Steady Start For DAX: Frankfurt Stock Market Opens After Record High

Table of Contents

DAX Opens Steady After Record-Breaking Week

Last week witnessed the DAX reach unprecedented heights, setting a new record high. This significant milestone has naturally created a sense of anticipation and some degree of cautious optimism amongst investors. The psychological impact of such a record is undeniable, influencing current trading behavior and risk appetite.

Today's opening values paint a picture of relative stability. Let's look at the specifics:

- Specific opening value of the DAX: (Insert actual opening value here – replace with the real-time DAX opening value when publishing)

- Percentage change from the previous day's close: (Insert percentage change here – replace with the real-time data)

- Comparison to the record high achieved the previous week: (Insert comparison – showing the difference between today's opening and last week's high)

- Significant early-morning movers within the DAX 30: (List 2-3 companies with significant early movements and a brief reason if known, e.g., "Volkswagen showed early strength, likely boosted by positive news regarding electric vehicle sales.")

Factors Influencing the DAX's Performance

Several macroeconomic factors are currently influencing the DAX's performance. Understanding these elements is crucial for assessing the index's future direction. These factors include:

- Inflation rates in Germany and the Eurozone: High inflation continues to be a significant concern, impacting consumer spending and business investment. (Add specific data on current inflation rates). The ECB's response to inflation will heavily influence the DAX.

- Recent interest rate decisions by the European Central Bank (ECB): The ECB's recent interest rate hikes aim to curb inflation, but these actions can also slow economic growth and impact corporate profitability, thus affecting DAX performance. (Include details about the most recent interest rate decision and its expected impact).

- Performance of key sectors within the DAX (e.g., automotive, technology, financials): The automotive sector, a major component of the DAX, is facing challenges related to supply chain disruptions and the global chip shortage. The technology sector's performance is linked to global economic growth and investor confidence. The financial sector is sensitive to interest rate changes. (Provide specific data on the performance of these key sectors).

- Impact of global supply chain issues: Ongoing supply chain disruptions continue to pose challenges to German businesses, leading to production delays and increased costs. This is a significant factor impacting the DAX.

- Influence of any major political developments in Germany or Europe: Political stability and policy decisions within Germany and the EU have a significant bearing on investor sentiment and the DAX. (Mention any relevant political developments impacting the market).

Investor Sentiment and Trading Activity

Gauging investor sentiment is crucial for understanding the DAX's current trajectory. Analyzing trading volume and volatility provides valuable insights into investor confidence levels.

- Trading volume compared to recent averages: (Insert data comparing current trading volume to recent averages. High volume suggests strong investor interest, while low volume may indicate indecision).

- Volatility levels within the DAX: (Provide volatility data. High volatility usually signifies uncertainty, while low volatility implies stability).

- Any notable increase or decrease in buying or selling pressure: (Discuss observable trends in buying or selling activity. Increased buying pressure is generally positive, while increased selling pressure indicates negative sentiment).

- Analyst comments and predictions regarding the DAX: (Summarize the consensus view from leading financial analysts regarding the DAX's short-term and long-term prospects).

Conclusion

The DAX opened steadily today, demonstrating resilience despite reaching record highs last week. However, several factors will continue to shape its performance. Macroeconomic conditions, particularly inflation and ECB interest rate decisions, remain key influencers. Investor sentiment, as reflected in trading volume and volatility, will also play a significant role. Individual company performances within the DAX 30, especially in key sectors like automotive and technology, will contribute to the overall index movement.

Call to Action: Stay informed on the ongoing developments of the DAX and the Frankfurt Stock Market. For continuous updates and in-depth analysis on the DAX, [link to relevant resource/website]. Keep a close watch on the DAX for further insights into German and European economic trends. Understanding the DAX is key to understanding the health of a significant portion of the European economy.

