Heineken Tops Revenue Expectations, Reaffirms Outlook Despite Tariff Worries

Table of Contents

Heineken's Revenue Surpasses Forecasts

Heineken's recent financial report paints a picture of robust growth, significantly surpassing initial revenue forecasts. This success is a testament to the company's effective strategies and adaptability in a challenging market.

Detailed Financial Performance

- Revenue Increase: Heineken reported a [Insert Percentage]% increase in revenue compared to the same period last year, reaching [Insert Exact Revenue Figure] in [Insert Time Period, e.g., Q2 2024]. This represents a substantial improvement over previous projections.

- Regional Breakdown: Strong performance was observed across various regions. Asia-Pacific saw a [Insert Percentage]% increase, driven by [mention specific factors]. Europe also experienced notable growth of [Insert Percentage]%, fueled by [mention specific factors]. The Americas showed a [Insert Percentage]% increase, attributable to [mention specific factors]. (Note: Replace bracketed information with actual data. Consider adding a bar chart visualizing this regional breakdown.)

- Key Contributing Factors: Several factors contributed to this impressive performance, including:

- Successful launches of new premium products.

- Increased market share in key regions through targeted marketing campaigns.

- Effective pricing strategies and cost management.

- Expansion into new markets.

Impact of Premiumization Strategy

Heineken's focus on its premium beer portfolio has been instrumental in driving revenue growth. The company's strategy of "premiumization" involves offering higher-priced, higher-quality products to a discerning consumer base.

- Key Premium Brands: Brands such as [List key premium brands and their contribution to overall revenue] have been particularly successful. [Provide specific data on the performance of these brands].

- Market-Specific Success: The premiumization strategy has proven particularly effective in [mention specific markets] where consumers are willing to pay a premium for high-quality beer experiences. (Note: Include data to support this claim.)

Reaffirmation of Outlook Despite Tariff Concerns

While Heineken has celebrated strong financial results, the company acknowledges the challenges presented by global tariffs and trade uncertainties.

Analysis of Tariff Impacts

Heineken faces potential disruptions from [Specify types of tariffs, e.g., import duties on raw materials, export tariffs on finished goods]. These tariffs could potentially affect:

- Profitability: Increased costs associated with tariffs might reduce profit margins.

- Market Access: Tariffs could make Heineken products less competitive in certain markets.

However, Heineken has implemented strategies to mitigate these risks:

- Supply Chain Diversification: Sourcing raw materials from diverse geographical locations to reduce reliance on tariff-affected regions.

- Price Adjustments: Strategic price adjustments in specific markets to offset tariff-related cost increases.

- Lobbying Efforts: Engaging in proactive lobbying efforts to advocate for fair trade policies.

Maintaining Positive Outlook

Despite these challenges, Heineken remains optimistic about its future outlook. This positive outlook is based on:

- Strong Brand Recognition: Heineken’s globally recognized brand enjoys high levels of consumer trust and loyalty.

- Efficient Supply Chain: The company's efficient supply chain network enables it to adapt to market changes effectively.

- Effective Cost Management: Strict cost control measures help maintain profitability even amidst rising costs.

- Future Expansion Plans: Heineken continues to invest in expansion initiatives, exploring new markets and product innovations.

Market Share and Competitive Landscape

Heineken maintains a strong position in the global beer market.

Heineken's Position in the Global Beer Market

Heineken holds approximately [Insert Market Share Percentage]% of the global beer market, placing it among the leading players. Its main competitors include [List major competitors, including their market share if available].

- Competitive Advantages: Heineken’s competitive advantages include its strong brand recognition, extensive distribution network, and innovative product portfolio.

- Competitive Disadvantages: The company faces competition from both large multinational breweries and local craft brewers, requiring continuous innovation and adaptation.

Growth Strategies for Maintaining Market Share

Heineken employs several strategies to maintain and expand its market share:

- Product Innovation: Continuously launching new products and variations to meet evolving consumer preferences.

- Targeted Marketing Campaigns: Employing effective marketing and advertising strategies to reach specific target audiences.

- Strategic Acquisitions: Exploring strategic acquisitions to expand into new markets or acquire complementary brands.

- Sustainability Initiatives: Investing in sustainable practices and promoting responsible consumption to enhance brand image and appeal to environmentally conscious consumers.

Investor Response and Stock Performance

The announcement of Heineken’s strong Heineken Revenue figures has been met with positive reactions from investors.

