Reliance Shares Surge: Biggest Gain In 10 Months After Strong Earnings

Table of Contents

Strong Q[Quarter] Earnings Drive Reliance Shares Higher

The phenomenal rise in Reliance shares is undeniably fueled by the company's robust Q[Quarter] earnings. The financial performance significantly surpassed analysts' predictions, showcasing impressive growth across multiple sectors. Revenue growth reached [Insert Percentage]% year-on-year, exceeding the projected [Insert Percentage]%. Profit margins also saw a substantial increase, reaching [Insert Percentage]%, up from [Insert Percentage]% in the previous quarter. This exceptional performance is a clear testament to Reliance's strategic initiatives and operational efficiency.

- Increased revenue in Telecom: Jio, Reliance's telecom arm, continued its impressive growth trajectory, adding millions of subscribers and significantly increasing its average revenue per user (ARPU).

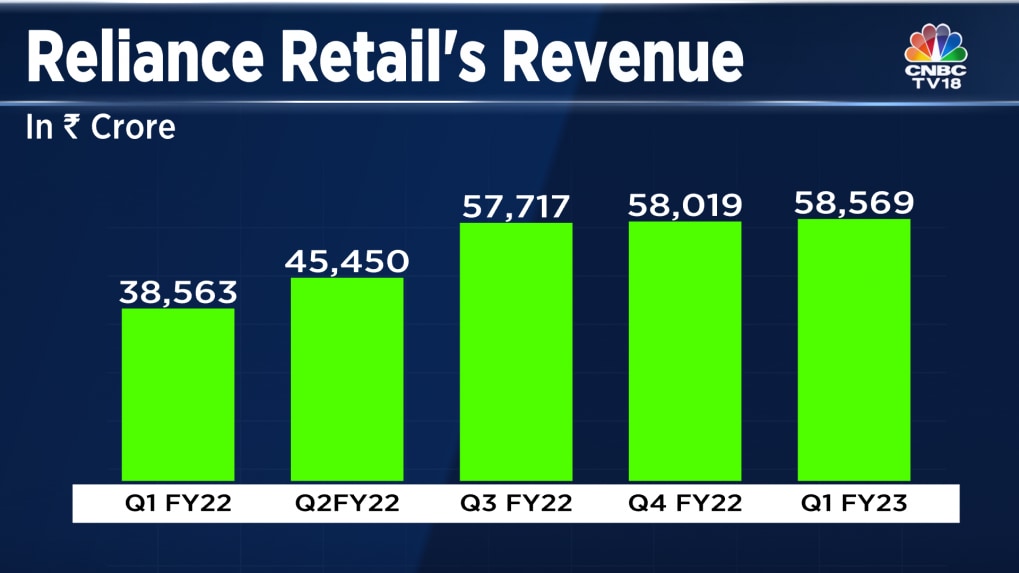

- Improved profitability in Retail: Reliance Retail demonstrated strong growth, driven by expansion into new markets and successful online initiatives. Profitability improved significantly due to streamlined operations and enhanced supply chain management.

- Positive outlook for future quarters: The company's management expressed confidence in maintaining this positive momentum, projecting continued growth in key segments throughout the upcoming quarters.

[Insert relevant chart or graph showcasing revenue and profit growth]

Investor Sentiment and Market Reaction to Reliance's Performance

The market reacted positively to Reliance's stellar earnings report, reflecting a surge in investor confidence. Trading volume for Reliance shares increased significantly, indicating strong investor interest and a rush to acquire shares. This heightened activity contributed directly to the share price surge. Several leading analysts upgraded their ratings for Reliance shares, citing the strong financial performance and positive future outlook. Many revised their price targets upward, suggesting further potential for growth.

- Increased trading volume: The trading volume for Reliance shares saw a dramatic increase, highlighting the strong investor interest and market excitement.

- Positive analyst commentary and ratings upgrades: Major financial institutions expressed positive sentiment, leading to ratings upgrades and increased buy recommendations.

- Increased foreign institutional investor (FII) interest: Foreign investors showed significant interest, further boosting demand for Reliance shares.

