Singapore's DBS Bank: Major Polluters Need Time For Green Transition

Table of Contents

The Challenges Faced by Major Polluters in Achieving Rapid Decarbonization

Rapid decarbonization presents immense challenges for major polluters. The transition away from fossil fuels requires substantial capital expenditure, far beyond the reach of many businesses without significant financial support and a realistic timeframe. This is especially true for heavy industries like steel manufacturing, cement production, and aviation, where established technologies and infrastructure are deeply reliant on fossil fuels.

- High upfront investment costs for renewable energy infrastructure: Shifting to renewable energy sources necessitates massive investments in new infrastructure, including solar farms, wind turbines, and smart grids. This presents a significant financial hurdle for many businesses.

- Technological hurdles in certain sectors (e.g., heavy industry, aviation): The technology to completely decarbonize some sectors is still under development. Finding viable, cost-effective alternatives for processes like steelmaking or long-haul aviation remains a key challenge.

- Risk of stranded assets and economic disruption: A rapid shift could lead to the devaluation of existing assets reliant on fossil fuels, causing significant economic disruption and potential job losses.

- Need for retraining and reskilling programs for workers: The transition requires a workforce equipped with the skills to operate and maintain new technologies, necessitating investment in education and retraining programs.

Decarbonization strategies must consider the economic impact of climate change and aim for a "just transition," ensuring that the shift to a greener economy is equitable and doesn't leave workers behind. The complexities involved in achieving rapid decarbonization highlight the need for a more pragmatic and phased approach.

DBS Bank's Role in Facilitating a Responsible Green Transition

DBS Bank has actively pursued sustainable finance initiatives, recognizing its responsibility in the fight against climate change. Their efforts include ESG (Environmental, Social, and Governance) investing, green bonds, and impact investing. However, their role extends beyond simply funding green projects. They must engage actively with major polluters to guide them through a responsible transition.

- Examples of DBS Bank's green financing projects: DBS Bank has funded various renewable energy projects and sustainable infrastructure initiatives across Southeast Asia. These projects demonstrate their commitment to financing the green transition.

- Analysis of their carbon footprint reduction targets and progress: Evaluating the bank's own carbon footprint reduction targets and their progress toward achieving these targets is crucial to assessing their overall commitment.

- Discussion of their engagement with clients on sustainability issues: DBS Bank's proactive engagement with clients to encourage sustainable practices and support their decarbonization efforts is vital for a successful transition.

- Evaluation of their support for renewable energy projects: Analyzing the scale and scope of their support for renewable energy projects helps determine their contribution to the broader shift towards renewable energy sources.

DBS Bank's approach to ESG lending and their commitment to corporate social responsibility are critical aspects of their efforts to drive a responsible green transition.

The Importance of a Phased Approach and Realistic Timeframes

Imposing overly aggressive decarbonization targets without considering the economic realities could lead to unintended consequences. A phased approach, incorporating realistic climate targets, is crucial. This allows businesses to invest strategically, develop necessary technologies, and adapt to changing market conditions without causing significant economic disruption. Collaboration is key; governments, businesses, and financial institutions like DBS Bank must work together to create supportive policies, incentives, and financing mechanisms.

- Arguments against rapid decarbonization targets: Rapid targets can lead to market instability, job losses, and potentially hinder the overall progress toward a sustainable future.

- Examples of successful phased transition strategies in other industries: Analyzing successful phased transition strategies in other sectors can provide valuable insights and best practices for decarbonization efforts.

- The role of government incentives and regulations: Government policies, such as carbon pricing mechanisms and tax incentives for green technologies, play a vital role in encouraging businesses to invest in decarbonization.

- The importance of international cooperation: Global collaboration is essential to address climate change effectively, as it requires coordinated efforts across borders.

Sustainable development goals require a holistic, long-term strategy, not just immediate, drastic changes that may prove counterproductive.

Conclusion: Supporting a Sustainable Future Through Responsible Green Transition Strategies

The green transition is a complex undertaking requiring a balanced and gradual approach. Major polluters need realistic timeframes and sufficient support to successfully decarbonize their operations. DBS Bank plays a crucial role in facilitating this process through responsible financing and engagement strategies. By focusing on sustainable business practices, supporting a just transition, and promoting responsible investing, DBS Bank can help shape a greener future for Southeast Asia and beyond. Learn more about how DBS Bank is supporting the green transition for major polluters and explore sustainable investment opportunities with them. Together, we can build a more sustainable and prosperous future.

Featured Posts

-

Collymore Calls For Artetas Accountability Arsenal News

May 08, 2025

Collymore Calls For Artetas Accountability Arsenal News

May 08, 2025 -

Darkseids Legion Attacks Superman Dc Comics July 2025 Solicits Revealed

May 08, 2025

Darkseids Legion Attacks Superman Dc Comics July 2025 Solicits Revealed

May 08, 2025 -

Finding Reliable Information In The World Of Cryptocurrency News

May 08, 2025

Finding Reliable Information In The World Of Cryptocurrency News

May 08, 2025 -

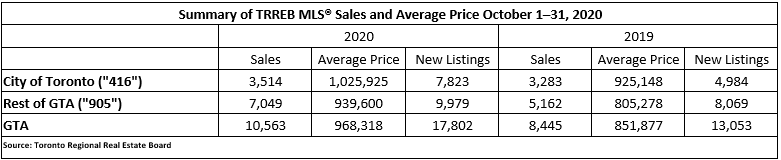

Sharp Decline In Toronto Home Sales 23 Year Over Year Decrease 4 Price Drop

May 08, 2025

Sharp Decline In Toronto Home Sales 23 Year Over Year Decrease 4 Price Drop

May 08, 2025 -

Lig 1 Lyon Psg Macini Canli Yayin Ile Izlemenin Yollari

May 08, 2025

Lig 1 Lyon Psg Macini Canli Yayin Ile Izlemenin Yollari

May 08, 2025

Latest Posts

-

Could Xrp Hit 5 Evaluating The 2025 Price Target For Xrp

May 08, 2025

Could Xrp Hit 5 Evaluating The 2025 Price Target For Xrp

May 08, 2025 -

Ripples Xrp Surges Analysis Of The Presidents Trump Related Article

May 08, 2025

Ripples Xrp Surges Analysis Of The Presidents Trump Related Article

May 08, 2025 -

400 Xrp Price Increase Investment Opportunities And Potential Risks

May 08, 2025

400 Xrp Price Increase Investment Opportunities And Potential Risks

May 08, 2025 -

Exploring The Possibility Of Xrp Reaching 5 In 2025

May 08, 2025

Exploring The Possibility Of Xrp Reaching 5 In 2025

May 08, 2025 -

Xrp Up 400 In Three Months Is It Time To Invest Risks And Rewards

May 08, 2025

Xrp Up 400 In Three Months Is It Time To Invest Risks And Rewards

May 08, 2025