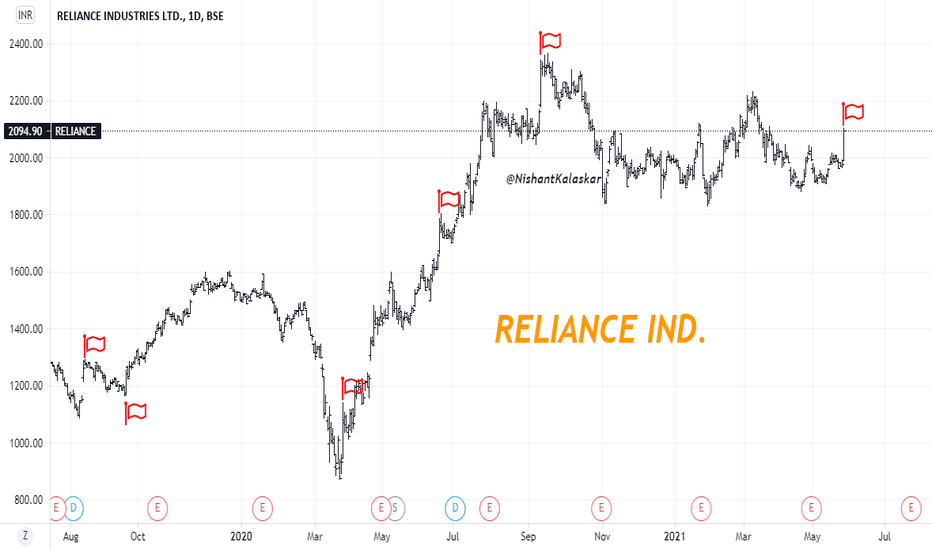

Strong Earnings Drive Reliance Shares To 10-Month Peak

Table of Contents

Exceptional Q2 Earnings Report Fuels Reliance Share Price Increase

The significant jump in Reliance shares can be primarily attributed to the company's outstanding Q2 (second quarter) earnings report, which significantly exceeded market expectations. This positive performance fueled a surge in investor confidence and triggered a substantial increase in trading volume.

Key Highlights of the Earnings Report:

- Revenue Growth: Reliance reported a remarkable X% increase in revenue, surpassing analyst forecasts by Y%. This substantial growth underscores the company's strong financial health and its ability to navigate challenging economic conditions.

- Improved Profitability: Profitability margins across various business segments showed marked improvement, reflecting efficient operations and effective cost management strategies. This improved profitability directly translates to higher earnings per share (EPS).

- Stellar Performance Across Sectors: The telecom sector, spearheaded by Reliance Jio, demonstrated exceptional performance, fueled by robust subscriber growth and increased data consumption. Similarly, Reliance Retail showcased strong growth in both online and offline sales channels, indicating a strong retail presence.

- EPS Impact: The impressive financial results translated into a significantly higher EPS, further boosting investor confidence and driving up the Reliance stock price. The reported EPS of Z rupees exceeded predictions by W%, contributing significantly to the increased stock valuation.

Market Reaction to the Positive Earnings News:

The market's response to the positive earnings news was immediate and enthusiastic. Trading volume for Reliance shares spiked dramatically following the release of the report, reflecting the high level of investor interest and buying pressure. This surge in activity is a clear indicator of the positive market sentiment surrounding the company. Compared to the previous quarter and the same period last year, the growth in Reliance stock price is unprecedented, signaling a significant upward trend. Many financial analysts lauded the earnings report, predicting further growth in the coming quarters.

Factors Contributing to Reliance's Strong Financial Performance

Reliance's exceptional financial performance isn't a singular event but rather a result of a confluence of positive factors contributing to its overall success.

Success of Reliance Jio's Telecom Operations:

Reliance Jio continues to be a major growth driver for the company. Its success is underpinned by several key factors:

- Subscriber Growth: Jio's subscriber base continues to expand rapidly, demonstrating its popularity and market dominance within the Indian telecom sector.

- 5G Expansion: The ongoing rollout of its 5G network is attracting new subscribers and driving data consumption, leading to substantial revenue growth.

- Strategic Pricing: Jio's competitive pricing strategies have helped attract and retain a large subscriber base, contributing to its market share and profitability.

Robust Performance of Reliance Retail:

Reliance Retail's strong performance is another key factor driving Reliance share price growth:

- Omnichannel Success: The seamless integration of online and offline sales channels allows Reliance Retail to effectively tap into various consumer segments.

- Market Expansion: The company's strategic expansion into new markets and product categories has broadened its reach and diversified its revenue streams.

- Strategic Acquisitions: Strategic acquisitions and partnerships have further strengthened its market position and expanded its offerings.

Other Contributing Factors:

Beyond Jio and Retail, other contributing factors include:

- Energy and Petrochemicals: The energy and petrochemicals sectors also contributed positively to the overall financial performance.

