Rise In Japan Trading House Shares: Berkshire's Long-Term Commitment

Table of Contents

Berkshire Hathaway's Investment Strategy in Japan

Berkshire Hathaway's significant investment in Japanese sogo shosha (general trading companies) has sent ripples through the global investment community. Understanding their strategy is key to understanding the rise in Japan trading house shares.

Why Japan Trading Houses?

Berkshire's foray into this sector wasn't arbitrary. Japanese trading houses possess several compelling characteristics that make them attractive to long-term, value-oriented investors like Buffett:

- Diversified Business Models: Sogo shosha are not confined to a single industry. Their vast portfolios span diverse sectors, from energy and metals to food and infrastructure, providing resilience against economic downturns. This diversification mitigates risk and ensures relatively stable earnings streams.

- Extensive Global Networks: These companies boast unparalleled global networks, facilitating international trade and providing access to lucrative opportunities worldwide. Their established relationships and logistics capabilities give them a significant competitive advantage.

- Stable Earnings: Historically, Japanese trading houses have demonstrated consistent profitability, even during periods of economic uncertainty. This stability is a major draw for investors seeking dependable returns.

- Undervalued Assets: Prior to Berkshire's significant investments, many analysts believed that the market undervalued the true worth of these companies, their extensive assets, and their future earning potential.

This long-term value proposition sharply contrasts with short-term trading strategies that focus on quick profits and often overlook the underlying strength and potential of established businesses.

The Impact of Berkshire's Investment

Berkshire's investment wasn't just a financial transaction; it was a powerful endorsement. The "Buffett effect" – the market's positive response to Berkshire's investment choices – was immediately apparent:

- Increase in Share Prices: The announcement of Berkshire's investments triggered a significant rise in the share prices of the targeted trading houses.

- Increased Investor Interest: The move attracted increased attention from international investors, boosting liquidity and further driving up share values.

- Improved Market Perception: Berkshire's involvement legitimized the sector in the eyes of many global investors who previously may have overlooked these companies.

Factors Contributing to the Rise in Japan Trading House Shares

Several factors beyond Berkshire's investment have contributed to the robust growth of Japan trading house shares.

Economic Recovery in Japan

Japan's economic recovery has played a significant role in boosting the performance of trading houses:

- Increased Global Demand: Rising global demand for resources and manufactured goods has directly benefited these companies, which act as vital intermediaries in international trade.

- Improved Domestic Consumption: Stronger domestic consumption within Japan has also boosted their performance in the domestic market.

- Government Policies: Supportive government policies aimed at stimulating economic growth have created a favorable environment for business expansion. Key economic indicators like GDP growth and industrial production figures demonstrate this positive trend.

Global Supply Chain Dynamics

The changing landscape of global supply chains has presented significant opportunities:

- Increased Demand for Resource Management: The volatility and disruptions of recent years have emphasized the importance of efficient resource management, a core competency of Japanese trading houses.

- Logistics Expertise: Their established logistical networks have become even more valuable in navigating supply chain complexities.

- Strategic Partnerships: Trading houses have leveraged their networks to forge strategic partnerships, securing access to critical resources and markets. For instance, their involvement in energy transition projects highlights their adaptability.

Strategic Investments and Acquisitions

Japanese trading houses have actively pursued strategic investments and acquisitions:

- Mergers and Acquisitions: Several trading houses have engaged in strategic mergers and acquisitions to expand their market reach and diversify their offerings.

- Investments in Growth Sectors: They are increasingly investing in high-growth sectors such as renewable energy, technology, and healthcare, positioning themselves for future success. These strategic moves demonstrate a proactive approach to adapting to changing market dynamics.

Long-Term Outlook for Japan Trading House Shares

The future of Japan trading house shares looks promising, although challenges remain.

Continued Growth Potential

Several factors suggest continued growth potential:

- Future Market Opportunities: Ongoing globalization, the need for efficient resource management, and the growing demand for sustainable solutions all present substantial opportunities for growth.

- Potential Risks and Challenges: Geopolitical uncertainties, economic fluctuations, and competition from other players remain potential challenges.

- Sustainability Initiatives: Increasingly, trading houses are focusing on sustainability initiatives, aligning themselves with evolving investor preferences and global ESG (Environmental, Social, and Governance) standards.

Berkshire's Continued Involvement

Berkshire Hathaway's long-term investment philosophy suggests a continued commitment:

- Berkshire's Investment Philosophy: Buffett's focus on long-term value creation aligns perfectly with the characteristics of Japanese trading houses.

- Long-Term Outlook: Berkshire’s perspective is not driven by short-term market fluctuations, suggesting sustained involvement in the sector.

- Potential for Further Investment: Given the positive developments, further investment by Berkshire remains a distinct possibility.

Conclusion

The rise in Japan trading house shares is a testament to the strength and resilience of these companies, driven by a confluence of factors including Berkshire Hathaway's significant investment, a recovering Japanese economy, evolving global supply chains, and the companies' own strategic initiatives. The long-term value proposition of these diversified, globally connected businesses, coupled with positive economic trends, suggests substantial growth potential.

Consider exploring the potential of Japan trading house shares as part of a diversified investment strategy. Learn more about the opportunities in this growing sector and consider researching specific companies to find those best aligned with your investment goals and risk tolerance. Remember to conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Psg Expands Globally New Research Facility Opens In Doha

May 08, 2025

Psg Expands Globally New Research Facility Opens In Doha

May 08, 2025 -

Kenrich Williams Reveals The Thunders Unsung Leadership Figure

May 08, 2025

Kenrich Williams Reveals The Thunders Unsung Leadership Figure

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025 -

Pennsylvania Senator Fetterman Addresses Fitness For Office Concerns

May 08, 2025

Pennsylvania Senator Fetterman Addresses Fitness For Office Concerns

May 08, 2025 -

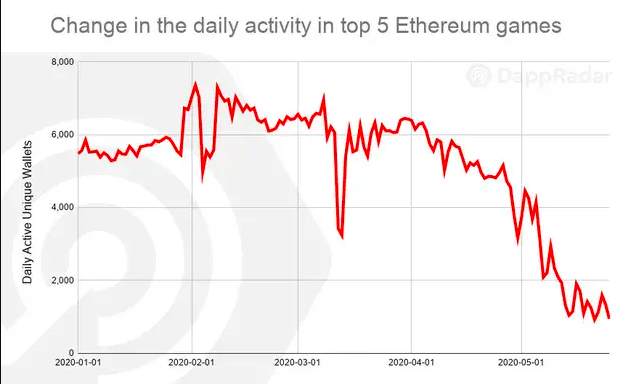

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Latest Posts

-

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Happen

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Happen

May 08, 2025 -

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Suggests So

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Suggests So

May 08, 2025 -

Ethereum Price Analysis 2 700 Target In Sight As Accumulation Phase Concludes

May 08, 2025

Ethereum Price Analysis 2 700 Target In Sight As Accumulation Phase Concludes

May 08, 2025 -

Ethereum Price Prediction Could 2 700 Be Next As Wyckoff Accumulation Ends

May 08, 2025

Ethereum Price Prediction Could 2 700 Be Next As Wyckoff Accumulation Ends

May 08, 2025 -

Trump Medias Crypto Etf Venture A Partnership With Crypto Com

May 08, 2025

Trump Medias Crypto Etf Venture A Partnership With Crypto Com

May 08, 2025