Ryanair Flags Tariff War As Primary Growth Risk; Initiates Share Buyback

Table of Contents

The Looming Threat of a Ryanair Tariff War

The European low-cost airline sector is increasingly competitive. A Ryanair tariff war is a very real possibility, driven by several factors.

Increased Competition and Price Pressures

Ryanair faces stiff competition from established players like easyJet and Wizz Air, as well as newer entrants vying for market share. These competitors are employing aggressive pricing strategies, leading to intense price pressure across various routes. This intense low-cost airline competition significantly impacts Ryanair's profitability and its ability to maintain its dominant market share in European air travel.

- EasyJet: Expanding its route network and leveraging its established brand recognition.

- Wizz Air: Focusing on Eastern European markets and aggressively expanding its fleet.

- New Entrants: Smaller airlines are challenging Ryanair in niche markets, further intensifying the competitive pressure.

A full-blown price war could severely erode Ryanair's margins and force the company to re-evaluate its business model.

Fuel Costs and Other Operational Expenses

The impact of a Ryanair tariff war is exacerbated by fluctuating fuel costs and other airline operational costs. Increased fuel prices directly impact operational expenses, squeezing profit margins even further. Any price reduction to compete in a tariff war would directly hit Ryanair's already thin margins, potentially leading to significant financial losses.

- Fuel hedging strategies: Ryanair's effectiveness in hedging against fuel price volatility will be crucial in mitigating the impact of a price war.

- Staffing costs: Labor costs represent a significant portion of airline expenses, adding another layer of complexity to managing profitability during a price war.

- Airport charges: Varying airport charges across different destinations also impact overall costs.

Impact on Passenger Numbers and Route Optimization

A protracted price war could lead to a decline in Ryanair passenger numbers, as price-sensitive customers may opt for the lowest fares regardless of airline. This may necessitate adjustments to Ryanair's route network, potentially involving flight cancellations on less profitable routes to optimize resource allocation and preserve airline strategy.

Ryanair's Defensive Strategy: The Share Buyback

In response to the potential Ryanair tariff war, Ryanair has initiated a significant share buyback program.

Rationale Behind the Share Buyback

The Ryanair share buyback is a strategic move intended to return value to shareholders and signal confidence in the company's long-term prospects. By repurchasing its own shares, Ryanair reduces the number of outstanding shares, potentially increasing earnings per share (EPS) and boosting shareholder value. This is a common financial strategy employed by companies with strong cash reserves.

- Strong financial position: The share buyback indicates Ryanair's confidence in its financial health and ability to withstand a potential price war.

- Return on investment: Instead of investing in risky expansion projects during uncertain times, the buyback allows Ryanair to allocate capital to improve returns for investors.

- Improved stock price: The buyback can also increase investor confidence and potentially push up the Ryanair stock price.

Signal of Confidence or Sign of Weakness?

The Ryanair share buyback can be interpreted in different ways. While it signals financial strength and a commitment to shareholder value, it could also be seen as a sign that Ryanair anticipates challenging times ahead and is seeking to manage excess cash in the face of uncertainty. Market analysis and investor sentiment surrounding the announcement will be crucial in determining the overall interpretation.

Alternative Strategies Considered (or not):

While a share buyback is the chosen strategy, alternative approaches could have been considered. These might have included increased marketing campaigns to boost passenger numbers or focusing on premium ancillary revenue streams, however the share buyback reflects the current assessment of risk and potential returns.

Long-Term Implications for Ryanair and the Airline Industry

The Ryanair tariff war, and its response, will have long-term implications for both Ryanair and the wider airline industry.

Adaptability and Innovation

Ryanair's ability to adapt to the changing market dynamics will be crucial. This includes embracing airline innovation, such as improving its digital transformation to enhance the customer experience and exploring strategies related to sustainability to appeal to environmentally conscious travellers.

The Future of Low-Cost Air Travel in Europe

The Ryanair tariff war highlights the intense competition and the evolution of the low-cost airlines market in Europe. The outcome will shape the future of European aviation and industry trends, potentially leading to consolidation or further differentiation within the sector.

Conclusion: Navigating the Ryanair Tariff War – Looking Ahead

The threat of a Ryanair tariff war presents a significant challenge to the airline's growth trajectory. Ryanair's response, the share buyback, is a strategic move reflecting its financial position and aimed at enhancing shareholder value amidst uncertainty. The long-term implications for both Ryanair and the low-cost airlines sector in Europe remain to be seen. The Ryanair's response to price competition will be closely watched by investors and industry analysts alike. To stay updated on this evolving situation, we encourage you to follow industry news and financial reports for further in-depth analysis of the Ryanair tariff war and its consequences.

