Revised Palantir Stock Price Targets: Analyst Reactions To Market Gains

Table of Contents

Positive Analyst Revisions and Their Rationale

Several analysts have raised their Palantir stock price targets, reflecting a growing optimism surrounding the company's prospects. These upward revisions are primarily driven by a confluence of positive factors:

- Strong Quarterly Earnings: Recent quarters have shown improved financial performance, exceeding expectations and boosting investor confidence. This improved profitability is a key driver of the increased price targets.

- Significant New Contract Wins: Palantir's success in securing substantial new contracts, particularly within the government sector, signifies strong demand for its data analytics platform. These wins demonstrate the company's ability to attract and retain major clients.

- Positive Market Sentiment: The overall positive sentiment surrounding the technology sector and the growing adoption of data analytics solutions have also contributed to the increased price targets for PLTR.

- Improved Guidance: Upward revisions in Palantir's financial guidance for future quarters have further strengthened analyst confidence and fueled price target increases.

Specifically, firms like Goldman Sachs and Morgan Stanley have increased their price targets, citing the aforementioned factors. The reputation of these established analyst firms lends credibility to the positive outlook for Palantir stock. The improved profitability, driven by increased government contracts and expansion into commercial markets, is a significant factor underpinning these positive revisions.

Factors Influencing Revised Palantir Stock Price Predictions

Several macroeconomic and company-specific factors significantly influence revised Palantir stock price predictions:

-

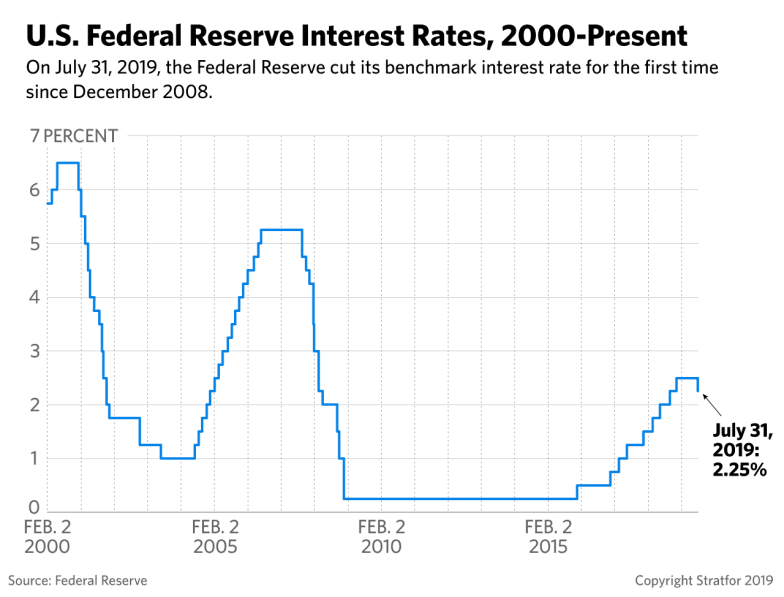

Macroeconomic Conditions: Interest rate hikes and inflationary pressures can impact investor sentiment and risk appetite, potentially affecting Palantir's stock price. Geopolitical instability can also introduce uncertainty into the market.

- Interest Rate Hikes: Higher interest rates can make borrowing more expensive, impacting Palantir's investment plans and potentially slowing revenue growth.

- Inflation: Increased inflation can impact operating costs and consumer spending, affecting overall market demand for Palantir's services.

- Geopolitical Events: Global instability can create uncertainty and volatility in the market, impacting investor confidence in technology stocks like Palantir.

-

Company Performance: Palantir's financial performance—revenue growth, profitability margins, and debt levels—directly impacts analyst sentiment and price targets. Consistent revenue growth and increasing profitability are key indicators of a healthy and growing company.

-

Competitive Landscape: The competitive landscape within the data analytics and artificial intelligence sectors is fiercely contested. Palantir's ability to maintain its competitive edge and differentiate its platform will play a crucial role in its future stock performance.

Analyst Price Targets: A Range of Opinions

Analyst price targets for Palantir stock vary significantly, reflecting the diverse perspectives on the company's future. Some analysts maintain a bullish outlook, while others are more cautious. This divergence stems from differing interpretations of the aforementioned factors.

| Analyst Firm | Price Target | Rating |

|---|---|---|

| Goldman Sachs | $25 | Buy |

| Morgan Stanley | $22 | Overweight |

| JP Morgan Chase | $18 | Neutral |

| Credit Suisse | $15 | Hold |

| (Example Data - Replace with actual data) |

This range of opinions underscores the inherent uncertainty in predicting future stock prices. Investors need to carefully consider these differing perspectives before making investment decisions. The implications for investors are significant, as the wide range suggests a high degree of uncertainty surrounding the future valuation of Palantir.

The Future Outlook for Palantir Stock

The future outlook for Palantir stock is a complex picture, with both positive and negative factors to consider.

-

Growth Drivers: Palantir's key growth drivers include its expanding customer base across both government and commercial sectors, ongoing technological innovation, and its potential to leverage artificial intelligence to enhance its platform's capabilities.

-

Potential Risks & Challenges: The company faces challenges such as intense competition from established tech giants and emerging players, potential regulatory hurdles, and the inherent volatility of the technology market.

A long-term investment strategy may be more appropriate for investors with a higher risk tolerance, while short-term investors might prefer a more cautious approach. Thorough due diligence is vital before making any investment decisions related to PLTR.

Conclusion: Navigating the Revised Palantir Stock Price Targets

Understanding the revised Palantir stock price targets is crucial for making informed investment decisions. The analysis reveals a range of price targets, reflecting the diverse perspectives of analysts on the company's future performance. Macroeconomic factors, company-specific performance, and competitive pressures all play a significant role in shaping these predictions. Conduct thorough research and consider consulting a financial advisor before investing in PLTR. Staying updated on Palantir stock price targets and market analysis is essential for navigating the complexities of this dynamic market.

Featured Posts

-

Young Thugs Back Outside Tracklist Predictions And Potential Release Date

May 10, 2025

Young Thugs Back Outside Tracklist Predictions And Potential Release Date

May 10, 2025 -

Elon Musk Net Worth 2024 The Influence Of Us Economic Policies On Tesla

May 10, 2025

Elon Musk Net Worth 2024 The Influence Of Us Economic Policies On Tesla

May 10, 2025 -

Florida Letartoztatas Noi Mosdo Hasznalata Miatt Transznemu No Esete

May 10, 2025

Florida Letartoztatas Noi Mosdo Hasznalata Miatt Transznemu No Esete

May 10, 2025 -

The Fed And Rate Cuts A Divergence From Global Trends

May 10, 2025

The Fed And Rate Cuts A Divergence From Global Trends

May 10, 2025 -

Dangote Refinerys Potential To Reshape Nigerias Petrol Market

May 10, 2025

Dangote Refinerys Potential To Reshape Nigerias Petrol Market

May 10, 2025