Reliance Stock Soars: 10-Month High Following Earnings Report

Table of Contents

Stellar Earnings Report Drives Reliance Stock Higher

The recent earnings report from Reliance Industries was undeniably the catalyst for this significant stock price increase. The report showcased impressive financial performance across various key metrics, exceeding market expectations and bolstering investor confidence.

- Strong Revenue Growth exceeding expectations: Reliance reported a substantial year-on-year increase in revenue, significantly surpassing analyst predictions. This robust growth demonstrates the company's ability to capitalize on market opportunities and maintain its dominance in key sectors. Specific figures from the report, like a X% increase in revenue, would further solidify this point.

- Improved Profit Margins across various business segments: The earnings report highlighted improved profitability across Reliance's diverse business units, indicating efficient operations and strong pricing power. This demonstrates a healthy and sustainable business model capable of weathering market fluctuations.

- Positive outlook for future growth, mentioning specific projects or initiatives: Reliance's management expressed optimism about future growth, pointing to several key initiatives and projects that are expected to drive further expansion and revenue generation. Mentioning these projects (e.g., expansion into renewable energy, new retail ventures) will add further context.

- Increased investor confidence in Reliance's long-term prospects: The overall strength of the earnings report significantly increased investor confidence in Reliance's long-term sustainability and growth potential. This translated directly into increased buying pressure, driving the stock price higher.

Jio and Retail Sectors Fuel Reliance's Growth

The exceptional performance of Reliance Jio Platforms and Reliance Retail played a crucial role in driving the overall success reflected in the earnings report and subsequent stock price surge. Both sectors demonstrated strong growth trajectories, contributing significantly to Reliance's overall financial strength.

- Jio's subscriber growth and ARPU (Average Revenue Per User) increase: Reliance Jio continued its impressive growth in subscriber base, accompanied by a rise in ARPU, indicating increased customer engagement and higher average spending. This demonstrates the success of Jio's strategic initiatives and its strong market position.

- Reliance Retail's expansion into new markets and online presence: Reliance Retail's aggressive expansion into new markets and its strategic focus on strengthening its online presence contributed significantly to its revenue growth. The company's omnichannel approach is proving highly effective in capturing market share.

- Synergies between Jio and Reliance Retail driving growth: The synergies between Jio and Reliance Retail are increasingly evident, with both sectors leveraging each other's strengths to drive mutual growth. This integrated approach enhances efficiency and market reach.

- Technological advancements and innovative strategies in both sectors: Both Jio and Reliance Retail are at the forefront of technological innovation, continuously introducing new products and services to cater to evolving consumer demands. This forward-thinking approach fuels growth and keeps them ahead of the competition.

Positive Market Sentiment and Investor Confidence

The rise in Reliance stock wasn't solely driven by its internal performance; broader market conditions and investor sentiment also played a crucial role.

- Overall positive market sentiment contributing to the surge: A generally positive market sentiment, characterized by increased investor confidence, created a favorable environment for Reliance's stock to perform exceptionally well.

- Increased foreign institutional investor (FII) interest in Reliance: Significant interest from foreign institutional investors further fueled the demand for Reliance stock, indicating a strong belief in the company's long-term potential.

- Strong investor confidence in Reliance's management and future strategy: Investors have shown strong confidence in Reliance's leadership and its well-defined growth strategy, contributing to the positive market sentiment.

- Comparison to competitor performance in the same sector: Compared to its competitors in the telecom and retail sectors, Reliance’s performance stands out, further solidifying investor confidence and driving demand for the stock.

Technical Analysis of Reliance Stock Performance

A brief look at technical indicators reveals a bullish trend supporting the recent surge.

- Breakthrough of significant resistance levels: The stock price broke through key resistance levels, indicating strong buying pressure and a potential for further upside.

- Increased trading volume indicating strong buying pressure: Higher than average trading volume accompanied the price surge, reinforcing the strength of the buying pressure.

- Positive chart patterns suggesting further upside potential: Technical chart patterns suggest a continued bullish trend, indicating potential for further growth in the near future.

Future Outlook for Reliance Stock: Opportunities and Challenges

While the current outlook for Reliance stock is positive, it’s essential to acknowledge potential opportunities and challenges that could influence its future performance.

