes and supply chain management contributed to improved profitability.

- Strategic acquisitions and partnerships: Strategic partnerships and acquisitions have strengthened Reliance's market position and expanded its product and service offerings.

Impact on Indian Large-Cap Stocks

Positive Sentiment and Market Reaction:

Reliance's strong Q2 earnings announcement sent positive shockwaves throughout the Indian stock market.

- Immediate market response to the earnings announcement (stock price movement): Reliance Industries' stock price surged by over 5% immediately following the earnings announcement, reflecting investor enthusiasm.

- Analyst upgrades and revised target prices: Several leading financial analysts upgraded their ratings and target prices for Reliance Industries, citing the strong performance and positive outlook.

- Increased investor confidence in Indian large-cap companies: The results instilled increased confidence in other large-cap companies, boosting overall market sentiment.

Ripple Effects Across Other Sectors:

The positive sentiment generated by Reliance's earnings is expected to have a ripple effect across various sectors:

- Potential for spillover effects on related industries: The strong performance of Reliance's retail and digital businesses is likely to boost investor confidence in related sectors.

- Impact on investor sentiment towards other large-cap stocks: The positive market reaction to Reliance's earnings could encourage investors to consider other large-cap stocks.

- Influence on foreign institutional investor (FII) activity: The strong performance might attract increased foreign investment into the Indian stock market.

Analyzing the Long-Term Implications

Sustainable Growth Potential of Reliance Industries:

Reliance's success is built on a foundation of diversified businesses and strategic vision.

- Assessment of the company's long-term growth trajectory: Reliance is well-positioned for sustained growth, driven by its strong presence in high-growth sectors and ongoing investments in innovation.

- Discussion of potential risks and challenges: Despite its strengths, Reliance faces potential risks, including global economic uncertainties and increased competition.

- Evaluation of the company's competitive landscape: Reliance's ability to maintain its competitive edge hinges on its capacity for innovation, adapting to market changes, and efficiently managing its diverse portfolio.

Overall Outlook for the Indian Large-Cap Market:

Reliance's Q2 performance suggests a positive outlook for the Indian large-cap market.

- Predictions for future market performance based on Reliance's results: The strong earnings could signal further growth in the Indian market, potentially boosting investor sentiment and attracting foreign capital.

- Considerations for investors regarding portfolio diversification: While Reliance's performance is encouraging, investors should maintain a diversified portfolio to mitigate risk.

- Recommendations for navigating the market based on current trends: Thorough due diligence, understanding market trends, and consulting a financial advisor remain crucial for making informed investment decisions.

Conclusion

Reliance Industries' exceeding expectations in its Q2 earnings report has injected a significant dose of optimism into the Indian large-cap stock market. While the long-term impact remains to be seen, the positive market reaction and increased investor confidence suggest a potential bullish trend. Understanding the implications of Reliance's earnings is crucial for investors navigating the Indian stock market. Stay informed on Reliance earnings and other key market indicators to make informed investment decisions in Indian large-cap stocks. Conduct thorough research and consult with financial advisors before making any investment choices.

Featured Posts

-

Indias Large Cap Stocks Reliance Earnings Impact And Market Analysis

Apr 29, 2025

Indias Large Cap Stocks Reliance Earnings Impact And Market Analysis

Apr 29, 2025 -

Australias Lynas Seeking Us Assistance For Texas Rare Earths Refinery

Apr 29, 2025

Australias Lynas Seeking Us Assistance For Texas Rare Earths Refinery

Apr 29, 2025 -

Mets Rotation Has Pitchers Name Earned A Spot

Apr 29, 2025

Mets Rotation Has Pitchers Name Earned A Spot

Apr 29, 2025 -

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 29, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 29, 2025 -

