India's DSP Fund Shifts Strategy: Stock Caution And Cash Increase

Table of Contents

Reasons Behind the Strategic Shift

The decision by DSP Investment Managers to adopt a more conservative investment strategy is driven by a confluence of factors affecting the Indian stock market and the broader global economy. Current market conditions paint a picture of heightened uncertainty.

-

High Inflation and its Impact: India, like many other nations, is grappling with persistent inflation, impacting consumer spending and potentially slowing economic growth. This uncertainty makes precise market forecasting challenging and increases the risk of unforeseen corrections.

-

Geopolitical Uncertainty: The ongoing geopolitical instability globally introduces further risk to the Indian economy. International events can create ripple effects, impacting investment sentiment and market stability.

-

Sector-Specific Concerns: DSP's concerns are not generalized; they seem to stem from specific sectors experiencing overvaluation or showing signs of weakening fundamentals. A careful review of their portfolio suggests a focus on risk mitigation within these segments.

-

Internal Portfolio Rebalancing: Beyond external factors, internal portfolio rebalancing requirements might also contribute to the decision. This could involve adjusting asset allocation to better align with the fund's risk profile and long-term objectives.

-

Bullet Points Summarizing Key Reasons:

- High inflation impacting consumer spending.

- Geopolitical uncertainties affecting global markets.

- Concerns over specific sector valuations. (e.g., overvalued technology stocks).

- Internal portfolio rebalancing requirements.

Increased Cash Holdings: A Defensive Strategy

DSP's strategic shift involves a notable increase in cash holdings across its various mutual funds. While the exact percentage varies across different funds, reports suggest a significant upward revision in cash allocation—a clear indicator of a defensive posture.

Holding a larger cash reserve serves as a crucial buffer against potential market downturns. Liquidity provides the flexibility to capitalize on attractive investment opportunities that may emerge during market corrections or to withstand periods of sustained volatility. This contrasts with previous strategies that may have prioritized higher equity exposure for potentially greater returns.

However, holding higher cash reserves also carries an opportunity cost. The potential return on those cash holdings is generally lower than that of actively managed equity investments. This trade-off between risk mitigation and potential return is a core consideration for DSP and other fund managers.

- Bullet Points Detailing the Cash Holding Strategy:

- Percentage increase in cash allocation (specific figures, if available, should be included here).

- Benefits of liquidity during market corrections.

- Potential opportunity cost of holding cash.

- Comparison with other fund managers' strategies (e.g., "Compared to competitor X, DSP's increase in cash holdings is significantly higher, suggesting a more conservative outlook").

Impact on Investors and Future Outlook

DSP's strategic shift has immediate and long-term implications for existing and prospective investors. In the short term, investors might experience lower returns compared to periods when the funds were more aggressively invested in equities. However, this reduced volatility could be seen as a positive, particularly for risk-averse investors.

For investors with a higher risk tolerance and a longer time horizon, this strategy might initially seem less appealing. However, the potential for downside protection during market corrections could prove beneficial in the long run. The long-term outlook depends significantly on the recovery of the Indian stock market and the broader global economic environment.

- Bullet Points on Impact and Outlook:

- Short-term implications for fund returns (e.g., "Expect potentially lower short-term returns compared to previous periods").

- Long-term outlook considering market recovery (e.g., "Long-term prospects remain positive, contingent on market recovery").

- Impact on different investor profiles (risk tolerance) (e.g., "This strategy benefits risk-averse investors more than aggressive growth-seeking investors").

- Potential future investment strategies of DSP (e.g., "DSP might gradually increase equity exposure as market conditions improve").

Conclusion: Navigating the Indian Market with DSP's Revised Strategy

DSP Investment Managers' strategic shift reflects the increasing volatility and uncertainty in India's stock market. Their decision to increase cash holdings and adopt a more cautious approach is a calculated move aimed at risk mitigation. This change impacts investors' potential returns, requiring careful consideration of their individual risk tolerance and investment timelines. Understanding this strategic shift is crucial for navigating the complexities of the Indian market. The current emphasis on cash management highlights the importance of portfolio optimization and a balanced approach to investment strategies. Learn more about how to optimize your portfolio based on India's DSP fund's new strategy and navigate the changing market landscape effectively.

