Stock Market Today: Trump's Tariff Threat And UK Trade Deal Impact

Table of Contents

Trump's Tariff Threats: A Looming Shadow over Global Trade

Trump's unpredictable trade policies continue to cast a long shadow over global trade, creating significant market uncertainty. His history of imposing tariffs, particularly on goods from China and other nations, has already demonstrably impacted various sectors. These actions have sparked trade wars, leading to retaliatory measures and disrupting established supply chains. Understanding the implications of these threats is crucial for navigating the stock market today.

-

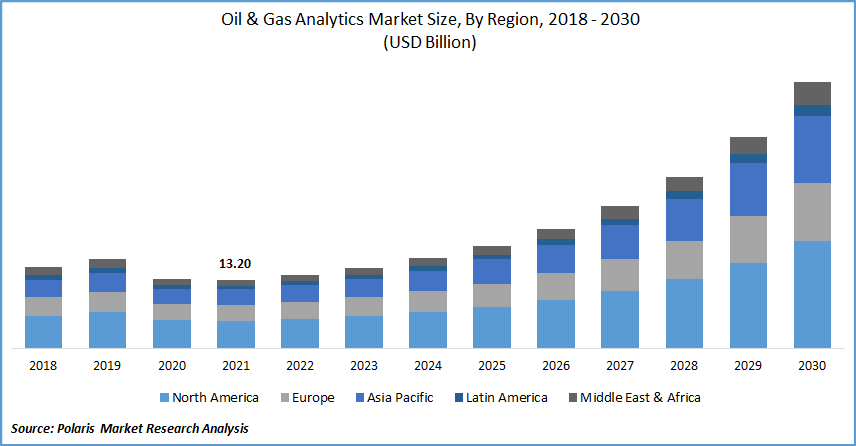

Specific Tariff Threats and Their Impact: Trump's past imposition of tariffs on steel and aluminum, for example, led to increased import prices for US manufacturers and retaliatory tariffs from affected countries. Similarly, tariffs on Chinese goods have impacted various industries, from technology to agriculture. Analyzing the historical impact of these tariffs on stock market performance provides valuable insights into potential future outcomes. [Insert relevant chart/graph here showing historical correlation between tariff announcements and market volatility].

-

Inflation and Consumer Prices: Tariffs directly increase the cost of imported goods, potentially leading to higher inflation and reduced consumer spending power. This inflationary pressure can erode profit margins for businesses and negatively impact overall economic growth, influencing the stock market today.

-

Impact on US Businesses and Supply Chains: Many US businesses rely on global supply chains. Tariffs disrupt these chains, increasing costs and potentially leading to production delays or shortages. This uncertainty makes it harder for companies to plan and invest, impacting their stock performance.

-

Retaliatory Measures: The imposition of tariffs often provokes retaliatory measures from other countries, escalating trade tensions and further destabilizing the global economy and impacting the stock market today.

The UK Trade Deal: Navigating a Post-Brexit Landscape

The UK's departure from the European Union and its subsequent trade deal with the EU continue to reshape the global economic landscape, impacting the stock market today. The long-term effects are still unfolding, but certain immediate consequences are already visible.

-

Key Terms and Conditions of the UK-EU Trade Deal: This agreement, while aiming for frictionless trade, introduced new customs procedures and regulatory hurdles, affecting businesses on both sides. Understanding these complexities is key to assessing the deal's impact on specific sectors and the stock market today.

-

Benefits and Drawbacks for UK Businesses: While the deal aims to maintain trade access, new barriers like customs checks and differing regulations pose challenges for UK companies. This increased complexity can impact efficiency and profitability, affecting stock valuations.

-

Impact on UK-US Trade Relations: The UK's post-Brexit trade relationship with the US is intertwined with Trump's broader trade policies. The potential for a comprehensive trade deal between the two countries remains uncertain, creating further uncertainty for UK businesses and impacting the stock market today.

-

Ripple Effects on the Global Economy: The UK's exit from the EU and its new trade arrangements have ripple effects across the global economy, affecting trade flows and investment decisions worldwide and impacting the stock market today. [Insert relevant chart/graph here showing UK's economic performance post-Brexit].

Investment Strategies in Times of Uncertainty

Navigating the complexities of the stock market today requires a robust investment strategy that accounts for the current geopolitical climate. Risk management and diversification are paramount.

-

Portfolio Diversification: To mitigate risk associated with tariff threats and Brexit's lingering effects, it's crucial to diversify your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and geographic regions. This approach reduces dependence on any single sector or economy.

-

Risk Management Strategies: Employing risk management techniques, such as stop-loss orders and hedging strategies, can help limit potential losses during periods of high market volatility. Regularly rebalancing your portfolio is also crucial.

-

Defensive Investment Options: Consider allocating a portion of your portfolio to defensive investments, such as government bonds or dividend-paying stocks, which tend to be less volatile during economic downturns.

-

Thorough Market Analysis: Before making any investment decisions, conduct thorough market analysis, paying close attention to economic indicators, company fundamentals, and geopolitical events.

