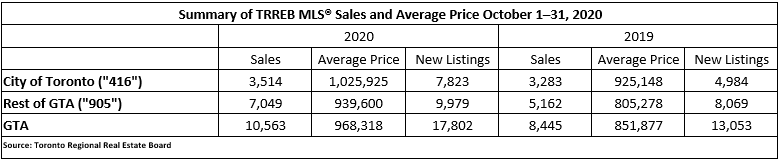

Sharp Decline In Toronto Home Sales: 23% Year-Over-Year Decrease, 4% Price Drop

Table of Contents

Factors Contributing to the Decline in Toronto Home Sales

Several interconnected factors have contributed to the recent slump in Toronto home sales. Understanding these elements is crucial for navigating the current market landscape.

Rising Interest Rates and Mortgage Costs

The most significant factor impacting Toronto home sales is the sharp increase in interest rates. The Bank of Canada's aggressive interest rate hikes have drastically reduced affordability for many potential homebuyers. For example, a 1% increase in interest rates can significantly increase monthly mortgage payments, making homeownership unattainable for some. This affects both first-time homebuyers entering the market and those looking to upgrade to larger properties.

- Increased borrowing costs: Higher interest rates translate directly into higher borrowing costs, making mortgages more expensive.

- Reduced affordability: The increased cost of borrowing significantly reduces the number of homes buyers can afford.

- Impact on buyer demand: Reduced affordability leads to decreased demand, directly contributing to the decline in Toronto home sales.

Economic Uncertainty and Inflation

Persistent inflation and growing economic uncertainty have also played a significant role in dampening buyer enthusiasm for Toronto real estate. Inflation erodes purchasing power, making consumers hesitant to commit to large financial investments like home purchases. Concerns about potential job losses or an economic slowdown further contribute to this hesitancy.

- Inflationary pressures: Rising inflation reduces real income, impacting consumer confidence and ability to afford homes.

- Economic uncertainty: Fear of job losses or economic recession discourages major purchases like buying a home.

- Reduced consumer confidence: Negative economic outlook translates into lower demand for Toronto properties.

Increased Inventory Levels

The increased supply of homes on the market has also shifted the dynamics of the Toronto real estate landscape. This increase in inventory represents a transition from a seller's market to a buyer's market, giving buyers more leverage in negotiations. Sellers now face increased competition and may need to adjust their pricing strategies to attract buyers.

- Increased supply: More homes available for sale provide buyers with more options.

- Shift in market dynamics: The market is shifting from favouring sellers to favouring buyers.

- Increased buyer leverage: Buyers have more negotiating power due to increased inventory.

Impact of the Decline on the Toronto Housing Market

The decline in Toronto home sales has had a noticeable impact on the overall housing market, leading to significant adjustments.

Price Adjustments and Market Corrections

The 4% price drop represents a significant correction after years of substantial price growth. This adjustment is particularly noticeable in certain neighborhoods, with some areas experiencing more significant price reductions than others. The impact varies depending on property type, with condos, townhouses, and detached homes all experiencing different levels of price adjustment.

- Price reductions: A significant percentage decrease in average home prices across Toronto.

- Market correction: The current market is experiencing a necessary adjustment after a period of rapid growth.

- Neighborhood-specific analysis: Price changes vary significantly based on location and property type.

Implications for Buyers and Sellers

The current market presents both opportunities and challenges for buyers and sellers. Buyers now have more negotiating power and a wider selection of properties, creating favorable conditions. However, sellers need to adapt to the changed market conditions, adjusting their pricing and marketing strategies accordingly.

- Buyer opportunities: Increased inventory and price reductions create advantageous conditions for buyers.

- Seller challenges: Sellers need to be realistic with their pricing and adapt to a more competitive market.

- Market navigation strategies: Both buyers and sellers should seek professional advice to navigate the changing market.

Conclusion: Navigating the Changing Landscape of Toronto Home Sales

The sharp decline in Toronto home sales, a 23% year-over-year decrease accompanied by a 4% price drop, is driven by rising interest rates, economic uncertainty, and increased inventory. This shift signifies a market correction after a period of sustained growth. While challenges exist, the current market presents opportunities for astute buyers. Understanding these factors is crucial for successfully navigating this evolving real estate landscape. Stay updated on the latest trends in Toronto home sales by subscribing to our newsletter, or contact a realtor today to discuss your options in this dynamic Toronto real estate market.

Featured Posts

-

The Next Pope Examining The Candidate Dossiers

May 08, 2025

The Next Pope Examining The Candidate Dossiers

May 08, 2025 -

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025 -

Inter Milan Stuns Bayern Munich In Champions League Quarterfinal

May 08, 2025

Inter Milan Stuns Bayern Munich In Champions League Quarterfinal

May 08, 2025 -

Arsenal I Ps Zh Rezultaty Vsekh Evrokubkovykh Vstrech

May 08, 2025

Arsenal I Ps Zh Rezultaty Vsekh Evrokubkovykh Vstrech

May 08, 2025 -

Second Jet Lost In Sea Us Navy Faces Growing Concerns After Truman Incident

May 08, 2025

Second Jet Lost In Sea Us Navy Faces Growing Concerns After Truman Incident

May 08, 2025

Latest Posts

-

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025 -

Bitcoin In Buguenkue Durumu Fiyat Hacim Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Hacim Ve Gelecek Tahminleri

May 08, 2025 -

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025 -

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025