- Comparison with competitor share performance: Compared to its competitors, Reliance’s share price performance significantly outperformed the market average, showcasing the strength of its financial results.

Key Factors Contributing to Reliance's Strong Earnings

Several key factors contributed to Reliance's outstanding earnings. The success of Jio's telecom services continues to be a major driver, complemented by the burgeoning growth of Reliance Retail. Strategic acquisitions, effective cost-cutting measures, and expansion into new market segments have also played a crucial role.

- Success of Jio telecom services: Jio's expanding subscriber base and increasing ARPU significantly boosted the telecom segment's performance.

- Growth of the Reliance Retail business: Reliance Retail's aggressive expansion and innovative strategies have propelled its growth, making it a significant contributor to overall earnings.

- Expansion into new market segments: Reliance's strategic diversification into new and emerging markets further enhanced its revenue streams.

- Effective cost management strategies: Efficient cost management and operational excellence have improved profit margins.

Future Outlook and Implications for Reliance Shares

Looking ahead, the future prospects for Reliance Industries appear promising, given its strong financial position and strategic initiatives. However, potential risks and challenges remain, including global economic uncertainties and competitive pressures. While predicting the future price movement of shares is inherently uncertain, the current performance suggests a positive outlook for Reliance shares in the medium to long term.

- Continued growth potential in key segments: The company's strategic focus on key growth areas positions it well for continued expansion.

- Potential impact of global economic conditions: Global economic headwinds could potentially impact Reliance's performance, although its diversified portfolio offers some resilience.

- Risks associated with specific business ventures: New ventures always carry inherent risks, which need to be carefully monitored.

- Long-term investment prospects: Despite potential short-term fluctuations, the long-term investment prospects for Reliance shares appear favorable.

Conclusion: Understanding the Reliance Shares Surge

The significant increase in Reliance share prices is primarily attributed to the company's exceptionally strong Q[Quarter] earnings, which exceeded expectations and boosted investor confidence. The market's positive reaction, reflected in increased trading volume and analyst upgrades, reinforces the impact of robust financial performance on share prices. Understanding a company's financial health and market dynamics is crucial for making informed investment decisions. Stay informed about future Reliance shares movements and continue your research into the company's performance to make well-informed decisions.

Featured Posts

-

Ambanis Reliance Strong Earnings Signal Positive Outlook For Indian Market

Apr 29, 2025

Ambanis Reliance Strong Earnings Signal Positive Outlook For Indian Market

Apr 29, 2025 -

Predicting Trumps Agenda The Next 100 Days Of Executive Orders And Policy

Apr 29, 2025

Predicting Trumps Agenda The Next 100 Days Of Executive Orders And Policy

Apr 29, 2025 -

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 29, 2025

Anchor Brewing Companys Closure A Look Back At 127 Years Of Brewing

Apr 29, 2025 -

Post April 8th Treasury Market Analysis Findings And Forecasts

Apr 29, 2025

Post April 8th Treasury Market Analysis Findings And Forecasts

Apr 29, 2025 -

Your Open Thread February 16 2025

Apr 29, 2025

Your Open Thread February 16 2025

Apr 29, 2025

Latest Posts

-

Pw Cs Strategic Retrenchment Analyzing The Withdrawal From 12 Countries

Apr 29, 2025

Pw Cs Strategic Retrenchment Analyzing The Withdrawal From 12 Countries

Apr 29, 2025 -

Pw Cs Global Retreat Exit Strategy Amidst Scandals

Apr 29, 2025

Pw Cs Global Retreat Exit Strategy Amidst Scandals

Apr 29, 2025 -

Scandal Driven Departures Pw Cs Exit From Over A Dozen Countries Explained

Apr 29, 2025

Scandal Driven Departures Pw Cs Exit From Over A Dozen Countries Explained

Apr 29, 2025 -

Pw C Philippines Opens New Bgc Office

Apr 29, 2025

Pw C Philippines Opens New Bgc Office

Apr 29, 2025 -

Pw C Exits Multiple Countries Reasons And Implications Of Recent Withdrawals

Apr 29, 2025

Pw C Exits Multiple Countries Reasons And Implications Of Recent Withdrawals

Apr 29, 2025