- Macroeconomic Indicators: Positive macroeconomic indicators within India have contributed to the overall growth of the stock market, benefiting Reliance shares.

- Company Initiatives: Successful implementation of various company initiatives and strategic decisions has further enhanced Reliance's position in the market.

Implications for Investors and Future Outlook of Reliance Shares

The strong Q2 earnings and the resulting increase in Reliance stock price present significant implications for investors.

Potential for Further Growth:

The current market trends and Reliance's strong performance suggest a significant potential for further growth. However, investors should also consider potential risks and challenges:

- Future Growth Prospects: Analysts predict continued growth based on ongoing expansion in key sectors and favorable market conditions.

- Potential Risks: Factors such as regulatory changes, competition, and global economic uncertainties could pose potential risks.

- Expert Opinions: Many financial experts express optimism about the long-term prospects of Reliance shares, citing its diversification and strong management.

Investment Strategies for Reliance Stock:

Investors considering investing in Reliance shares should carefully consider their risk tolerance and investment goals:

- Risk Tolerance: Reliance shares, like any stock, carry inherent risk. Investors should only invest an amount they can afford to lose.

- Investment Goals: Investors should align their investment strategy with their long-term financial goals.

- Sector Comparison: Comparing Reliance with other companies in the same sector is crucial for informed decision-making.

Conclusion

Reliance Industries' strong Q2 earnings have undeniably propelled its shares to a 10-month peak, reflecting exceptional performance across its diverse business segments. This significant jump in Reliance stock price is a testament to robust financial health and promising growth prospects. The success of Reliance Jio and Reliance Retail, coupled with other positive factors, has played a pivotal role in this remarkable achievement.

Call to Action: Are you considering adding Reliance shares to your investment portfolio? Understanding the factors driving this recent surge in Reliance stock price is crucial for making well-informed investment decisions. Conduct thorough research, carefully assess your risk tolerance, and consider consulting a financial advisor before investing in Reliance shares or any other stock. Staying updated on the latest financial news and market trends will help you make sound investment choices.