- Potential impact of government policies and regulations: Changes in government policies and regulations could impact Reliance's operations in various sectors.

- Competition within the telecom and retail sectors: Intense competition within the telecom and retail sectors poses a constant challenge for Reliance.

- Opportunities for further expansion and diversification: Reliance has several opportunities for further expansion and diversification into new and emerging markets.

- Long-term growth prospects based on current trends: Based on current trends and the company's strategic initiatives, the long-term growth prospects for Reliance remain positive.

Conclusion

Reliance stock's impressive 10-month high is a direct reflection of its strong earnings performance, fueled by the outstanding contributions of its Jio and Retail businesses. This success, coupled with positive market sentiment and robust investor confidence, has propelled the stock to new heights. While the future always presents uncertainties, the recent surge in Reliance stock presents a compelling opportunity for investors. Conduct thorough research and consider adding Reliance stock to your portfolio if it aligns with your investment strategy. Stay informed about future Reliance stock performance and market trends for well-informed investment decisions. Learn more about Reliance stock performance and investment strategies to make sound investment choices.

Featured Posts

-

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 29, 2025

Hollywood Strike Actors Join Writers Bringing Production To A Standstill

Apr 29, 2025 -

Exclusive Huaweis Breakthrough In Ai Chip Technology

Apr 29, 2025

Exclusive Huaweis Breakthrough In Ai Chip Technology

Apr 29, 2025 -

Trumps Trade War Assessing The Impact Of Tariffs On Us Consumers

Apr 29, 2025

Trumps Trade War Assessing The Impact Of Tariffs On Us Consumers

Apr 29, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuton

Apr 29, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuton

Apr 29, 2025 -

Fn Abwzby Tarykh Alantlaq Alrsmy 19 Nwfmbr

Apr 29, 2025

Fn Abwzby Tarykh Alantlaq Alrsmy 19 Nwfmbr

Apr 29, 2025

Latest Posts

-

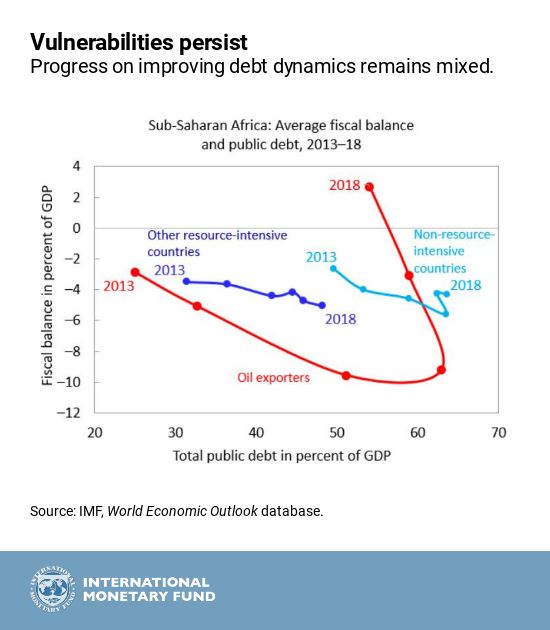

Nine Sub Saharan African Countries Affected By Pw Cs Departure

Apr 29, 2025

Nine Sub Saharan African Countries Affected By Pw Cs Departure

Apr 29, 2025 -

Charges Against Jeffrey Goldberg Benny Johnsons Perspective

Apr 29, 2025

Charges Against Jeffrey Goldberg Benny Johnsons Perspective

Apr 29, 2025 -

Pw C Exits Nine Sub Saharan African Nations A Detailed Look

Apr 29, 2025

Pw C Exits Nine Sub Saharan African Nations A Detailed Look

Apr 29, 2025 -

National Defense Information Benny Johnsons Concerns Regarding Jeffrey Goldberg

Apr 29, 2025

National Defense Information Benny Johnsons Concerns Regarding Jeffrey Goldberg

Apr 29, 2025 -

Pw Cs Withdrawal From Nine Sub Saharan African Countries Implications And Analysis

Apr 29, 2025

Pw Cs Withdrawal From Nine Sub Saharan African Countries Implications And Analysis

Apr 29, 2025