Featured Posts

-

Tadic Fenerbahce De Bir Ilk Mi Tarih Yazacak Mi

May 20, 2025

Tadic Fenerbahce De Bir Ilk Mi Tarih Yazacak Mi

May 20, 2025 -

Schumachers Return Red Bulls Unheeded Warnings And A Futile Attempt

May 20, 2025

Schumachers Return Red Bulls Unheeded Warnings And A Futile Attempt

May 20, 2025 -

Giakoymakis I Los Antzeles Kanei Kroysi

May 20, 2025

Giakoymakis I Los Antzeles Kanei Kroysi

May 20, 2025 -

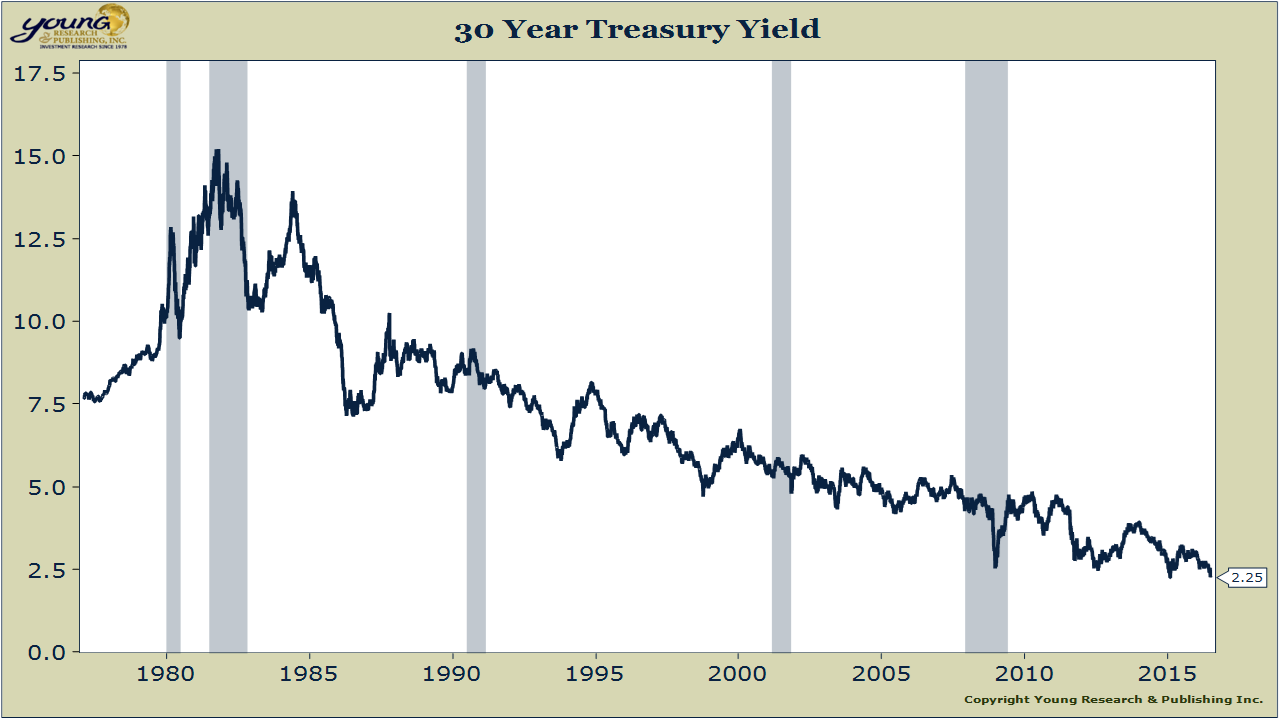

Is The Sell America Trade Resurfacing As 30 Year Treasury Yields Hit 5

May 20, 2025

Is The Sell America Trade Resurfacing As 30 Year Treasury Yields Hit 5

May 20, 2025 -

Fridays D Wave Quantum Qbts Stock Increase A Detailed Look

May 20, 2025

Fridays D Wave Quantum Qbts Stock Increase A Detailed Look

May 20, 2025

Latest Posts

-

Cassis Blackcurrant Recipes From Classic To Creative

May 21, 2025

Cassis Blackcurrant Recipes From Classic To Creative

May 21, 2025 -

La Haye Fouassiere Haute Goulaine Nouveau Service De Navette Gratuite

May 21, 2025

La Haye Fouassiere Haute Goulaine Nouveau Service De Navette Gratuite

May 21, 2025 -

Le Port De La Croix Catholique Au College De Clisson Un Enjeu Pour La Laicite

May 21, 2025

Le Port De La Croix Catholique Au College De Clisson Un Enjeu Pour La Laicite

May 21, 2025 -

Cassis Blackcurrant From Berry To Bottle A Journey

May 21, 2025

Cassis Blackcurrant From Berry To Bottle A Journey

May 21, 2025 -

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025