Featured Posts

-

Onrust Op Wall Street De Impact Op De Nederlandse Aex Index

May 25, 2025

Onrust Op Wall Street De Impact Op De Nederlandse Aex Index

May 25, 2025 -

News Corps Business Units Undervalued Assets Or Fair Market Price

May 25, 2025

News Corps Business Units Undervalued Assets Or Fair Market Price

May 25, 2025 -

Dax Surge Will A Wall Street Rebound Dampen The Celebrations

May 25, 2025

Dax Surge Will A Wall Street Rebound Dampen The Celebrations

May 25, 2025 -

Konchita Vurst Prorokuye Peremozhtsiv Yevrobachennya 2025 Prognoz Unian

May 25, 2025

Konchita Vurst Prorokuye Peremozhtsiv Yevrobachennya 2025 Prognoz Unian

May 25, 2025 -

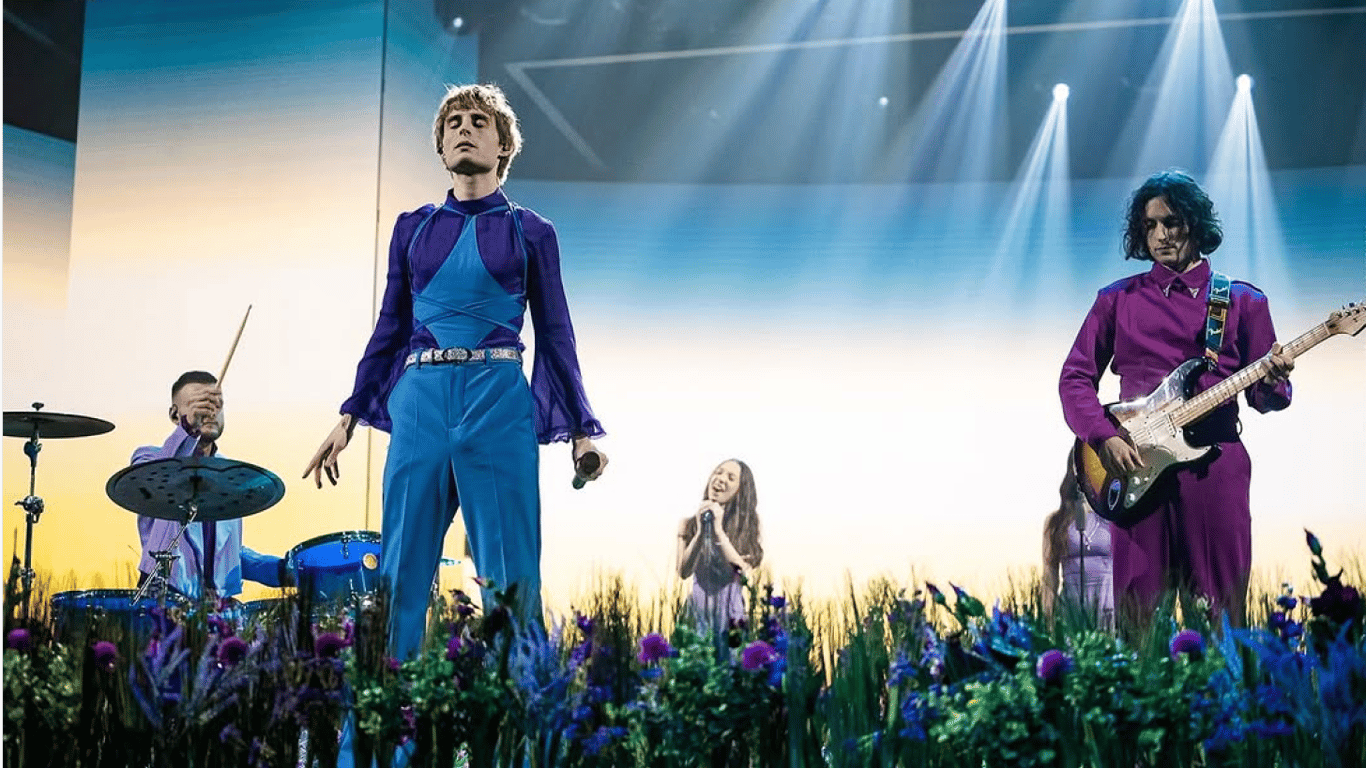

Conchita Wurst And Jj To Perform Together At Esc 2025 Eurovision Village

May 25, 2025

Conchita Wurst And Jj To Perform Together At Esc 2025 Eurovision Village

May 25, 2025

Latest Posts

-

Le Francais Aujourd Hui Analyse De Mathieu Avanzi

May 25, 2025

Le Francais Aujourd Hui Analyse De Mathieu Avanzi

May 25, 2025 -

Mathieu Avanzi Redefinir L Enseignement Et L Usage Du Francais

May 25, 2025

Mathieu Avanzi Redefinir L Enseignement Et L Usage Du Francais

May 25, 2025 -

2nd Edition Best Of Bangladesh In Europe Showcases Collaboration And Future Growth Opportunities

May 25, 2025

2nd Edition Best Of Bangladesh In Europe Showcases Collaboration And Future Growth Opportunities

May 25, 2025 -

Over 1 500 To Attend Best Of Bangladesh Event In The Netherlands

May 25, 2025

Over 1 500 To Attend Best Of Bangladesh Event In The Netherlands

May 25, 2025 -

L Enseignement Du Francais Selon Mathieu Avanzi Au Dela Des Classes

May 25, 2025

L Enseignement Du Francais Selon Mathieu Avanzi Au Dela Des Classes

May 25, 2025