-

Consult a Financial Advisor: Seeking guidance from a qualified financial advisor is highly recommended. They can provide personalized advice tailored to your individual financial situation and risk tolerance.

Conclusion

The stock market today is undeniably influenced by the interplay of Trump's tariff threats and the UK's post-Brexit trade landscape. These factors inject significant volatility into the market, requiring a cautious but proactive approach to investing. Diversification, rigorous risk management, and thorough market analysis are crucial for weathering these challenging times. Remember that while short-term market fluctuations can be unsettling, long-term investment strategies often prove resilient. Stay informed about the latest developments influencing the stock market today, and continue to monitor market trends to make informed decisions that minimize risk and maximize potential returns. Understanding the nuances of the stock market today is key to achieving your long-term financial goals.

Featured Posts

-

Growth Of Canadas Leading Natural Gas Producer Market Dominance And Future Outlook

May 11, 2025

Growth Of Canadas Leading Natural Gas Producer Market Dominance And Future Outlook

May 11, 2025 -

Examining The Impact Of Michael Kays Comments On Juan Sotos Performance

May 11, 2025

Examining The Impact Of Michael Kays Comments On Juan Sotos Performance

May 11, 2025 -

Grown Ups 2 Comparing It To The Original Film

May 11, 2025

Grown Ups 2 Comparing It To The Original Film

May 11, 2025 -

Hotel Transylvania A Complete Guide To The Monster Filled Franchise

May 11, 2025

Hotel Transylvania A Complete Guide To The Monster Filled Franchise

May 11, 2025 -

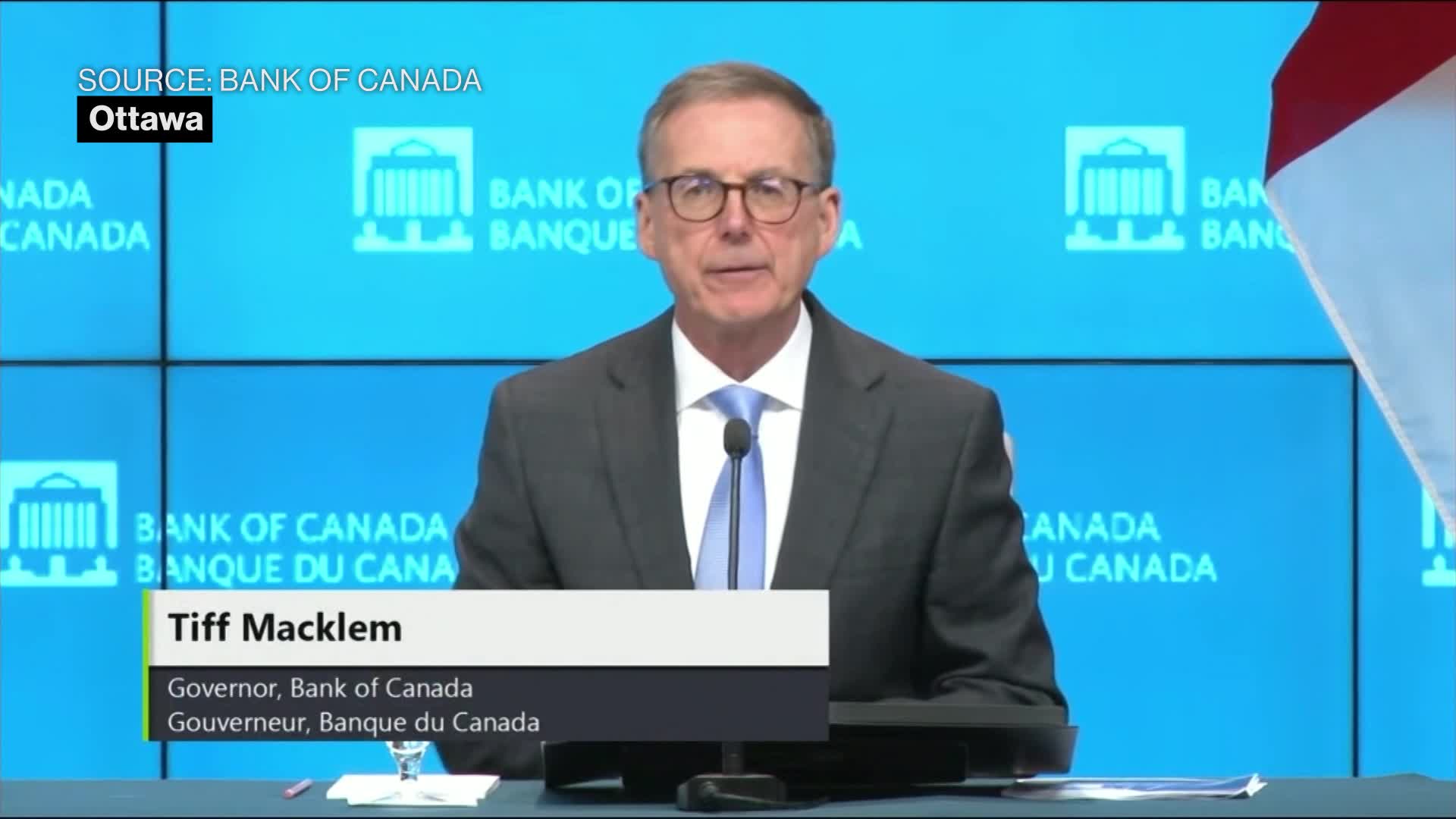

Bank Of Canada Rate Cuts Predicted Amidst Tariff Driven Job Losses

May 11, 2025

Bank Of Canada Rate Cuts Predicted Amidst Tariff Driven Job Losses

May 11, 2025

Latest Posts

-

S 3

May 11, 2025

S 3

May 11, 2025 -

3 S

May 11, 2025

3 S

May 11, 2025 -

3 S 10

May 11, 2025

3 S 10

May 11, 2025 -

3 S Get 10

May 11, 2025

3 S Get 10

May 11, 2025 -

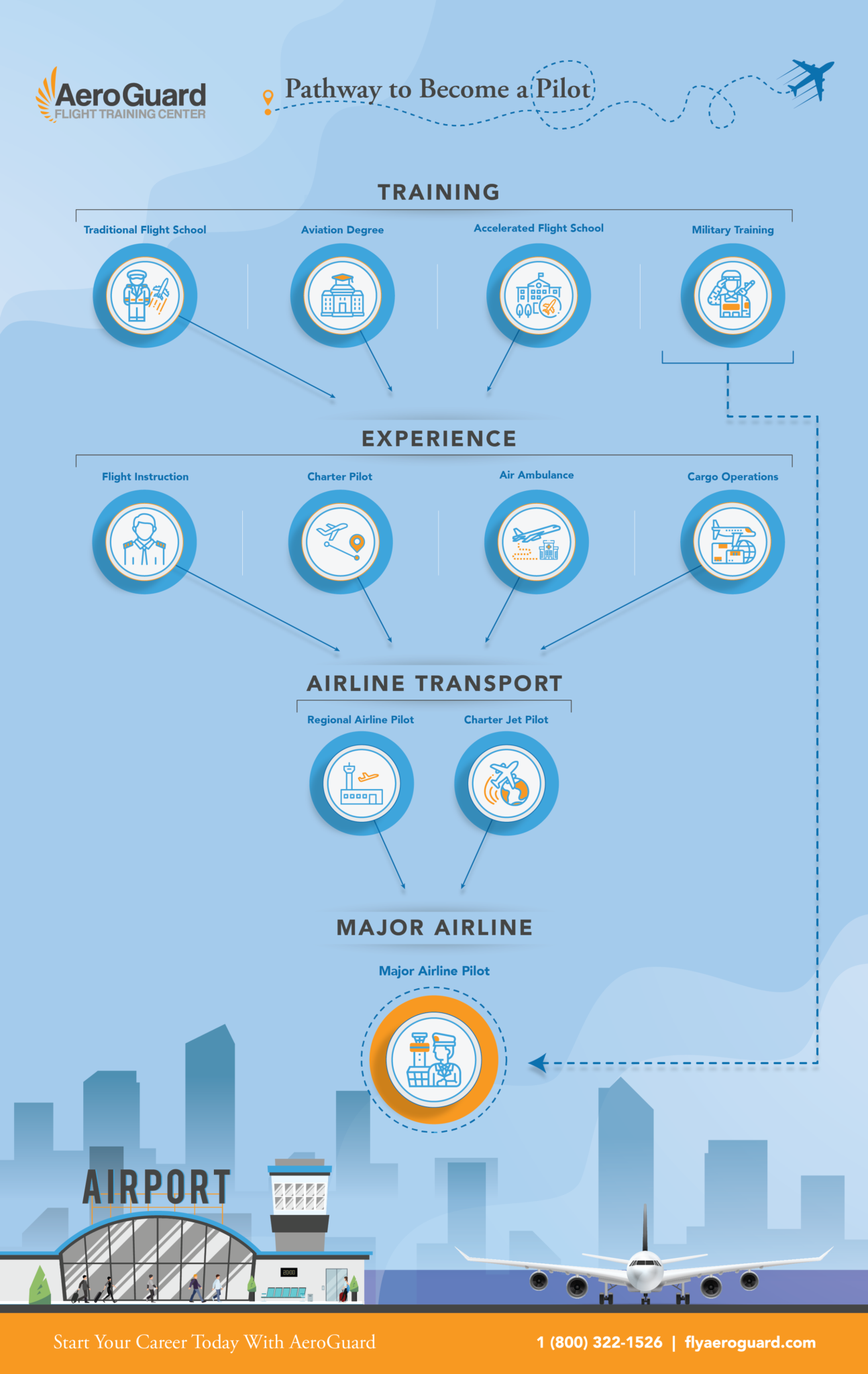

From Cabin Crew To Captain One Womans Path To Becoming A Pilot After Singapore Airlines

May 11, 2025

From Cabin Crew To Captain One Womans Path To Becoming A Pilot After Singapore Airlines

May 11, 2025