Securing A Place In The Sun: Tips For Overseas Property Investment

Table of Contents

Due Diligence: Researching Your Chosen Location

Before investing your hard-earned money, thorough due diligence is paramount. This involves meticulous research across several key areas to ensure your overseas property investment aligns with your goals and minimizes potential risks.

Market Research: Analyzing Property Market Trends

Understanding the property market dynamics of your target location is critical. This involves analyzing several key indicators:

- Population Growth: A growing population often translates to increased demand for housing, potentially leading to higher property values.

- Tourism: Areas with thriving tourism sectors often experience strong rental yields due to high occupancy rates. Consider the seasonality of tourism when assessing potential returns.

- Infrastructure Development: Ongoing infrastructure projects like new roads, public transport, and utilities can significantly boost property values in the long term.

- Economic Stability: A stable and growing economy is crucial for maintaining property values and attracting investment. Research the country’s GDP growth, inflation rates, and overall economic outlook.

Use reliable sources for your analysis, including:

- Government statistics and reports from official real estate agencies.

- Reputable real estate market analysis reports from international firms.

- Local expert opinions from real estate professionals and economists familiar with the region.

Legal and Regulatory Framework: Understanding the Legal Landscape

Navigating the legal aspects of overseas property investment is crucial. Each country has its unique laws and regulations governing property ownership. Be sure to thoroughly research:

- Property Taxes: Understand the local property tax rates and how they are calculated. These can vary significantly from one country to another.

- Inheritance Laws: Clarify the inheritance laws to understand how property ownership is transferred upon death.

- Restrictions on Foreign Ownership: Some countries may have restrictions or limitations on foreign ownership of property. Understand any such limitations that might apply to you.

Seek expert advice:

- Consult with a qualified local lawyer specializing in real estate transactions in your chosen country. They can provide crucial legal guidance and ensure you comply with all local regulations.

Local Lifestyle and Culture: More Than Just Bricks and Mortar

Beyond the financial aspects, consider the local lifestyle and culture. This is a significant factor influencing your long-term satisfaction with your investment:

- Language Barriers: Assess any potential language barriers and how they might affect your communication with local residents, professionals, and authorities.

- Healthcare Access: Research the quality and accessibility of healthcare in the region.

- Social Integration: Consider how easily you can integrate into the local community.

Visiting the location before making a purchase is highly recommended. This firsthand experience will provide invaluable insights into the area's character and suitability for your needs.

Financing Your Overseas Property Investment

Securing the necessary financing is a crucial step in your overseas property investment journey. This involves careful planning and consideration of various financial factors.

Securing a Mortgage: Exploring Your Options

Obtaining a mortgage for an overseas property can be more complex than a domestic mortgage. Explore the options available to foreign buyers:

- Interest Rates and Terms: Compare interest rates and loan terms offered by different lenders, both in your home country and in the country where you're buying the property.

- Documentation Requirements: Understand the required documentation for a foreign buyer's mortgage application. This is usually more extensive than a domestic application.

Managing Currency Exchange: Mitigating Risk

Currency fluctuations can significantly impact the overall cost of your overseas property investment. It’s crucial to understand and manage these risks:

- Currency Exchange Services: Use a reputable currency exchange service to convert your funds with favorable exchange rates.

- Hedging Strategies: Explore hedging strategies, such as forward contracts or options, to mitigate the risk of unfavorable currency movements.

Budgeting and Financial Planning: A Realistic Approach

Developing a comprehensive budget is essential. Account for all potential costs:

- Purchase Price: The primary cost, naturally.

- Legal Fees: Include costs for lawyers, notaries, and other legal professionals.

- Taxes: Factor in all applicable taxes, including stamp duty, property taxes, and any other relevant taxes.

- Ongoing Maintenance: Budget for ongoing maintenance and repairs.

- Rental Income (if applicable): If you plan to rent out the property, account for potential rental income.

- Capital Appreciation (potential): While not guaranteed, consider the potential for capital appreciation.

- Emergency Fund: Always have a buffer for unexpected expenses.

Finding the Right Property and Making the Purchase

Once you've completed your research and secured financing, it's time to find and purchase your property.

Working with Local Real Estate Agents: Expert Guidance

Working with a local real estate agent is highly recommended:

- Licensing and Reputation: Ensure your agent is licensed and has a good reputation within the local market.

- Fees and Commission: Clarify the agent's fees and commission structure upfront to avoid any surprises.

Negotiating the Purchase Price: A Skillful Approach

Negotiating the purchase price requires skill and preparation:

- Market Value Research: Thoroughly research comparable properties to establish a fair market value.

- Negotiation Tactics: Be aware of the cultural nuances of negotiation in your target country. Be prepared to walk away if the price is not right.

Completing the Purchase: A Meticulous Process

The final stage involves completing the purchase:

- Legal Document Review: Thoroughly review all legal documents with your lawyer before signing any contracts.

- Secure Payments: Ensure all payments are made securely and according to the agreed-upon terms.

Conclusion

Securing a place in the sun through successful overseas property investment requires a multifaceted approach. Thorough research into the chosen location, secure financing, and a meticulously planned purchase process are critical elements. Remember, due diligence, professional advice, and realistic financial planning are paramount. By following these tips, you can significantly increase your chances of a rewarding overseas property investment experience. Begin your journey into overseas property investment today – take the first step towards securing your place in the sun with careful overseas property investment planning.