Featured Posts

-

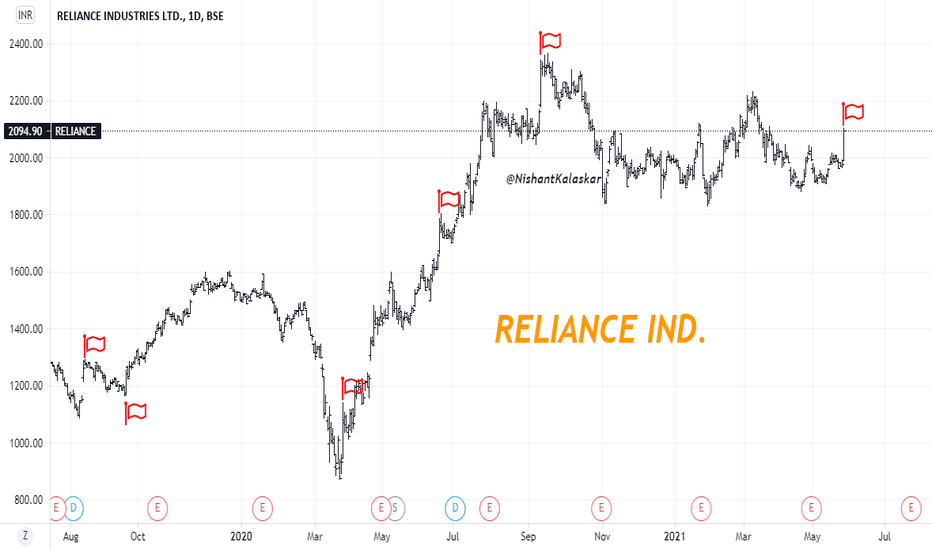

Negative European Electricity Prices A Solar Power Success Story

Apr 29, 2025

Negative European Electricity Prices A Solar Power Success Story

Apr 29, 2025 -

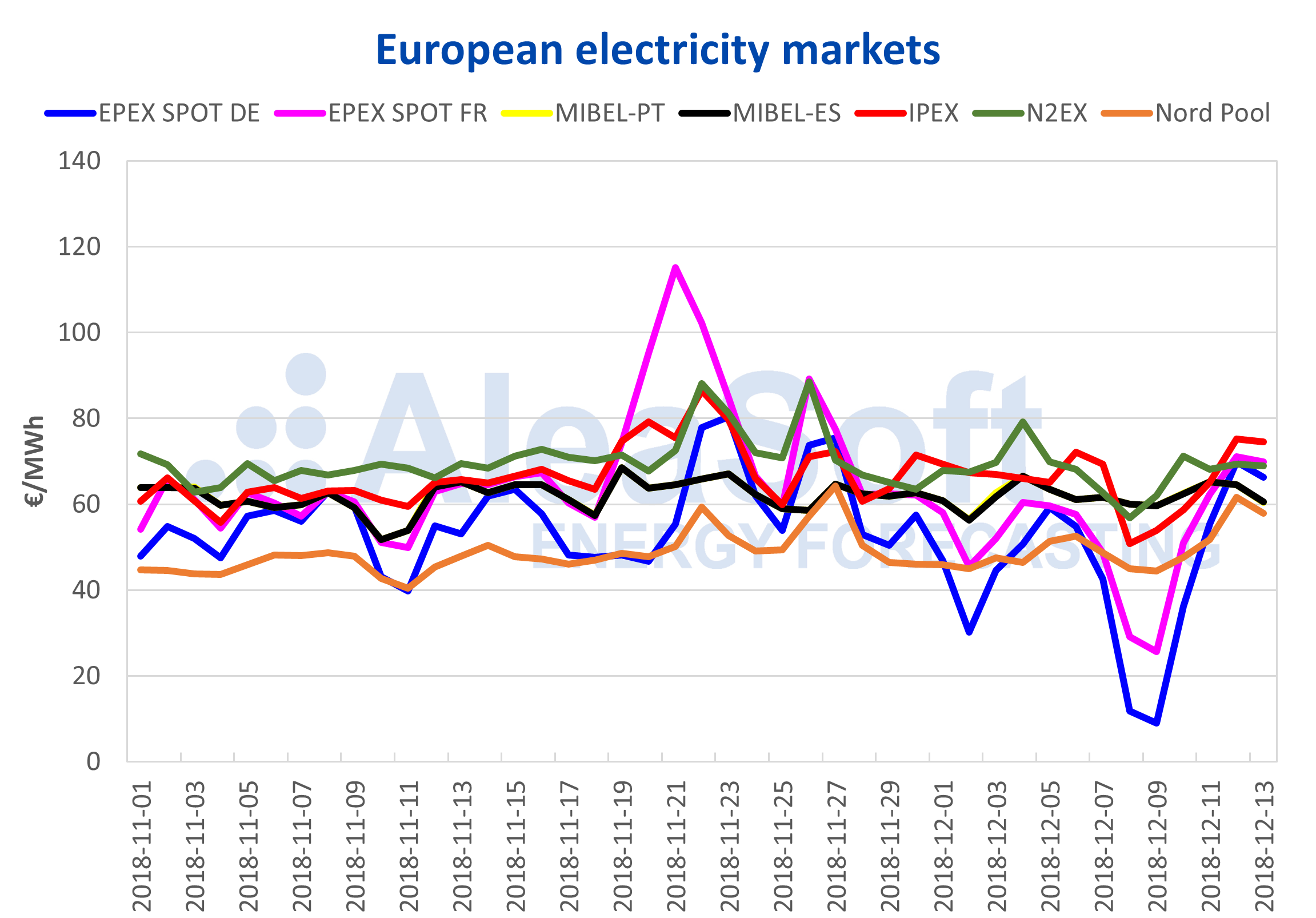

Your Guide To Capital Summertime Ball 2025 Tickets Braintree And Witham

Apr 29, 2025

Your Guide To Capital Summertime Ball 2025 Tickets Braintree And Witham

Apr 29, 2025 -

Investor Guide Navigating High Stock Market Valuations With Bof As Analysis

Apr 29, 2025

Investor Guide Navigating High Stock Market Valuations With Bof As Analysis

Apr 29, 2025 -

Lessons Learned From The April 8th Treasury Market

Apr 29, 2025

Lessons Learned From The April 8th Treasury Market

Apr 29, 2025 -

Mets Fall To Twins 6 3 In Second Game

Apr 29, 2025

Mets Fall To Twins 6 3 In Second Game

Apr 29, 2025

Latest Posts

-

Princetons Laptop Donation Boosts Higher Ed In New Jersey Correctional Facilities

Apr 30, 2025

Princetons Laptop Donation Boosts Higher Ed In New Jersey Correctional Facilities

Apr 30, 2025 -

Sjl Eshaq Alraklyt Rqma Qyasya Jdyda Fy Martyny Alswysryt

Apr 30, 2025

Sjl Eshaq Alraklyt Rqma Qyasya Jdyda Fy Martyny Alswysryt

Apr 30, 2025 -

73

Apr 30, 2025

73

Apr 30, 2025 -

Exploring The Link Between Blue Ivy Carter And Tina Knowles Eyebrow Style

Apr 30, 2025

Exploring The Link Between Blue Ivy Carter And Tina Knowles Eyebrow Style

Apr 30, 2025 -

Beyonce Jay Z Blue Ivy And Rumis Family Super Bowl Style

Apr 30, 2025

Beyonce Jay Z Blue Ivy And Rumis Family Super Bowl Style

Apr 30, 2025