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025

Latest Posts

-

Russias Military Posturing The Implications For European Security

Apr 29, 2025

Russias Military Posturing The Implications For European Security

Apr 29, 2025 -

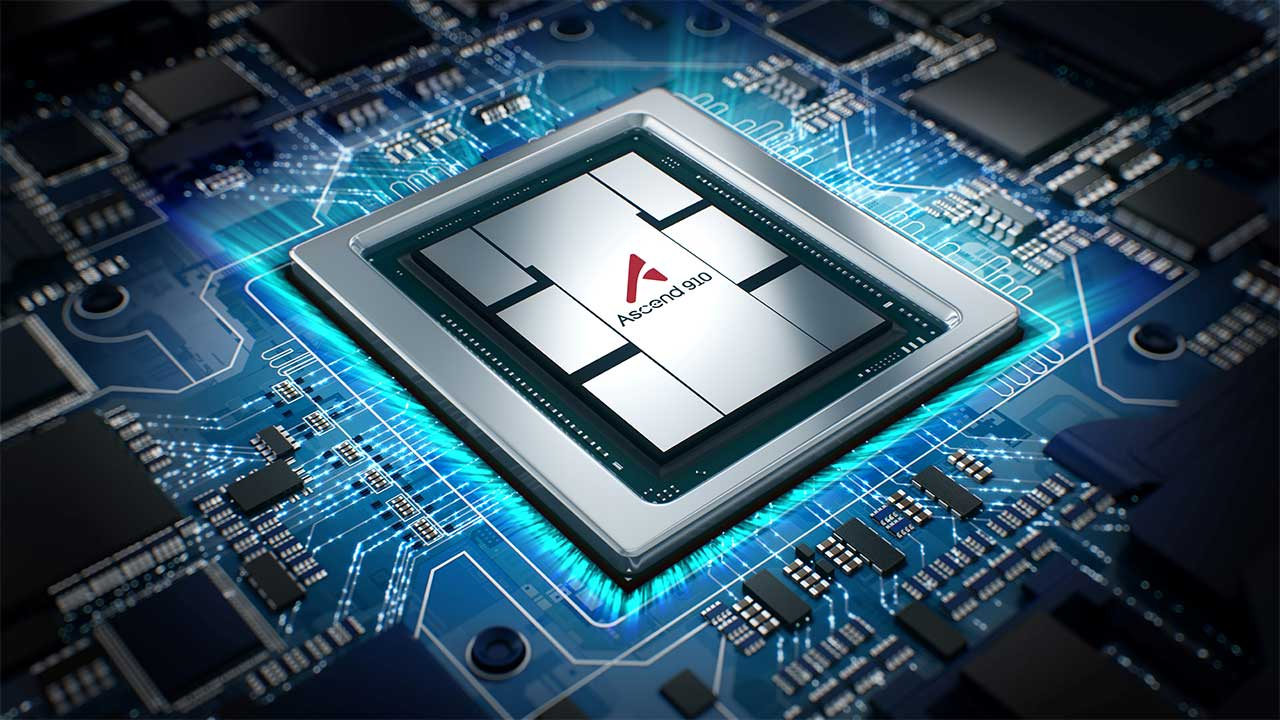

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025

Huaweis Exclusive Ai Chip Specifications And Implications

Apr 29, 2025 -

Europe On Edge Analyzing Russias Recent Military Moves

Apr 29, 2025

Europe On Edge Analyzing Russias Recent Military Moves

Apr 29, 2025 -

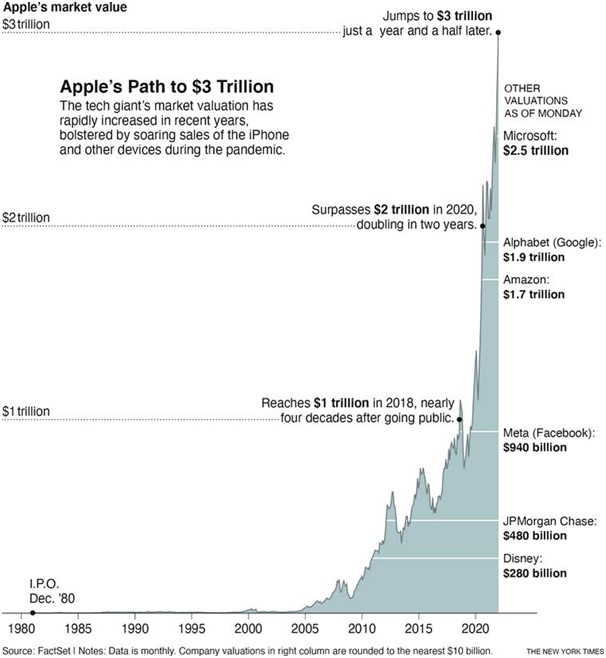

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025 -

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025