Featured Posts

-

Is Fortnite Offline Checking Server Status And Update 34 21

May 03, 2025

Is Fortnite Offline Checking Server Status And Update 34 21

May 03, 2025 -

Freedom Flotilla Coalition Alleges Drone Attack Near Maltese Territorial Waters

May 03, 2025

Freedom Flotilla Coalition Alleges Drone Attack Near Maltese Territorial Waters

May 03, 2025 -

Newsround Airtimes Bbc Two Hd Channel

May 03, 2025

Newsround Airtimes Bbc Two Hd Channel

May 03, 2025 -

Gobierno Entrega Siete Vehiculos Al Sistema Penitenciario

May 03, 2025

Gobierno Entrega Siete Vehiculos Al Sistema Penitenciario

May 03, 2025 -

Thdhyr Khtyr Mn Jw 24 Slah Mghamratk Thdd Wdek

May 03, 2025

Thdhyr Khtyr Mn Jw 24 Slah Mghamratk Thdd Wdek

May 03, 2025

Latest Posts

-

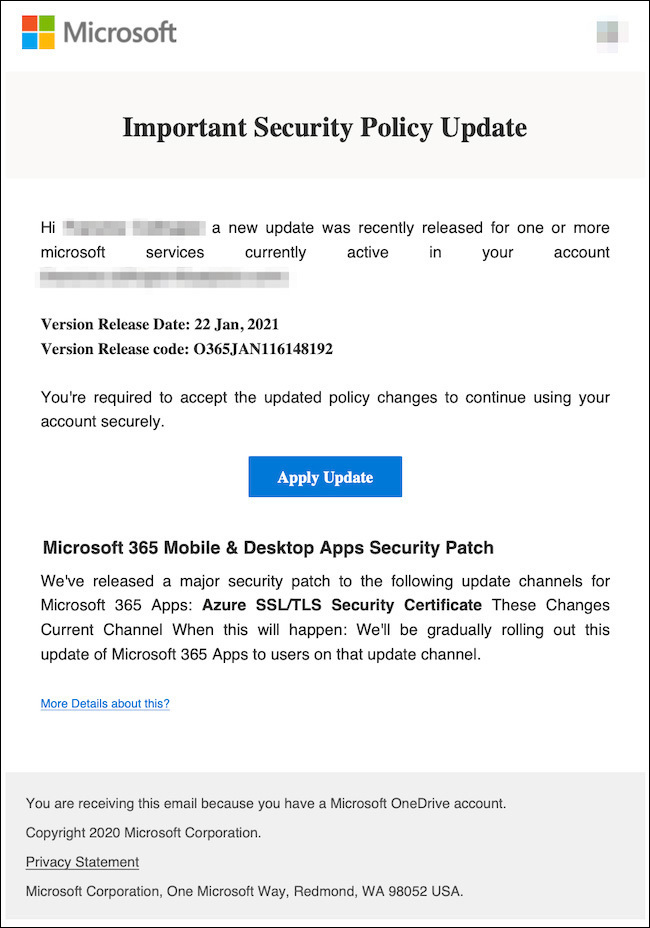

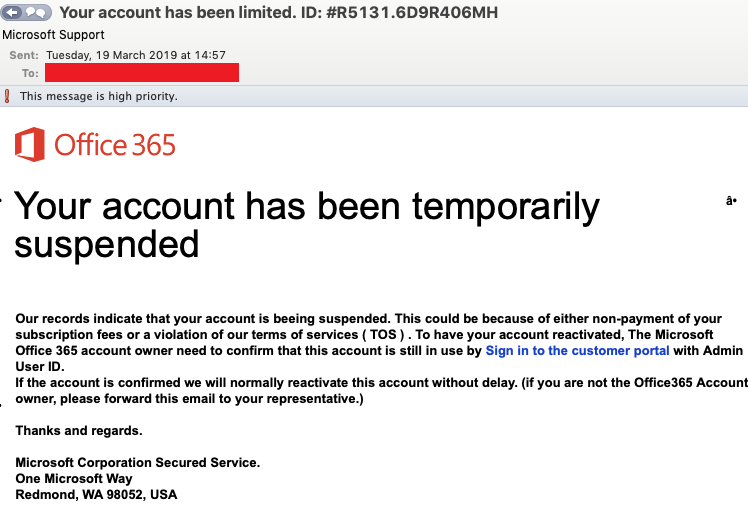

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

May 04, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

May 04, 2025 -

Millions Made From Executive Office365 Account Hacks Federal Investigation

May 04, 2025

Millions Made From Executive Office365 Account Hacks Federal Investigation

May 04, 2025 -

The Thunderbolts Initiative Can Marvel Revitalize Its Cinematic Universe

May 04, 2025

The Thunderbolts Initiative Can Marvel Revitalize Its Cinematic Universe

May 04, 2025 -

Marvels Thunderbolts A Critical Look At The Mcus Latest Offering

May 04, 2025

Marvels Thunderbolts A Critical Look At The Mcus Latest Offering

May 04, 2025 -

Solid U S Job Numbers For April 177 000 Jobs Added 4 2 Unemployment

May 04, 2025

Solid U S Job Numbers For April 177 000 Jobs Added 4 2 Unemployment

May 04, 2025