Featured Posts

-

North Korea Confirms Troop Deployment To Russia In Ukraine First Official Admission

Apr 29, 2025

North Korea Confirms Troop Deployment To Russia In Ukraine First Official Admission

Apr 29, 2025 -

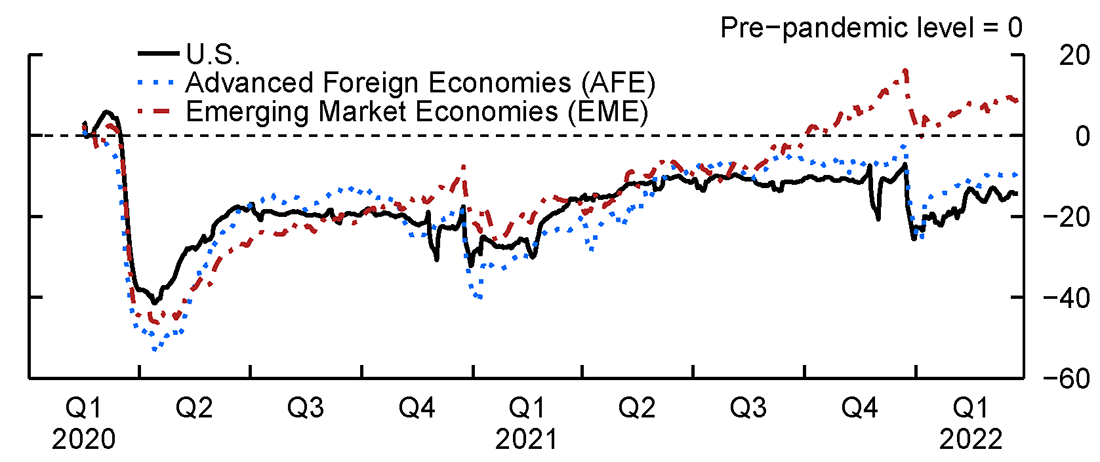

Ecb Continued Inflation Driven By Pandemic Fiscal Measures

Apr 29, 2025

Ecb Continued Inflation Driven By Pandemic Fiscal Measures

Apr 29, 2025 -

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025 -

Goldman Sachs Offers Exclusive Guidance On Tariffs A Trump Administration Strategy

Apr 29, 2025

Goldman Sachs Offers Exclusive Guidance On Tariffs A Trump Administration Strategy

Apr 29, 2025 -

Betting On Natural Disasters Examining The Los Angeles Wildfire Example

Apr 29, 2025

Betting On Natural Disasters Examining The Los Angeles Wildfire Example

Apr 29, 2025

Latest Posts

-

Exploring The Countrys Fastest Growing Business Regions

Apr 29, 2025

Exploring The Countrys Fastest Growing Business Regions

Apr 29, 2025 -

Ecb Report Post Pandemic Fiscal Policies Contribute To Inflation

Apr 29, 2025

Ecb Report Post Pandemic Fiscal Policies Contribute To Inflation

Apr 29, 2025 -

Inflation Persists Ecb Attributes High Prices To Pandemic Relief Spending

Apr 29, 2025

Inflation Persists Ecb Attributes High Prices To Pandemic Relief Spending

Apr 29, 2025 -

A Data Driven Look At The Countrys Newest Business Hotspots

Apr 29, 2025

A Data Driven Look At The Countrys Newest Business Hotspots

Apr 29, 2025 -

Post April 8th Treasury Market Analysis Findings And Forecasts

Apr 29, 2025

Post April 8th Treasury Market Analysis Findings And Forecasts

Apr 29, 2025