Reaction to Financial Results

- Stock Price Movement: The stock price of Heineken has [Describe the impact on the stock price, e.g., increased by X% following the announcement].

- Analyst Ratings: Financial analysts have generally expressed [Describe the general sentiment of analysts, e.g., positive views on Heineken's future prospects].

- Investment Implications: The strong performance signals continued potential for long-term growth and investment in Heineken. [Include relevant quotes from analysts if available].

Conclusion

Heineken's exceeding revenue expectations demonstrate the resilience and adaptability of the brand in a challenging economic environment. The company’s strong performance, driven by a premiumization strategy and effective risk mitigation plans related to tariff concerns, indicates a positive outlook for future growth. Heineken’s consistent focus on innovation, market share expansion, and responsible practices positions it for continued success. To stay informed about future Heineken Revenue reports and company announcements, subscribe to our newsletter, follow us on social media, or visit the Heineken investor relations website for detailed financial information. Understanding the intricacies of Heineken revenue streams is key to grasping the company’s overall market position and future prospects.

Featured Posts

-

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

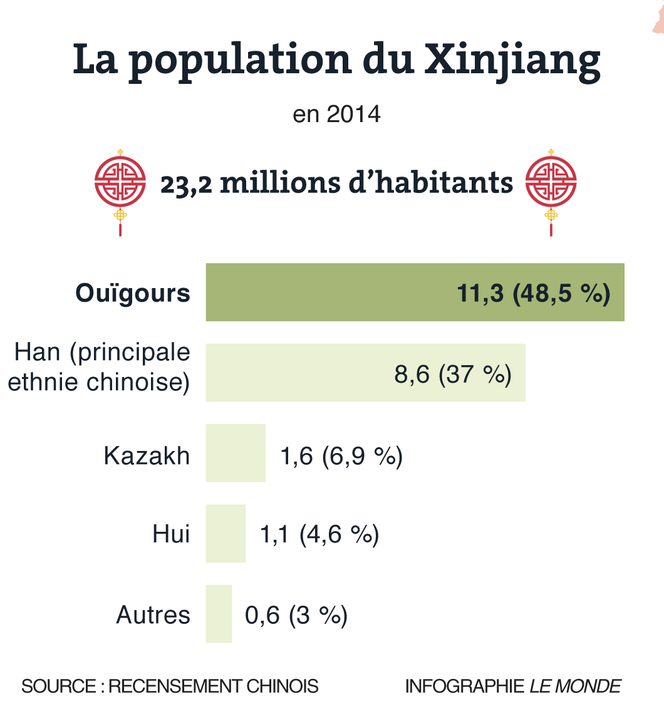

Chine La Repression Des Dissidents Francais

May 24, 2025

Chine La Repression Des Dissidents Francais

May 24, 2025 -

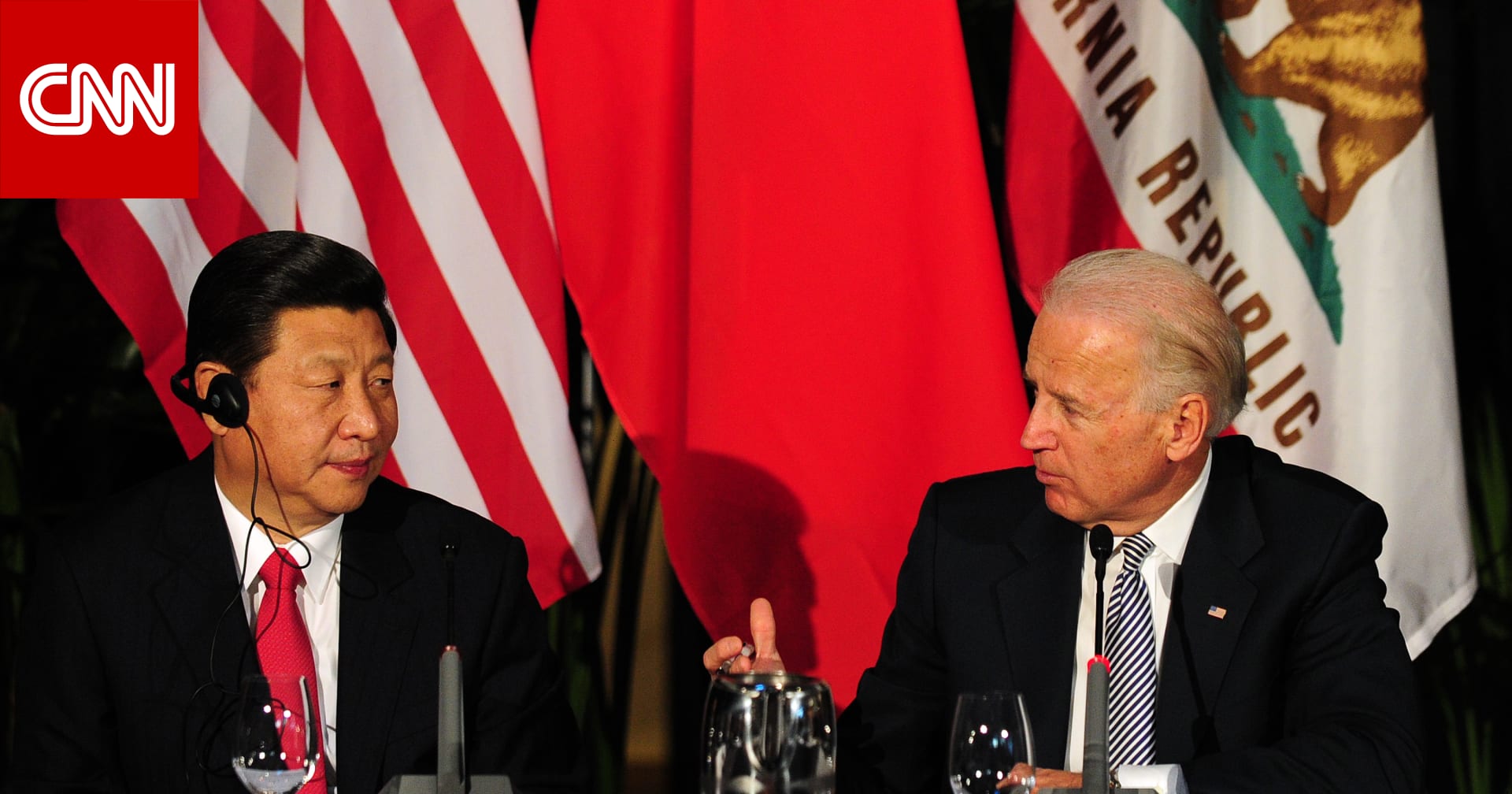

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Alalmany

May 24, 2025

Tathyr Atfaq Washntn Wbkyn Ela Mwshr Daks Alalmany

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

The Alix Earle Effect How A Dancing With The Stars Contestant Became A Marketing Mastermind For Gen Z

May 24, 2025

The Alix Earle Effect How A Dancing With The Stars Contestant Became A Marketing Mastermind For Gen Z

May 24, 2025

Latest Posts

-

Understanding The Debate Surrounding Thames Water Executive Bonuses

May 24, 2025

Understanding The Debate Surrounding Thames Water Executive Bonuses

May 24, 2025 -

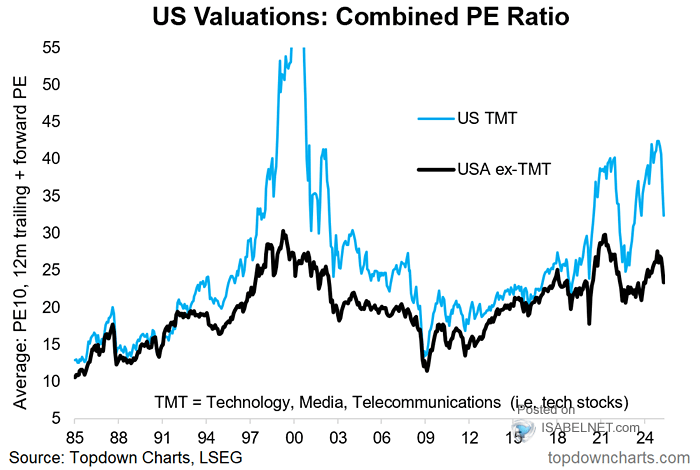

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

May 24, 2025

Bof A Reassures Investors Why Current Stock Market Valuations Arent A Threat

May 24, 2025 -

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025

Universal Vs Disney A 7 Billion Theme Park Showdown

May 24, 2025 -

The Thames Water Bonus Controversy Examining The Facts

May 24, 2025

The Thames Water Bonus Controversy Examining The Facts

May 24, 2025 -

Universals 7 Billion Investment Reigniting The Theme Park Arms Race

May 24, 2025

Universals 7 Billion Investment Reigniting The Theme Park Arms Race

May 24, 2025